Inflation and ESG

This week, our thought leadership focuses on two prominent topics in the media, company communications and client discussions:

- Inflation

- Emerging ESG Themes, a topic we talk about every day with clients

Inflation

Last quarter, our Inside The Buy-Side® Earnings Primer®, conducted from Dec. 3, 2020 – Jan. 6, 2021 with 80 investors and analysts globally, found inflation was the most notable identified risk – a concern raised by nearly one-third of respondents, more than double the previous quarter, which led to a slight pullback in those expecting margins to improve.

An early read on our Q1’21 Earnings Primer, launched earlier this week and to be released in early April, continues to see inflation as a Top 3 concern. While February saw a modest 0.4% increase in CPI, with over half of the seasonally adjusted increase linked to a 6.4% rise in gasoline, U.S. Treasury yields climbed in anticipation of stronger economic growth and higher inflation, as well as the $1.9 trillion COVID stimulus package signed by President Biden yesterday. Meanwhile, Fed Chair Jerome Powell noted while there “could [be] some upward pressure on prices,” he doesn’t expect the move to be long lasting or enough to change the Fed from its accommodative monetary policy.

While economists are mixed on the prospects of a rising CPI, we continue to hear of rising costs for corporations, most notably raw material, labor, and transportation.

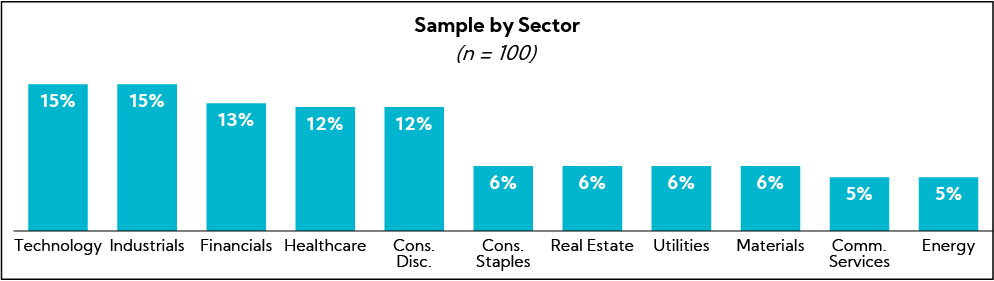

To better understand how companies are communicating the potential effects of rising inflation and, more importantly, how they are addressing and mitigating risk, we analyzed a basket of 100 S&P constituents. We selected the top companies by market cap size in each sector and weighted based on the number of companies from each sector in the S&P 500.

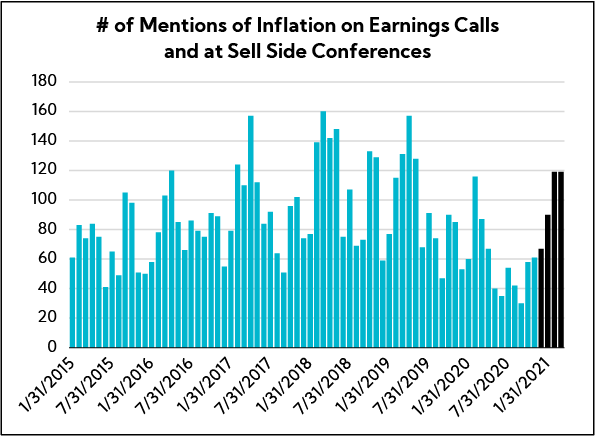

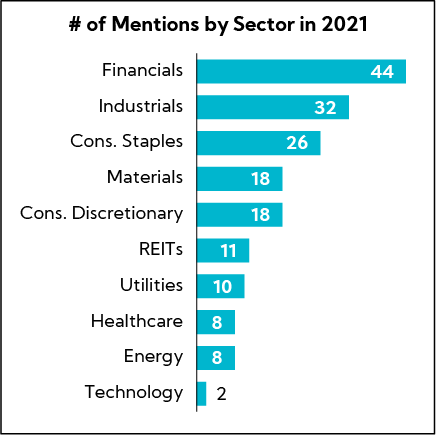

After inflation commentary from our identified group unsurprisingly decreased in 2020 amid COVID-19, since November, we have seen an increasing number of companies discussing inflation on earnings calls and sell side conferences, with the majority focused from 5 key sectors:

- Financials: note inflation is arising as a key factor for consideration in 2021

- Industrials: point to rising raw material costs, particularly steel and lumber, as well as wage inflation

- Consumer Staples: cite concern with rising transportation costs and wage inflation

- Materials: highlight rising raw material and commodity costs

- Consumer Discretionary: identify wage inflation

Notably, we have seen selected companies proactively communicate their plan to mitigate rising costs – a best practice and highlighted in the table below – through four key areas:

- Pricing actions

- Productivity initiatives

- Supplier negotiations and sourcing plans

- Leveraging the power of the company operating system

Company Commentary

- JPMorgan ($474.7B): “Inflation has been getting a lot of talk these days. As we think about the level of support that’s out there and the possibility for an incredibly strong recovery in the second half of this year, that’s the risk we’re starting to really think about.“

- Morgan Stanley ($133.6B): “Macro-wise, I think most of us are expecting rates to go up, inflation to reenter.”

- S&P Global ($82.2B): “While we expect policy rates to remain low, creditors fearing inflation or reacting to an unexpected adverse event could reset risk-return expectations, resulting in higher debt- servicing costs and reduced accessibility to funding. Interest rates are already beginning to normalize as the COVID recovery gathers pace.”

- US Bancorp ($81.1B): “You have a fair amount of stimulus that’s going to focus around infrastructure, putting money into people’s pockets, possibly also creating a little bit of inflation.”

- Truist ($79.9B): “We don’t have any idea the magnitude of the compounding effect on the economy except it’s going to cause dramatic increases in growth. It is going to create impending increases in inflation.”

- Honeywell ($148.9B): “We are definitely seeing some inflation. But we’re going to be able to manage it in the context of the guidance that we shared. You’re going to see some inflation in things like the semiconductor businesses. Obviously, steel as a commodity is going to see some inflation. I wouldn’t get so hung up about where it will come and when. I would ask you to consider that our confidence level with our Honeywell operating system and being able to both anticipate when that’s happening and being able to take the right proactive measures, whether it’s through price or through our sourcing productivity, we are not concerned about our ability to play through those situations.”

- Union Pacific ($145.6B): “We expect total dollars generated from our pricing actions to exceed rail inflation costs.”

- 3M ($107.3B): “With inflation, there are 3 areas: 1) raw material. I think depending on where crude goes, we also have crude derivatives like polypropylene, ethylene, wood pulp, all of them are inflationary. We are monitoring that to see how much it moves and how fast all of these move. 2) Labor shortage, I think you’re seeing inflation in labor. There are labor shortages in the world. And depending on how you’re going in and out of pandemic, there are places where you have severe labor shortage versus not severe labor shortage. 3) Logistics cost is something else that we are watching.”

- CSX ($71.2B): “All else equal, when I look at my infrastructure, we obviously have inflation. We’re hoping to offset that with productivity.”

- ITW ($67.4B):”As these economies are recovering globally, there’s definitely some pressures on raw materials. Particularly in our case, steel, resin, chemicals, we’re seeing inflation. The way we manage that at ITW going into the year, we have a plan that factors in all the known raw material cost increases and price increases. As we see these raw material costs come in at a higher level in 2021, our businesses are reacting and raising prices. The challenge is there can be a lag between when you see those raw material cost increases and the price increases are realized. You could see certainly some margin pressure in the short- term, but we’re going to try to minimize this lag as much as we can. Ultimately, we will recover that, just like we did last time around, but it’s going to maybe take some time.”

- Norfolk Southern ($66.8B): “For comp per employee, you can expect the traditional year-over-year inflationary rate increases of a few percent. But you’re going to also have some incentive headwinds as well. Clearly, we didn’t pay out on incentive compensation at target this year, we fully expect to be at or above target next year. So, you’ll have pressures there.”

- Eaton ($55.4B): “With respect to supply chain, we’re absolutely seeing inflationary pressures in copper. We’re seeing it in some steel. Our teams have been very busy putting together mitigation plans, largely around things that we can do to either change sourcing or taking our prices up in the marketplace. While there could always be a quarter-or-so timing impact, we’re confident that we’ll be able to offset any inflation that we see in the business with either cost-reduction measures or through pricing in the marketplace.”

- Walmart ($369.2B): “We’re watching input costs like everybody else is, and that ebbs and flows. It’s very product-based. It’s not something where you hear someone say, ‘Inflation is going to be x, and I need to take prices up by x.’ It’s much more strategic than that. We work with suppliers – if we’re getting cost inflation in a product, how do we potentially change the product? All these conversations that happen and it’s supplier by supplier and it’s product by product.”

- Coca-Cola ($220.1B): “We’re very clear on the drivers at the local market level when it comes to both pricing and its relationship with inflation and having the right packaging architecture to enable us to manage it in an optimal way the conditions of any given market. I think our teams around the world are even more focused on that area as a way to navigate a path forward that allows us to deliver on the revenue objectives that we’ve outlined.”

- PepsiCo ($183.6B): “Our revenue growth and productivity initiatives are expected to more than offset ongoing pressures associated with wage inflation, geographic and channel mix complexities, and ongoing capability investments in digitalization, information technology systems and automation.”

- Costco ($142.2B): “We’ve seen a little more inflation than we had, in part because of some of the container shortages. Freight costs are a little higher. There are some high-demand items or product shortages due to supply chain in general that have gone up. When asked on a broad stroke basis on some of these items what type of inflation are we seeing, sometimes it’s as much as 2% to 4%, sometimes less than that.”

- Linde ($141.2B): “Pricing remains healthy at 2%, as most business units are keeping up with local inflation.”

- Sherwin- Williams ($65.3B): “One key assumption embedded in our outlook is that the market rate of inflation for our raw material basket will be up by a low to mid single-digit percentage in 2021 compared to 2020, assuming no further escalation above our current outlook and no supply disruption. We expect to see year-over-year inflation in all 4 quarters, with the largest impact likely occurring in the middle 2 quarters. We expect the rate of inflation to be most significant on the petrochemical side of the basket. As we’ve demonstrated in the past, we will seek to offset these increased costs with pricing actions as appropriate.”

- DuPont ($56.1B): “I would quantify raw material inflation for 2021 at about $100 million of a headwind in 2021 with the predominance of it being within T&I and some of the nylon feedstock.”

- Home Depot ($285.7B): “On the inflation piece, it starts with lumber. I mean lumber is at record highs right now. We’re over $1,000, 1,000 board feet. That’s up roughly 1.5x from last year. Our sales in 2020 alone on price inflation in lumber was impacted about $1.7 billion. Similarly, in copper, we’re seeing significant inflation. But those are commodity markets that are priced weekly, if not daily, and we mark-to-market those in the normal course. So, we don’t plan for inflation in lumber or copper. We just manage it, again, on a weekly basis as those market is largely set market to market. But broader inflation in how we run the portfolio.”

- McDonald’s ($156.8B): “I think our view is the minimum wage is most likely going to be increasing, whether that’s federally or at the state level. And so long as it’s done, like I said, in a staged way and in a way that is equitable for everybody, McDonald’s will do just fine through that.”

- Starbucks ($127.9B): “Much of the year-over-year reduction in our operating margin for Q1 was due to sales deleverage attributable to COVID-19 as well as growth in wages and benefits, partially offset by store labor efficiencies and pricing in the Americas.”

- Lowe’s ($125.8B): “We are experiencing a little pressure from lumber inflation, obviously, puts pressure on margin, but we’re managing our way through that. At the same time, we’re investing in the supply chain. So those investments are kind of eating away, if you will, of the expansion of margin from a product perspective. And those will largely eat away at one another. So, they’ll largely end up being flattish from a gross margin perspective because of those efforts. I think ’21 is going to have more inflation, no doubt about it, would be my sense, particularly in lumber and building materials. And I think we feel pretty confident about being able to pass those along. The commodity piece like in lumber, that’s kind of industry practice and industry standard. I think where you have to really be thoughtful and sophisticated is in those categories where there’s kind of embedded inflation and raw materials that is either unique to home improvement or unique to your box versus the other box, and how do you manage your way through that. And I feel like we have a very sophisticated tool to kind of benchmark where we are, understand elasticity across the different SKUs and categories and have a good handle on how we push and pull on that at this point.”

Turning to ESG, one of our favorite topics to discuss, the following is a summary of notable trends:

- As we noted last week, the SEC announced the creation of a Climate and ESG task force to examine ESG-related disclosure and identify any material gaps or misstatements – this is just another nod from Washington that ESG is a main priority for the current administration

- BMW Group issued an integrated report combining its Annual Report and Sustainability Report, underscoring the importance of integrating ESG into the corporate strategy, commenting, “The BMW Group Report 2020 shows that our business model and sustainability cannot be separated”

- More companies are pledging to work toward “net-zero” greenhouse gas emissions; to date, 53 companies across 18 industries and 12 countries have committed to net-zero carbon emissions by 2040 as part of The Climate Pledge (co-founded in 2019 by Amazon and Global Optimism)

- Signatories include Best Buy, IBM, Johnson Controls, Microsoft, Unilever, Verizon

- Increasingly, companies are linking executive compensation to ESG targets

Regarding executive compensation, we analyzed 54 proxy filings published to date from the S&P 500 in 2021. One-third of companies (18) have included an ESG factor in annual incentive plans, the most common of which is related to diversity & inclusion (8/18 companies).

However, most qualitatively note this will be measured based on D&I initiatives and few have provided quantitative goals publicly. As ESG continues to become more important to all stakeholders, we recommend our clients evaluate ESG as a compensation factor that is aligned with corporate strategy. We have attached all company proxy examples for convenience.

Companies Citing ESG as a Compensation Factor That is Aligned with Corporate Strategy

Basic Materials

Sherwin-Williams ($62.8B)

Qualitative / No Specific Factors

Dow ($47.9B)

Customer Experience, Sustainability, Inclusion

Communication Services

Walt Disney ($357.1B)

Diversity & Inclusion

Consumer Discretionary

Starbucks ($126.4B)

Inclusion; representation target for Black, indigenous and LatinX representation

Goodyear ($4.2B)

Engagement & Diversity

Consumer Staples

Coca-Cola ($219.3B)

Qualitative / No Specific Factors

Kellogg ($20.2B)

People Safety, Food Safety / Quality, Diversity & Inclusion

Energy

Schlumberger ($41.1B)

Talent, Ethics, Health and Safety, ESG objectives, such as GHG Emissions

EQT Corporation ($5.4B)

Greenhouse Gas Safety, Safety Intensity, Employee DART

Helmerich & Payne ($3.5B)

Qualitative / No Specific Factors

Financials

Moody's ($54.4B)

Qualitative (advancement of ESG and climate goals and metrics)

Industrials

Avery Dennison ($14.9B)

Qualitative / No Specific Factors

Technology

Apple ($2.1T)

ESG Modifier

Qualcomm ($149.7B)

Diversity & Inclusion

IBM ($113.6B)

Diversity Modifier

Applied Materials ($107.5B)

Safety Performance, Organizational Health, Employee Engagement

HP ($37.8B)

Qualitative / non-financial (diversity, equity and inclusion, employee engagement)

Utilities

American Electric ($39.7B)

Non-emitting Generation Capacity