Capital Allocation: M&A

Setting the Stage

M&A

As outlined last week, a key trend we communicated following the onset of the COVID-19 pandemic was that experienced management teams would apply lessons learned from the Financial Crisis and position their companies for long-term success, focusing their efforts on capturing the recovery in growth – both through reinvestment and M&A. And we also noted companies with strong balance sheets, like what we saw following the 2008-2009 period, would emerge as acquirers.

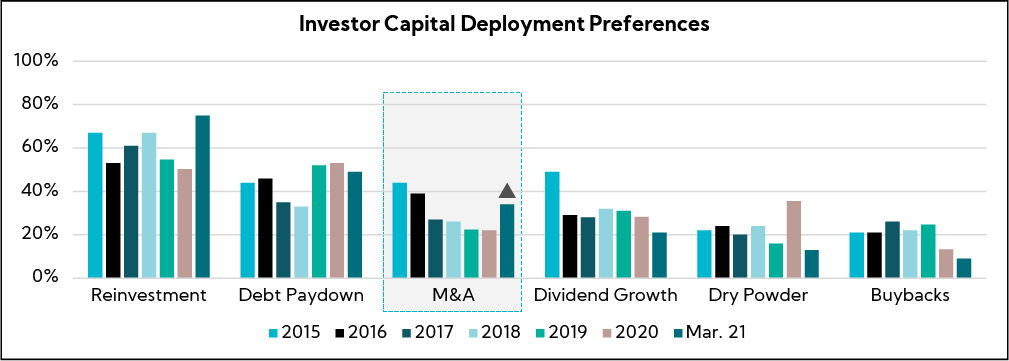

Following that, in our August “Closing the Quarter”, we identified increasing investor appetite and expected M&A to heat up in the back half of 2020. At the time, 30% of investors were in favor of M&A as a leading use of excess free cash, more than doubling QoQ, with more than 60% favoring bolt-ons and nearly one-quarter open to transformational acquisitions.

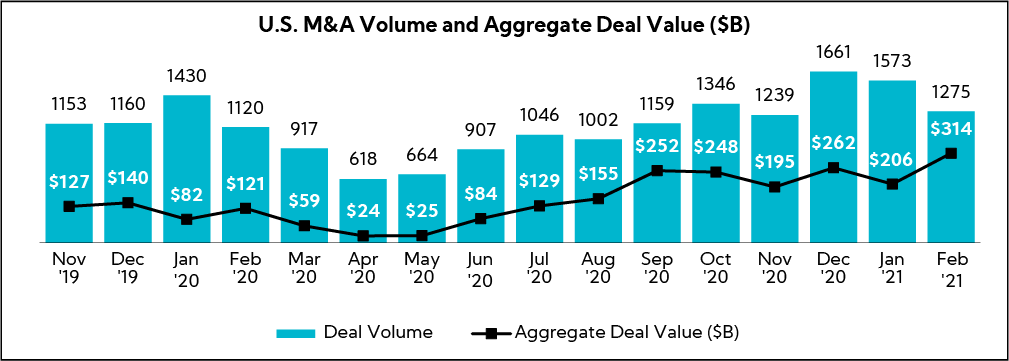

Fast forward, after total U.S. deal value bottomed at $24 billion in April 2020, M&A activity continued to increase and rebounded to pre-pandemic levels in December. February 2021 activity has now reached more than $310 billion in aggregate deal value, more than 2.5x February 2020.

With this increase in M&A activity, our Q1’21 Inside The Buy-Side® Earnings Primer® similarly finds increasing investor appetite for M&A, which is now viewed broadly as the third best use of cash, trailing only reinvestment and debt paydown – this comes after five consecutive years of declining preference for M&A.

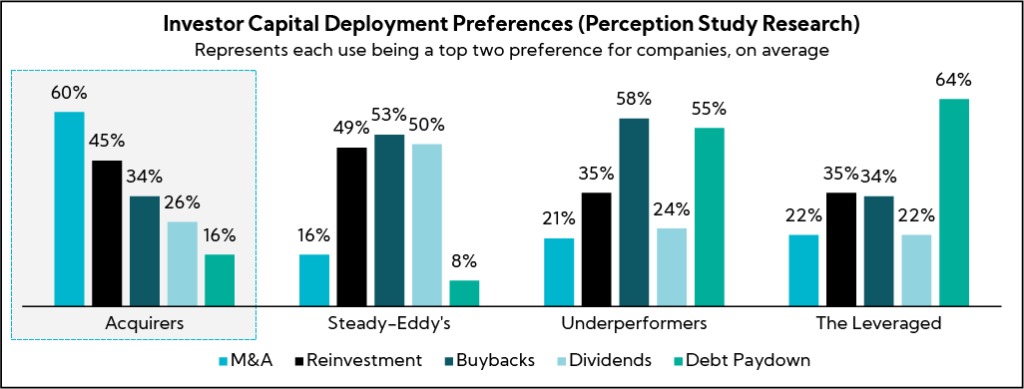

Still, as we outlined last week, specific portfolio companies see varying levels of preference for M&A based on company profile. Acquisitive companies (“The Acquirers”), which are those with a history of compelling acquisitions and/or strong M&A appetite, see the highest preference from 60% of their investors, on average. This is double the level of preference for companies we analyzed that have a perceived poor history of acquisitions (i.e., rated the lowest in our database), which see only 30% of investors on average.

With that said, M&A is expected to continue to increase across sectors driven by several key tailwinds, including persistently low interest rates, record cash flow exiting 2020, an outsized appetite for growth, and the continued proliferation of SPACs.

However, at the same time, M&A is notoriously recognized as one of the most challenging corporate endeavors – the Harvard Business Review in 2016 noted that 70% to 90% of all acquisitions fail. Based on our experience, we assert this is largely because most companies employ a suboptimal communication strategy around M&A, provide limited upfront “table-setting” on the capital deployment strategy and often cease communication once a deal closes or shortly thereafter. Based on our research, acquisitions are generally better received by investors when the transaction fits with the previously communicated framework and financial parameters.

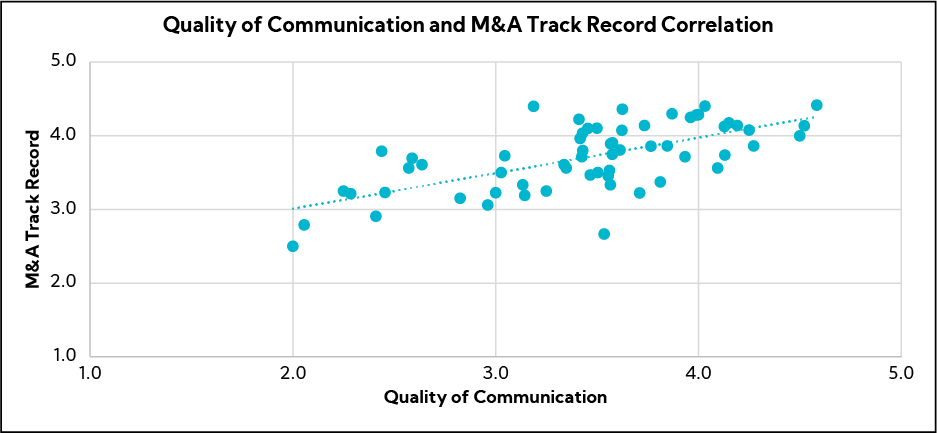

To support our position, we ran an analysis to determine correlation between high-quality communication and strong M&A track records. On a 5.0-point scale of increasing value, investors rated leadership on both Quality of Communication and M&A Track Record. Our finding: companies recognized for higher-quality communication received stronger scores for M&A track record, reflected in greater appetite for The Acquirers above.1

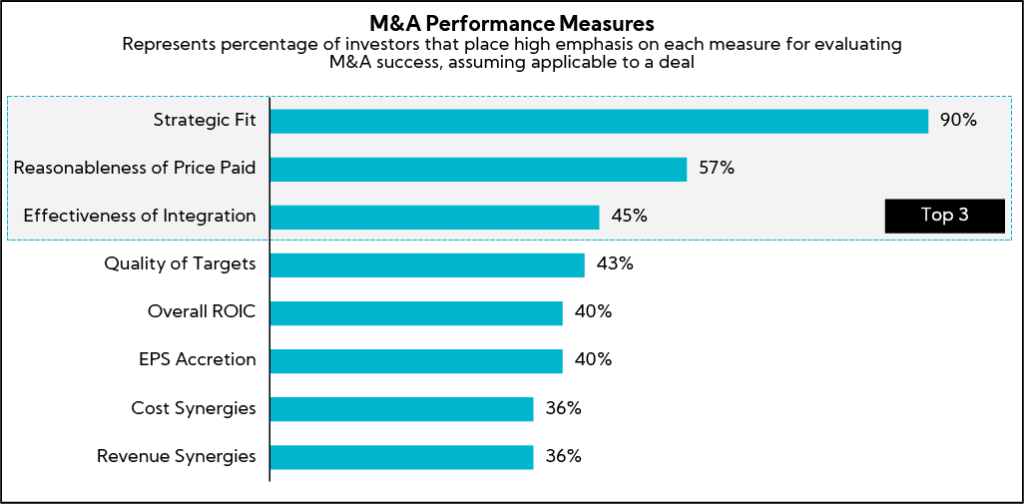

To identify M&A measures most important for communication in the eyes of investors and where top performers excel, we asked investors to identify which measures are most important in measuring M&A success, assuming each is applicable to a deal. The result: strategic fit is by far the #1 determinant of M&A success, followed by reasonableness of price paid and effectiveness of integration.

To understand why and how investors think about the top three perceived measures of value, we analyzed our database – Corbin Analytics – which includes more than 4,200 mentions of M&A. Here is what investors have to say:

As noted last week, many investors focus on M&A vs. buybacks, with compelling M&A that advances the company’s strategy viewed as a better use of cash than buybacks:

“It depends on if they see good M&A in the pipeline. For a business of this size, they’re better off doing smart M&A and repo should be done if they don’t.”

“If there are no inorganic growth initiatives, then stock buybacks.” “Share repurchases have to be weighed against M&A first.”

“They should buy back stock when there are no good deals so it shows that they will not make deals at high prices.”

“They should buy back stock in the absence of tremendous deals.”

“A buyback would add shareholder value if an acquisition opportunity does not come along that makes sense.”

Regarding Strategic Fit, investors most often provide the following recommendations, concerns and/or questions:

- Proactively communicate an M&A framework with key strategic filters

- Non-core acquisitions, particularly if unexpected, require an even greater level of transparency

- Provide perspective on the current landscape, how the company is positioned and what the strategic focus areas and/or gaps are

- Worst practices: changing M&A approach without clearly communicating the pivot to the investment community, “growth for growth’s sake” and diversification without clear rationale / synergy

“Why the companies they have been allocating capital to from an M&A perspective make sense.” “If they are planning to do an acquisition, they should lay down the groundwork in advance.” “When they do M&A, give investors more information about how it fits into their overall mix.”

“The one element of the strategy I question is some of the non-core M&A they have done that I was not expecting.”

“How much room is there to grow via M&A? How big is the pipeline and how should we think about the pace of M&A over the next two to three years?”

“I would like to understand the M&A framework, who makes the decisions and how they think about the prospects.”

“Management should address acquisition objectives and their current position in various markets.”

“They need to give investors a good sense of how these acquisitions will drive further growth. It’s not visible how they will do this in the basic investor deck.”

“I question why they feel like they have to go out and do acquisitions in general versus letting shareholders take that money and diversify it for them.”

“To the extent the executive team is thinking about making changes to historical M&A practices, help us bridge where we have been to where we are going.”

“Lay out what they see as the opportunity set for acquisitions. What does the deal pipeline look like and, if there aren’t any more tuck-in deals, do they need to start looking at bigger deals?”

“One of the areas I have a concern over is as you get the economy rolling back on track, how do some of the acquisitions fit into making a stronger business model? How are non-core acquisition meshing with the strategy? Are they providing expanded reach and generating attractive returns?”

Regarding Price Paid, investors most often provide the following recommendations, concerns and/or questions:

- To justify a higher price paid, the strategic rationale and benefits must be clear at the time of the acquisition and during integration

- For investors, acquisitions are a question of value vs. price, and are generally understanding of higher prices when the benefits are well understood

- Worst practices: paying high prices at peak cycle, communicating a targeted price range and executing a deal well above that range, not disclosing price for material acquisitions and changing precedence on the level of detail provided for similarly sized deals

“If they pay a very high multiple for acquisitions, you get nervous. For a really good business, that doesn’t bother me, but they haven’t been transparent enough on how the business has done to get me excited.”

“My main question on the acquisitions is, ‘How does the price compare to the value of what they got?’ Very few companies give a lot of visibility into that question unless it’s an extremely material acquisition. There are always competitive reasons not to disclose some of that information. It would be much more comforting to at least understand the multiples they paid and the growth rates of the underlying businesses.”

“The most recent acquisition lacked disclosure in terms of the multiple paid and the amount of revenues acquired given the actual size. Historically, the Company gave a lot of detail on prior acquisitions. They did not do a call after they announced the deal. Historically, there would be a call. That is usually a good way to do things during a major deal.”

“We like to hear more about what they are able to do with acquisitions. What is the multiple paid, what is the multiple now and how are you able to lower the multiple in such a way?”

“The acquisition was too pricey, especially given they have yet to make a return.”

“The most recent large deals were not good. They bought assets at the peak of the cycle and paid a premium multiple.”

“They paid up. We were expecting them to pay 6x to 8x but they ended up paying around 10x, which was different than what they were telling us.”

“They paid high multiples but if they were for truly good businesses, then that is okay.”

“Since many of the acquisitions were private companies, you have to take management’s word on the reasonableness of price. When a public company buys another public company, you can see that they paid a certain number of times revenue and EBITDA; that has not been as transparent with this company. They talk about their pipeline, but they haven’t talked a lot about the details.”

“It is what they do with them after they acquire them that is key. Price can be higher if it strategically enables growth, and they continue to update us.”

“In this market, it is hard to find things that are both high quality and growing and pay a good price. We do not have great transparency into the prices they are paying for businesses.”

Regarding Effectiveness of Integration, investors most often provide the following recommendations, concerns and/or questions:

- Continue to provide updates post close across key investor communication channels

- Communicate a post-mortem on key acquisitions, including what went right, what went wrong and learning lessons

- Detail how the acquired business has been improved

- Worst practices: ceasing communication after acquisition close and providing limited updates on benefits realized

“They need to keep explaining this on every earnings call for at least one year.”

“It is very hard for those on the outside, especially because between the time you buy something and the time you say that you are done integrating it, the world moves under your feet. It is very hard for me to break things apart and see them like the company can.”

“They do not give you a post-mortem on what they have bought, so it’s hard to evaluate M&A execution.”

“I was never able to get a great handle on the degree of integration that is possible and is being achieved.”

“Provide an update on where we’re at with the acquisition, how big the business could be and how meaningful it could be to revenues over the next five years.”

“As they continue to develop these technology assets, I am curious to the extent they can give timelines for when they would expect those to eventually play out. Making that more of a regular cadence of updates is always helpful, recognizing that can go both ways if development gets slowed.”

“M&A track record is a question I always ask – how would they honestly grade themselves.”

“I find it hard to tell if the acquisitions they have made have actually added value, so what gives them comfort that the strategy is working and adding value?”

“Talk more about acquisitions a few years out after they happen. How successful have they been? What is the level of engagement on M&A, new product introductions, operating incomes and margins?”

“Businesses acquired that have been improved under this company’s ownership.”

“Dig into the last couple deals and talk about the performance of those deals, how they have improved the stuff they have acquired and how the stuff is performing relative to their expectations.”

“Track record of M&A performance over an elongated period of time would be helpful.”

“More real-world use applications would be beneficial to understanding the M&A they have done. What exactly do these assets do?”

“Get people more comfortable with the track record and performance of the deals.”

“Do a case study or two. ‘We bought this two years ago, we paid this price, we combined it with this business we already owned and here is the earnings and cash flow now and the returns on the deal.'”

As evaluators of risk and opportunity, investors inherently have a skeptical eye toward M&A and the onus falls on companies to continually communicate to the Street all aspects of the acquisition – from the original deal announcement to the deal completion and up to at least a year following the deal closing, particularly for large, material acquisitions. In order to ensure benefits are realized and management is seen as strong capital allocators, it is imperative to continually update the Street on the progress of the integration.

Communication about deals should be consistent across investor communication channels, in particular earnings materials (press release, prepared remarks and presentation), industry conference presentations, NDRs and Investor Days.

We have seen many companies experience initial outsized negative sentiment on price paid at the onset only to see that abate through consistent, effective communication of integration execution, benefits realized and [conservative] milestone targets achieved. This is particularly important as Lazard’s Review of Shareholder Activism found half of activist campaigns in the second half of 2020 had an M&A angle, up from one-third in the first half of 2020.

Corbin has deep research and expertise partnering with companies on deal communication across all sizes, from bolt-ons to transformational transactions, including strategic message development and positioning (press release, prepared remarks and presentation development), management preparation and coaching and post-announcement investor communication strategy to ensure value realization is perceived.

p-value: <.001, R-squared = 98%