Climate Reporting

For over a decade, we have been surveying investors, conducting in-depth research, and advising clients on ESG. We have a dedicated and growing practice that supports our clients’ ESG strategy, reporting, and stakeholder communication efforts, including but certainly not limited to conducting materiality assessments, developing authentic and compelling ESG narratives, producing sustainability reports, and targeting and marketing to investors around ESG.

In today’s Thought Leadership, we tackle Climate Reporting.

Setting the Stage

According to our proprietary research, 79% of surveyed corporations report an ESG program has been put in place at their company. Furthermore, 84% of surveyed investors note that ESG has grown in importance as an investment factor over the last two years, and 56% believe that companies that integrate ESG into corporate strategy will outperform over the long-term.

While perspectives on ESG remain varied and stakeholder attitudes toward ESG continue to shift, regulation is continuing to play an integral role in advancing conversations. Below, we’ve outlined the evolving lingua franca of one column of ESG – climate reporting – along with real-time disclosure trends amid pending SEC regulations.

The SEC Push for Climate Disclosure Catalyzes Discussion

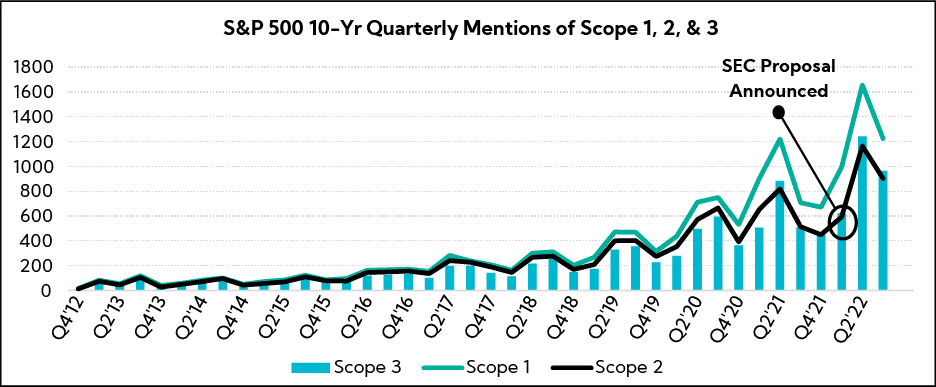

In March 2022, the SEC published new proposed rules which would require U.S. companies to disclose both data and plans of action regarding climate risks facing the business. Included in the regulation are measurements of the companies’ climate footprints caused directly (Scope 1), indirectly through purchased electricity and other energy sources (Scope 2), and indirectly from upstream and downstream activity throughout the value chain (Scope 3).

The proposed rules aim to provide investors with measurable, consistent, and comparable data, all long-standing asks from stakeholders in support of enhanced climate disclosures, and indeed for ESG disclosure, in general.

Across the S&P 500, all three measures have proliferated in mentions over the past decade among public documents, and the proposal appears to have catalyzed Scope emissions as a marquee topic. Coinciding with the announcement of the rule proposal in Q1, quarterly mentions of Scope 1, 2, and 3 spiked.

One Step Forward, Two Steps Back: Scope 3 in Focus

However, as we have discussed in prior research pieces, myriad factors continue to weigh on the SEC’s expansive climate disclosure directives – pushback among corporates and investors, technical glitches, and a Supreme Court verdict in June restricting the EPA’s authority (potentially resulting in legal knock-on implications) have collectively impeded any action.

A self-imposed October deadline has come and gone, and any movement on behalf of the SEC will likely be delayed until 2023. As of this writing, the Commission has not come to a final decision despite multiple extensions, and there remains a strong likelihood that the final ruling will be challenged in court.

Deep Dive: Scope 3 Disclosure

Scope 3 reporting requirements are the most divisive part of the new SEC proposal. These emissions account for the vast majority of global GHG for most sectors1, though are inherently difficult to track and measure given the information resides with entities outside the company. In addition to accuracy concerns, compliance imposes substantial financial burdens on smaller companies, suppliers, and customers.

On the other hand, without Scope 3 data, measuring and reporting company carbon footprints – let alone reducing externalities – becomes largely unfeasible. The meat and potatoes of GHG emissions reside with Scope 3, and some companies have proactively began reporting, in part due to an increase in shareholder proposals.

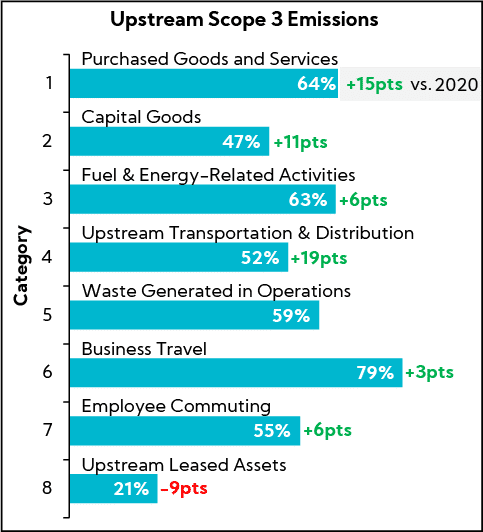

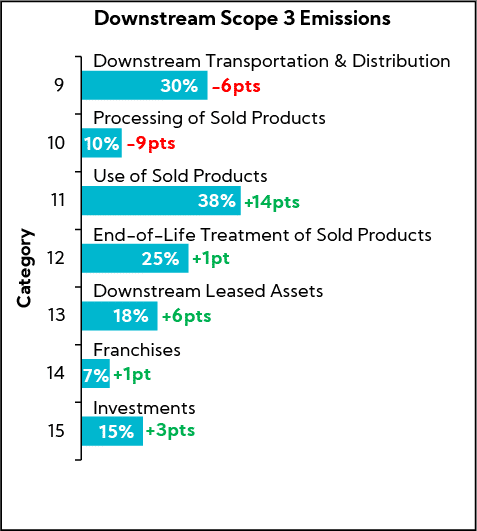

To understand the current state of Scope 3 emissions disclosure, we conducted a proprietary analysis of the S&P 500 over a 3-year period to analyze trends in reporting. We anchored our analysis by Scope 3 category which, according to CDP’s Activity Classification System, is reduced into 15 buckets, classified by upstream or downstream activity.

The disclosure breakdowns for 2022 to date2 are as follows:

S&P 500 Scope 3 Reporting (Today vs. 2020)

Key Findings

- 35% disclosed one or more categories of Scope 3 emissions in 2022, up from 7% in 2020 and 16% 2021

- Most disclosed categories are Business Travel, Purchased Goods and Services, and Fuel & Energy Related Activities

- The categories that saw the largest increases in company disclosure since 2020 include Upstream Transportation and Distribution, Purchased Goods and Services, and Use of Sold Products

- Utilities, Energy and Materials are sectors with the largest proportion of companies disclosing any Scope 3 categories, while Healthcare, Communications, and REITs have the lowest levels of disclosure

U.S. and Global Pressures Mount

As more than one-third of S&P 500 companies take a proactive approach, the SEC is acting where it can, and we are beginning to see a push for disclosures emerge elsewhere:

A growing number of companies have received a questionnaire from the SEC, acting on its 2010 Climate Change Guidance:

- These questions seek updates on climate risk factors, both physical (e.g., catastrophic weather events) and transition (e.g., diversifying widget manufacturing energy sources), along with their expected financial impact

- Further, for certain companies, the questionnaire prods discrepancies between the company’s climate disclosure in the CSR/ESG/Sustainability Report with what is disclosed in SEC filings such as the 10-K (e.g., SEC charges Brazilian mining giant Vale [ADR listing on the NYSE] with misleading investors in the run up to the mining disaster that killed 270 people)

In October, the International Financial Reporting Standards (IFRS) reported that its sustainability standards board (ISSB) unanimously voted to include Scope 3 disclosures in a new reporting standard being developed; ISSB includes other notable reporting standards and frameworks under its umbrella, including SASB, CDSB, and IIRC

In November, the U.S. proposed a rule aimed at protecting the Federal supply chain from climate-related risks; under the new rule, the largest suppliers, including Federal contractors receiving more than $50M in annual contracts, would be required to publicly disclose Scope 1, Scope 2, and relevant categories of Scope 3 emissions, climate-related financial risks, and set science-based emissions reduction targets

The push from activists is likely to grow through 2023. This year, we have already seen more than 100 climate-related shareholder resolutions, up from 60 in 2021 and 50 in 20203. 11 of these passed, including resolutions at Boeing, Caterpillar, Chevron, Chubb, Costco, and Exxon Mobil.

Further, universal proxy rules that recently came into effect could make such climate activism more accessible to smaller shareholders. Individual directors will be more vulnerable with shareholders able to pick from a common slate of candidates instead of choosing between competing slates proposed by the company and activist.

What Can Companies Do?

Align with TCFD

The SEC proposal covers the same four pillars of disclosure as the TCFD framework: governance, strategy, risk management, and metrics & targets

As well, the requirements within each pillar in the SEC proposal are broadly aligned with the TCFD’s 11 recommended disclosures; investors, such as BlackRock and State Street, have explicitly encouraged TCFD alignment

Establish a Climate Reporting Team

Combine members of finance, legal, and ESG teams along with representation from downstream and upstream parts of the business (such as procurement) to form a cross-functional team; this will ensure the data collected will be decision-useful both internally and for stakeholders

Third-party consultants can add value, ranging from building a strategy to helping account for emissions along the value chain

Educate Directors

Directors need not know carbon accounting, but they must understand the industry-specific climate risks and opportunities

Conduct Competitive Intelligence

Stay abreast of competitor’s GHG emissions disclosures and changes to their plans and schedules

Plan for the Proposed SEC Rules as They Are

While many expect the SEC to dilute the proposed rules, the safer bet would be to plan as if they won’t be; even if the SEC dilutes the requirements for Scope 3 disclosures, the need for measuring and reporting it won’t go away

In Closing

We recommend that clients do not slow down work on climate disclosures because the SEC decision is delayed, as we are seeing increasing influential demands for the information from others, including some of the largest asset managers globally.

Without Scope 3 data, measuring, reporting, and managing the climate-related externalities of a company will be incomplete, and serve to invalidate and call into question climate-related goals already issued.

Finally, our research shows companies are not slowing down on climate disclosures.

- Source: CDP

- As of 11/30/22

- ConferenceBoard.org