This Week in Earnings – Q1’24

The Sector Beat: Industirals

In today’s thought leadership, we cover:

- Key Events this week

- Earnings Snap, covering the S&P 500 stats to date

- Key Insights from our 36th issue of Inside The Buy-Side® Industrial Sentiment Survey®, published last week

- Spotlight on Industrials in The Sector Beat

Key Events

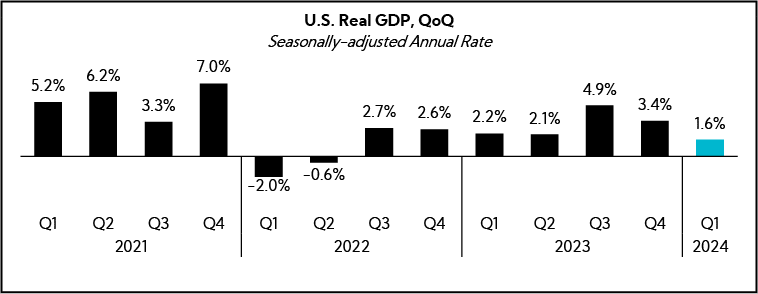

U.S. GDP

- U.S. economic growth slowed in the first part of the year to a seasonally- and inflation-adjusted annual rate of 1.6% in Q1, well below consensus estimates of 2.4% and following a 3.4% gain in Q4’23 and 4.9% in the previous period. A pullback in spending on goods such as cars and gasoline, as well as decreased inventory investment by businesses, weighed down overall growth. (Source: Commerce Department)

Personal Consumption Expenditures (PCE)

- The core PCE price index, excluding food and energy, increased 2.8% from a year ago in March, unchanged from February but slightly above the 2.7% Dow Jones estimates. Personal spending rose 0.8% on the month, more than the personal income increase of 0.5%. The personal saving rate fell to 3.2%, down 0.4% from February and 2.0% from a year ago. (Source: Commerce Department)

U.S. Unemployment

- The number of Americans filing new claims for unemployment benefits unexpectedly fell last week, pointing to still tight labor market conditions; Initial claims for state unemployment benefits dropped 5,000 to a seasonally adjusted 207,000 for the week ended April 20. (Source: Labor Department)

Housing

- Mortgage rates in the U.S. increased for a fourth straight week. The average for a 30-year, fixed loan was 17%, up from 7.1% last week. Purchases of newly built properties jumped 8.8% last month from February to their fastest pace since September. (Source: Bloomberg)

Geopolitics

- President Biden signed into law measures to provide aid to Israel, Ukraine, and Taiwan, as well as force the divestiture of social media platform TikTok from its Chinese parent company ByteDance or face a national ban. Biden’s official approval ends a 6-month saga of tense political battles on Capitol Hill that led to a deadlock on the issue of foreign aid. TikTok has already vowed to fight the measure. (Source: CNBC)

Chinese Economy

- GDP is now projected to expand 4.8% in China, according to the median estimate in a Bloomberg survey, up from a 4.6% forecast in last month’s poll, and closer to the government’s goal of around 5%. (Source: Bloomberg)

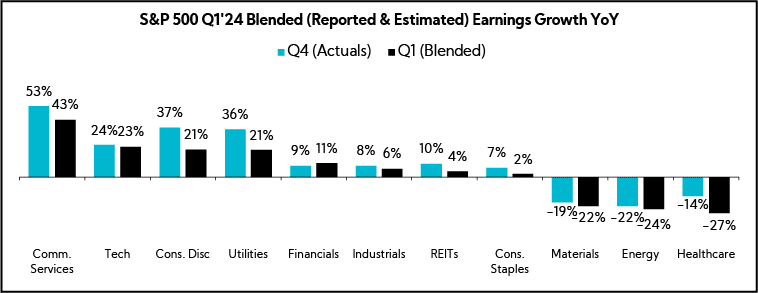

S&P 500 Earnings Snap

Q1'24 Revenue Performance

- 46% of the S&P 500 has reported earnings to date

- 59% have reported a positive revenue surprise, below the 1-year average (67%) and the 5-year average (69%)

- Blended revenue growth (combines actual reported results for companies and estimated results for companies yet to report) is 3.8%

- Companies are reporting revenue 1.3% above consensus estimates, below the 1-year average (+1.4%) and the 5-year average (+2.0%)

Q1’24 EPS Performance

- 78% have reported a positive EPS surprise, in line with the 1-year average (78%) and slightly above the 5-year average (77%)

- Blended earnings growth (combines actual reported results for companies and estimated results for companies yet to report) is 5.6%

- Companies are reporting earnings 9.5% above consensus estimates, above the 1-year average (+6.4%) and the 5-year average (+8.5%)

Key Insights

Inside The Buy-Side® Q1’24 Industrial Sentiment Survey®

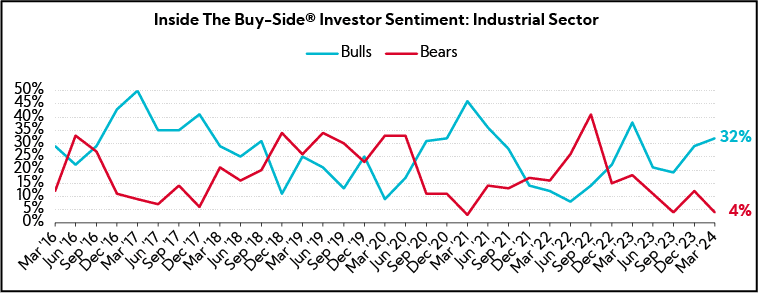

Following last quarter’s survey which found investors shifting into Neutral territory from a largely Neutral to Bearish stance the period prior, this quarter’s Industrial Sentiment Survey® finds a jolt of optimism among respondents amid anticipation of Industrial growth potential.

Based on responses from 52 sector-dedicated participants globally, from March 14 to April 9, 2024, comprising 69% buy side and 31% sell side, and equity assets under management totaling ~$1.83T, including ~$184 billion invested in Industrials.

Investor Sentiment and Perceived Executive Tone Converge in Positive Territory; Q1 KPIs are Unilaterally Expected to Improve, though Questions Around Improving Demand Signals and Impact on Margins Dominate Mindshare

- 68% characterize current sentiment as Neutral to Bullish or Bullish, more than double the 32% observed last quarter when sentiment was decidedly more Neutral

- Similarly, 66% describe executive tone as Neutral to Bullish or Bullish, up from 45% last quarter; perceived stances reverse two quarters of ebbing positivity

- 54%, expect results to be In Line with consensus while those expecting beats more than double

- Regarding Q1 KPIs, the majority anticipate Improving performances, particularly in Revenue and EPS; fewer than one-quarter expect Worsening results across all measures, though FCF does see an uptick in that view

- ~60% anticipate companies to Maintain annual guides

- Top areas to address on earnings calls this period include demand and growth, margins/pricing power, and inflation, which is in bigger focus this quarter

Majority Shrug Off Broad-Based Industrial Weakness Concerns, as Expectations for an Improving Landscape After a Period of Weakness Take Root; Support for Growth Investment Continues

- Fewer than half, 47%, now expect broad-based Industrial weakness, down from 90%+ captured for three consecutive quarters

- 46% now expect 2024 Industrial Organic Growth to be Higher than 2023, up from 38% QoQ; those expecting a Lower growth rate declined from 50% to 27%

- As for order rates over the next six months, contributors anticipate steady to improving conditions, particularly for short-cycle products

- 59% report prioritizing growth over margins at this time, up from 48% last quarter

- Still, despite the increasing optimism, Demand and Margins are the leading identified concerns this quarter

- Reinvestment remains the preferred use of cash, with 44% in support for Increasing growth capex, up significantly from just 3% in Q3’23

- M&A continues to see increased backing with 94% In Favor or Highly in Favor of bolt-on acquisitions

Investors Rally Around Technology-Enabled Business Narratives, China Derisking, and North America; Majority of Sub-industries Bask in Bullish Glow

- Leverage to AI and nearshoring/reshoring activity are cited as the most compelling investment themes

- North America remains the regional darling for eight consecutive quarters, while APAC (ex-China) sees increasing support QoQ

- China as a compelling region garners zero support for the second consecutive quarter and aversion toward the country continues to grow

- 80% now assign a High or Very High level of risk to companies with operational exposure, up from 76% last quarter

- Nearly all sub-industries register more bulls than bears

- Industrial Equipment & Components and Water are the largest bull gainers while Materials sees the highest influx of bears; Ag and Transportation are decidedly out of favor

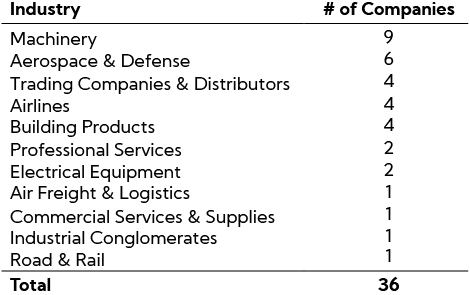

The Sector Beat: Industrials

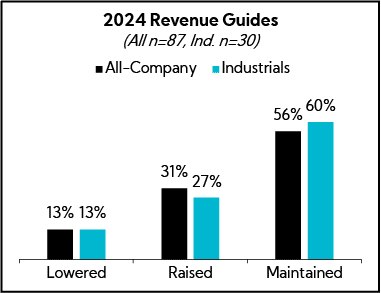

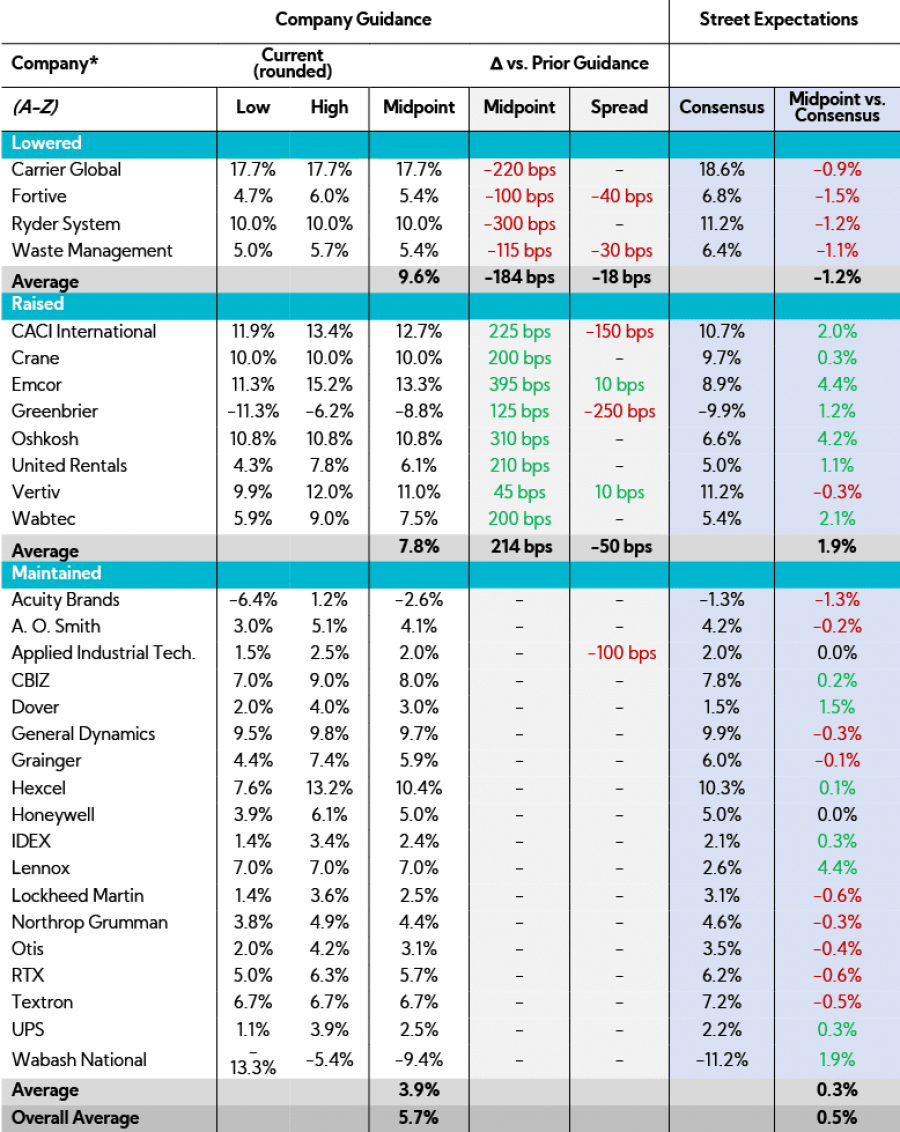

Each quarter, we analyze annual revenue and EPS guidance provided by Industrial companies with market caps greater than $1B that have reported to date.1 Below are our findings.

For comparison purposes, we provide an “All-Company” benchmark, which tracks in real-time a basket of companies larger than $1B in market cap across all sectors that have reported guidance to date.

Guidance Breakdown by Industry

Revenue Guidance

- Companies that raised guidance (n = 8)

- 88% raised the bottom and top of the original range

- 12% raised the bottom but maintained the top of the original range

- Average midpoint of 7.8% growth versus 5.7% last quarter

- Average spread decreased by 50 bps to 2.4%

- Companies that maintained guidance (n = 18)

- Average midpoint of 9% growth

- Average spread of 6%

- Overall midpoints assume 5.7% annual growth vs. 5.2% analyst estimates, on average

- According to our Q1’24 Inside The Buy-Side® Industrial Sentiment Survey® published last Thursday, investors are expecting 2024 Industrial organic growth rates to be higher than in 2023

Annual Revenue Guidance Summary

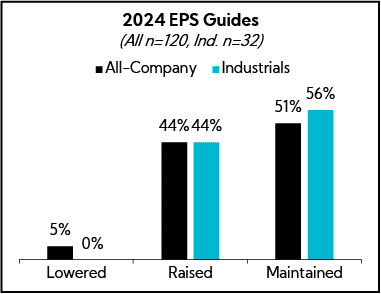

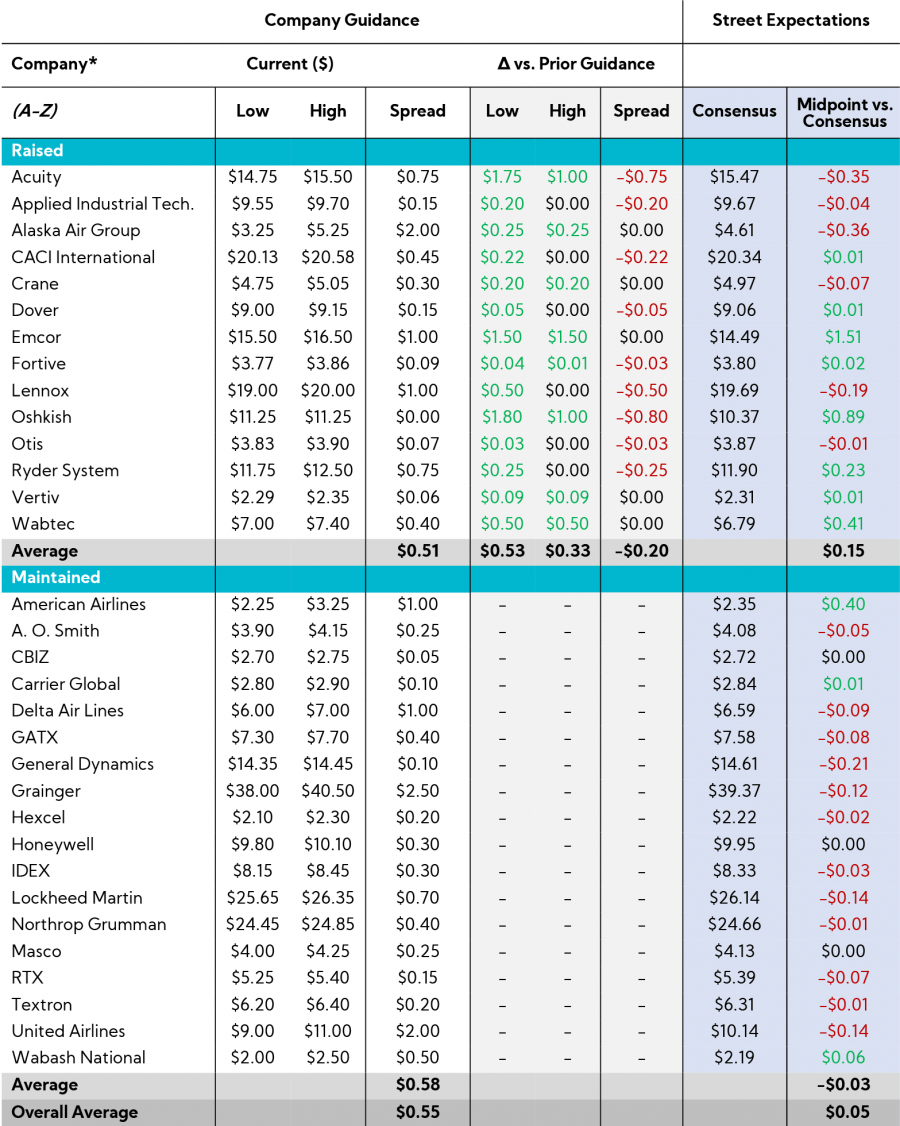

EPS Guidance

- Companies that raised guidance (n = 14)

- 57% raised the bottom and top of the original range

- 43% raised the bottom but maintained the top of the original range

- Average spread decreased from $0.71 to $0.51

- Companies that maintained guidance (n = 18)

- Average spread of $0.58

- No industrials lowered EPS guidance

Annual Adj. EPS Guidance Summary

Earnings Call Analysis

Further, we analyzed the earnings calls for this group and the broader industrial universe to identify key themes.

The diversity of the Industrial sector has come into full focus this quarter, as a variety of macroeconomic and industry-specific factors have led to diverse earnings narratives depending on the end market, more notably so than in prior quarters.

While performances have varied from company to company, in aggregate, Industrials currently represent the only sector in the S&P 500 where the majority of reported top-line figures have come in below consensus. Moreover, while bottom-line results have fared more positively relative to estimates, those beating earnings consensus is still below the S&P 500 average (73% vs. 78%, respectively).

Despite executives pointing to continued macro headwinds, very few companies have lowered initial annual guides delivered at the top of the year, and many are in fact raising (albeit, not at propensities remarkably different than the broader market). Indeed, the Manufacturing PMI came up for air during the latest March print after 16 months of readings in contraction territory, in addition to a well-received improvement in the New Orders Index. While one month does not make a trend, these data points imply light at the end of this tunnel for some of the harder-hit segments, such as freight, which has been in a recession. As one executive put it, “We should be getting closer to the end of this than the beginning”.

As a result of what many surveyed investors heard as increased executive optimism during Q1, more describe their temperament as increasingly bullish. But is that enthusiasm pacing ahead of reality?

Key Earnings Call Themes

Tough Market Conditions Persist across Certain Industries Such as Transportation and Building Products, but Companies are “Controlling the Controllables” and Underlying Conditions Seem to be “Building Momentum” with “Back-Half Strength” a Consistent Theme

- Norfolk Southern ($52.7B, Railroad): “The macro landscape presents a mixed bag with uncertainty regarding inflation and future Fed rate actions overshadowing the recent recovery in manufacturing. However, our improving service product places us in an excellent position to capitalize on growth opportunities, and we also expect to drive incremental volumes.”

- Greenbrier ($1.6B, Railroads): “The economy in North America has been resilient. The probability of a soft landing is increasing, and the Fed has signaled it will likely make three interest rate cuts by the end of 2024. Of course, this year is also a U.S. Presidential Election year, not to mention national elections in the EU and Mexico. In Europe, while the economy is still lagging the U.S., the growth projections have been trimmed once again by the European Central Bank, but we’re building momentum.”

- MSC Industrial Direct ($5.3B, Industrial Distribution): “While macro conditions have not materially improved since the start of the calendar year, we continue to hear a more positive overall sentiment about the coming months from our team on the ground.”

- Crane ($8.1B, Specialty Industrial Equipment): “The uncertainty just remains what’s outside of our control. You have a highly charged political environment. You have wars. We have an unknown inflationary environment and Fed action. There’s just a lot of global uncertainty, that is the right reason to be cautious and be prepared for anything. Having said that, what’s within our control and what we see immediately, it feels high confidence, I would say that I see, if this trend continues, little downside risk with some upside potential opportunity.”

- Ryder System ($5.3B, Rental & Leading Services): “Rate market conditions remain challenging. We continue to believe that 2024 will reflect trough market conditions and used vehicle sales and rental, and our forecast assumes a gradual pickup in the second half of 2024.”

- Owens Corning ($14.4B, Building Products & Equipment): “We’re seeing fairly weak conditions as we have for a while in Europe and in Asia. And, we were down on revenue in both of those regions on a year-over-year basis and it’s really macro driven. It’s driven by the interest rate environment that we’re in, it’s driven by the construction markets in those geographies, and really neither region has recovered quite the same way. We’ve seen the U.S. bounce back from the impacts of inflation and interest rates.”

- Barnes Group ($1.7B, Specialty Industrial machinery): “Our overall sales funnel is healthier. Our overall look into the markets are healthier and it’s resulting in sequential orders increase on all the businesses that we have in industrial. And it’s that momentum and the effect of the full year of the transformation product savings coming into effect that make the trajectory into the second half stronger. We’re not expecting any macro shifts in the markets, but it just our operational performance and execution that will deliver against that and we feel very well positioned to do that.”

Moving Past Notable Inclement Weather Impact in Q1, Commentary Suggests Accelerating Backlog Growth in Coming Quarters; Freight Remains a Sore Spot, though Many Suggest We Have Reached a Bottom

- CSX ($66.2B, Railroads): “You can see the dip [in volume] probably around early February, late January, this is after the winter started, or after we went through the winter storms, and it really impacted our southern corridors. [However], the total demand is very strong against a healthy backlog of large construction projects with infrastructure spending expected to accelerate.”

- Fastenal ($39.2B, Industrial Distribution): “Q1s are seasonally low volume to start, but this year contended as well with severe weather in January and a Good Friday holiday that fell in March for the first time in five years, an impact that was compounded by it falling on the last business day of the quarter. No matter how one treats this noise however, it doesn’t mask that the primary challenge remains poor underlying demand. However, we do believe we are seeing good indications of progress which should reaccelerate market share gains as we proceed through 2024.”

- Vertiv Holdings ($32.3B, Electrical Equipment): “Our orders grew 60% YoY and 4% sequentially. This is an indicator of good market demand and of our very relevant market position. The strength in order drove a very strong Q1 book-to-bill at 1.5x. Important to note, most of the orders overage in Q1 is for deliveries beyond 2024. Most of the acceleration comes from large orders, which typically have longer customer requested lead times. [Also], we anticipate orders will remain strong, but I want to caution 60% order growth is not the new expectation. The comparison will get tougher as 2024 progresses.”

- Fortive ($26.7B, Scientific & Technical Instruments): “We saw book-to-bill of about 1, and we anticipate that book-to-bill as well in Q2. So we’re starting to see the orders come back. Obviously, shipments not yet. The first half is really playing out the way we anticipated. So, in that sense, we’re seeing an order book building. We said last call that we would start to see orders start to move to growth at the tail end of the second quarter.”

- Moog ($5.4B, Aerospace & Defense): “If I look to the backlog, the change in our backlog is really the strengthening on the commercial aerospace side and the defense businesses over the course of the last year. I think a slight weakening on the industrial side as well is reflective of the slowdown in the orders that we have described.”

- Owens Corning ($14.4B, Building Products & Equipment): “We might be at a trough here where we see the opportunity as demand conditions improve, as we go through the back half of 2024 into 2025, we get better volume growth. We can start to run more assets and produce more. And then we see that as a positive on future pricing as we go forward. We see some green shoots of some potential opportunities as we move in the back half of the year as we see that demand environment start to improve and potentially that spot pricing environment improved with better economic conditions.”

- Old Dominion Freight Line ($42.7B, Trucking): “I would say right now, underlying demand has felt relatively consistent, but it does feel like things are improving a bit. We’ve seen some sequential acceleration, and I feel like there’s several factors that are starting to turn. We’ve been in a long, slow cycle for going back to April of 2022. And maybe to borrow a line from Taylor Swift, is it over now? We’re kind of waiting to see. We saw ISM inflect back above 50% for the first time.”

- Ryder System ($5.3B, Rental & Leading Services): “We should be getting closer to the end of this than the beginning. We look at spot rates and spot rates seem to be bumping along the bottom. You are seeing class A production come down. So, the balance of freight and vehicles to move that freight should be beginning to get more in balance. In rental, we’re not as confident yet. What we saw in the first quarter was certainly less demand than we expected. We did bring down our demand expectations for the balance of the year. We’re expecting more modest recovery in Rental in the second half. A lot of that is driven by not only that, [but] demand hasn’t come back the way we’d like, but there is an oversupply of rental trucks in the market right now. The industry has done a pretty good job over time to right-size these fleets, but this one may take a little bit longer.”

- Rush Enterprises ($3.6B, Auto & Truck Dealerships): “Hopefully, the freight recession will be clearing up by the back half of this year. I’ve been watching everybody kick the can for a year about when freight was going to pick back up. So, I’m not going to be in the economist to tell you when.”

Persistent Inflation Leads to Continued Pricing Actions Leads to Persistent Inflation

- Lennox International ($17.0B, Building Products & Equipment): “[Another] aspect of pricing is simply to capture pricing ahead of inflation, because people think inflation has gone away, and it hasn’t. So, as we do price increases, we need to just work with all our channel partners and customers and make sure we get price ahead of inflation, not behind inflation, because inflation continues to impact us, whether it’s SG&A or materials or labor, all of that impacts SG&A.”

- MillerKnoll ($1.8B, Furnishings, Fixtures & Appliances): “We’re kind of back to what I would say are more traditional, more ongoing annual price increases as a cadence. There are still inflationary pressures. They are nowhere near the level that we were seeing when we were having to do multiple price increases per year.”

- Veralto ($22.9B, Pollution & Treatment Controls): “I would say inflationary pressures are there, we are managing them really well, but it’s also about the operating discipline to make sure we are minimizing any kind of spot buys which can really have a big impact on the margin side. [On the] price side, there’s a lot of discipline that starts all the way from operating discipline.”

- Otis Worldwide ($39.4B, Specialty Industrial Equipment): “Favorable pricing and productivity more than offset annual wage inflation.”

- Vertiv Holdings ($32.3B, Electrical Equipment): “We multiple times have indicated and been vocal about our strengthened and continuously strengthening pricing muscles. And that also includes factoring in dynamics on the material cost side of the equation that’s factoring in our target of price cost positivity, [and] better contractual terms that allow us to react to something that is [not] forecasted.”

- CSX ($66.2B, Railroads): “Nothing has changed on the pricing side. Obviously, it’s a tough truck backdrop, that will improve, and we’ll see a lot of benefits from that as we see the cycle hopefully has bottomed here from what we’re seeing. But when you look at the market, what we do on the pricing side is obviously, we’re able to capture that inflation, and I don’t see anything really changing there.”

As Noted in our Recent Industrial Sentiment Survey®, Destocking Woes Enter the Rearview Mirror as Inventory Trends Find a New Normal

- Lennox International ($17.0B, Building Products & Equipment): “With the destocking effect on volume, counterbalanced by price and mix, we delivered 30 bps margin expansion, and we are all glad to see the destocking phase nearing its end.”

- Carlisle ($19.3B, Building Products & Equipment): “What our conversations are showing in Q1 is that really a lot of the channel, while the destock is over, we’re not seeing a huge build in inventory. I think as we get closer to the season, people are still concerned about…the carrying cost of [higher] inventory now than they have been. Maybe a little bit of conservatism around getting burned again on having too much inventory. So if demand holds up, obviously that will need to be addressed and we think we’re in a good position to be able to address that increased demand, even if distributors…and contractors aren’t carrying as much inventory as [we] would like them to have going into the season.”

- Dover ($24.9B, Specialty Industrial Machinery): “The demand trend is getting better now because of the headwind from destocking in the previous comps. If you want a macro comment, even if you look back two years, unitary demand was relatively flat, right? There was a lot of pricing flowing through the marketplace, but the unitary demand was relatively flat. And then because of interest rates, you had a negative headwind last year in terms of destocking. So, going into this year – thinking positively – we’ll see about unitary demand YoY, whether it inflects up, but what we know categorically is that you don’t have the headwind from destocking.”

- Honeywell International ($125.6B, Industrial Conglomerate): “We are starting to see recovery in some areas of our short-cycle portfolio, including consecutive quarters of order growth in productivity, solution and services, while the other short-cycle businesses continue to normalize as the effects of destocking fade, consistent with our second half acceleration framework.”

An Ongoing Challenge, as Labor Issues and Geopolitical Risks Continue to Weigh on Reliability

- Crane ($8.1B, Specialty Industrial Equipment): “We continue to remain somewhat supply chain constrained, with steady but gradual improvement over the last few quarters. As we have discussed previously, this is not just related to on-time deliveries from suppliers, but the broader supply infrastructure spending from raw materials, components, and labor, both availability and supplier, employee turnover, and employee experience levels.”

- RTX Corporation ($134.3B, Aerospace & Defense): “Commercial aero demand is there. But as you all know, the industry is still working through supply chain constraints and other challenges, which is leading to some OE production rate uncertainty. And this will continue to be a watch item for us for the year.”

- MSC Industrial Direct ($5.3B, Industrial Distribution): “Obviously, the Baltimore situation is so new and so tragic. We’re monitoring closely events in the Middle East and some of the supply chain disruptions. So far, impact is projected to be modest.”

- Masco ($16.1B, Building Products & Equipment): “Container costs have decreased slightly, but are certainly an elevated ongoing risk, as I talked about, in the East Coast port negotiations, the Red Sea, a number of other areas as it relates to freight.”

- Barnes Group ($1.7B, Specialty Industrial machinery): “On the OEM side, we have a mix of both supply chain challenges and inputs which are not symmetrical, they’re jumpy, as well as we have some labor productivity [challenges] in the plants with lower tenured employees and inefficiencies… For our second half of the year, we’re projecting that we’ll be able to work our way out of those challenges, just like we did the aftermarket facility. We can’t control the supply chain asymmetries, but we are expecting relief over the course of the second half of the year on some of that supply chain inconsistency that hurts OEM production flow.”

Executives Tout the Benefits of Several Quarters of Cost-Optimization Efforts Coming to Fruition

- JetBlue Airways ($1.9B, Airlines): “In the first three months of the year, our structural cost program delivered $30M in incremental savings, driven by more efficient management of disruption costs and optimizing mid-to end-of-life maintenance spend. With to-date savings of $100M, we remain on track to deliver run rate savings in the range of $175M to $200M by the end of the year, and we expect savings to ramp significantly throughout this year, driven by productivity improvement.”

- Masco ($16.1B, Building Products & Equipment “The team has done a real phenomenal job of lining up a pipeline of productivity initiatives, and this is something that’s been going on for several quarters now and part of the reason why we have the confidence of the overall margin increase YoY.”

- MSC Industrial Direct ($5.3B, Industrial Distribution): “We’ve increased our marketing efforts to generate awareness and demand by featuring the recent enhancements to our value proposition. My conviction is also derived from our ongoing gross margin execution which is a growing pipeline of productivity initiatives that provide runway for operating margin expansion as the business returns to growth. “

- Waste Management ($82.3B, Waste Management): “Our continued adoption of technology and automation initiatives led to substantial reductions in both labor costs and repair and maintenance expenses. On the labor front, efficiency in all three of our collection lines of business improved meaningfully from the first quarter of 2023 as our implementation continues to gain traction. This tool allows us to more dynamically route and it improves our efficiency, which is reducing our cost to serve and improving our asset planning.”

In Closing

As we noted heading into earnings season, investor optimism, including that captured in our Q1’24 Inside The Buy-Side® Industrial Sentiment Survey®, is seemingly outpacing corporate reality at this time, but executive commentary suggests increasing hope and optimism around normalization and back-half acceleration. Flagging headwinds are hampering straight-line momentum and the U.S. Presidential Election is more and more cited as curtail capex confidence, especially large, long-cycle projects. Year-over-year, the tone is improved.

We’ll continue to provide insights into the different sectors as earnings season rolls on, including during our coverage of the Consumer Discretionary sector next week.

In case you missed it, you can access the link below for a replay of our Inside The Buy-Side® Earnings Primer® webinar The Big So What™ – Q1’24 Earnings Season. Thank you to all who attended the session live and submitted questions!

- As of 4/25/24