This Week in Earnings – Q4’23

The Sector Beat: Consumer Discretionary

In today’s thought leadership, we cover:

- Key Events this week

- Earnings Snap, covering the S&P 500 stats to date

- Spotlight on Consumer Discretionary in The Sector Beat

With our pulse on the Street and ongoing client dialogues, there seems to be an inflection at play. Yes, uncertainty remains and not all sectors are popping at the same time, but the tone of 2024 is palatably more optimistic than 2023… there’s a different level of energy. Amid conservative guides, the table is being set for another under promise, over deliver year. We seem to be gearing up for stabilization followed by acceleration… the proverbial hockey stick, which was the narrative last year this time.

Key Events

Interest Rates

- The Federal Reserve on Wednesday held rates steady at the end of its two-day meeting while also setting the stage for rate cuts to come, but not by March; Fed Chairman Jerome Powell remarked, “Based on the meeting today, I would tell you that I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting to identify March as the time to do that. But that is to be seen.” (Source: CNBC)

- Euro-zone inflation eased less than anticipated at the start of the year, testing investor expectations that the European Central Bank (ECB) will begin lowering interest rates as soon as the spring after the ECB held rates steady at a record high last week. Consumer prices rose 2.8% from a year ago in January, above the 2.7% median estimate. (Source: Bloomberg)

- The Bank of England (BOE) left its key interest rate unchanged, but signaled it is likely to lower borrowing costs this year for the first time since 2020 though perhaps not as soon as investors expect. BOE left its key interest rate at 5.25% and removed a warning that it might have to raise it again, the clearest signal yet that it is preparing for cuts. (Source: WSJ)

Employment

- Initial jobless claims totaled 224,000 for the week ended January 27, up 9,000 from the previous week. Continuing claims, which reflect the number of people seeking ongoing unemployment benefits, jumped by 70,000. (Source: Department of Labor)

- Hiring accelerated with 353,000 jobs added in January, with an unemployment rate of 3.7%, above estimates of +185,000 and below the anticipated 3.8%, respectively. (Source: Department of Labor)

- Companies announced the highest level of job cuts in January since early 2023, a potential trouble spot for a labor market that will be in sharp focus this year; job outplacement firm, Challenger, Gray & Christmas, said planned layoffs totaled 82,307 for the month, a jump of 136% from December though still down 20% from the same period a year ago. It was the second-highest layoff total and the lowest planned hiring level for the month of January in data going back to 2009. (Source: CNBC)

Manufacturing

- Seasonally adjusted S&P Global U.S. manufacturing PMI increased to 50.7 in January, up from 47.9 in December 2023 and slightly higher than the earlier released flash estimate of 50.3. The latest reading marked the strongest improvement in operating conditions since September 2022. (Source: S&P Global)

S&P 500 Earnings Snap

46% of the S&P 500 has reported earnings to date

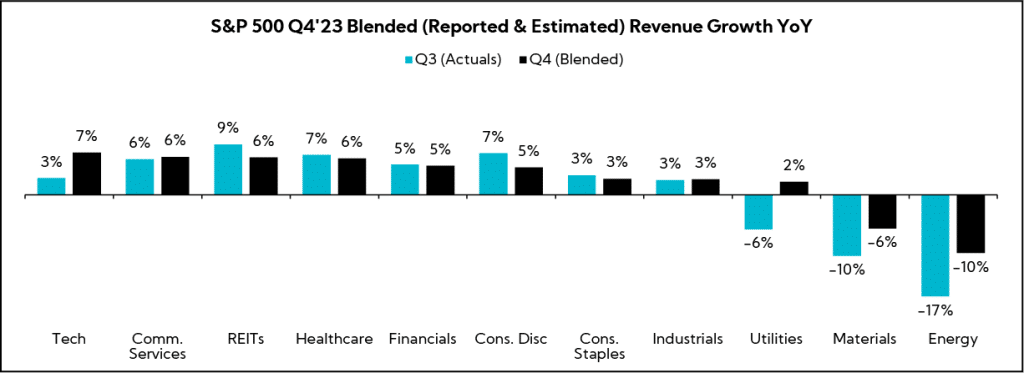

Q4'23 Revenue Performance

- 63% have reported a positive revenue surprise, below the 1-year average (67%) and the 5-year average (68%)

- Blended revenue growth (combines actual reported results for companies and estimated results for companies yet to report) is 3.1%

- Companies are reporting revenue 1.2% above consensus estimates, below the 1-year average (+1.6%) and the 5-year average (+2.0%)

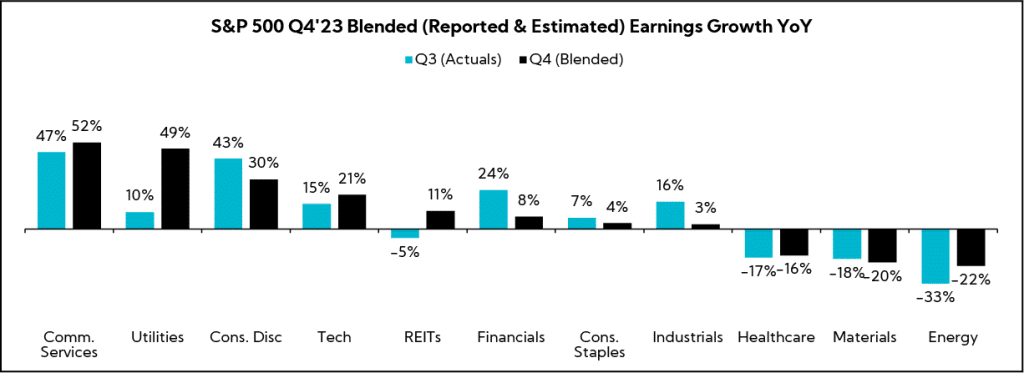

Q4’23 EPS Performance

- 80% have reported a positive EPS surprise, above the 1-year average (77%) and the 5-year average (77%)

- Blended earnings growth (combines actual reported results for companies and estimated results for companies yet to report) is 7.8%

- Companies are reporting earnings 6.4% above consensus estimates, above the 1-year average (+5.7%) but below the 5-year average (+8.5%)

The Sector Beat: Consumer Discretionary

Guidance Trends

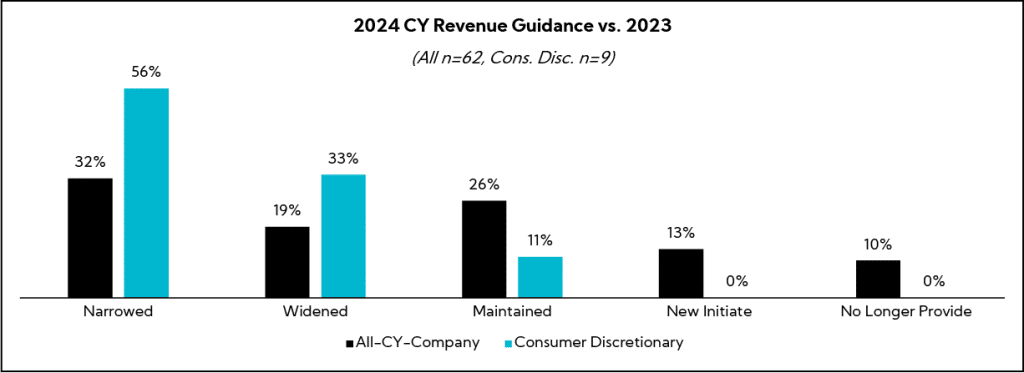

We analyzed annual revenue and EPS guidance provided by calendar-year U.S. Consumer Discretionary companies with market caps greater than $1B that have reported to date.1

For comparison purposes, we provide an “All-Company” benchmark, which tracks in real-time2 all companies larger than $1B in market cap across all sectors that have reported to date.

Calendar-Year Guidance Breakdown by Industry

Revenue

- Most spreads Narrowed (56%) relative to last year, though 14% more have Widened their guidance compared to the all-company benchmark (19%)

- 44% of midpoints are above 2023 actuals

EPS

- Most spreads were Maintained (50%) relative to last year, 13% more compared to the all-company benchmark (37%)

- 25% of midpoints are above 2023 actuals

Earnings Call Analysis

We analyzed the earnings calls for this group and the broader Consumer Discretionary universe to identify key themes.

Similar to commentary we observed in our Big U.S. Banks Sector Beat, management teams continue to see consumer spending normalizing, but overall better than feared as some investors and corporate executives had been bracing for recession risk in early 2024. While a broad recession has not manifested to date and U.S. consumers are seen as more resilient than expected (i.e., they are spending more), their long-time health is a question mark (i.e., an increasing number are spending above their means). Further, evidence that the consumer is a tale of two [income] cities continues to mount.

Over the past month alone, we have seen:

- U.S. GDP increase 3.3% in Q4, well above expectations for a 2.0% uptick and driven largely by consumer and government spending3

- U.S. consumer confidence increase in January to the highest level since December 2021, the third straight monthly increase in confidence4

- Use of “Buy Now, Pay Later” hit an all-time high, contributing to $16.6B in online spending during the holiday season, up 14% YoY5

- U.S. new home sales increase 8% to a 664,000 annual pace in December, representing the first pickup in annual sales in three years6

- Over one-third of Americans, 36%, say they have amassed more credit card debt than emergency savings, the highest percentage on record7

- Consumer borrowing spiked by $23.8B in November, more than doubling economists’ expectations for a $9.0B increase and sending outstanding credit balances north of the $5.0 trillion mark for the first time on record8

Continuing, there remains bifurcation in consumer purchasing trends and outlooks. For example, consumer companies selling highly discretionary, larger-ticket items (e.g., boats, tractors, off-road vehicles) were less constructive on the Q4 environment and their outlooks compared with companies generating revenue from more routine consumer purchases, where people can more easily shift to value-conscious consumption (e.g., beauty supplies).

While the U.S. consumer is holding up, the other primary area of consumer weakness on a global scale is China. Many executives raised warning flags this quarter over weakening conditions amid a property crisis and high youth unemployment levels. While these concerns are not surprising given three consecutive quarters of more investors anticipating worsening economic conditions over the next six months, the lingering unknown is how long this weakness will persist through 2024.

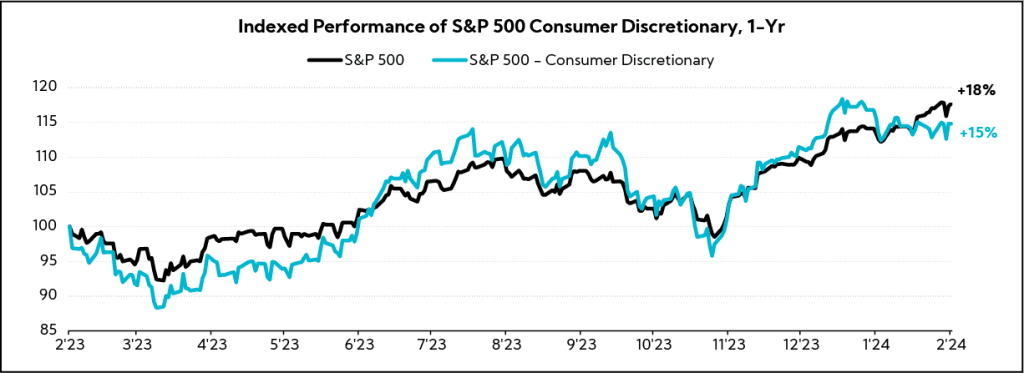

According to our latest Inside The Buy-Side® Earnings Primer® published on January 11, at the start of earnings season, we saw the level of investor bullishness toward Consumer Discretionary companies bounce off the record low observed last quarter. Interestingly, this resulted in the sector holding the distinction as being the largest bull-sentiment gainer in Q4, while simultaneously registering second only to REITs as the sector with the most downbeat views overall (and with virtually no slippage of those taking the bearish case). Moreover, 37% expected improving consumer confidence over the next six months, a stark contrast from just 8% in our Q3 survey. The net effect of these results demonstrates that more investors are finding reasons to become constructive on the consumer than they were last year as recession concerns fade to the background for now

Key Earnings Call Themes

Executives Express Caution Amid “Mixed Signals” and Expectations for a Gradual Slowdown, Though Many are Optimistic the Environment Will Improve by the End of 2024

- Tractor Supply ($25.3B, Specialty Retail): ”No doubt this past year has proved challenging, more topsy-turvy than we expected with the beginning of [2023] with unfavorable weather, rising interest rates, and inflation impacting consumer spending habits, but we believe these headwinds are temporary. We are anticipating a gradual slowdown with the lingering question of do we have a soft landing or if the risk of a harder recession remains. With this in mind, we have taken a cautious approach to our 2024 financial outlook and have forecasted our comparable sales performance below our long-term algorithm.”

- Brinker International ($2.0B, Restaurants):“The data that we track is all mixed. On one hand, you see low unemployment and continued wage growth. And we saw some pretty big up-ticks in consumer sentiment in December. On the flip side, you see increases in borrowing and credit card balances past due and a significant percentage of households are resuming paying on the student debt. So, there’s all these mixed signals that would tell you it’s going one way, but it’s also going the other way.”

- Polaris ($5.1B, Recreational Vehicles): “We can’t have another couple of years like we’ve had from a broader economic perspective. What gives me confidence is, we’re at the end of what was a record tightening cycle as well as coming out of an environment that I don’t think anybody could have ever predicted in terms of COVID… everybody back to work… and just some of the other geopolitical things that were going on. And it’s not to say that there won’t be more issues in front of us, but I do think we’re getting into a more stabilized environment.”

- Modine Manufacturing ($3.7B, Auto Parts): “The overall market remains depressed from previous levels. We expect this softness to continue for at least another quarter, but the market data is indicating a potential bottom, and we believe it will improve through calendar 2024.”

- PulteGroup ($22.5B, Household Durables): ”With many forecasting interest rates to fall, the economy to stay relatively healthy, and conditions in the job market [to] remain favorable, there are certainly reasons to be optimistic.”

Spending Outlooks Differ Across the Sector, though Many Point to “Consistent” Consumer Demand Thus Far; “They are Still Coming in and They are Still Shopping… They are Just Very Frugal”

- Starbucks ($7B, Restaurants): ”We did see a slowdown in the very occasional customer, which we’re still working to get back. But the folks in the middle who are occasional, some of the tactics that we use have helped bring them back into the fray. In terms of the traffic, we’ve seen it bounce back towards December.”

- Malibu Boats ($0B, Recreational Vehicles): “While the general consensus is that we are at or near the bottom for retail demand, as interest rate pressures are forecasted to subside, we are already seeing positive signs following our year-end sales event.”

- Boot Barn ($2.4B, Apparel Retail): “There’s some optimism that our core customer is relatively healthy and is mostly employed. They are feeling the impacts of inflation still and there is an overall concern around the economy, geopolitical factors, etc. So, there is a tendency to push off spending, but I don’t think there’s any endemic challenges with the health of our customer.”

- Polaris ($5.1B, Recreational Vehicles): “Q4 concludes a year that can be defined by a volatile macro environment and consistent consumer demand and a lack of execution on our part. Recreational Off Road vehicle retail continued to see softness in the quarter, which marks the fifth straight quarter of negative retail in our recreational portfolio. These vehicles tend to be more discretionary purchases and are more sensitive to economic conditions and the health of the consumer. We feel higher interest rates, coupled with economic uncertainty are negatively impacting retail.”

- Sally Beauty ($1.4B, Specialty Retail): “The build-up of all the inflation over time, we’re seeing that come through. And we’re also seeing consumers shop with a higher mix to credit card and buy now, pay later for what they are buying, exhibiting that stress. But they are still coming in and they are still shopping… they are just very frugal about buying to need. And buying to need means, I buy color because I do touch up my roots and I want to keep doing that. What I’m probably not going to do is be buying that styling tool, that extra hairbrush, the things that would be more splurges at this point in time. So, we see a little bit of trade-down.”

- Vista Outdoor ($1.8B, Leisure): “From a sales perspective, what we saw in the quarter was a little bit more [demand] of the products that sell in our mass channels. Those are historically a little bit lower margin. Our specialty channels, including our higher-priced helmets and snow helmets, are typically a little bit higher-margin, and we did see a transition away from those as we saw fewer selling than what we had previously seen. So, we did see that mix shifting a little bit in the channels and within the product categories that drove that.”

Priorities Shift to Organic Investment with Openness towards Opportunistic M&A

- Modine Manufacturing ($3.7B, Auto Parts): “We have spent a lot of time on the organic growth and the businesses that we want to stand up and create organizations around it to drive. And then at the same time, we have been active on the M&A front. We’ve done multiple divestitures and a couple of small deals in the last couple of quarters. And we’re doing that in strategic areas where it helps us build out our product portfolio, helps us expand in the geography, and most importantly, helps us improve our technology in the areas that we want to serve.”

- Malibu Boats ($0.9B, Recreational Vehicles): “Our capital allocation priorities haven’t changed. First, we look to fund organic growth initiatives. We have an active share buyback program and we’re always on the lookout for M&A opportunities.”

- Coursera ($3.0B, Education & Training Services): “We continue to focus on investments in our organic growth, while valuing the resilience and the strategic optionality provided by our strong balance sheet.”

- Vista Outdoor ($1.8B, Leisure): “We are optimistic that potential future divestitures, alongside the $250M in cash that we expect to capitalize the Revelyst balance sheet with at the time of separation, will allow us to accelerate our momentum through a capital allocation strategy that we expect will include investment in core organic growth opportunities, opportunistic share repurchases when we believe valuation is highly attractive, and selective tuck-in acquisitions with clear integration use cases. Our focus will be to drive tech enablement and unlock performance in our existing brands.”

Pricing Power Ebbs as Companies Prioritize Cost Savings and “Educated” Pricing Strategies to Navigate Market Challenges and Enhance Long-term Competitiveness in 2024

Pricing

- Levi Strauss ($6.0B, Personal Services): “To your question on gross margin across regions and pricing, we haven’t built in a lot of pricing in 2024. We’re just conscious of a value-conscious consumer in the pricing we have taken.”

- Boot Barn ($2.4B, Apparel Retail): “As far as the recovery goes, if we look at the components, the average unit retail, a lot of the big price increases are behind us. A low-single digit increase in AUR is probably the way to think about that. So any recovery that we see as we get into next year, we would expect to be transaction-based in nature.”

- Sally Beauty ($1.4B, Specialty Retail): “In light of the landscape that’s out there on both sides of the business, you can expect that we’ll remain conservative on pricing. The good news is we’re seeing fewer price increases come through for our vendors as commodity costs and other things have moderated. But importantly, we would not expect to be flowing through any significant increases that would drive AUR in the near term in light of the macro environment.”

- Brinker International ($2.0B, Restaurants): “I don’t think the story is totally over yet as it relates to price. First, there will be carryover [for] some of the pricing actions we’ve taken this year as you move into the first part of FY’25. We clearly are going to price at much lower levels than we have priced in the past. But we’re getting to be more educated around how we price and have a more specific ability to price where that is available to us without having an impact on the traffic side of the equation.”

Productivity & Cost Savings

- Columbia Sportswear ($4.7B, Apparel Manufacturing): “The balance is in SG&A. And what I would say about that is that it relates to the normalization of our inventory. And you’ll recall that we incurred pretty heavy inventory carrying costs in 2023 related to distribution, third-party logistics and termination-related costs. So, those are the recovery of the vast majority of that. And then, there’s another $40 million of savings that is tied up in operational cost savings across our business, as well as some organizational cost savings that include, unfortunately, headcount reductions.”

- Brunswick ($5.8B, Recreational Vehicles): “There is a cross enterprise project that we’re undertaking to right-size the overall cost structure of the enterprise. If you think about where our strategic plan and our targets are, we’re still very confident in those. But getting there to 2027 is going to take a little bit. The shape of that is unfolding as we’d expect, which is 2024 being a little bit more muted and then picking back up in the outyears. We need to make sure that our cost structure matches that same shape. Those actions are in-flight actions. If we need to find more, we always find a way.”

- Autoliv ($9.2B, Auto Parts): “To offset the negative effects from inflation and market conditions and to secure our long-term competitiveness, we have launched a number of cost saving activities. We believe that the net effect of our actions and headwinds should result in a substantial step in 2024 towards our adjusted operating margin target.”

Companies Trade Off Larger Wage Costs for Lower Employee Turnover

- Autoliv ($9.2B, Auto Parts): “In 2023, the main cost challenges were around labor, cost inflation, and energy. For 2024, we expect inflation mainly to impact labor cost for us and for our suppliers. We estimate the combined labor exposure, our own and our suppliers’, represents more than 40% of our cost base. Already during 2023, the tight labor market in some countries resulted in significantly higher than normal labor inflation. For 2024, we will see further headwinds from wage increases, especially in Europe and North America.”

- Tesla ($8B, Auto Manufacturers): ”We’re definitely aware of the cost increases which are coming through because of the wage increases.”

- Polaris ($1B, Leisure Products): ”Operating expense dollars are expected to be up 1% to 2% relative to 2023, driven by wage inflation and return to target payouts on incentive compensation.”

- Tractor Supply ($25.3B, Specialty Retail):“On wage rate growth, we are anticipating wage rate growth slightly above the historical averages pre-pandemic. It varies across different areas of the business, but I’d center around a 3% to 4% wage rate growth. We continue to see a strong solid workforce. Unemployment continues to be low. Our culture, our teams continue to have all the success with hiring. But it’s appropriate to anticipate that you’d be at that level of wage rate growth.”

- Starbucks ($105.3B, Hotels, Restaurants & Leisure): ”Our new stores continued to deliver attractive returns on both the top line and profitability with further strengthened unit economics in stores opened in new county cities. And our turnover amongst full-time store partners reached a record low in the quarter.”

- Brinker International ($2.0B, Restaurants):“Our 12-month turnover improved another 2 points to 22% during the second quarter, accelerating our outperformance on retention versus the industry.”

Many Point to Weakening Consumer Conditions, though Others Expect Traction in 2024; Further, with a U.S. Presidential Election Looming, Executives Weigh in on the Tariff Environment

Demand

- Starbucks ($3B, Hotels, Restaurants & Leisure): ”We experienced a slower-than-expected recovery in China, driven by a more cautious consumer. While we had a relatively very strong Double 11 holiday, the overall market weakness led to significantly increased pricing competition. We responded quickly to these headwinds. I think it’s fair to say that the Chinese consumer is very cautious. And so, the recovery is going to be choppy. But we think we factored that into the guidance. The long-term opportunity in China is tremendous.”

- General Motors ($44.8B, Automobiles): “We expect relative stability in our South America and Middle East operations. However, we anticipate ongoing pressure in China including the plan to reduce production in Q1 to balance dealer inventory levels. There’s tremendous change not only from a technology point of view but from a competitive point of view, so we’re evaluating China.”

- Columbia Sportswear ($4.7B, Apparel Manufacturing): “Transit, our premium China-specific collection, performed well this season, highlighting our continued efforts to create localized product that resonates with Chinese consumers. Under the strategy of our new leadership team, we’re now gaining traction in this important market. We expect China to again be one of the fastest-growing parts of our business in 2024. We’ve been operating in China for many, many years, both through a distributor and then as a joint venture in our own business. And we really underperformed historically there, in the last several years. [However], our expectations is that, that business is going to lead the geographies for us and be very, very successful.”

- Sketchers USA ($9.8B, Textiles, Apparel & Luxury Goods): ”So far we continue to be encouraged by what we’ve seen in China in their early January reads, definitely outpacing our early expectations which is good. There’s obviously Chinese New Year coming up in a period of time we need to see unfold. But so far, China continues to do better than we originally expected and continues to show every marker of recovery that we could hope for.”

Tariffs

- Polaris ($5.1B, Recreational Vehicles):”The nearshoring opportunity is something we’ve continued to push. I would say we’ve made inroads, but there’s still a lot more to do. But we haven’t built in some substantial improvement [in the tariffs environment]. We know really well what those tariffs are and how to calculate them. And look, if we get some level of good news that would be great. I’m not counting on it. I think even if there’s a Republican in the White House, I think the pressure relative to China is still so great that it’s going to take a while if those things go away. So, we’re going to continue to do what we do and act like they’re permanent and do it right for the business.”

- Tesla ($599.8B, Auto Manufacturers): “Our observation is generally that the Chinese car companies are the most competitive car companies in the world. So, I think they will have significant success outside of China depending on what kind of tariffs or trade barriers are established. Frankly, I think if there are not trade barriers established, they will pretty much demolish most other car companies in the world.”

- General Motors ($44.5B, Auto Manufacturers): “Look, I don’t discount any competitor. We need to make sure we have beautifully designed vehicles. And we have to do it at a competitive cost base. And that’s why we’re focused so much on our cost base. Now, when you mention the Chinese consumers, we do need a level playing field. There comes a point where if it’s not a level playing field between tariff and non-tariff barriers, any industry is going to struggle to compete. So, give us a level playing field and I’ll put our products and our cost structure that we continue to improve up against any.”

- Brunswick ($6B, Leisure Products): “It’s been a few years since we’ve had to discuss tariffs, but despite a favorable exemption extension into the spring, we anticipate paying $15M more tariffs versus 2023. These tariffs are primarily related to components sourced from China.”

In Closing

The better-than-expected U.S. GDP, consumer confidence, and spending in various areas certainly point to a more buoyant U.S. consumer, but on the flipside is the burden of record credit card debt and borrowings – the current concern about which can best to described as a bombastic shoulder shrug. Much hinges on the consistently strong employment environment, though we continue to see increased layoffs as companies manage profitability in a slowing growth environment and as pricing power has now hit the wall.

The anticipation is ripe…what will be in store in 2024? In an election year with the promise of rate cuts… the resilient consumer will soar! We will continue to monitor these trends and more as we work through the quarter, and hope you find our research timely and insightful.

In case you missed it, you can access the link below for a replay of our Inside The Buy-Side® Earnings Primer® webinar The Big So What™ – Q4’23 Earnings Season. Thank you to all who attended the session live and submitted questions!

- As of February 1, 2024

- The total number of companies in the all-company benchmarks are different across revenue and EPS charts and based on the data available and reported by companies at the time of our publication

- Source: Commerce Department

- Source: The Conference Board

- Source: Adobe Analytics

- Source: U.S. Census Bureau

- Source: Bankrate’s 2024 Annual Emergency Savings Report

- Source: Federal Reserve’s latest Consumer Credit Report