This Week in Earnings – Q1’24

The Sector Beat: Materials

In today’s thought leadership, we cover:

- Key Events this week

- Earnings Snap, covering the S&P 500 stats to date

- Spotlight on Materials in The Sector Beat

Key Events

Labor

- Initial applications for U.S. unemployment benefits rose last week to the highest level since August, consistent with signs of gradual cooling in the labor market. In the week ending May 4th, seasonally adjusted initial jobless claims increased 22,000 to 231,000, higher than consensus estimates of 214,000, while the 4-week moving average increased 4,750 to 215,000. Continuing claims, a proxy for layoffs, totaled just shy of 1.8M. (Source: Labor Department)

Retail

- Online retail sales in the U.S. rose about 7% from January to April this year, driven by strong demand for groceries and cheaper discretionary items. The share of the cheapest units sold in categories like grocery and personal care has increased during the first four months of the year, while the share of the most expensive products has come down, indicating consumers are looking for cheaper alternatives. (Source: Adobe Analytics)

Wholesale Inventories

- U.S. wholesale inventories fell 0.4% in March on a monthly basis, in line with estimates, confirming that inventory investment was a drag on economic growth in Q1. On a YoY basis, inventories dropped 2.3%. Stocks at wholesalers rebounded 0.2% in February. (Source: Commerce Department)

China

- China’s exports and imports returned to growth in April after contracting in the previous month, signaling an encouraging improvement in demand at home and overseas as Beijing navigates numerous challenges in an effort to shore up a shaky economy. Exports grew 1.5% YoY last month after falling 7.5% in March, which marked the first contraction since November. Imports for April increased 8.4%, beating an expected 4.8% rise and reversing a 1.9% fall in March. (Source: Reuters)

Europe

- The U.K.’s central bank left its key rate at 5.25% for the sixth straight meeting of its policymakers, in line with what investors and economists had been expecting. However, in Europe, the central banks of Switzerland and Sweden have already lowered their key interest rates for the first time since the inflation surge began in 2021, while the European Central Bank has strongly indicated that it will cut in early June. (Source: WSJ)

S&P 500 Earnings Snap

92% of the S&P 500 has reported earnings to date

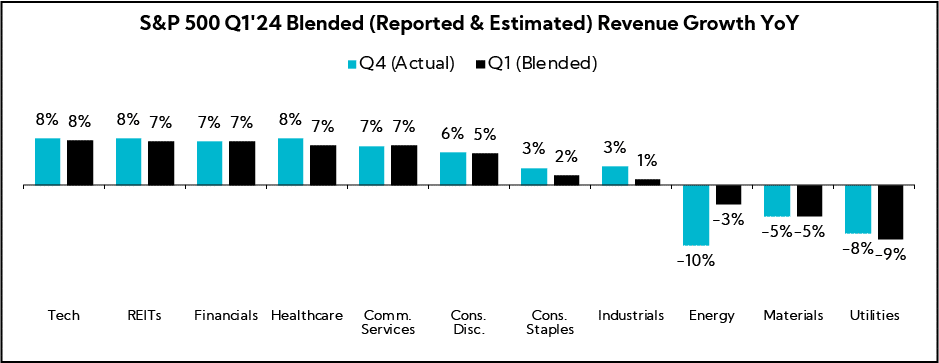

Q1'24 Revenue Performance

- 60% have reported a positive revenue surprise, below the 1-year average (67%) and the 5-year average (69%)

- Blended revenue growth (combines actual reported results for companies and estimated results for companies yet to report) is 3.7%

- Companies are reporting revenue 1.0% above consensus estimates, below the 1-year average (+1.4%) and the 5-year average (+2.0%)

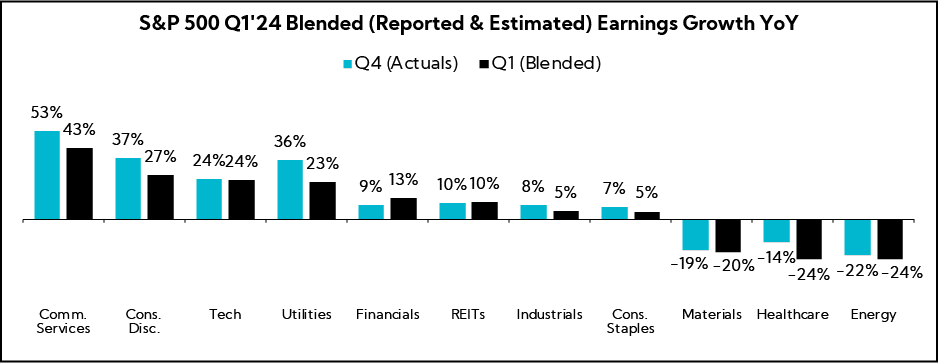

Q1’24 EPS Performance

- 77% have reported a positive EPS surprise, below the 1-year average (78%) and in line with the 5-year average (77%)

- Blended earnings growth (combines actual reported results for companies and estimated results for companies yet to report) is 7.4%

- Companies are reporting earnings 8.3% above consensus estimates, above the 1-year average (+6.4%) and below the 5-year average (+8.5%)

The Sector Beat: Materials

Materials Guidance Trends

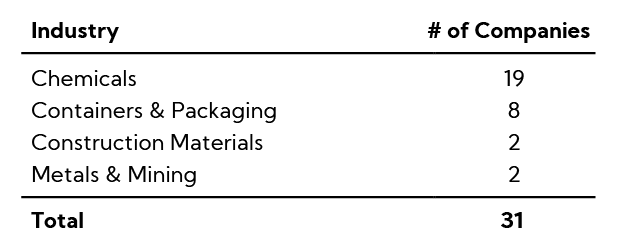

Each quarter, we analyze a basket of Materials companies with market caps greater than $1B that have reported to date, as this sector is a barometer for economic trends.1 Below are our findings.

For comparison purposes, we provide an “All-Company” benchmark, which tracks in real-time a basket of companies with market caps greater than $1B across all sectors that have reported earnings and provided guidance to date (n = 629).

Guidance Breakdown by Industry

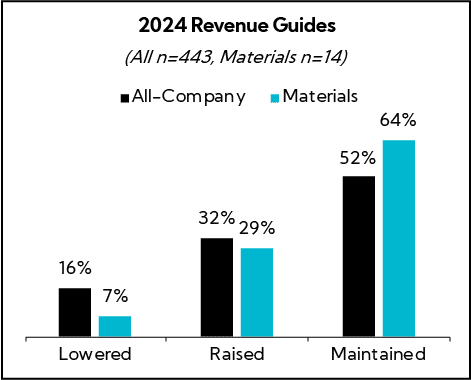

Revenue Guidance

Most ranges have been Maintained (64%), though 9% fewer have Lowered outlooks compared to the All-Company benchmark (16%); midpoints assume 180 bps of growth, on average

- Recap: Full year 2024 guides provided last quarter saw more companies publish wider ranges than the previous year, with revenue midpoints all above 2023 actuals

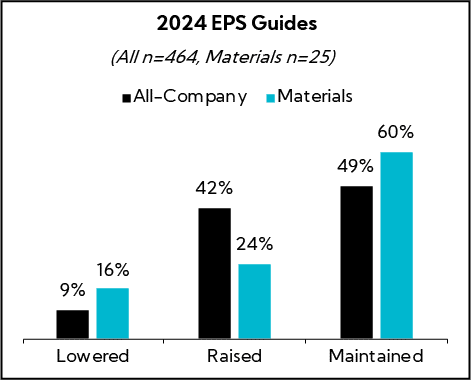

EPS Guidance

Most ranges were Maintained (60%), though 18% fewer Raised outlooks compared to the All-Company benchmark (42%); spreads average $0.36

- Recap: more companies also provided wider ranges than the previous year, with just 27% of midpoints above 2023 actuals

Earnings Call Analysis

We analyzed the earnings calls for this group and the broader Materials sector universe to identify key themes.

In last quarter’s Materials Sector Beat we reported, “While executive commentary has stopped short of characterizing the broad-based slowdown in inventory destocking as a “volume recovery”, early indications through January suggest there are reasons to be optimistic that demand will normalize as the year progresses. Indeed, many outlooks are baking in an uptick in dynamics through the back half of 2024.”

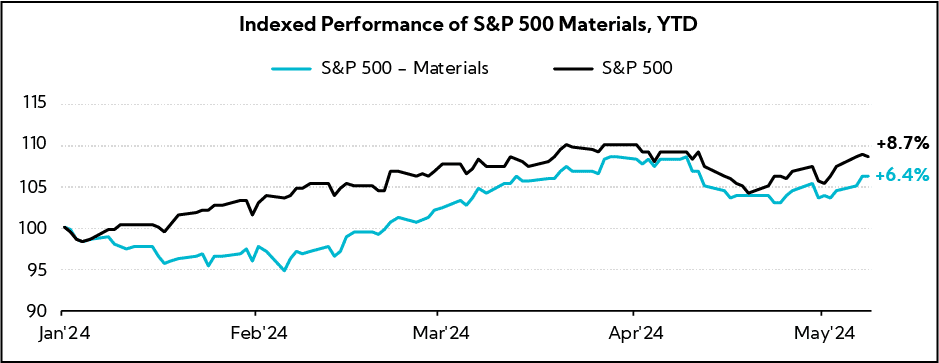

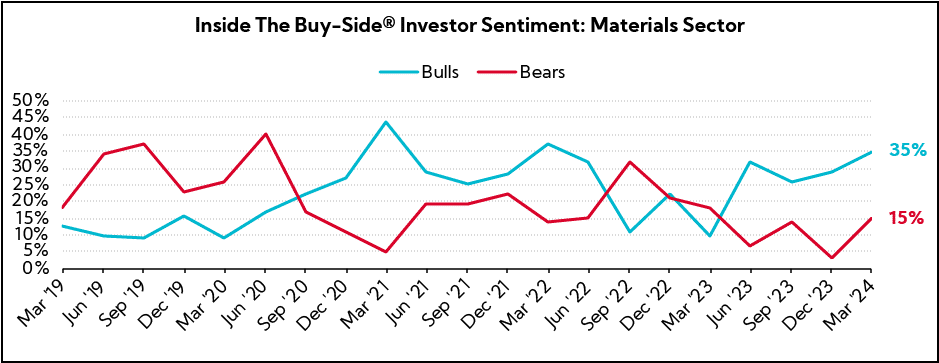

Fast forward to this quarter’s Beat, the Materials sector garnered the unique distinction as simultaneously being the largest bull- and bear-gainer in our Q1’24 Inside The Buy-Side® Earnings Primer®, while garnering enough bullish views to place it in the Top 3 most bullish sector, following Technology and Healthcare.

An examination of Materials sector earnings announcements this quarter finds an improving executive tone. “Variable” is the defining word this quarter. Its frequent appearance in prepared remarks and Q&A underscores an industry still in flux, but showing early signs of stabilization and more optimism relative to previously cautious views. This pivot is evident not only in executive commentary, but also in consensus estimates for the remainder of the year.

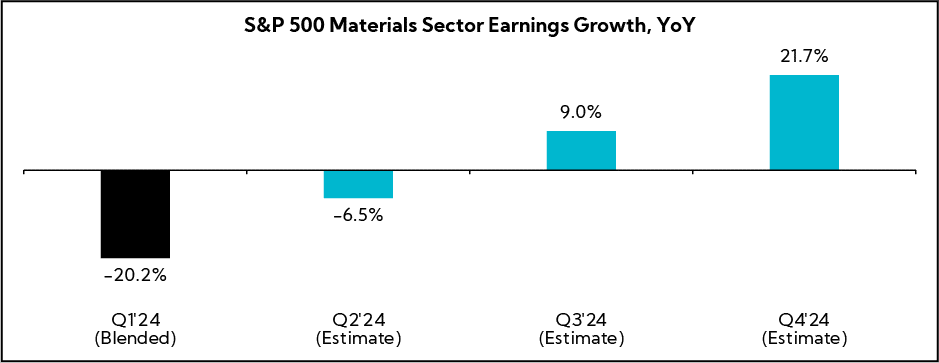

While Materials sector YoY blended earnings growth (combines reported and estimated results) of -20.2% is among the worst performances in the S&P 500 through Q1, surpassed only by Energy (-24.1%) and Healthcare (-24.0%) results, signs of green shoots, specifically volume stabilization, is underpinning consensus estimates of continued growth as the year progresses.

Executives continued to collectively express more optimism about the latter half of 2024 as pockets of restocking begin to emerge. Despite macroeconomic variability across markets and regions, many companies are anticipating conditions to be buoyed by innovation and new product demand, and secular themes in certain sub-industries, such as aerospace, electric vehicles, and infrastructure — all of which are expected to grow faster than the general economy. Still, allegations of import dumping, pricing pressure, and largely improved input costs that are showing signs of reigniting serve as continued headwinds to a sector that has been beleaguered since the first signs of demand deceleration emerged in Q2’22.

Key Earnings Call Themes

Timing of Improving Conditions Remains “Variable” Depending on the End Market, though Many Across the Sector Continue to Express More Optimism toward the Back-Half of 2024

- FMC Corp ($7.6B, Agricultural Inputs): “The magnitude and timing of improving market conditions remains the biggest variable. Our expectation is that recovery will vary by region, but broadly speaking, we anticipate meaningful improvement in market conditions in the second half. We expect new products will continue to show greater resilience in sales, which is a trend they’ve demonstrated for several quarters.”

- Huntsman Corporation ($4.4B, Chemicals): “Where we end the second half will certainly be a trajectory as to where we go in 2025. I’m getting more bullish…as we look at the beginning of this year, we’ve seen a good, reliable, and consistent growth and recovery. And the second half, what we need to see is that continued growth, and I’ve said this before, but movement in pricing. And so, as we look at the direction we’re moving, I like the direction of which we’re going. Volumes ought to be growing for the year at the rate of the overall macro-GDP. You’re going to see areas like applications that are going to electrical infrastructure, aerospace industry, automobile lightweighting, EV applications, that’ll be growing better than GDP. A lot of your industrial coatings and so forth will be at GDP, maybe a little bit less than GDP.”

- Martin Marietta Materials ($37.0B, Building Materials): “Looking ahead, we remain enthusiastic about Martin Marietta’s attractive market fundamentals and long term secular trends across our three primary end uses of public works, non-residential and residential construction. More specifically, we believe these markets and Martin Marietta’s chosen geographies will drive aggregates-intensive growth and favorable pricing trends for the foreseeable future. We expect robust multi-year demand in public infrastructure, U.S.-based manufacturing, energy projects and data center construction will partially offset near-term softness in warehouse, light non-residential, and residential end markets. That said, we fully expect the housing recovery, particularly in single family once affordability challenges subside as demand in our key markets remains robust.”

- Pactiv Evergreen ($2.4B, Containers & Packaging): “We expect near-term challenges such as lower consumer demand to persist into the second quarter. That said, we are also optimistic about the actions we are taking to mitigate costs, drive operational improvements and increase volumes during the second half of the year.”

- Quaker Chemical Corp ($3.4B, Specialty Chemicals): “Beginning with the second quarter, we expect a modest seasonal improvement in demand across all of our regional segments, but at varying degrees. We expect the positive momentum in metals to continue, and while we expect growth in metalworking, it will likely remain more tepid and mixed by end market. We expect the seasonal improvements in underlying market growth rates will continue to be complemented by our new business wins across all regions.”

- Sealed Air Corp ($5.3B, Containers & Packaging): “We anticipate continued softness in the first half of 2024 as volume reaches the trough and gradually improves as the market conditions and seasonality improve in the second half. We remain disciplined to drive the necessary cost actions to offset further volume weakness.”

Near-term Weakness Noted for Many in North America, though “Varying Degrees” of Demand Pickup Observed; Inventory Sees “Pockets of Restocking” for Some and “Destocking Coming to an End” for Others

- International Flavors & Fragrances ($24.1B, Specialty Chemicals): “Regionally, we have seen greater strength in a combination of Asia and LatAm, so more of the emerging markets from a volume standpoint and across the board generally a little softer in North America and then EMEA. That’s probably not dissimilar than what others are seeing in the marketplace.”

- Koppers Holdings ($1.0B, Specialty Chemicals): “While Europe and Australia came in slightly better than expected in Q1, North America drove the negative variance. Even with higher phthalic anhydride volumes, which received a boost due to backfilling for another producer’s outage, we endured higher plant costs due to weather-related unplanned downtime early in the year, higher raw material costs working their way through inventory, and lower pit volumes and plant throughput.”

- Sonoco Products ($5.8B, Containers & Packaging): “[In Consumer Packaging], we’re expecting to be down a little over 1% in Q2, which is an improvement from Q1. That’s driven by some really nice international growth, with softness continuing in North America. Our customers are telling us it’s the price on the shelf, they are promoting, but we’ve seen limited impact from that. Hopefully that shows up over time…we’re calling Consumer flat for the second quarter.”

- Martin Marietta Materials ($37.0B, Building Materials): “Manufacturing projects continued to be supported by steady demand from ongoing reshoring of critical products supply chains. Construction spending for domestic manufacturing continues to trend positively. Equally, we expect the long-term secular trends toward cloud based services and artificial intelligence will drive renewed growth in data center construction, which had moderated from a post-COVID peak.”

- Cabot ($5.6B, Specialty Chemicals): “In Performance Chemicals, we are beginning to see some early signs of end market improvement, most notably in our automotive, infrastructure and semiconductor applications, with volumes expected to be modestly higher sequentially. We are optimistic that demand trends will continue to improve in this segment as we head into fiscal year 2025.”

Destocking / Restocking

- Huntsman Corporation ($4.4B, Chemicals):”Our number one priority this year was to recover lost volumes. We were able to make some modest gains and we’ll be doing more throughout 2024. The gains that we saw in volume were attributed to a combination of new business, demand growth, and pockets of inventory restocking. We question how much of this was the end of inventory destocking and the beginning of inventory rebuilding versus demand growth. While it will vary customer-by-customer, I believe it to be about 50/50.”

- AptarGroup ($10.0B, Containers & Packaging): “Turning now to North America. While some end markets remain soft, overall, the region is showing clear signs that the widespread destocking is coming to an end. We continue to expect that recovery will not be linear and will be different end market by end market across Beauty and Closures segments.”

- Crown Holdings ($10.2B, Containers & Packaging): “[In Europe], I think the destocking was so great last year in Q4, and there’s a bit more confidence in the market from our customers. But I think the destocking was so great that we have a little bit of a restocking effect. But all signs point towards a pretty healthy summer as we sit here today.”

- Eastman Chemical ($11.9B, Specialty Chemicals): “I’d say, on the margin, there’s probably a bit of restocking that’s occurring. I mean, it’s almost impossible to really know the answer to that question. When you get into destocking or restocking, your customers are not exactly that clear on what’s going on. But I can definitely point to a few examples, such as Red Sea logistics concerns, where this has caused some customers to buy ahead of that risk. But, at this stage, it’s really hard to call lack of destocking…we’re not seeing large orders come in where people are restocking in a noticeable way.”

Amid Continued Constrained Volume, Expense Management and Productivity Initiatives, Including Headcount and Variable Pay Reductions, Remain Intact; Several Point to Future Operating Leverage Amid Eventual Normalized Production Rates

- Alpha Metallurgical Resources ($3.9B, Coking Coal): “In response to the sharp market decline that has occurred so far in 2024, we’ve made small adjustments to safely reduce costs where possible by optimizing production and logistics. We will continue monitoring external market drivers while also maintaining a close eye on controllable costs within our business and we’ll take further action as necessary. [We have] made the difficult decision to make certain incentives cuts across the organization.”

- MP Materials ($2.6B, Other Industrial Metals & Mining): “As we discussed last quarter, our early cost of production of separated products is higher than our expected costs; once we reach more normalized production levels, given we are staffed for higher production rates and early production often requires additional processing, labor and certain rework that should not recur once operations normalize. With these impacts and the rapid deterioration in market prices, we reserved for certain inventory where costs are currently estimated to exceed net realizable value.”

- FMC Corp ($7.6B, Agricultural Inputs): “We’ve moved quickly to right-size our organization and remain diligent in our cost controls and reducing indirect spend. These changes have been made without sacrificing strategic investment in areas such as Plant Health and our R&D pipeline. Restructuring provided significant YoY savings in [Q1]. As the year progresses, our prior year comparison will include cost actions taken in 2023 to limit spending.”

- Berry Global ($7.1B, Containers & Packaging): “We have a significant amount of availability issues in key assets where we have unplanned downtime due to really what I would consider a lack of world-class total predictive maintenance kind of approach. We are very focused on elevating that and accelerating our implementation of a consistent world-class maintenance program. I think that’s going to pay dividends on several fronts, not just variable cost reduction, but improved reliability for product and service, and also more efficient capital deployment.”

- Pactiv Evergreen ($2.4B, Containers & Packaging): “From manufacturing cost reductions to logistics process improvements, our teams are focused on identifying inefficiencies and eliminating unnecessary expenses. We expect sequential improvements into the second half of the year, providing an additional layer of earnings momentum in 2024.”

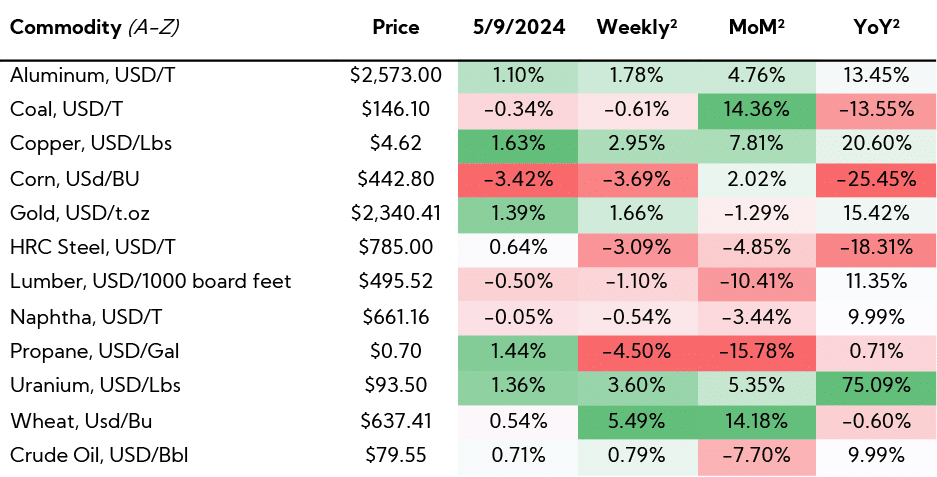

Largely Stabilized and Lower Raws…For Now

- Cabot ($5.6B, Specialty Chemicals): “We expect margins to hold sequentially as pricing moves in line with raw material costs. The cost of goods sold decline is really because of lower raw material costs. And through our pricing mechanisms, we pass that through in the revenue line. We also have price increases in the revenue and higher volumes in the revenue. So, they’re offsetting the pass-through amount.”

- Quaker Chemical Corp ($3.4B, Specialty Chemicals): “Gross margins are now in the expected range that we had communicated, and we anticipate we’ll be in the similar range in Q2. And that’s a combination of our assumption on raw material prices now stabilizing, maybe even with a little bit of pressure as we go forward and relatively stable prices for us against the value we’re providing for our customers.”

- Pactiv Evergreen ($2.4B, Containers & Packaging): “While commodity input costs have trended down over the past two years, recent macroeconomic developments suggest that raw material costs may trend a bit upwards. For example, the price of oil has recently increased, which has introduced more volatility in resin prices compared to last year. That said, we ultimately pass the resin cost on to our customers and do not expect recent volatility to have a material impact on results in the near future.”

- Knife River ($4.3B, Building Materials): “Our backlog is up from last year with higher expected margins and we continue to see momentum on our materials pricing.”

- Balchem ($5.0B, Specialty Chemicals): “Our gross margin percent was 34% of sales, up 255 bps compared to 31.5% in the prior year. The increase was primarily due to a favorable mix and decreases in certain manufacturing input costs.”

Executives Call for Action against Unfair Trade Practices (AKA “Dumping”) Amid Rising Concerns Over Low-Cost Imports from Asia

- Balchem ($5.0B, Specialty Chemicals):”We have discussed how our European feed-grade choline business has been negatively impacted by low-cost product flooding the market, and we expect this to continue for some time. We are looking into this unfair pricing behavior in an effort to understand if there could be potential for antidumping or other tariff relief.”

- Westlake ($20.1B, Specialty Chemical): “On April 3, as a member of the U.S. Epoxy Resin Producers Ad Hoc Coalition, we participated in filing petitions with the U.S. International Trade Commission and the U.S. Department of Commerce, requesting the initiation of antidumping and countervailing duty investigations regarding imports of certain epoxy resins from five Asian countries. We remain proponents of the free and fair trade of goods on a global basis, but we also remain committed to working with trade groups such as the US Epoxy Resin Producers Ad Hoc Coalition to use all the tools at our disposal to ensure a fair and level playing field in all the geographies in which we operate.”

- Olin ($6.7B, Specialty Chemicals): “We are seeing an influx over the last year or so of product that is being dumped into the United States. First, I’ll say we’re all for fair trade, free trade, but we’re going to fight against unfair trade, and that’s what you see here. So, we had the first hearings in Washington, DC this week. It’s early in that process, but we are going to continue to push that case. And we believe that there is a risk within the United States having only two producers of epoxy resin is a risk for the future. We’ve got a very critical material here that we’re producing, and it is under threat by unfair trade.”

- Cleveland-Cliffs ($8.2B, Steel): “Our other major move this quarter was announcing the indefinite idle of our Weirton facility, which officially ceased production on April 11. Over the past three years, Weirton’s average annual contribution to our EBITDA was a negative $100M due largely to unfairly traded imports of tinplate products. In January, the Department of Commerce recommended antidumping and countervailing duties on some of these imports, which would have mitigated this issue. But in February, the International Trade Commission, in a totally surprising decision, reversed the Department of Commerce recommendation allowing for low-priced imports to continue to flow into the United States. As a result, we had no choice but to exit the tinplate market, leaving more than 900 Weirton employees without a job.”

- Cabot ($5.6B, Specialty Chemicals): “The decline in the Americas, both North and South America, was largely driven by the impact of economic conditions in South America as well as the replacement tire imports from China, particularly in South America, where that has been impacted more, and to a lesser extent in North America.”

In Closing

As we look at the broader landscape and try to read the tea leaves on behalf of our clients this quarter, the Materials sector – a barometer for the economy – is showing signs of slow, but steady stabilization. Indeed, Materials, one of the “canary in the coal mine” sectors, has now moved to a “variable degree” of optimism, a better place than we were last quarter and the boom-and-bust nature that played out from the Covid-induced cycle. However, with many companies exposed to the consumer, progression will most likely be choppy and bounce along versus linear.

Next week, we’ll be back with our Closing the Quarter piece to round out the Q1’24 reporting period. We hope you find our research and insights helpful for staying apprised of what’s happening across economic sectors and as you think through your own company’s positioning.

- As of 5/8/24

- As of 5/9/24