Client Update:

SVB Collapse and Implications for Executives & IROs

Today, we’re providing a mid-week update outside of our regularly scheduled Friday Thought Leadership amid the rapidly changing events following Silicon Valley Bank’s (SVB) collapse. With the significant amount of data and news flow we’re all receiving, we wanted to provide you with actionable insights and selected recommendations on how to navigate and communicate through this environment, based on what we know today.

What Happened?

Below we have outlined the key events which led to today:

- Before last week, SVB was the 16th largest bank in the U.S., a member of the S&P 500, handled banking for more than 2,500 VC firms, and had been operational for 40 years

- On Friday, February 24, KPMG signed an audit report for Silicon Valley Bank’s parent, SVB Financial Group, giving the lender a clean bill of health; on Monday, February 27, the Big 4 accounting firm also signed off on Signature Bank’s audit

- On Wednesday, March 8, SVB announced it had sold $21B worth of its securities at ~$2B loss after tax and noted it needed to raise $2.25B to meet depositor’s withdrawal requests and fund additional lending

- Following the announcement, Founders Fund, a prominent VC fund co-founded by Peter Thiel, advised their companies to pull money from SVB amidst financial stability concerns

- On Thursday, March 9, the stock price began to spiral, leading to a loss of more than $80B in bank shares globally

- With an FDIC insurance limit of $250K, this meant that more than 95% of SVB’s deposits were uninsured as of December 2022, with an outsized concentration of customers within the VC community

- By the end of Thursday, March 9, depositors withdrew more than $42B – about a quarter of the bank’s total – resulting in the firm’s collapse and the second-largest bank failure in U.S. history

- On Friday, March 10, SVB was seized by regulators, and the Fed said they would be offering a lending facility to work as a backstop to insure all deposits; Treasury Secretary Janet Yellen asserted, “No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer”

- On Sunday, March 12, the FDIC, Federal Reserve, and Department of Treasury issued a joint press release announcing that the Federal Reserve had invoked a “systemic risk exception”, thereby protecting all SVB depositors; furthermore, they announced they will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors

- On top of these actions, on Sunday, March 12, regulators announced a “similar risk exception” for New-York based Signature Bank, which was subsequently affected by the contagion effect over the weekend following SVB’s collapse

- Following the weekend events, HSBC stepped in to purchase SVB’s U.K. arm for £1, and JPMorgan and PNC are reportedly among the potential companies in talks to acquire SVB Financial Group in a deal that would exclude the commercial bank currently under U.S. government control

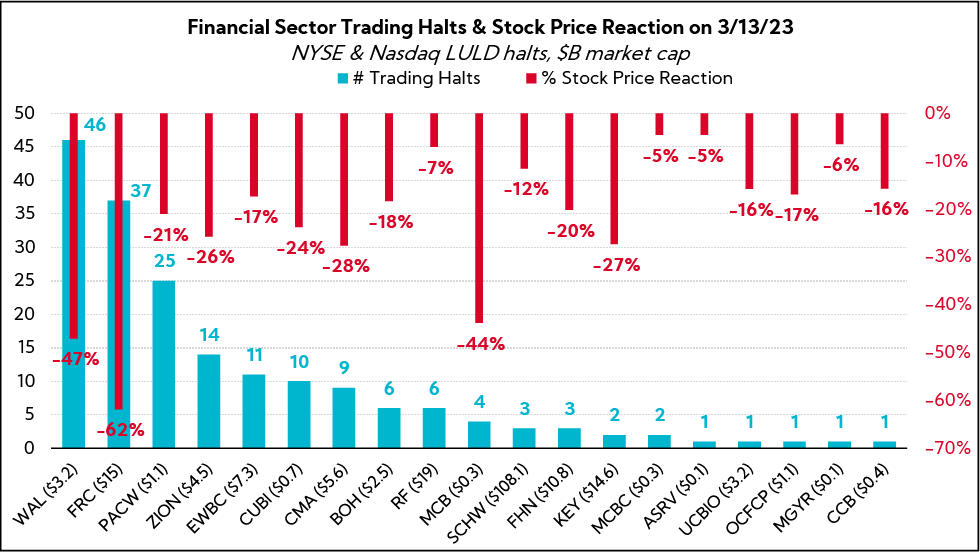

- On Monday, March 13, the Street reacted, pushing regional bank stocks to new lows and resulting in hundreds of Limit Up Limit Down (LULD) trading halts across the NYSE and Nasdaq

Company Disclosures and Commentary

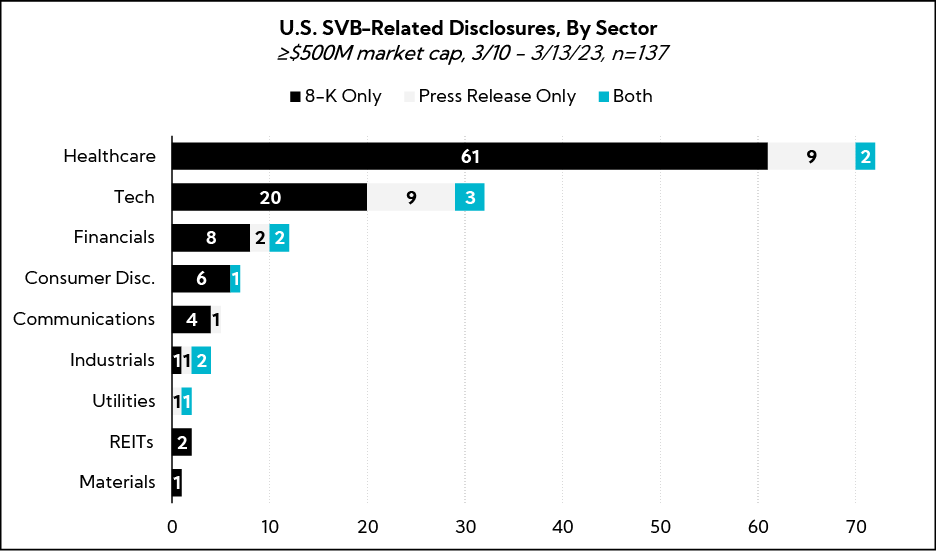

To gain an understanding of company responses to the bank’s collapse, we analyzed 137 U.S. company disclosures with market caps >$500M from 3/10 – 3/13.

Thus far, those companies that have publicly commented have primarily done so through 8-K filings, though some have opted to issue a press release.

Of the companies that commented:

- 53% had cash or cash equivalents exposure to SVB

- Exposures were primarily concentrated within Healthcare (50%) and Tech (26%)

- 47% proactively issued a disclosure reporting no direct exposure or impact

- Those with exposure largely cited between <1% and 3%, often denoted as “immaterial” or “de minimis,” though we identified impacts of >20%1

- Where applicable, companies commented on their cash exposure, often reflected as a percentage of total cash, cash equivalents, and short-term investments

- While only 3% of identified disclosures provided secondary exposure (i.e., counterparty risks), we expect this to be a burgeoning theme as many noted they are actively evaluating their partnerships to ensure coverage of any further risks

It’s unclear at this point what the additional, indirect fall-out effects may be on the global and domestic economy as the coming weeks unfold, though many banks are noting limited expected impact at this time. In situations like these, we recommend our clients remain fluid in their communication with the financial community and strive to be appropriately and responsibly transparent.

Some selected strategies and best practices include:

- Gather facts internally (and quickly): In concert with Treasury, quantify the level of exposure (or lack thereof) and aggregate relevant details; determine what the company has disclosed publicly and assess any gaps.

- Refresh on where/how the company holds its cash and cash equivalents: For many, this may be the first time investors are scrutinizing this piece of information. Be prepared to speak to where the cash is being held, through which mechanisms, and any potential liquidity implications for your company.

- Draft a concise statement: Draft a fact-based, “at this time” communication and use as needed. While we generally advise proactive communications, the situation remains fluid and it may be difficult to provide any level of certainty. Notably, a “no exposure” public disclosure is one of the most efficient ways to address concern and quell investor angst.

- Determine your indirect exposure: That is, evaluate which of your customers, suppliers, partners etc. may be exposed, if applicable, and be prepared for investors to shift focus beyond your direct connection.

- Strategize communications for Q&A: Regardless of whether your company has been directly impacted by the SVB failure and its resulting events, all companies should be prepared to answer “directly related” and “broader implications” questions from the investment community at upcoming conferences and one-on-ones. Ensure Street-facing spokespeople are aligned on message, tone, and positioning.