Closing the Quarter – Q4’23

In today’s thought leadership, we cover:

- Key Events this week

- Closing the Quarter Summary — Q4 performance, guidance moves and consensus shifts, and capital allocation trends

Key Events

The Consumer

- The personal consumption expenditures (PCE) price index excluding food and energy costs (core PCE) increased 0.4% for the month and 2.8% from a year ago, in line with consensus estimates. Headline PCE, including the volatile food and energy categories, increased 0.3% monthly and 2.4% on a 12-month basis, in line with estimates. (Source: Bureau of Economic Analysis)

Labor

- Initial jobless claims, a proxy for layoffs, increased by 13,000 to 215,000 last week, above expectations of 210,000, while the four-week moving average for jobless claims of 212,550 was down 3,000 from the previous week; continuing claims, which reflect the number of people seeking ongoing unemployment benefits, rose to 1.91M, up 45,000 from the week before. (Source: Labor Department)

U.S. Congress

- Senate Minority Leader Mitch McConnell, the longest-serving Senate party leader in history, said Wednesday he would step down from his leadership role in November, yielding to both the pressures of age (he’s 82) and the rapid changes in the Republican Party. Sens. John Thune (R., SD), John Barrasso (R., WY) and John Cornyn (R., TX) have been positioning themselves for the day McConnell steps down. (Source: WSJ)

- Congress approved a temporary spending bill to prevent a partial government shutdown this weekend, with Speaker Mike Johnson (R., LA) forced again to turn to a coalition made up mostly of Democrats to clear it in the House, followed by passage in the Senate. The House vote was 320 to 99, with slightly more than half of Republicans joining with almost all Democrats to support the measure. (Source: WSJ)

Bitcoin

- Bitcoin continued its surge on Wednesday, shooting above $63,000 for the first time since November 2021 and just below its all-time high of $68,982. The iShares Bitcoin Trust (ticker IBIT) saw its biggest one-session haul Tuesday, marking the largest daily inflow so far among the batch of new US exchange-traded funds investing directly in the world’s biggest cryptocurrency. It was also the second-largest daily intake for any U.S. ETF across all asset classes. (Source: Bloomberg)

Closing the Quarter Summary

Heading into this past earnings season, our Q4’23 Inside The Buy-Side® Earnings Primer® registered a more optimistic tone overall after last quarter’s survey found sentiment increasingly trending neutral. Buttressing this notable shift in mindset was the view that the macro outlook would improve in 2024 amid expectations for a lower interest rate environment. Still, concerns around geopolitics and slowing growth remained.

With Q4’23 earnings season in the books, we “Close the Quarter” with some notable themes:

1. Earnings

Better-than-expected fundamental Q4 earnings reports were bolstered by several macro tailwinds, including a resilient consumer, government spending, and the AI investment cycle.

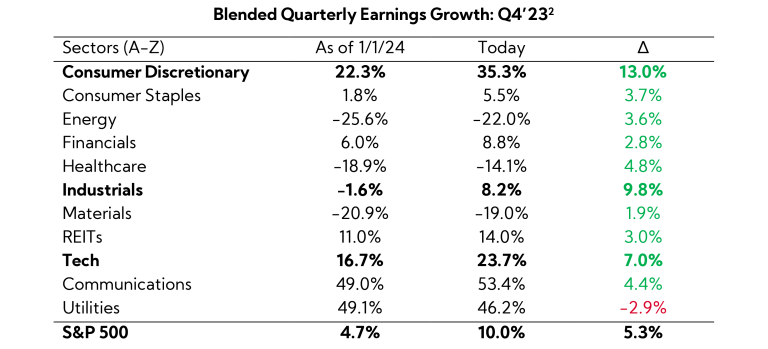

With over 90% of S&P 500 companies reporting earnings to date, the index is reporting year-over-year blended1 revenue and earnings growth of 3.4% and 10.0%, respectively. Interestingly, while top-lines have surpassed consensus estimates by 1.1% on average, which is below the one-year average of 1.6%, bottom-line beats have averaged 6.8% above consensus estimates, eclipsing the one-year average of 5.7%.

Indeed, the data tells us that heading into the quarter, quarterly earnings growth expectations for Q4’23 on January 1st were less than half, or 4.7%, of what the blended results are today, 10.0%.

From a sector perspective, Consumer Discretionary, Industrials, and Tech demonstrated the most relative improvement in blended performances through the quarter compared with initial expectations at the beginning of the year — and for good reason.

The Consumer

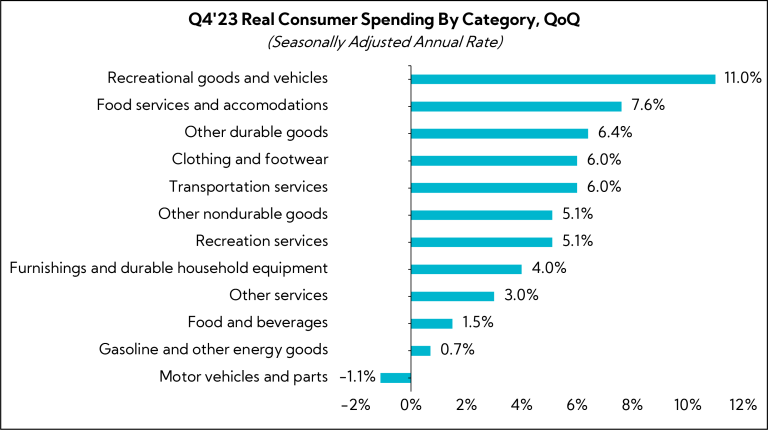

At a macro level, real GDP increased at a seasonally adjusted annual rate of 3.2% in Q4, the sixth consecutive quarter of growth following the Pandemic. Despite record credit card debt levels, the U.S. consumer has remained surprisingly resilient, buoyed by an unemployment rate that has trended under 4% for two years straight. Meanwhile, government stimulus has remained historically accommodative overall — both of which are the case despite more recent aggressive rate tightening by the Fed.

Digging a bit deeper, Q4 saw huge QoQ consumption increases even in much more discretionary spending areas like recreational goods and vehicles. As such, executive commentary across sectors indicated “consistent” consumer demand despite fears of a drop-off at some point, as we entered 2024.

Government Spending

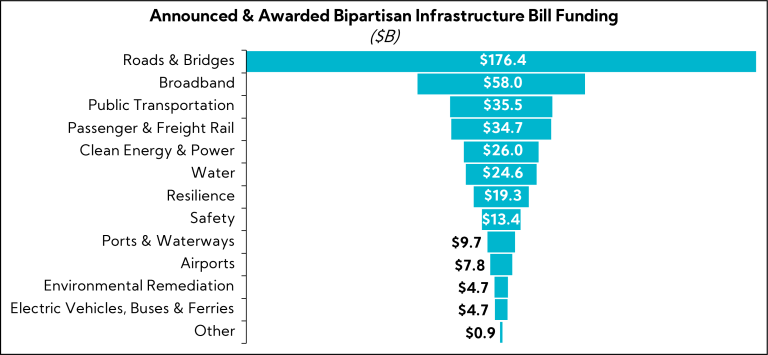

Fiscal spending continues to materialize across the economy and more and more being referenced up in prepared company remarks. Approximately 75% of the $550B Bipartisan Infrastructure Bill passed in November 2021 has been announced or awarded3, and many executives on Q4 calls forecasted additional tailwind support as more monies are distributed and industrial project activity picks up. In addition, the government’s CHIPS Act of 2022 began contributing in its FY2023 (which began in October 2022) another $100M every year over the following five years toward semiconductor supply chain spending and security, and many have been quick to tout the benefits.4 In addition, mentions of Inflation Reduction Act tailwinds are also picking up on calls.

- Valmont Industries ($4.4B, Industrials, Conglomerates): “Our favorable market outlook is relatively unchanged. This segment is supported by multi-year megatrends, such as the energy transition, grid resiliency efforts, and replacing aging infrastructure. These demand drivers are leading utilities to sustain their capex spending at an elevated level. In addition, our Solar business is supported by favorable policy and strong demand globally is expected to continue. Our Lighting and Transportation business is being supported by road construction investments and benefits from the IIJA are expected to be an incremental tailwind in the U.S. later this year.”

- Tetra Tech ($9.4B, Industrials, Engineering & Construction): “When we discuss market drivers for the water cycle, a lot of airtime has been given to new federal infrastructure funding from the IIJA, IRA, and the CHIPS and Science Act. Clients across all of our end markets are benefiting from multiple state, local and commercial funding opportunities, sometimes augmented by federal government funding like the IIJA.”

- Nordson ($15.4B, Industrials, Specialty Industrial Machinery): “We remain very positive about the growth opportunities driving the next electronics cycle, including AI, automotive electronics, onshoring, CHIPS and Science Act, and more. While we fully expected to see benefits of those opportunities in the second half of calendar 2024, we now realize it may be closer to the end of the year. As the year progresses, we plan to provide investors with better visibility to what we are seeing in the market.”

Artificial Intelligence Investment

Lastly, the generative AI boom is taking on a life of its own. For one, the dollars being spent are real and growing rapidly. While semiconductor chips and other technology companies grab the headlines, the spend is happening across many industries of the economy, and companies continue to add to the buzz. Indeed, Generative AI and AI-related startups raised nearly $50B in 20235, and “AI investment”6 mentions among the U.S. public companies of at least $1B in market cap rose 20% QoQ on Q4 calls.

As we forecasted in our Letter To Our Clients at the beginning of the year, commentary through earnings appears to be bolstering the case that 2024 is the year AI goes from tinkering to tactical across many sectors. And, with recent hype (and some eye-catching upward revenue and earnings revisions, too) surrounding some of the biggest names in the space driving much of the S&P 500 gains, clearly the market is captivated.

- Pros Holdings ($1.7B, Technology, Software – Application): “The other component that I wanted to add that I think is very strategic for us is our focus on the AI. Not just providing AI for our customers, but infusing AI into every aspect of our business. We’re really looking at setting the standard for how AI is used in the enterprise from every area. Think about from marketing, from sales, legal, all the way into implementations, customer success, and across every aspect of the organization. We want to equip our teams to really thrive in the generation of AI. And you’re going to continue to see us lean in to drive efficiencies while we’re driving the latest innovations in AI for our customers with easier adoption that’s going to help to drive growth. At the same time, we’re driving process and automation internally to make us more scalable for the future.”

- Donaldson ($8.5B, Industrials, Specialty Industrial Machinery): “We continue to talk about AI within the company. There’s two approaches to that. One is, what are we able to put inside our product families? And then the other one is, are there operations or process efficiencies that we can gain by using AI inside the corporation? Our focus is more on the internal looking one, relative to the process improvement inside the company using AI rather than on the product-based activities. That’s the way we look at it. Overall, AI is likely still early innings for us, much like so many other corporations in the industrial space. We’ll continue to invest and learn about it.”

- Six Flags Entertainment ($2.1B, Consumer Cyclical, Leisure): “In technology, we had to attack labor and to that extent we are automating many of our functions. And we are lucky that AI and our IT team has embraced it very strongly. We are now using AI in many parts of our business; from our customer service, to personalizing our guest experiences, to improving operational efficiencies, to basically using AI-based safety measures.”

2. Guidance Moves and Consensus Shifts

In general, company forecasts are calling for a weaker first-half, followed by strength toward the end of the year. Guidance and executive commentary resulted in relatively few consensus cuts to annual figures, with more analysts opting to boost full year 2024 estimates for both revenue and EPS.

Guidance Moves

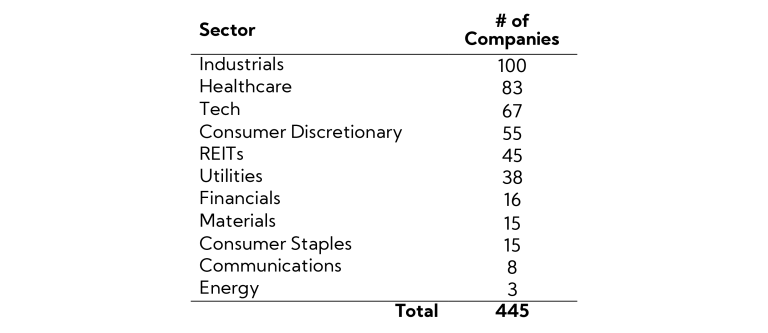

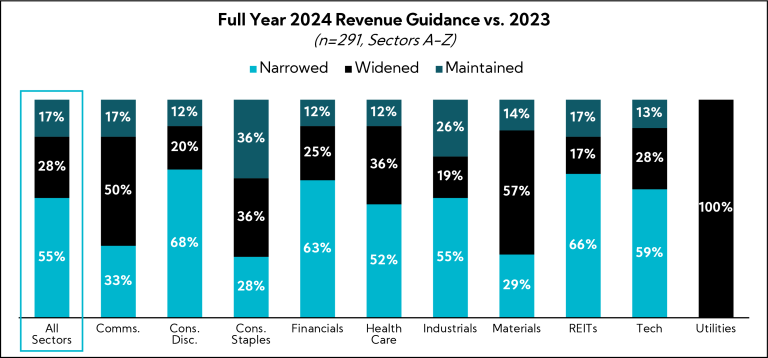

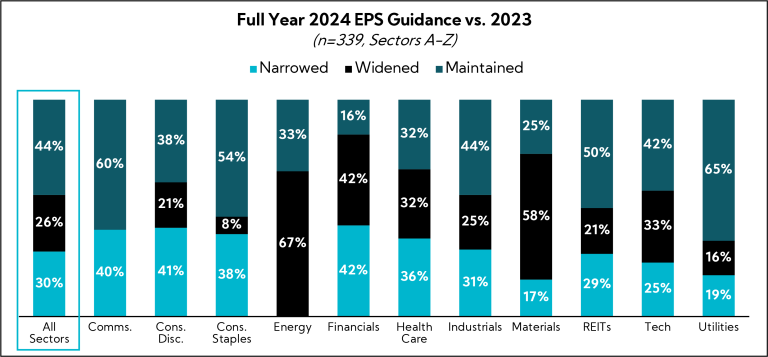

We analyzed annual revenue and EPS guidance trends for a basket of over 400 companies with market caps larger than $1B in market cap across all sectors that have reported to date.7 Below are our findings.8

Breakdown by Sector

Quarterly Guidance

Annual Guidance (YoY Trends)

Revenue

- More companies, 55%, Narrowed the range relative to last year, while 28% Widened, and 17% Maintained

- Average spreads decreased 20 bps, with an average range of 2.8%

EPS

- More companies. 44%, Maintained the range relative to last year, though 30% Narrowed

- Average EPS growth spreads increased 100 bps, with an average range of 7.0%

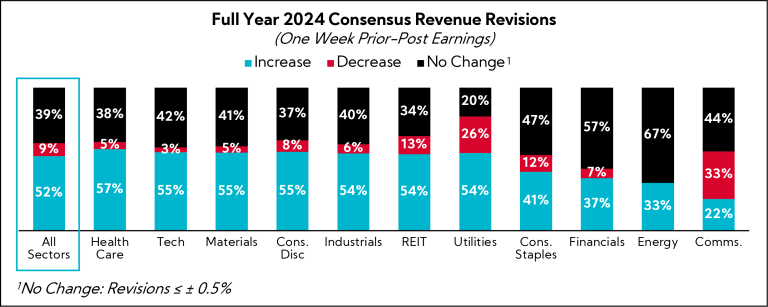

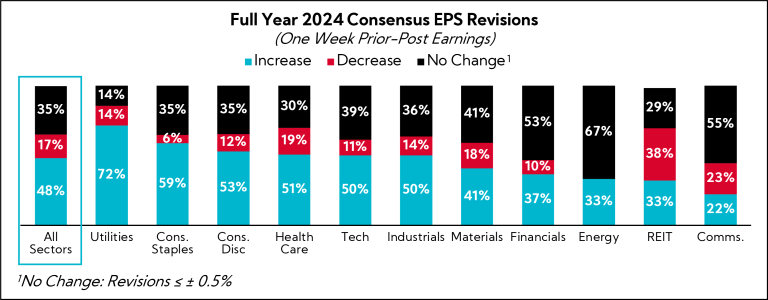

Consensus Shifts

When analyzing full-year consensus shifts of the same basket of companies one week prior through one week post Q4 earnings announcements, analyst estimates reflect expected growth— roughly half of all companies had analysts increase 2024 revenue and/or EPS estimates.

In particular, 7 out of the 11 sectors saw revenue consensus increases across at least 54% of companies, led by Healthcare. In terms of earnings, 6 of the 11 sectors saw upward revisions for at least 50% of companies, led by Utilities and Consumer Staples.

That said, 9% and 17% of companies across all sectors experienced downward revenue and EPS revisions, respectively. However, only the Communications sector saw more revenue and EPS cuts versus increases, and REITs — identified as the most out of favor sector among investors and analysts during our Q4’23 Earnings Primer® — were the only sector to see a majority of companies experience outright negative revisions for EPS.

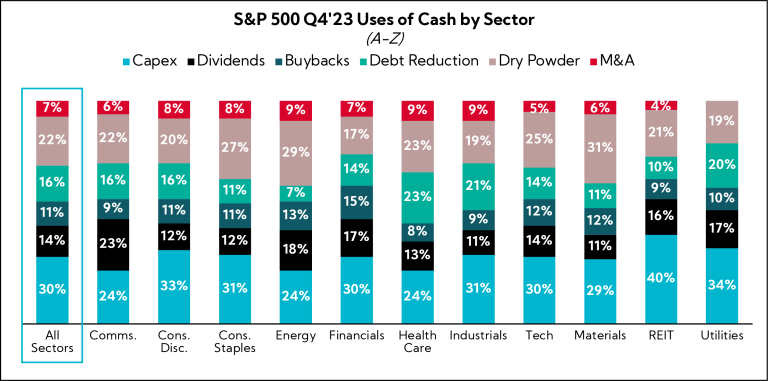

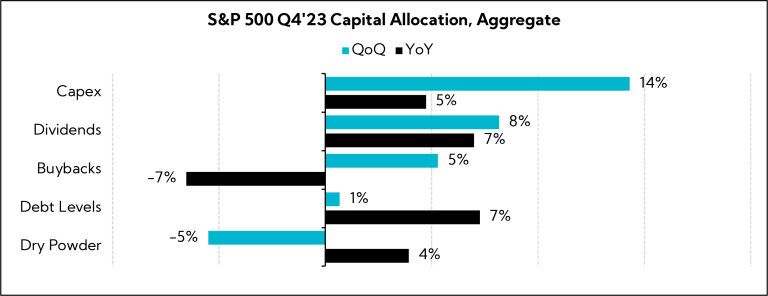

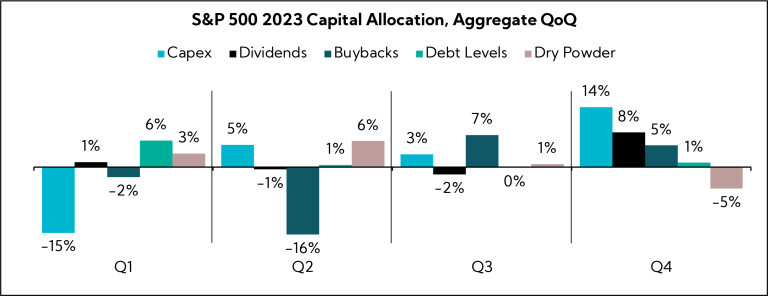

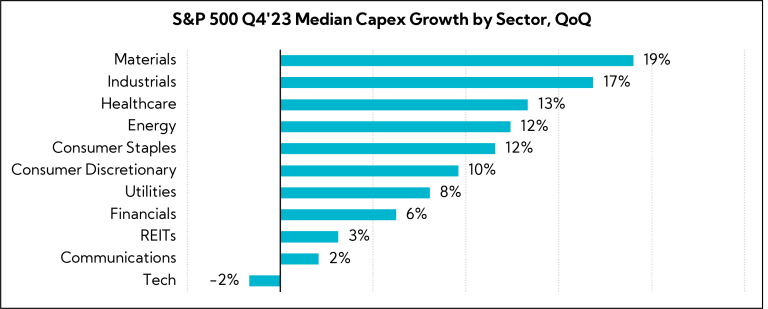

3. Capital Allocation

Sequential cash uses indicate double-digit increases in capex and an uptick in deal activity more broadly.

To garner insights into capital trends, we analyzed the average sector allocations within the S&P 500.

Sequentially, capex was the only category to experience a double-digit increase (14%) among the aggregate S&P 500 capital allocation buckets (and the largest sequential increase in all of 2024), led by median investment boosts in Materials, Industrials, and Healthcare sectors. Meanwhile, the index experienced moderate increases in QoQ shareholder returns, up 8% for dividends and 5% for buybacks. In contrast, dry powder was the only metric to decline from Q3 to Q4, decreasing 5%. Though aggregate debt levels remained relatively constant QoQ, 29% of individual companies reduced their debt balance over the same timeframe.

Continuing, while the S&P 500 saw significant increases in M&A both QoQ and YoY, three companies — Microsoft, Pfizer, and Amgen — accounted for 71% of the aggregate spending levels in Q4. Absent these three deals, spending levels decreased 3%.

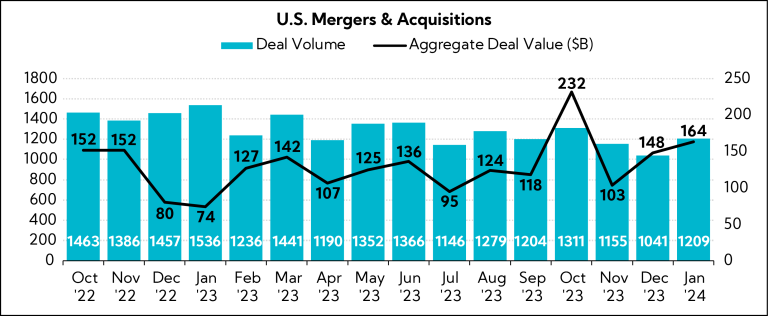

However, more broadly, U.S. deal values increased 43% in Q4 versus Q3, and aggregate values and volumes reached a three-month high in January. Indeed, our coverage this quarter reveals executives across sectors indicating openness to deals, further supported by bank chief expectations for an uptick in activity this year.

In Closing

This U.S. economic cycle thus far has proven that if people feel confident about their jobs, they will continue to spend and support the economy, even if borrowing more to do so. Notably, consumer expenditures represent about two-thirds of the total U.S. economy. The added secular layers of government and AI spending are also supportive for growth. Despite warning signs that have caused concerns in prior economic cycles (for example, an inverted yield curve and declines in certain leading economic indicators), many companies at a minimum seem increasingly less worried, and in some cases, outright more confident based on recent quarterly management commentary. Capital allocation trends suggest companies are eyeing growth mode again, particularly with most forecasting a stronger back-half of the year. Notably, in both our Inside The Buy-Side® Q4’23 Earnings Primer® and Q4’23 Industrial Sentiment Survey®, published January 11 and 18, respectively, we identified a notable increase in investor support towards growth.

However, despite the recent market exuberance, there remain percolating undercurrents of caution in executive earnings addresses that still hint at a more measured outlook in the nearer term (under promise and over deliver is alive and well). There also remains mixed views on what the Federal Reserve will do and when, as the old adage “Don’t fight the Fed” resonates strongly in the current climate. Expectations have tempered somewhat to just four rate cuts in 2024, a significant reduction from the seven anticipated at the close of 2023. Furthermore, geopolitical issues without conceivable ends continue to be a thorn in the side of the Fed getting inflation down to its target. And, with the November election on the horizon, companies should brace for heightened volatility and a potential shift in focus, as political developments may sway market sentiment and redirect investor attention.

We hope you have found our research and reporting for the Q4’23 period timely, insightful, and actionable. We’ll be taking a break next week, but will be back in your inboxes for our inaugural two-week series on AI where we’ll dive into buy-side and corporate perspectives, strategies, and best practice use cases of how the technology is influencing the way the world works and communicates. Stay tuned!

- Combines actual reported results for companies and estimated results for companies yet to report

- Source: LSEG I/B/E/S (Formerly Refinitiv)

- Source: General Services Administration

- Source: State Department

- Source: Crunchbase

- Search includes “AI” (and like terms) within 15 words of “Investment” among earnings transcripts

- As of February 27, 2024

- Based on company guidance provided at the time of publication; total number of companies differ across revenue and EPS

- Of note, this group consists largely of Tech (42%), Industrials (14%), and Consumer Discretionary (12%) sectors