Part 4: Best Practices

Best Practices and Recommended Strategies for Effectively Communicating ESG Journeys

Implementing an Effective ESG Strategy

Based on our ongoing research, including input from over 650 institutional investors globally, broader statistics and trends demonstrating the monumental shift occurring in ESG investment strategies, and the Business Roundtable’s August 2019 declaration that reframed the Purpose of a Corporation from “shareholder capitalism” to “stakeholder capitalism,” we believe ESG will continue to become a core investment factor and, as such, companies should integrate the tenets of ESG into business strategy, or otherwise risk being left behind.

When it comes to implementing an effective ESG strategy, determining what to focus on can present a significant hurdle given the complexity of ESG frameworks, as they are still being defined and there is no single benchmark on which to evaluate approaches, progress and impact. In fact, this is the leading issue identified by investors in our ongoing ESG survey – the disparateness and inaccessibility of information with no universal measuring stick. To be clear, there is no one-size-fits-all approach, as ESG issues can vary widely by company and industry. Furthermore, companies are at various points of their ESG journeys – from just getting started to highly advanced. To provide clarity and affirmation, as well as support you in your ESG effort, we are focusing our recommendations in four key areas:

Agree on a Definition of What ESG Means to Your Company

ESG has been a polarizing topic since its inception, with the debate further intensified by BlackRock Chairman and CEO Larry Fink’s groundbreaking letters to CEOs, A Sense of Purpose (2018) Purpose & Profit (2019), and A Fundamental Reshaping of Finance (2020).

While ESG covers the broad range of Environmental, Social and Governance topics, we hear the terms Corporate Social Responsibility (CSR), Sustainability, Corporate Citizenship, Impact Reports and others used almost synonymously. A critical first step for a company just starting their ESG journey is to align the board of directors and management on how their company defines ESG. For boards where ESG is not yet a meaningful agenda item, discussions should be contextualized around organization-wide long-term value creation and in business terms, specifically risk, opportunity and financial performance. For example, rather than discussing the company’s political views on climate change, framing the conversation around the impact of climate on the supply chain and manufacturing facilities focuses the conversation in a different, more constructive manner.

Despite the continued ascension of ESG, our ongoing corporate survey reveals that one pushback to doubling-down on ESG is because executives and IR leaders “do not receive ESG-related questions from investors in meetings.” Notably, investment firms are developing proprietary approaches to evaluating ESG and its influence on alpha; While there are still a large number of firms that are more traditionally-focused or that place the onus of ESG analysis on the sector analyst and/or portfolio manager, our research finds that an increasing number of firms have established ESG-dedicated investment divisions. Despite receiving no to limited questions directly from investors on the topic, companies should avoid assuming it is unimportant – in every meeting, you should be asking about their focus on ESG and understanding how their firm is approaching it, which can help shape yours.

A critical step in implementing an effective ESG strategy over the long-term is to first ensure there is clear commitment from the Board and executive leadership by aligning on what ESG means to your company. This sets the foundation for future impact.

Determine Which ESG Risks and Opportunities Are Material to Stakeholders

Critical to developing an ESG framework is identifying the risks and opportunities that matter most to the organization now and in the future. To identify material factors, companies should take into consideration sector and industry practices, best practices irrespective of business category and key stakeholder views.

Understanding the Relevant ESG Ecosystem, including Industry and Best Practice

As previously noted, one of the largest and widely-reported ESG pain points for investors is the lack of standardization to evaluate public companies – this is the genesis of Mr. Fink’s 2020 letter and why BlackRock has publicly endorsed:

- Sustainability Accounting Standards Board (SASB), which provides “a clear set of standards for reporting sustainability information across a wide range of issues, from labor practices to data privacy to business ethics”

- Task Force for Climate-Related Disclosure (TCFD), which provides a framework…“for evaluating and reporting climate-related risks, as well as the related governance issues that are essential to managing them”

Indeed, companies face a challenge in determining which of the various reporting frameworks to utilize. SASB and the Global Reporting Initiative (GRI) are currently the most commonly cited frameworks according to our proprietary research, with the United Nation’s Sustainable Development Goals (UNSDGs) and TCFD also being referenced broadly.

As each sector is unique with its own material factors, best practices for tailoring your approach include:

- Research the ESG ecosystem, including SASB, GRI, TCFD, UNSDGs, and CDP, among others, to better understand the landscape; one of the most useful tools we have found is the World Economic Form ESG Ecosystem Map

- Conduct a comprehensive analysis to determine the material factors most relevant to the industry

- Identify relevant peer and best-in-class companies for communication best practices and reporting benchmarks

- Conduct a thorough review of your company’s ESG communication materials; identify best practice alignment and gaps

- Address identified issues in any third-party proxy and ESG reports (e.g., MSCI, Sustainalytics); ensure information is easily accessible on the corporate website

- Understand how ratings providers gather information; fill out industry questionnaires you determine to be most critical within the ESG ecosystem (e.g., BlackRock, MSCI)

Identifying What Matters to Your Organization and Key Stakeholders

In a 2019 Conference Board Survey, 92% of companies reported undertaking a materiality assessment at the onset of their ESG journey. Materiality is the principle of defining the ESG topics that matter most to your business and this process involves reaching out to internal and external stakeholders to obtain their views. Best practices include:

- Define what ESG materiality means for your organization and be clear about your objectives and targeted audiences

- Create a comprehensive list of potential material topics

- Explore each material topic in detail to understand its relevance to the business and stakeholders; refine and then group into categories (e.g., climate impact)

- Administer a comprehensive survey to key stakeholders – employees, executive leadership, field management, board directors, suppliers, customers and current and aspirational shareholders – based on the identified categories and themes to identify areas of statistically significant importance

- As it pertains to shareholders, develop questions that identify their preferred ESG reporting frameworks and data sources; according to our proprietary research, the leading service providers utilized by investors outside of internal resources are 1) Sustainalytics; 2) MSCI; 3) ISS, respectively, and to a much lesser extent Glass Lewis and RobecoSAM

When conducting a materiality assessment, it’s important to take an outcome-based approach. At the conclusion, you want to be able to:

- Identify where the company is creating or reducing value for society

- Prioritize material topics based on the strategic importance to the business and importance to stakeholders

- Determine critical areas to address and lesser but still important issues to monitor and move into the queue as workstreams get executed

Integrate ESG into Your Business Strategy

It is imperative that, after conducting a materiality assessment and understanding the industry landscape, the identified material factors connect with and influence your organization’s long-term business strategy. Best practices include:

- Develop a system to monitor performance, set targets and achievable timeframes, and incentivize executives and employees to deliver on critical ESG goals

- Prioritize your company’s resources for the ESG issues that matter most to your business and stakeholders, so you can focus resources and investments for maximum impact

- Develop and publish a statement of corporate purpose (Purpose, Way and Impact)

- Develop a custom materiality matrix (graphic) that simply and effectively communicate the pillars of your ESG strategy and supporting focus areas

- Identify trends on the horizon that could significantly impact your company’s ability to create value in the long-term

- Ensure leadership oversight and board support of key initiatives; present progress updates quarterly

- Create linkage between your purpose and ESG initiatives to your innovation approach and activities

Communicate your ESG Journey

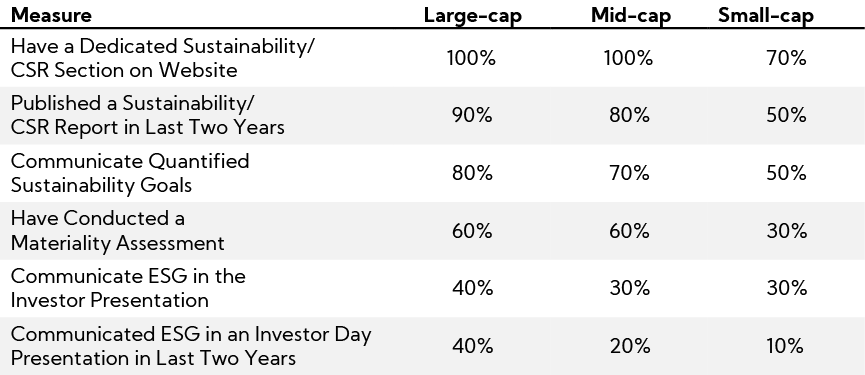

As noted in Part 3 of our ESG mini-series, to understand the communication practices of companies most-oft included in ESG funds, our analysis reveals nearly all companies, with the exception of three small caps, have a dedicated sustainability/CSR section on the website and 73% have published a sustainability/CSR report in the last two years. Fewer companies, or 33%, have communicated ESG information in the Investor Presentation or Investor Day presentation, though those that have are generally the highest-ranked of their respective market caps (e.g., Danaher and Xylem).

All companies should be focused on architecting a communication strategy grounded in best-in-class ESG reporting that serves to simplify the complex; importantly, investors are focused on progress not perfection, so communicating where you are on your journey – even if early – will be seen as a catalyst and can deliver tangible value as you execute against what you say you’re going to do (communicating action versus information). Best practices include:

- Develop a dedicated Sustainability section on the corporate website; ensure content related to the leadership team and board of directors is robust and relevant (e.g., include photos and highlight experience and attributes, including key stats and a skills matrix)

- Publish a Sustainability/CSR report annually or biennially; ensure material factors identified and goals are displayed prominently and avoid providing boilerplate information; best practice examples include Intel and Owens Corning

- Incorporate an ESG section in the investor presentation that addresses history and background on your company’s ESG approach; the ESG matrix, strategy and specific initiatives currently being executed; where you are on your journey; goals, including those already achieved or in the process; and proof points / case studies of ESG in action at your organization

- Tailor your message for ESG-dedicated and generalist investors; they will be focused on how ESG initiatives translate into risk, returns and long-term performance

- Importantly, do not “greenwash” communication materials and avoid the overuse of ESG rankings and awards

- For companies further along in their ESG journey or that are sustainability-focused, develop a dedicated ESG presentation (please see Xylem as a best practice example)

In addition to elevating ESG communication, developing a robust investor engagement strategy is another critical component. Best practices include:

- Contact the ESG and stewardship teams at your top 20 shareholders and arrange a meeting to discuss ESG-related risks biannually

- During proxy season, remain current on new rules and trends and reassess proxy disclosures in the key areas of interest to shareholders; outside of proxy season, build relationships with ESG-dedicated investors and index shareholders

- Integrate ESG communication into equity and fixed income non-deal roadshows, particularly for the firms we have identified as viewing ESG “very important” to “critical” to their investment theses

- For companies further along in their journey, target appropriate ESG mutual funds and incorporate ESG-dedicated non-deal roadshows into your outreach efforts

In Closing

Through this miniseries, we hope you walk away with a better understanding of ESG and the increasing influence it will have on investment decisions and business decisions alike over the long term. We have enjoyed sharing our thought leadership and actionable recommendations with you and are here to support your efforts, as a research firm and strategic advisor.