Commencing the Quarter – Q1’23

In today’s thought leadership, we cover:

- Key Events this week

- Key Insights from our 54th issue of Q1’23 Inside The Buy-Side® Earnings Primer®, published yesterday, April 13th

Communication Playbook, based on our channel checks, identification of emerging trends, and review of company earnings to date

Next week, we’ll pivot to key findings from our Industrial Sentiment Survey® and cover emerging themes on the economy from U.S. Bank earnings.

Key Events

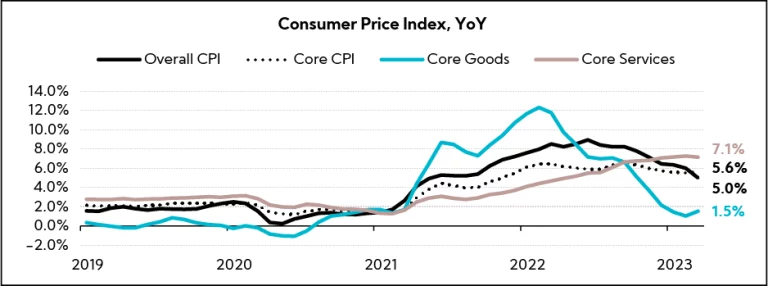

- U.S. inflation eased to 5.0% in March compared with a year earlier, representing the smallest 12-month increase since May 2021, while core prices, a measure that excludes volatile energy and food categories, increased 5.6% in March YoY, registering a slight uptick from 5.5% in February; core goods increased 0.5% and core services jumped 7.1% YoY after abating from the four-decade high of 7.3% in February (Source: Labor Department)

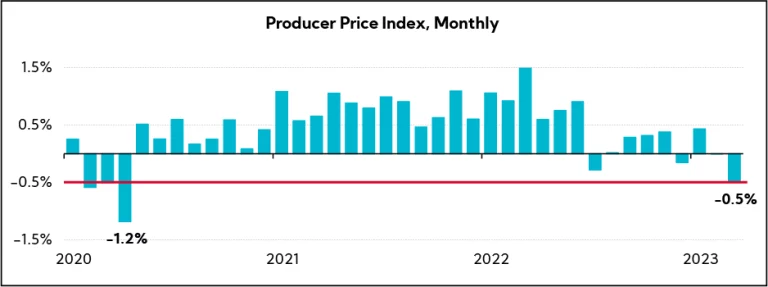

- The U.S. producer price index decreased 0.5% from February, representing the largest sequential decline since the start of the pandemic; on an annual basis, the PPI rose 2.7% (Source: Labor Department)

- Initial jobless claims, a proxy for layoffs, increased by 11,000 to a seasonally adjusted 186,000 last week from 239,000 the week before; the four-week moving average for jobless claims increased slightly to 240,000, and continuing claims, which reflect the number of people seeking ongoing unemployment benefits, registered at 1.8M, a decrease of 13,000 (Source: Labor Department)

- Retail sales declined 1% in March, well below the 0.4% projected decline and a marked drop from February, when sales fell 0.2%; core retail sales, which exclude automobiles, gasoline, building materials, and food services, decreased by 3% last month, compared with a 0.5% increase the month prior (Source: Commerce Department)

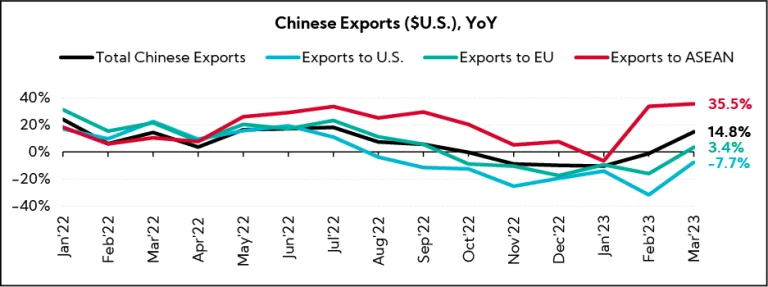

- Chinese exports posted a surprise surge in March, jumping 14.8% YoY (in USD terms), supported by a rise in exports to Southeast Asian countries and sustained demand Europe; exports to Russia totaled $24B in Q1, up 48% YoY, though only represent ~3% of total exports (Source: PRC General Administration of Customs)

Key Insights

From Q1’23 Inside The Buy-Side® Earnings Primer®

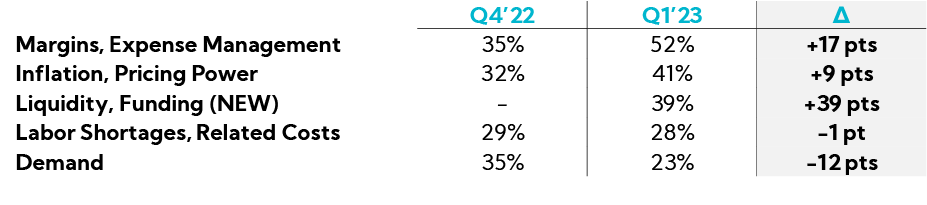

Following last quarter’s survey which found continued broad-based expectations for decelerating performance and global economic weakness but less draconian views first identified in Q3’22, this quarter’s survey identifies a notable disconnect between investor sentiment and executive tone, with investors more bearish and bracing for impact.

Despite Generally Well-received 2023 Guides and a More Optimistic Executive Tone QoQ, Expectations for Continued Deceleration Persist with Bearishness Reaching 50%+ Levels

- 85% note 2023 company guides were In Line to Stronger Than expected

- 43% describe executive tone as Neutral to Bullish or Bullish, up meaningfully from 28% QoQ

- While views on Organic Growth are somewhat warmer QoQ, the majority, 55%, expect Worsening sequential earnings and margins, while demand, particularly in 2H’23, is identified as a top three concern (unaided) by nearly one-third

- 52% of investors and analysts describe themselves as Neutral to Bearish or Bearish, up from 44% QoQ and more than double the number of perceived cautious executives

- Another cautionary sign, investors remain focused on buttressed balance sheets with 65% continuing to cite debt reduction as the top use of cash, also a survey record

Recessionary and Other Concerns Mount, Exacerbated by Recent Bank Turmoil and an Increasingly Strained but Inured Consumer with Western Economies Expected to Falter

- 88% now anticipate 2023 will be a recessionary year, up from 80% QoQ, with less confidence that it will be a “short” and “shallow” contraction

- 47% identify monetary policy/interest rates as the leading concern

- 50%+ expect consumer confidence and unemployment to Worsen over the next six months

- Just 32% remain concerned over labor availability (aided) amid slower demand, down from 78% QoQ; notably, layoff mentions in public transcripts increased 49% QoQ

- Most Western economies are expected to Worsen in 2023, led by the U.S., UK, and Western Europe

- 84% express More Concern or a Continued High Level of Concern (aided) over U.S./China relations, and greater than 70% continue to assign a high level of risk to companies with exposure to China

- With companies continuing to derisk supply chains, onshoring, nearshoring, and friendshoring mentions have increased ~8x since March 2020 across global financial communications

- Financials and REITs see the most bearish sentiment, the latter of which garners a new survey low

While We Wait and Watch the Unwinding In Slow Motion with Eyes Wide Open, Some Bright Spots In Focus with Continued Support for Investing In Long-term Growth

- 58% report Holding equities at this time, a survey record, while none report Selling, also a notable first

- Not all is doom and gloom from an economic standpoint, as investors anticipate China, India, Southeast Asia, and Mexico will improve over the next six months; the duration and severity of a potential U.S. economic recession, however, will be a factor

- To that end, 49% encourage Maintaining growth capex at this time, an increase from 29% QoQ, while at the same time, those encouraging Moderating or Reducing capex is down to 34% vs. 42% QoQ

- Sectors that saw broad-based selloffs in 2022, specifically Tech and Biotech, see the highest levels of bulls; Industrials see the most significant increase in support due in part to recent favorable congressional actions

Q1’23 Key Questions/Areas of Interest for Upcoming Earnings Calls

Communication Playbook

As we do every quarter, we analyzed the earnings communication trends of 30 companies reporting between March 28, 2023 and April 10, 2023, to identify important themes and precedence. These companies span market cap sizes and sectors.

Closing out Q4, companies continued to surpass the Street’s expectations, albeit by slimmer margins, as revenue and EPS surprises came in below 1-year and 5-year averages. Commentary suggested commodity inflation across sectors was softening, likely settling around the mid-single-digit range, on average, for 2023, and supply chains were generally improving (and recalibrating). That said, cost control measures remained in focus, hiring freezes and layoff announcements continued to trickle in, and a once resilient consumer began to show signs of real strain.

As earnings prints hit the airwaves, executive outlooks, in general, appear to be neutral to positive, in line with our Earnings Primer® findings. Most are anticipating a strong second half of the year, owing in part to signs of moderating inflation, improving working capital levels, and select regional economic strength, particularly in China.

Still, focus remains on expense management paired with properly “balancing” pricing actions with economic reality. The recent collapse of SVB and other regional banks has placed an additional cloud of uncertainty over the near-term, with many executives outlining their direct exposures in prepared remarks as well as fielding questions from analysts on potential knock-on effects within Q&A. Furthermore, the health of the consumer continues to be tested in certain industries.

To that end, companies report inventory levels are normalizing, with the next few quarters serving as a “realignment” phase with the current demand environment. Moreover, hiring freezes and/or layoff communications continue to permeate earnings calls.

Visual Representation of Recent Earnings Commentary

Constitutes word frequencies from 30 recent off-cycle earnings transcripts

Q4’22 (Prior)

Q1'23 (Current)

Earnings Topics

Key trends from our analysis of 30 off-cycle earnings calls include:

While Many Fiscal Year Companies Portend Back-half Strength, Cautious Optimism is Tempered by Uncertainty Regarding Near-term Consumer Strength and Banking Crisis Ripple Effects

- Levi Strauss (FY Q1’23 – $6.0B, Consumer Cyclical, Apparel Manufacturing): “We continue to expect 2023 to be a tale of two halves, with the first half weaker and the second half considerably stronger given a number of factors; we are lapping promotional levels, record cotton prices impacting COGS in H1, and supply chain disruptions progressively getting better. In talking with our wholesale customers, virtually all customers are keeping their open-to-buy budgets pretty tight given the uncertainty. That value consumer is really being squeezed. There’s definitely a bifurcation happening where the lower-end consumer is making hard choices and either trading down or just not buying denim.”

- Semtech (FY Q4’22 – $1.4B, Technology, Semiconductors): “We are still expecting the second half to be stronger across all segments. There’s no indication of that in terms of hard bookings yet but given some of these markets have been soft for some time now, especially consumer – and if you look at China – one would expect them to come back. Some of these other regional segments, like North America and Europe infrastructure, we should start to see some improvements in the second half.”

- WD-40 (FY Q2’23 – $2.4B, Basic Materials, Specialty Chemicals): “And the prospects for revenue growth in the back half of the fiscal year are looking optimistic. Indeed, I’m happy to report that it’s looking like the month of March, though not yet fully finalized from an accounting perspective, will be a new record sales month for the Company. This includes a very strong recovery in EMEA. As we emerge from the price-related disruptions we’ve experienced despite slower economic activity in some regions, we expect stronger top-and bottom-line growth for the remainder of the fiscal year.”

- Core & Main (FY Q4’23 – $6.2B, Industrials, Industrial Distribution): “In terms of the cadence for volume, looking back to 2022, we had a really strong performance last year with Q1 being one of our stronger YoY volume quarters. Comping against that this year, it’s going to be a difficult hurdle to hit. As you think about YoY cadence, in Q1 we are expecting a little softness relative to where we’ve been in ’22, and then getting back on the normal seasonal increases into Q2 and Q3, like we’ve had in the past.”

- Conagra Brands (FY Q3’23 – $17.9B, Consumer Defensive, Packaged Foods): “Our approach to guidance this entire fiscal year has been about being prudent. And it’s because of the volatile environment we’re in with the supply chain challenges and then the historic inflation and pricing. We’re continuing with that approach for Q4. We still expect inflection in our gross margins, but we are building in a healthy level of contingency for supply chain friction costs in our cost of goods sold.”

- MSC Industrial (FY Q2’23 – $5.2B, Industrials, Industrial Distribution): “While sentiment and IP readings continue moderating, the tone on the ground is stable. Most of our customers continue to see solid order levels and demand activity. Of course, we’re watching the banking situation closely to monitor any potential ripple effect on the broader industrial economy. At this time, though, our overall read on the environment remains constructive.”

- Paychex (FY Q3’23 – $39.4B, Industrials, Staffing & Employment Services): “All of us on the call were wondering two or three weeks ago when we’re going to have a systemic banking crisis on our hand, but we certainly were looking at that and are concerned about it. It seems like the economy was resilient enough and the Treasury did the right things in terms of shoring up the banking system. We have the environment we have. We understand what factors are moderating. We think that what this outlook incorporates is our best thinking on the environment. Having said that, our confidence in the second half will be something that we’ll talk more about as we go through the year.”

- RH (FY Q4’23 – $5.2B, Consumer Cyclical, Specialty Retail): “Our view is to be conservative, be prepared, and try to capitalize on the opportunities that may unveil themselves in times like these…because this is the time of dislocation. Anybody that thinks it’s not a big deal that three banks went down, where they don’t think it’s a big deal if the government directed 11 banks to lend $30B just to save that bank is living with a euphoric view of the world. I’ve been on the planet for long enough to know this is not normal, and this is dangerous.”

Magnitude of Inflation Appears to Be Moderating, and, along with it, Pricing Power; ‘Ensuring Pricing is Appropriately Balanced’ is a Key Theme this Quarter

- MSC Industrial (FY Q2’23 – $5.2B, Industrials, Industrial Distribution): “Looking forward, while inflation has tempered, we are still seeing some suppliers move on price, though not at the levels of the past year.”

- Core & Main (FY Q4’23 – $6.2B, Industrials, Industrial Distribution): “We’re still seeing some price increases come through, though not necessarily at the same magnitude or frequency that we saw last year. That’s what gives us the confidence that we’ll see price stabilize as we get to midyear.”

- WD-40 (FY Q2’23 – $2.4B, Basic Materials, Specialty Chemicals): “In terms of overall price increases, we believe we’re through most of the significant price increases…and now it’s about driving back those volumes in store after all of this disruption we faced for the last six months.”

- Constellation Brands (FY Q4’23 – $41.7B, Consumer Defensive, Beverages): “From a pricing perspective, at this stage, we are planning for average annual pricing within our 1% to 2% algorithm. We are mindful that consumers will likely continue to face challenging macroeconomic conditions for the foreseeable future, and that our pricing increases in the last two fiscal years were above this algorithm. As we advance throughout the year, we will continue to monitor inflationary dynamics and potential recessionary risks to ensure our pricing is appropriately balanced to support the momentum of our brands.”

- Cintas Corporation (FY Q3’23 – $46.8B, Industrials, Specialty Business Services): “Our pricing is above what it has been historically…and the reason is the inflationary environment is such that we have to pass on a larger price increase than we [have done] historically. Fortunately, the customers understand that. They understand the environment, and we’ve been very successful in providing the right levels of service so that they are open to those adjustments. We’re not here to give guidance beyond Q4. If the work of the Fed is such that it brings inflation down, then we’ll manage our business accordingly to match that.”

- Conagra Brands (FY Q3’23 – $17.9B, Consumer Staples, Packaged Foods): “We have successfully executed pricing actions in response to inflation. That inflation is moderating, and elasticities remain remarkably consistent and benign. We’re moving past discrete supply chain disruptions and continue to make progress on our margin expansion initiatives such as productivity and value over volume, all within an environment that is normalizing.”

Clearing Out and Recalibrating amid Customer and End Consumer Cautiousness Resulting in Improved Working Capital

- Levi Strauss (FY Q1’23 – $6.0B, Consumer Cyclical, Apparel Manufacturing): “We made meaningful progress on inventory. Both in dollar and unit terms, it is sequentially improving, but that did hurt margins. The inventory improvement is largely driven by the fact that we proactively cut 1H buys, and we were able to clear inventory…inventory levels at the end of Q4 were up 90% YoY and Q1 is down to 35% YoY. It’s a dramatic improvement in the U.S., and that’s why we think that it gets better as the year progresses.”

- Lululemon Athletica (FY Q3’23 – $46.3B, Consumer Cyclical, Apparel Retail): “In terms of inventory, we’ve been navigating the dynamic supply chain environment. We placed a number of core buys earlier to try to manage our air freight expense…we’re going to see inventory moderate to 30% – 35% growth, and we expect it to come in line towards the second half of the year. Our goal is to manage our inventory in line with our revenue growth, and we believe we’ll be there over time.”

- PVH (FY Q4’23 – $5.5B, Consumer Cyclical, Apparel Manufacturing): “Looking at the balance sheet, we expect to build cash with a significant increase in cash from operations, reflecting an improvement in working capital due to lower inventories compared to 2022 as receipt flow normalizes.”

- WD-40 (FY Q2’23 – $2.4B, Basic Materials, Specialty Chemicals): “We anticipate our inventory levels will continue to decline for the rest of fiscal year 2023. I do not believe that we will be at pre-COVID inventory levels anytime soon as the environment today remains dynamic and requires us to carry higher levels of inventory than we have historically.”

- TD Synnex (FY Q1’23 – $8.9B, Technology, Electronics & Computer Distribution): “There was a lot of visibility brought by vendors broadly due to extra inventory within the channel. We don’t have visibility with precision to all the inventory that’s held by our sellers, but through those discussions, we were led to believe that there was an inventory work down…I do believe that that’s part of the realignment for the second half of the year. To answer your question explicitly, have we seen the green sprouts yet? No, we haven’t. I do believe there are months ahead as opposed to beginning currently.”

With Margins Squarely in Focus, Some Point to the Success of Digital Optimization and Innovation, While Others Resort to Hiring Freezes and Layoffs

- Tilray (FY Q3’23 – $1.5B, Healthcare, Drug Manufacturers – Specialty & Generic): “We are diligently optimizing the efficiencies of our global operations and driving the disciplines and accountability that ensure we remain a low-cost producer in the cannabis business and our other businesses. This includes realizing substantial cost savings and synergies, discontinuing certain partnerships, and exiting certain unprofitable businesses in order to focus our resources on the businesses that are driving profitability and cash flow.”

- Core & Main (FY Q4’23 – $6.2B, Industrials, Industrial Distribution): “We’ve made great progress in optimizing system-wide pricing through IT enhancements and data-driven analysis, which enables us to identify pricing opportunities and mitigate the impact from rapid cost changes. We expect these initiatives and others to contribute positively to our gross margin in the years to come.”

- Braze (FY Q4’23 – $3.1B, Technology, Software-Application): “We are using machine learning-driven predictive models designed to improve our quality of service while lowering our infrastructure costs. We [announced in December] that we had broadly paused net growth in overall headcount…we’re staying the course on that. We are able to continue on with this path to profitability and make meaningful progress this year because we have incredible amounts of control and visibility into our overall spend for the balance of the year.”

- Semtech (FY Q4’23 – $1.4B, Technology, Semiconductors): “We are successfully managing our operating expenses in this challenging revenue environment. Q4 combined operating expenses was $6M. In Q4, operating expenses for Semtech organic were down 13% sequentially to $59M, driven by a reduction in headcount and other variable comp.”

- RH (FY Q4’23 – $5.2B, Consumer Cyclical, Specialty Retail): “Times like these also require us to have the discipline to say no to the things that are nice to do in order to focus our time and resources on what is truly important. That includes making the difficult decision to graciously say goodbye to team members whose roles are no longer essential in our new view of the future, enabling us to work in a more integrated and collaborative fashion on fewer, more important priorities….approximately 440 roles were eliminated as part of our organizational redesign, and we expect to achieve cost savings of approximately $50M annually, inclusive of associated benefits and other cost savings. Concurrently, we will be focused on reducing inventories and generating cash and further strengthening our balance sheet to maximize optionality.”

- H.B. Fuller Company (FY Q1’23 – $3.6B, Basic Materials, Specialty Chemicals): “We also felt like we needed to adjust to recessionary volumes in our other business units. So as a consequence of the activity, we are closing one plant in North America for our construction business, and we’re also exiting our facility in Argentina.”

Spending Signals Suggest Many Companies, Particularly Industrials, are Prioritizing Strategic Investments, Primarily Growth Capex, with Several Reiterating an Openness toward M&A

- Cintas Corporation (FY Q3’23 – $46.8B, Industrials, Specialty Business Services):”The most important thing for us is to make sure that we’re investing in the right way for long-term success of the business. We want to make sure that we are growing capacity as needed with our growth, that we’re training our partners, that we’re doing the things that we need to do to continue to grow long-term. We still want to be very acquisitive, but it’s hard to pinpoint when those may or may not happen, but we want to continue to be acquisitive.”

- Core & Main (FY Q4’23 – $6.2B, Industrials, Industrial Distribution):”Our primary capital allocation priority remains to invest in the growth of the business, both organically and through acquisition, but we expect to have excess capital available to deploy, which we intend to return to shareholders. We are adding dividends as a potential future form of capital return alongside share repurchases as we consider the strength of our cash flows and our desire for a balanced approach.”

- Acuity Brands (FY Q2’23 – $5.1B, Industrials, Electrical Equipment & Parts): “We’ve invested $36M in capex and $124M to repurchase approximately 700,000 shares during the first half of fiscal 2023. As we said before, our capital allocation priorities remain the same. We have invested for growth in our current businesses through R&D and capex. We’ve expanded our platform through acquisitions as evidenced by the purchase of OPTOTRONIC in our lighting business. We’ve maintained our dividend and we’ve created a permanent shareholder value through over $1.1 billion of share repurchases since Q4 2020, which was funded by our organic cash flow generation.”

- Excelerate Energy (FY Q4’22 – $2.5B, Utilities, Renewable): “The combination of the amended revolver and our cash on hand will provide ample capital to operate our business and pursue strategic growth opportunities. We are committed to maintaining a prudent and disciplined approach to capital investments. This means prioritizing investment opportunities that maximize the returns on our assets, given the increased competition globally for FSRUs and LNG infrastructure. We are currently evaluating additional opportunities to deploy our capital in Europe and other markets across our footprint.”

- Braze (FY Q4’23 – $3.1B, Technology, Software-Application):”Turning to operating expenses. Non-GAAP sales and marketing expense was $46.5M or 47% of revenue compared to $35.3M or 50% of revenue in the prior year quarter. While the dollar increase reflects our investment in headcount to support our ongoing growth, global expansion and increased travel and entertainment expenses, the improved efficiency reflects our disciplined investment approach to resource deployment across our go-to-market organization.”

- H.B. Fuller Company (FY Q1’23 – $3.6B, Basic Materials, Specialty Chemicals): “Fundamentally, we believe it is important to have facilities close to our customers. We also have been reassessing our overall manufacturing network. We’re looking at capacity by plant, by line, by technology to determine what is the right amount of capacity for us to have in place not just now, but 5 years from now.”

While Reservations Certainly Exist, China and Europe Show Promising Signs of Economic Recovery, with the Former Being Attributed to Reopening and Favorable YoY Comps

China

- McCormick (FY Q1’23 – $23.2B, Consumer Defensive, Packaged Foods): “In Q2, we’re going to lap the lockdowns from last year, and we’re expecting a significant recovery in China. As we go through Q2, we’re going to have double-digit growth compared to a year ago unless there’s some other exogenous shock. The question on that double digit is just what the first number is, but it’s going to be big…we’re optimistic that this normalization will continue to unfold in the market. We expect to see much of that come through in Q2.”

- Semtech (FY Q4’23 – $1.4B, Technology, Semiconductors): “After three quarters of sequential decline, one anticipates that we are probably nearing the bottom. I would say, Q1 or maybe Q2 is going to be close; then, I expect it to start to go the other way. Bookings are starting to trend upwards a little bit. We’re starting to see some design-in activity that’s been fairly quiet in China in some areas. Generally, I would say that things are looking a little bit more positive coming off a very low base.”

- Lululemon Athletica (FY Q3’23 – $46.3B, Consumer Cyclical, Apparel Retail): “We haven’t put a fine point on China in 2023. However, what I’d say is we still had a degree of COVID disruption in both Q4 and full year ’22, when we were at a 30% growth rate. We have seen that trend accelerate as we moved out of Q4 and into 2023, particularly Q1. In terms of profitability, we are profitable in China. We haven’t put a fine point on it beyond that.”

Europe

- WD-40 (FY Q2’23 – $2.4B, Basic Materials, Specialty Chemicals): “The disruptions we’ve been experiencing in EMEA, primarily due to the pricing actions we’ve taken over the last 12 months, coupled with our loss of sales in Russia and Belarus have gotten us off to a rocky start. However, we’re expecting a strong comeback in EMEA in the second half of the fiscal year.”

- Levi Strauss (FY Q1’23 – $6.0B, Consumer Cyclical, Apparel Manufacturing): “Every market in Europe grew with the exception of a couple of the smaller markets in the Nordics. Our largest markets, France, UK, Germany, were all collectively up low single digits. Spain and Italy were up double digits. Europe is doing a little bit better than what we thought it was going to do going into the year…the last thing I would say about Europe, just like the U.S., we’re pretty cautious about our wholesale business there as retailers are playing their open-to-buy budgets pretty close to their best given all of the macro uncertainty.”

- Progress Software (FY Q1’23 – $2.5B, Technology, Software-Application): “From a regional perspective, we probably saw the most strength in the Americas and Europe…in Europe, certainly with the conflict still ongoing, it’s something we’re keeping an eye on. However, performance across Europe and the EMEA region was strong.”

In Closing

A dose of insights into how companies are positioning the various topics of interest on earnings calls. We hope you find our primary research timely, informative, and actionable, beginning with today’s “Commencing the Quarter” and throughout the Q1 2023 earnings season as we report on updates and emerging trends.