Supply Chain Disruption

Building on last week’s thought leadership on inflation concerns, this week, our thought leadership focuses on another prominent and related topic in the media, company communications, and client discussions – supply chain disruption.

Supply Chain Disruption

Shortly after the initial COVID-19 peak in May 2020, we closed the most challenging quarter any of us had faced with a strong belief that a new set of sustainable competitive advantages would emerge – what we called “Widening Moats as the Wheat Separates from the Chaff”. The first area we recommended focusing on in terms of building competitive advantage during the pandemic was supply chain excellence, including deep understanding of the supplier network and raw materials sourcing.

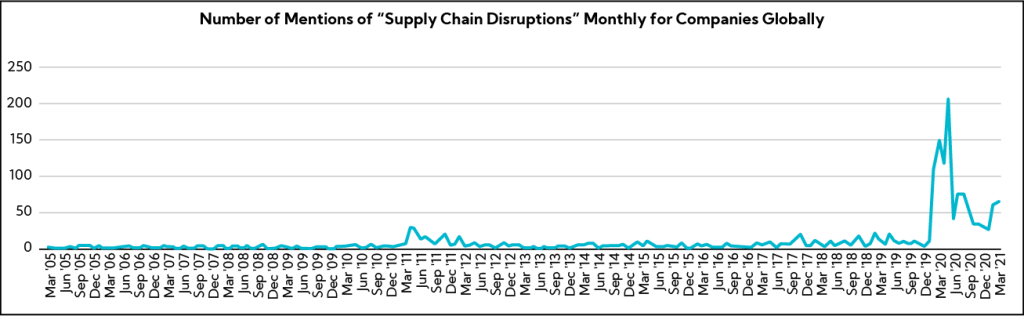

While the initial supply chain disruption caused by COVID-19 was expected broadly and company commentary in this regard escalated to new levels – save a small bump in 2011 following the natural disaster that devastated eastern Japan’s regions at the center of high-tech manufacturing – commentary decreased steadily from July 2020 to January 2021, as fewer sectors faced as significant of supply chain challenges.

However, first escalating in the semiconductor industry and home building because of continued high demand, supply chain disruption has again reemerged as a key issue for companies across sectors – driven for many by February’s Texas freeze, resulting in closed facilities and port backlogs. From the lowest point seen in January 2021 since the pandemic started, commentary has steadily increased over the last two months.

With auto makers Toyota Motor and Honda Motor commenting this week they would halt production at plants in North America and Samsung guiding to a negative impact in the next quarter, we conducted an analysis to identify the sectors most impacted, understand how companies are addressing this key issue, and capture any changes to guidance outlooks.

Sectors with the Highest Number of Companies Discussing Supply Chain Disruption

Industrials

85

- Building Products

- Industrial Machinery

- Electrical Components

Technology

62

Semiconductors

Consumer Discretionary

42

- Auto

- Apparel Retail

Basic Materials

34

- Specialty Chemicals

Three Key Areas of Disruption are:

Semiconductor shortage impacting the semiconductor, auto and electrical components industries

- Companies are providing qualitative outlooks on the normalization of production, which is expected in the second half of the year

Petrochemicals and refinery companies lowering guidance due to plant shutdowns as a result of the Gulf Coast winter storm

- At least 12 companies have quantified the negative impact to Q1 guidance, with Q2 expected to see a return to normalcy, including Olin and W.R. Grace

Continued high demand for building products and rising raw material costs

- Companies note supply chains could “operate more fluidly” and are outlining strategies to manage disruption

As such, we pulled commentary outlining company communication, mitigation strategies and outlooks.

We encourage our clients to leverage the upcoming earnings season to proactively address effective supply chain management and/or how you are offsetting disruption impact. Whether directly or indirectly impacted, or not impacted at all, we believe positioning supply chain agility as a key focus and core competitive advantage this quarter, as appropriate, is key to differentiating your company as an investment. For those seeing a more meaningful impact, investors and analysts will be seeking to understand if current guidance assumes any material impact to quarterly and/or annual outlooks.

Best practice examples emphasize mitigation strategies to address supply chain disruption, including supplier diversification and ongoing communication with suppliers and customers, as well as active inventory management / leveraging of safety stock.

Two best practice examples:

Ecolab (Materials, $69.1B)

Directly addresses timing and extent of impact, underscores key actions being taken and addresses outlook

“We believe the impact from the freeze should be limited in time and impact, similar to those seen in prior weather events like hurricanes, and that the fundamental strengthening trends within our sales and margins will continue through the year and be reflected in our results going forward. Further, we are undertaking actions to ensure our raw material supply as well as taking appropriate pricing for our products to reflect the higher input costs. As such, we continue to expect strong year-on-year growth in 2021, with earnings per share that would be above 2019’s earnings per share from continuing operations excluding the effects of this weather impact.”

Lennar (Consumer, $48.0B)

Provides perspective on the environment, discusses impact and outlines key mitigation strategies

“I would best describe the production environment as challenged, but manageable. In the first quarter, we saw a mild increase in our cycle time as we dealt with resolving issues as they presented themselves. And through our strong supply chain partnerships, we were largely able to overcome supply constraints. Our highest volume partners have given us expanded lead times, which we were able to accommodate due to our production first model, where our needs are forecasted several quarters out.”

We employ the following strategies and processes. First, we remain disciplined about our Everything’s Included approach, which simplifies the entire building process for our trades. We shared data by providing frequent forecast an open purchase order information. We simplified by rationalizing SKUs across multiple categories. We access alternative supply chain solutions and aggressively prebuy materials as needed. Most importantly, we communicate.

Our trade partners are well in advance of our upcoming production needs. Our divisions know the extended manufacturing lead times in real time and our national supply chain team, led by Kemp Gillis, together with our retail purchasing VPs, are in constant communication with each other, our divisions and all of our trade partners.”

Company Commentary

Red: Negative Commentary

Blue: Forward-looking / Guidance

Black: Mitigation Tactics / Approach

Huntington Bancshares (Financial, $17.1B)

- “If there’s a concern, it’s supply, as the semiconductor shortage is very real and is causing a slowdown in production from manufacturers and even other lingering supply chain issues, the major storm that was in Texas recently, disrupted a number of ports, all pressuring supply.”

- “…manufacturers and dealers say the supply issue will be sorted out by the second half of the year.”

Methode Electronics (Technology, $1.7B)

- “Supply chain disruptions led to additional costs such as premium freight and factory inefficiencies. These challenges will linger and be joined by demand disruptions caused by the ongoing semiconductor and potentially other material shortages, some of which are related to the recent extreme weather events in the U.S.“

- “…driving a level of near-term uncertainty that can be seen in our wide guidance range for the fourth quarter. However, none of these issues are systemic, and we expect most to be resolved by the middle of this calendar year.”

Norfolk Southern (Industrials, $66.4B)

- “…pushback in the auto sector associated with the semiconductor shortage. All that does is push volume out of the first quarter into the second quarter and into the third.”

Qorvo (Technology, $20.4B)

- “…believe we are in a constrained demand environment today. The probability of the inventory build is quite low. I can tell you that our inventories and for the last year, we’ve run very lean. I feel good about that. The second thing I’d point out is we have more frequent conversations with our customers. So they’re not stockpiling inventory. So we feel very good about how healthy our inventory is, their inventories. We talk to them about sell-through. And this is not different.”

QUALCOMM (Technology, $150.4B)

- “…have an industry-wide shortage of semiconductors. We still have our demand basically higher than supply, and supply is really driving a lot of the results. We basically can ship everything we can get. But the important part is we actually saw a permanent expansion of the addressable market of QUALCOMM. As a result, what happened to Huawei.”

- “…what we like about it is that the high demand is going to stay. And as supply started to meet demand towards the later part of 2021, we see an incredible opportunity for the company in the coming years.”

Stellantis (Industrial, $57.4B)

- “…facing a significant shortage of semiconductors. From everything we have seen so far, the number of plant closures is for Stellantis quite competitive against what I have seen from other car companies. So far, we have been able to push back and to fight on this matter. Hopefully, this will continue, and we are now working hard and as fast as we can while respecting all the quality standards on finding alternatives for the semiconductors that are in short supply, but this is also a very big hit to our business plan.

- “…this band that we are guiding you on is something that we believe we can deliver. But of course, there is something we do not control is to which extent things will improve in terms of health conditions in terms of COVID-19-related business disruptors. This is something we do not control. And of course, we are facing the other headwinds that we have here.”

Union Pacific (Industrial, $145.3B)

- “…our premium line, automotive continues to be challenged by the impact of the semiconductor chip shortage. Our expectation is that production will be recovered through the course of the year.”

Air Products and Chemicals (Materials, $60.1B)

- “…storm obviously affected our volumes because during that time, most of our plants, we were ordered to shut down. We couldn’t deliver product to our customers because of the freezing roads and all of that. Our costs went up because we had to support overtime to deal with that and make sure our plants don’t completely freeze up on all of that.”

- “…had a negative effect on us. It is not material. We are still figuring out what the effect is on our bottom line because of some of the intricacies of the reimbursements for natural gas and power during the shutdown. But overall, it did affect us and I think it will turn out to be in a negative way.”

DOW (Materials, $49.3B)

- “…what we saw with the freeze is we’re one issue, one weather event away from supply/demand tightening operating rates. And so, it doesn’t take much to tilt the market. Now Dow’s ability to rapidly respond and restart, I would say, is a true testament to team Dow’s dedication and our pride of ownership. And once all the units are back at full production rates, as we do with all significant operational events, we’ll be taking a look at additional maintenance and improvements and incorporating all of our learnings into our future plans.”

- “Assessment of the financial impact due to the storm is still underway. But despite the impact from the shutdown, the repair, the ramp-up cost, we actually, today, expect net upside for the quarter from the tight dynamics we’re experiencing across both durable and consumer end markets, resulting in first quarter results that should be $50 million to $100 million higher than the current first call EBITDA consensus estimate.”

Ecolab (Materials, $60.1B)

- “The subsequent winter freeze in Texas and the Gulf Coast region interrupted significant sources of supply and impacted certain larger customer locations, including refineries, as well as several of our own plants. Our facilities are back online, and customer and supplier facilities are generally expected to recover operations over the next several weeks, but the impact from supplier force majeures and product restrictions have continued.”

- “We currently expect the effect of the freeze will be a one-time event and short- term challenge, with the negative impacts from these combined factors expected to be approximately $0.15 per share, primarily impacting the first quarter.”

- “…we believe the impact from the freeze should be limited in time and impact, similar to those seen in prior weather events like hurricanes, and that the fundamental strengthening trends within our sales and margins will continue through the year and be reflected in our results going forward. Further, we are undertaking actions to ensure our raw material supply as well as taking appropriate pricing for our products to reflect the higher input costs. As such, we continue to expect strong year-on-year growth in 2021, with earnings per share that would be above 2019’s earnings per share from continuing operations excluding the effects of this weather impact.”

Kansas City Southern (Industrial, $20.6B)

- “We clearly are still seeing some negative impact from customers in the Gulf Coast, particularly some refineries and some plastics facilities that have been relatively slow to come back with their operations. But we do expect some continued catch- up effect to help make up for the declines that we saw in the month of February.”

Union Pacific (Industrial, $145.3B)

- “…impact from Texas storm continues to affect our industrial, chemicals and plastics business as the majority of the overall top line impact from the event lies within that business group. We’re working with those customers to support their recovery and are ready to serve them.”

WestLake (Materials, $12.1B)

- “Last week, extreme winter weather across much of Texas and Louisiana caused widespread power outages and disrupted feedstocks, raw materials and utilities to many plants in our industry, including some of our plants. As a consequence, several of our facilities experienced disruption to their operations.”

- “While we are still assessing the impact of the storm, our estimate for loss margins from sales and repair expenses are approximately $120 million. Approximately $100 million will impact our first quarter 2021 results with the remainder falling into the second quarter.”

Allegion (Industrials, $11.1B)

- “On sourcing, because of electronic components, you want to ensure you’ve got multiple sources, a product, you’ve got inventory on the shelf. The latest change would be we’re better off having on the shelf more inventory, at least in the near term. And so, we’re stocking up. We’re providing longer lead times to our supply chain and rethinking about sources of supply more than changes in terms of our production base.”

Floor & Décor (Consumer, $10.1B)

- “I think you’re seeing that now with the supply chain disruption. It’s not just a Floor & Decor center thing, it’s everybody is trying to get stuff out of China to meet the demand that exists. I think supply chain could be something that’s there. We’re in a delicate environment with COVID and the macro.”

JELD-WEN (Industrial, $2.9B)

- “We believe that given sort of labor constraints in the homebuilder side, the supply chain is probably not working quite as fluidly as it could.”

Lennar (Industrial, $29.5B)

- “To manage for these disruptions in the supply chain of materials as well as to be the builder of choice in a continually constrained labor market, we employ the following strategies and processes. First, we remain disciplined about our Everything’s Included approach, which simplifies the entire building process for our trades. We shared data by providing frequent forecast an open purchase order information. We simplified by rationalizing SKUs across multiple categories. We access alternative supply chain solutions and aggressively prebuy materials as needed. Most importantly, we communicate.”

- “Our trade partners are well in advance of our upcoming production needs. Our divisions know the extended manufacturing lead times in real time and our national supply chain team, led by Kemp Gillis, together with our retail purchasing VPs, are in constant communication with each other, our divisions and all of our trade partners.”

- “…best describe the production environment as challenged, but manageable. In the first quarter, we saw a mild increase in our cycle time as we dealt with resolving issues as they presented themselves. And through our strong supply chain partnerships, we were largely able to overcome supply constraints. Our highest volume partners have given us expanded lead times, which we were able to accommodate due to our production first model, where our needs are forecasted several quarters out.”

Whirlpool (Consumer, $13.7B)

- “Our U.S. supply chain recovery expected by the end of Q2. We experienced disruptions in 2020. We’ve been consistently evolving those such that we’re progressing out of them. We have good confidence that by the end of Q2, our back orders and our pent-up orders will be relieved.”

Cigna (Healthcare, $86.2B)

- “We saw in the month of February some weather-related disruption, both in terms of care delivery but also in the pharmacy supply chain. That created some noise.”

Children’s Place (Consumer, $1.2B)

- “The pandemic-driven disruption in the global supply chain is impacting our receipt timing, and we anticipate this will continue through the first half of 2021.”

Five Below (Consumer, $10.7B)

- “Some delayed receipts, where we are seeing some delays related to that global supply chain disruption. I think the team is managing it very well. We don’t see a material impact to that related to Q1 based on the guidance and the sales that we provided.”

Hibbett Sports (Consumer, $1.3B)

- “Increased demand and supply chain disruption continued to put pressure on our inventory.”

Patterson (Healthcare, $3.2B)

- “While the infection control supply chain has stabilized from where it was a number of months ago, we are continuing to manage through some supply chain disruption and price fluctuations for certain infection control products.”

Steven Madden (Consumer, $3.1B)

- “While we are confident in our long-term positioning and optimistic about our prospects as conditions normalize, we are cautious on the near-term outlook due to headwinds that include supply chain disruption, higher freight costs.”

- “We expect supply chain disruption, primarily related to congestions and slowdowns at the ports, to negatively impact Q1 revenue by approximately $30 million. Including this impact, we currently expect Q1 wholesale revenue to decrease high- single digits and retail revenue to increase mid-single digits on a percentage basis compared to last year’s first quarter.”

In Closing

Companies who achieve supply chain excellence and demonstrate agility amid disruption can rise above the fray, build credibility, and capture investor wallet share. We hope you find our research helpful as you continue to engage with investors and analysts and prepare for first quarter earnings.