Downturn Playbooks

The Downturn Playbook and Balancing Messaging

Controlling the Controllable to Remain Well-prepared for Any Business Environment Mindset

As we noted in our thought leadership two weeks ago, in a period of macro uncertainty, like we’re experiencing currently, investors, who are inherently risk-averse, seek clarity into how a company may perform in different business scenarios. This is significantly pronounced for companies that are perceived as cyclical.

In our recent buy side research, we identified deep-seeded investor angst, particularly around companies overemphasizing growth without addressing how the company is well-positioned to weather a downturn or recession. This comes amid 87% of companies in a recent analysis of 100 corporations reporting continued strong demand levels in Q1.

One of the most helpful communication tools companies have to assuage investor fears in times like these is the downturn playbook.

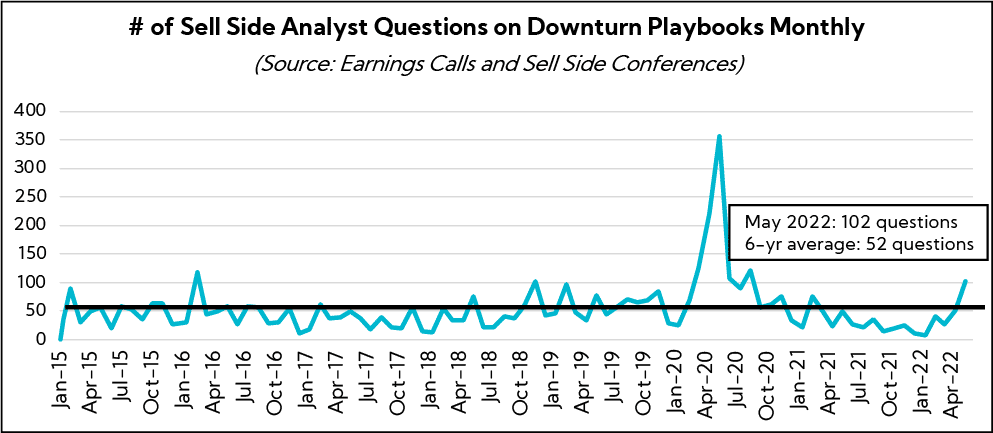

While every industry and cycle is different, it’s important to note that 53% of investors in our Q1’22 Earnings Primer® published in April were more concerned with a recession over the next 12 months, and our early read from this quarter’s ongoing survey finds continued high levels of concern. While we have not yet seen broad-based company communication around downturn playbooks, our analysis finds 102 companies globally received questions from analysts on downturn playbooks in May 2022 during earnings calls and sell side conferences, the highest level since November 2018 (excluding COVID-19 onset).

Articulating baseline assumptions that help investors understand internal inputs and external factors that drive performance is also a best practice. This is especially true during times of macro uncertainty and amid recessionary concerns. Outlining 2 – 3 scenarios that provide perspective on how the business will perform in different situations provides a floor and ceiling for investors and is a reality-based, often more positive base case than what is being modeled. Finally, noting variables that are excluded from financial goals, such as M&A, is critical to mitigating misinterpretation.

In this environment, educating investors on your company, leadership experience, and durable business model while providing financial scenarios is key to maintaining investment and minimizing stock sales.

Timing is of the essence around communicating the downturn playbook – go too early, and you call the peak and rattle the market. Go too late and you miss the opportunity to build management credibility. With headlines ablaze with the “R” word and investors and analysts beginning to ask, this upcoming earnings season may just be the right time to dust of the downturn playbook to put things into perspective – that in different environments, KPIs – namely FCF – still work and it’s not as bad as you think.

Balancing the downturn playbook with messaging around confidence and durability is critical. So, what should companies do effectively land this communication approach and build trust with the Street? Here are five best practices:

Regardless of the likelihood of a downturn, ensure your company has an off-the-shelf playbook

No matter the industry environment, investors seek to invest with leadership teams that are best prepared for any economic scenario. Ensuring your company has an off-the-shelf playbook to be utilized at the appropriate time and importantly, thoughtful messaging should the question arise.

Most often, emphasis is placed on variable vs. fixed costs and cost-cutting strategies, approach to investments / capex in terms of size and pace (as well as the flexibility to regulate), financial strength (particularly balance sheet, free cash flow, low debt levels) and management’s experience in operating through prior downturns.

If operating in an industry with greater uncertainty or likelihood of a downturn, proactively lay out a downturn playbook in a public forum

While the timing and impact of a recession – and whether we will see one – remains unknown, cyclical companies should proactively communicate a downturn playbook, preferably in a high visibility platform, including investor days, earnings calls and in investor presentations.

Ensure that this important information is shared across investor materials. We have provided examples below of downturn playbooks at the end of this communication.

If electing not to proactively communicate a downturn playbook, prepare a well-constructed response for Q&A

For companies operating in industries with unique dynamics that are more insulated or benefit in recessionary times, the better choice may be to actively withhold discussing a downturn playbook to not proliferate a message that was not already top-of-mind for investors.

Still, with generalist investors – who possess varying levels of knowledge – looking at your company as a potential investment opportunity and the prospect of receiving questions from the sell side during Q&A, companies should prepare a thoughtful, balanced response that demonstrates a downturn playbook is in place but is unlikely to be required in the environment given current industry dynamics.

Educate the Street on company strengths, business model durability (or greater durability due to actions taken to strengthen) and resiliency

Over the past decade, companies have seen cycle ebbs and flows but, outside of COVID-19, which after a fast and deep cratering, saw top-line growth slingshot, have not experienced a broad-based, lengthy recession since the GFC. During this time, companies have pursued strategies to create stronger and more resilient businesses to withstand and mitigate the impact of a downturn relative to the past.

Balance sheets are as strong as they’ve ever been! As such, we recommend reinforcing messaging that conveys executing what is within your control without downplaying the macro (avoid coming off as “tone deaf” to investors), underscoring capabilities that support market outperformance, and highlighting actions taken in recent years that have resulted in a stronger or structurally enhanced business model. In instances where the industry has undergone positive fundamental change, spend time unpacking that was well. Notably and something to be aware of, as skepticism around the sustainability of growth increases, elevated capex / investment often comes under pressure as investors begin to beat the margin drum.

If we enter a recessionary environment, newer management teams have the opportunity to “earn their stripes”

One of the most consistent themes in our Voice of Investor® research over the past decade has been the perspective that investors “need to see this management team operate through a downturn to give us confidence in their execution.”

This is particularly true for newer leadership teams or executives with limited public company experience. Winners will be made in a more challenging business environment and set companies up for above-peer valuations for years to come.

Best-in-Class Examples: Downturn Playbooks

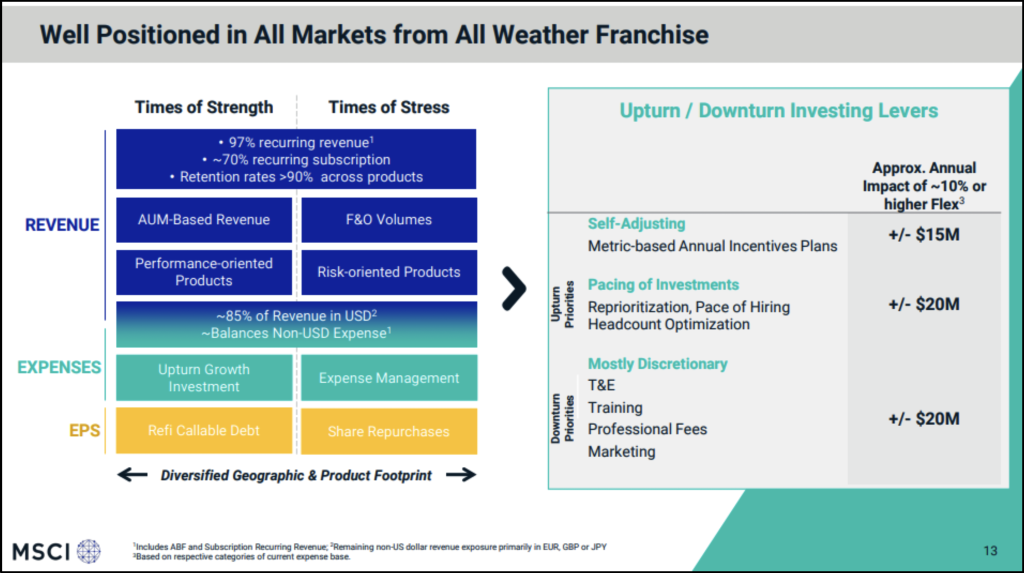

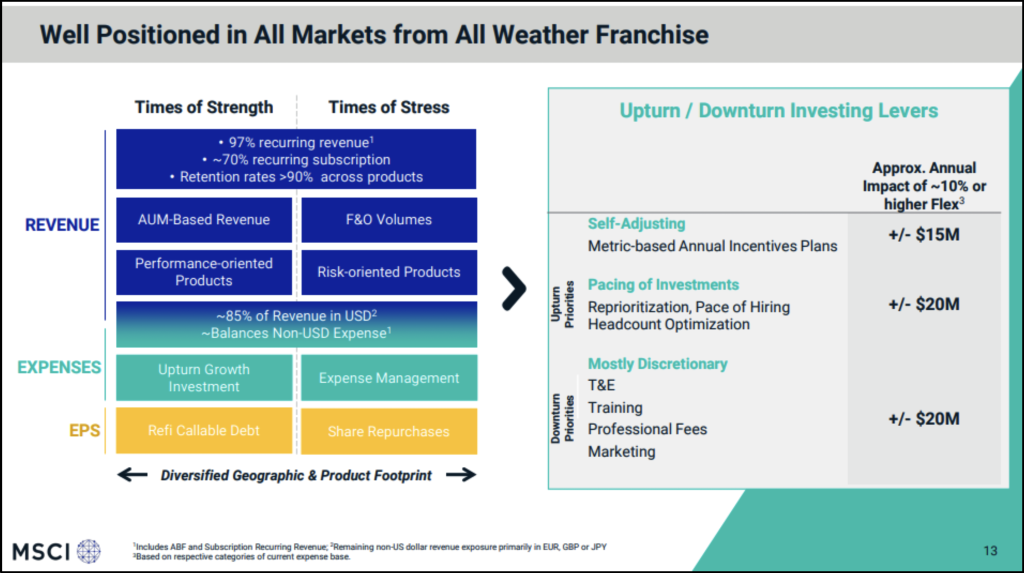

MSCI (NYSE: MSCI), $31.8B Market Cap, Financial Services

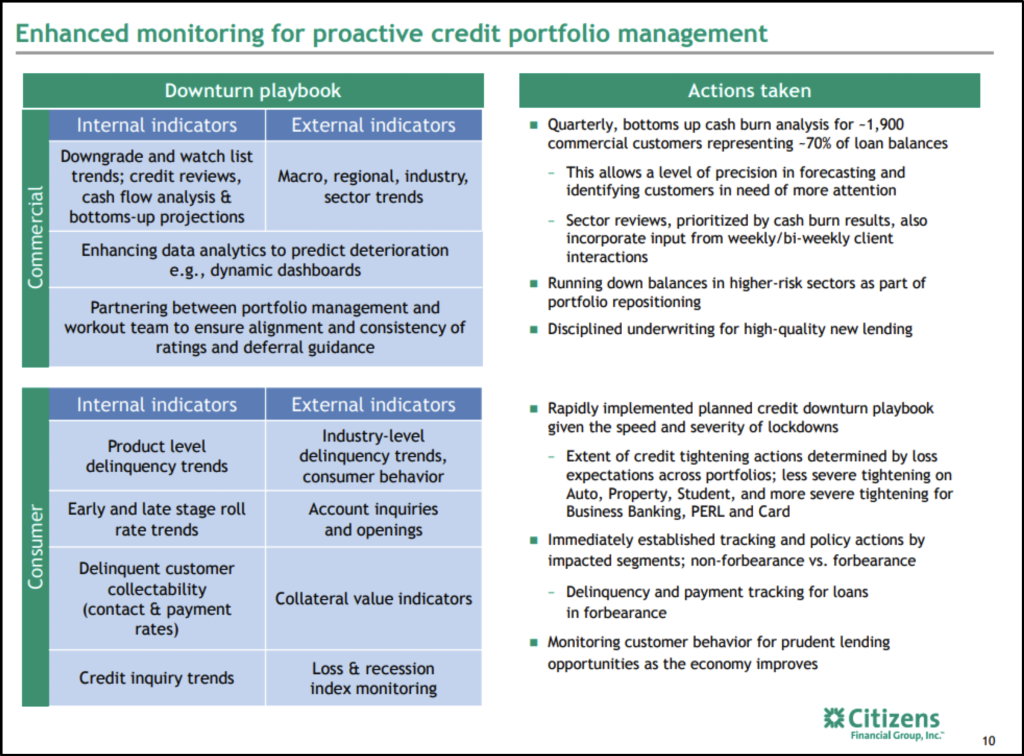

Citizens Financial Group (NYSE: CFG), $17.8B Market Cap, Banking

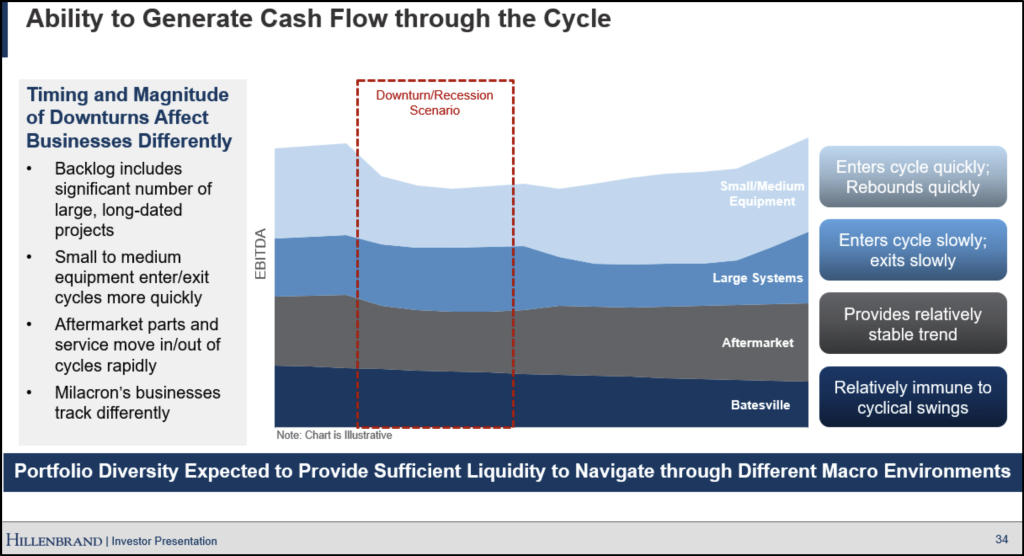

Hillenbrand (NYSE: HI) $2.9B Market Cap, Industrials

(Nasdaq: PATK), $1.3B Market Cap, Consumer