This Week in Earnings – Q4’23

The Sector Beat: U.S. Banks

In today’s thought leadership, we cover:

- Key Events this week

- Spotlight on U.S. Banks in The Sector Beat, which provides valuable insight into the U.S. economy, consumer, and deal environment.

In case you missed it, you can access the link below for a replay of our Inside The Buy-Side® Earnings Primer® webinar The Big So What™ – Q4’23 Earnings Season. Thank you to all who attended the session live and submitted questions!

Key Events

Employment

- Initial jobless claims dropped 16,000 to a seasonally adjusted 187,000 for the week ended Jan. 13, below the Dow Jones estimate of 208,000 and the lowest level since Sept. 2022, suggesting job growth likely remained solid in Jan. (Source: Labor Department)

Retail

- U.S. retail sales rose a seasonally adjusted 0.6% in Dec. from a month earlier, a larger-than-expected gain after a healthy 0.3% increase in Nov. In Dec., retail sales rose 5.6%, just under the prior year period’s increase of 5.8%. (Source: Commerce Department)

Housing

- Mortgage rates in the U.S. fell after two weeks of increases, dropping to the lowest level in almost eight months. The average for a 30-year, fixed loan was 6.6%, the lowest since May and down from 6.7% last week. (Source: Bloomberg)

U.S. Politics

- Congress on Thursday passed a stopgap bill to fund the Federal government through early Mar. and avert a partial government shutdown. (Source: Reuters)

Geopolitics

- The U.S. launched new strikes against Houthi anti-ship missiles aimed at the Red Sea on Thursday, as growing tensions in the region’s sea lanes disrupted global trade and raised fears of supply bottlenecks that could reignite inflation. (Source: Reuters)

- Iran-backed Hezbollah has rebuffed Washington’s initial ideas for cooling tit-for-tat fighting with neighboring Israel, such as pulling its fighters further from the border, but remains open to U.S. diplomacy to avoid war, Lebanese officials said. (Source: Reuters)

Energy

- Oil rose alongside equities, with the widening conflict in the Middle East. West Texas Intermediate rose ~1.3% to top $73 a barrel. U.S. crude stockpiles dropped 2.49M barrels last week and now are at the lowest level since October. Meanwhile, crude exports jumped to 5M barrels a day. (Source: Bloomberg)

The Sector Beat: U.S. Banks

The fourth quarter of 2023 marked the end a turbulent year for the Financials sector. Indeed, interest rates across the yield curve eclipsed their highest levels since before the Great Financial Crisis, deal activity plummeted, competition for bank deposits skyrocketed, five banks failed with a combined $549B in assets (the largest total of assets ever during a single year1), and the largest U.S. banks were forced to set aside roughly $9B to cover the FDIC’s tab on this new regional banking crisis. Whew!

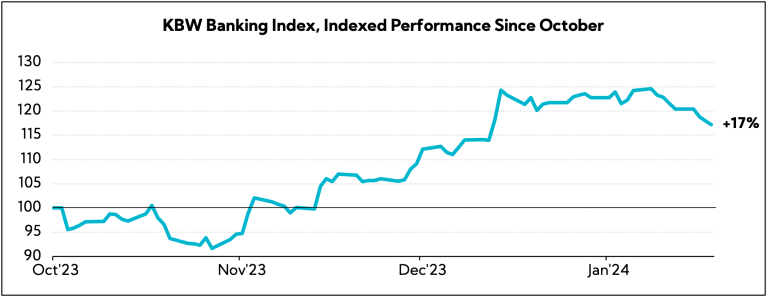

With a wall of worry resurrected earlier in 2023 for the sector, U.S. Bank year-end earnings performances seemed more muted in comparison. Yes, Citi announced a 20,000 headcount reduction through 2026, Bank of America’s net income fell by $4B from a year ago due to regulatory levies, and Wells Fargo charged off nearly $400M in commercial real estate loans. Yet, despite these jarring headlines, the KBW Banking Index, a basket of the largest U.S. banks and financial institutions, absorbed these headlines in stride and held onto 17% gains since October.

Some of the bright spots this past quarter that helped propel the year-end 2023 rally:

- Economic Outlook: Last year was not the economic disaster that some feared on the heels of rapid-fire interest rate hikes from the Fed. To the contrary, many now point to — and are counting on — a relatively resilient U.S. economy to bolster performances in the coming quarters, despite a near universal acknowledgement of the geopolitical pressures abroad;

- Consumer Outlook: While credit card balances and delinquencies are on the rise, consumer spending and resiliency continues to surprise to the upside as employment trends remain robust. Commentary suggests executives are cautiously optimistic about the levels of normalization they are seeing as pandemic-era stimulus begins to fade into the abyss; and

- Interest Rate Outlook: Hopes sprung eternal late in the fourth quarter that the Fed would finally pivot and lower the Fed Funds rate multiple times during 2024, thereby potentially reversing some financial pressures on banks, including accumulating unrealized losses on bank securities portfolios.

Investment banking began to show some positive momentum as well. Related revenue picked up in Q4, with optimism increasing on deal pipelines in the coming year. As we shared in our Inside The Buy-Side® pieces over the past two weeks, investors, too, share this perspective, with M&A seeing a near doubling of support in both our Earnings Primer® and Industrial Sentiment Survey®.

Commercial real estate (CRE) continues to weigh on sentiment and U.S. Bank balance sheets, with several banks lending extended airtime to the topic. With unrealized losses in office spaces in particular continuing to balloon, several banks point to shoring up reserves, reducing CRE positions, and settling in for a multi-year CRE winter. As Wells Fargo CFO Michael Santomassimo put it, “It’s a long movie. We’re still not past the opening credits, we’re still in the beginning of the movie. It’s going to take some time for this to play out.”

Key Earnings Call Themes

While Risks Still Cloud Commentary, Executives Express Optimism for 2024, Citing Economic Resilience in the U.S. and Increased Confidence for a Soft Landing

- Bank of America ($251.1B): “We began the [fiscal] year with a pretentious aura as economists predicted a mild recession. Instead, 2023 showcased economic resilience led by U.S. consumers despite higher interest rates. Now, we’ve ended 2023 with our economists projecting the Fed has successfully steered the U.S. economy to a soft landing.”

- Citigroup ($97.7B): “2024 looks to be similar to 2023 in terms of the macro environment with moderating rates and inflation. We expect to see growth slowing globally with the U.S. well-positioned to withstand a run-of-the-mill recession should one materialize.”

- Goldman Sachs ($123.0B): “The U.S. economy proved to be more resilient than expected, and I’m encouraged by capital markets activity. I’m not going to say it’s running back to 10-year averages right away, but it has materially improved. There are still debates about if the Fed does or does not continue on its quantitative tightening. So, all this will continue to play into people being active in markets. But at a high level, the environment in 2024 feels like it will be better for our mix of businesses than it was in 2023.”

- Morgan Stanley ($137.3B): “We enter 2024 with confidence, and our base case for the coming year is constructive. There are two major downside risks. The first is geopolitical, that global conflicts intensify and conflagrate. The second is the state of the U.S. economy over the course of 2024. The base case is benign, namely that of a soft landing. These risks… present some uncertainties as we start 2024. While downside risks are linked to the consumer with the rate path and geopolitics as two key determinants, we expect the U.S. will lead the recovery globally. Corporate confidence will ultimately drive the cycle forward.”

- Wells Fargo ($168.0B): “As we look forward, our business performance remains sensitive to interest rates and the health of the U.S. economy. We are closely monitoring credit, and while we’ve seen modest deterioration, it remains consistent with our expectations.”

Spending Remains Better Than Feared as Still-Gainfully Employed Consumers Exhibit “Slow and Gradual” Normalization to Post-Pandemic Levels; Sustained Dynamics Anticipated throughout 2024

- Bank of America ($253.6B): “We see consumer activity indicating that they’re still in the game, they’re still spending money. Where they are spending is a little different, more in services and going out in restaurants and experiences and less on goods at retail. We’re getting pretty close now to things beginning to stabilize. They’re beginning to normalize. This is a period of transition for the economy, and it’s a period of transition for our clients, too.”

- Citizens ($14.6B): “[We see] continued normalization on the consumer side, which has been extremely slow and gradual, but they’re still slightly better than where we were pre-COVID. We should see that sustain in the first half of the year as rates start to tick down. We’re starting to see good dynamics with the consumer, and we expect that to continue.”

- Discover ($24.4B): “What we’re seeing is that consumers had significant amount of savings. Those savings levels have been depleted. You had a spending pattern with the consumers across the board that was reflecting pent-up demand. As savings rates came down, the consumers needed to adjust their spending patterns. Some did successfully, some did not.”

- M&T Bank ($21.8B): “We are encouraged by the continued strong performance of the consumer as well as wage growth above inflation that has helped drive consumer spending. Consumer spending has slowed enough to alleviate inflation pressure for many goods and services. We expect that to continue in 2024.”

- Wells Fargo ($168.5B): “The financial health of our consumers remains strong. While average deposit balances per customer continued to decline from their peak, they remained above pre-pandemic levels. As wage growth has more than offset increased spending, consumer spending remains strong.”

Despite Regulatory and Political Uncertainty, a “Constructive” Interest Rate Backdrop and Prospects for a Soft Landing Boost M&A Sentiment, with Most Pointing to an Uptick in Activity through Q4

- P. Morgan ($478.2B): “All else equal, this more dovish rate environment is of course supportive for capital markets. We are in an environment of M&A regulatory headwinds, as has been heavily discussed. But having said that, we’re seeing a bit of pick-up in deal flow, and I would expect the environment to be a bit more supportive.”

- Hancock Whitney ($3.8B): “Acquisition finance is obviously very low right now as people struggle with what the appropriate valuation is for different businesses that could be available for sale for whatever reason. That’s going to probably continue to occur until we get past the election and people understand what the tax posture might be in terms of those types of transactions.”

- Goldman Sachs Group ($124.1B): “There’s no question that the capital markets and M&A activity levels have been depressed. As I’ve said before, I don’t think that continues YoY and we really started to see in the second half of this year real improvement… the M&A backlog saw really strong replenishment and improvement in Q4.”

- Morgan Stanley ($137.3B): “We’ve had a very light M&A calendar, so that has been in a trough. However, we quite possibly could have a dynamic where if we are in this soft-landing zone, we could see increased activity.”

- Citizens ($14.6B): “[Regarding M&A] it’s basically a continuation of some of the trends we’re seeing in Q4 of 2023, where capital markets are starting to pick up again. Pipelines are incredibly strong. And the lead driver seems to be M&A advisory. That’s picked up in Q4, not only due to seasonal factors, but in terms of a more constructive backdrop.”

Outlooks Remain Varied; While Some Anticipate Muted Demand Due to Tight Financial Conditions, Others Expect Improvement in 2024 as Rates Ease and the Economy Improves

- U.S. Bancorp ($64.5B): “We have four interest rate cuts by the Fed starting in the second quarter of this year. Now, whether or not that’s two cuts or six cuts, it’s not going to be a material driver to our outlook. By the end of this quarter, we’ll be nine months past the last Fed hike, as an example. Our loan pipelines have continued to strengthen over this quarter, certainly stronger than we’ve seen in the past couple of quarters. And we think that loan demand should be improved just given that the Fed is likely going to be in a cutting mode over time.”

- Hancock Whitney ($3.8B): “Starting with the balance sheet, loan balances were relatively flat this quarter as loan demand once again was tepid in Q4, similar to the last several quarters. As we look forward into 2024, we expect loan demand will return after rates begin to soften mid-year, and therefore much of our loan growth is anticipated in the second half of the year.”

- Synovus Financial ($5.4B): “Short-term, if rates are going lower, it tells us that the economy is slowing. So, there may be a latent impact of that. But longer term or more moderate term, it could drive up commercial and industrial, as people are looking at projects again and starting to expand their facilities or add inventory as prices come down. Regarding the economy, the underlying economic conditions remain constructive, and it would result in having stronger loan growth in the out quarters.”

- Bank of America ($251.1B): “You can see loan growth improved this quarter as we saw improvement in both credit card and commercial borrowing offset by declines in commercial real estate and securities-based lending. The commercial growth reflects good demand overall and was muted only at quarter-end by companies paying down commercial balances as they finalize their year-end financial positions.”

With Further Charge Offs Expected, Companies Continue to Reduce Exposure and Keep Counterweight Reserves Elevated

- Goldman Sachs ($123.0B):”We have a new disclosure the last couple quarters on CRE in particular on the nature of the loans in that sector and then as well as office, in particular. You can obviously see from those disclosures we’ve made substantial progress moving down the positions over the course of 2023.”

- Wells Fargo ($0B): ”The increase in commercial net loan charge-offs reflected the higher losses in commercial real estate office, while losses in the rest of our commercial portfolio were stable from the third quarter. As expected, losses started to materialize in our commercial real estate office portfolio as market fundamentals remained weak… it is still somewhat specific to the asset. When you look at the broader CRE market, at least in our portfolio, we are not seeing the stress spread to other parts.”

- PNC ($59.2B): “Our credit quality remained strong during the quarter, reflecting our thoughtful approach to growing our balance sheet. While we continue to expect credit charge-offs to increase over time, particularly in the CRE office segment, we’re adequately reserved.”

- M&T Bank ($22.0B): “From a timing perspective, it’s hard to say exactly when [CRE] reserves will get adjusted. Right now, we feel good with what we have given what our risk is that we know right now on the credit side. But over time, probably, there will be some reserve releases… you just don’t know when that’s going to happen.”

In Closing

Financials were dealt an interesting hand over the past year, which led to a lot of consternation among investors and corporate executives about the economy in 2023. However, this sentiment has shifted and was much more cautiously optimistic in Q4’23 than we have seen in some time as the Fed showed signs of pivoting on interest rates, though with geopolitics increasingly being a major unknown. More broadly, this shift in perspective is aligned with the positive sentiment change we saw from investors in our latest Inside The Buy-Side® Earnings Primer® survey.

With earnings now in full swing, we’ll continue to track sector trends that are important to understanding the broader economic landscape. As always, we hope you find our research coverage timely, insightful, and helpful as you prep for your earnings announcements.