Part 2 of 4

Part 2: Our Primary Research on ESG

Our Primary Research on ESG from the investor and corporate perspective

Key Insights

When BlackRock Chairman and CEO Larry Fink published his groundbreaking 2018 letter to CEOs, A Sense of Purpose, the ESG landscape became as polarizing and complex as we had seen with any industry previously. Many of our client calls centered on questions like: “What is the return?” and “What do we need to know?”, while the ESG ecosystem began to rapidly progress with a large number of data providers, voting services, standard setters, assurers, investor coalitions and framework developers vying to shape the narrative and become the gold standard in the industry. This created significant noise and general frustration for corporates and investors alike, which led us to create one of our favorite graphics in 2018 that captured this complexity (and the myriad of acronyms).

Indeed, based on our proprietary research, while there was a group of investors that considered ESG important, predominantly in Europe, a majority of investors were skeptical that ESG was anything more than a fad. Even for larger investment firms that created and hired sustainability-focused teams, the portfolio managers and analysts in our interviews largely could not articulate how ESG would be incorporated into their investment process, nor did they see it as an important component. However, as time progressed and investment firms further invested in sustainability teams and developed processes to partner with the investment decision makers, ESG became a more solidified component of the process, albeit still highly uncertain. Still, 38% of investors in 2019 noted that the leading frustration was inconsistency in data quality and access, which still holds true today.

Coupled with mixed views on whether ESG funds would outperform, issuer and investor frustration with data inconsistency and the overwhelming number of providers in the ecosystem created a healthy amount of skepticism to the long-term viability of ESG. One common counterpoint was that executives and IROs were not being specifically asked about “ESG” in investor meetings, and that it truly only mattered to sustainability-driven firms, which comprised a very small portion of the investment universe.

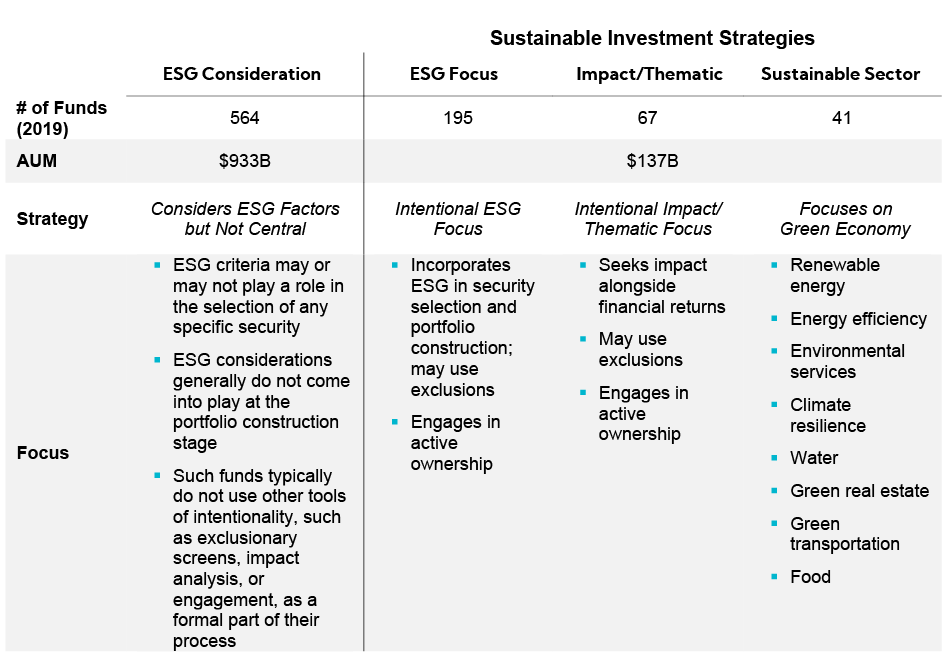

However, earlier this year, Morningstar published its widely read Sustainable Funds Landscape Report, which included a very important distinction and point of clarity versus the 2019 report: what they call the “ESG Consideration” group, and what we view as the Generalist Portfolio Manager that incorporates ESG as a part of the investment process.

As noted, while sustainable mutual and ETFs held $137.3 billion in total assets at the end of 2019, that was less than 1% of the $20.7 trillion held in the universe of mutual and ETF funds in the U.S. These sustainable funds and ETFs create an opportunity for sustainability-focused companies to target (we will provide an analysis of sustainability-focused funds and recommendations in Part 3 of our series) but the potential universe is small and provides little opportunity for a large portion of companies with less friendly-ESG business models (e.g., exposure to nuclear, fossil fuels), smaller-caps and/or those early in their journey.

However, the “ESG Consideration” group creates a new opportunity for all public companies – conventional funds that consider ESG a part of the their process but have not made sustainability a central focus (i.e., consider ESG as relevant to a more complete investment analysis). These conventional funds are where executives and IROs spend the overwhelming majority of their time targeting and meeting in non-deal roadshows and in 2019, the number of conventional funds that now say they consider ESG factors has grown to 564 from 81 in 2018, with $933 billion AUM – this is ~4.5% of the $20.7 trillion held in the universe, a much larger percentage and one that is expected to continue to grow. In Part 3 of our series, we will outline the top asset managers that fit this category.

The following from Morningstar distinctly separates two primary groups – ESG Consideration and Sustainable Investment Strategies.

Investment Process

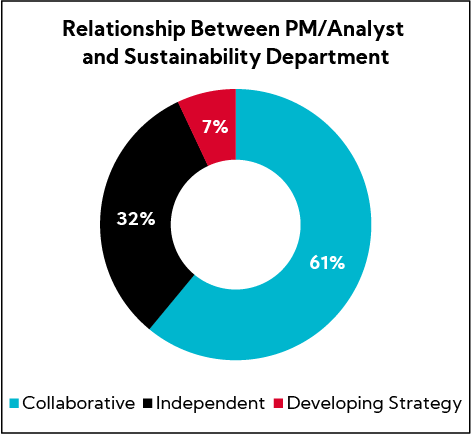

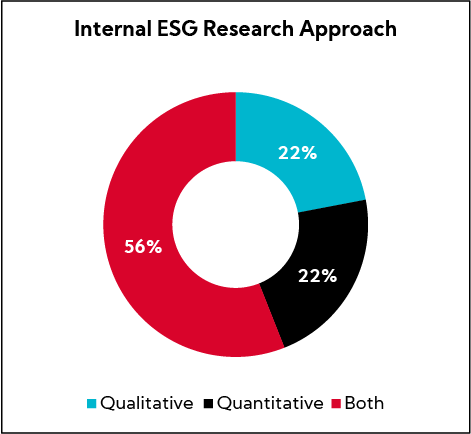

While our research incorporates views from ESG-dedicated investors, fixed income investors and sell side analysts, the overwhelming majority is derived from interviews with the generalist equity investor. Similar to your meetings with investors, our conversations focus on the overall investment picture for companies and investment philosophy, with ESG being one component of our conversations.

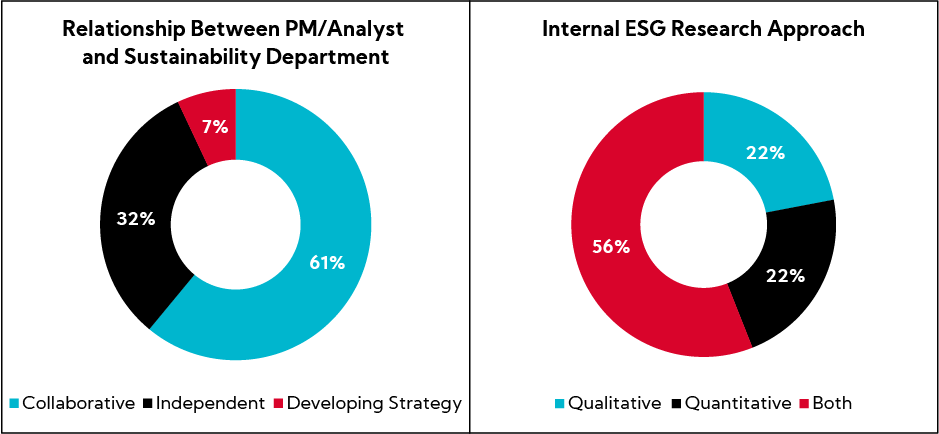

With that said and as we outlined last week, our research finds the majority of these investors utilize service provider research and ratings as only a starting point to a much more comprehensive analysis – both quantitative and qualitative as well as internal collaboration – and the overwhelming consideration is primarily one of risk/return. Furthermore, while a poor ESG rating does not automatically preclude the majority of investors surveyed from investing in a company, we think this will become a higher hurdle to receive internal approval going forward. As noted last week, the majority emphasize it is case sensitive regarding whether they are precluded from investing in a company if it has a poor ESG score.

Investor Perspectives on ESG

When discussing investor perspectives on ESG, we believe it is important to distinguish the E, S and G. While the “G” remains the most important ESG element currently, per investors, focus is growing on the “E” and “S”.

The following Voice of Investor® research comprises five components:

- Brief introduction

- Importance to investment theses

- Most frequently cited considerations during investor interviews

- Word cloud, which showcases frequency of occurrence in interviews

- Verbatim investor commentary

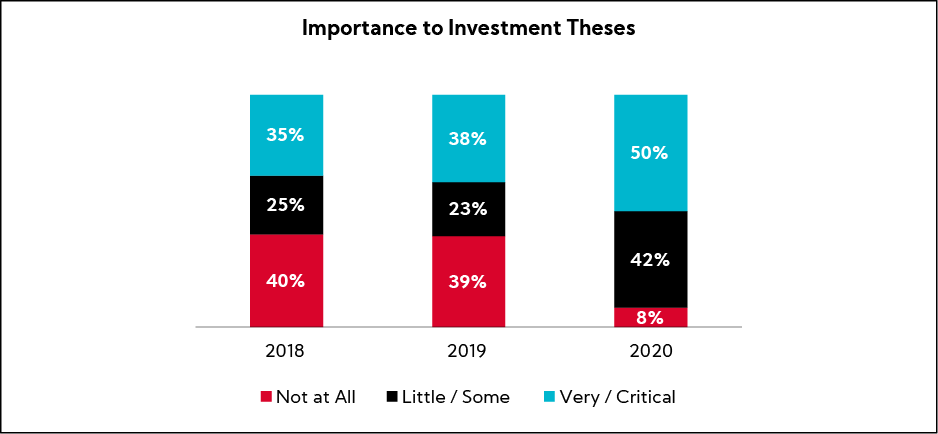

Environmental

Increasing from slightly over one-third in 2018, half of investors now consider Environmental Very Important to Critical to their investment thesis. With industry conversations emphasizing TCFD (Task Force on Climate-related Financial Disclosures), the 2-Degree Scenario and Net-Zero emissions, to name a few, investor buy-in to the “E” has steadily shown progress over the past two years. Still, many investors, primarily in the U.S., note they will consider investing as long as there are “no red flags”.

Analysis: Most Frequently Cited Environmental Considerations during Interviews (Unaided)

- As long as a company is not “flagrantly destroying the world”, no liabilities

- Carbon footprint and greenhouse gas emissions

- Only matters for industries with meaningful environmental impact

- Plastic use

Word Cloud: Frequency of Occurrence during Interviews

“For all our investments, I expect the companies to be good environmental stewards.” Capital Research

“Because if you are doing something environmentally wrong, then you know there are going to be problems. If you are doing environmental things that are going to save money on operating expenses, great. As long as you are not hurting the tenant or customer experience.” ClearBridge

“The E is growing. That will probably change over time and keep growing.” Columbia Threadneedle

“Industrial companies tend to have some skeletons in the closet. It is impossible to be an industrial investor without that. The environmental aspect provides both opportunities as well as risks.” Franklin Advisers

“It is generally easier to quantify than ‘G’. We are definitely emphasizing it more now.” Kennedy Capital Management

“Environmental is very important because, if you do things that are later viewed as unacceptable, you pay forever.” Lapides Asset Management

“It’s not typically what will drive a decision unless it elevates to a level which really causes a problem for the business but it is becoming more important.” T. Rowe Price

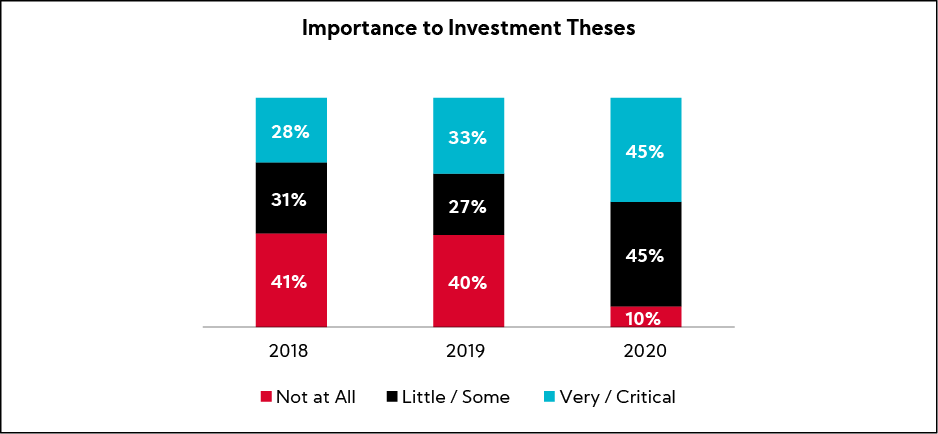

Social

The Social component of ESG was met with the most widespread skepticism from investors in 2018 and 2019, which saw the lowest percentage of contributors considering it Very Important to Critical among the E, S and G. However, 45% in 2020 now consider it Very Important to Critical to their investment thesis. Amid COVID-19, the Black Lives Matter movement and many more initiatives, Social is now becoming more critical in the eyes of investors. As of June 18, more than 1,000 companies globally referenced “stakeholder” on the most recent earnings call, compared to less than a tenth of that in 2008 and 2009.

As a result, when asked in our current Inside The Buy-Side® Earnings Primer® survey, comprising views from 60 investors to date, 63% note they are placing more emphasis (or continued high emphasis) on Social in their investment decisions following COVID-19.

Analysis: Most Frequently Cited Social Considerations during Interviews (Unaided)

- No “red flags”

- Culture

- Community impact

- Supply chain

Word Cloud: Frequency of Occurrence during Interviews

“As long as they are not doing anything that is harmful and would destroy value, it is not a part of my investment case.” ClearBridge

“In some ways, this is also a given, particularly for companies that are dealing with customers of other governments. There is a risk to the business if they are not seen to be socially responsible.” Invesco Advisers

“The ‘S’ part is kind of a black box and this is true for a lot of investors. You get a green checkmark in the ‘S’ category if you are just not destroying things. Otherwise, it is a tough one to gauge.” Kennedy Capital Management

“Social is important but it is difficult to evaluate from the outside.” Norges Bank

“It has not historically been a focus for the asset management industry but it is a trend that seems to be emerging.” T. Rowe Price

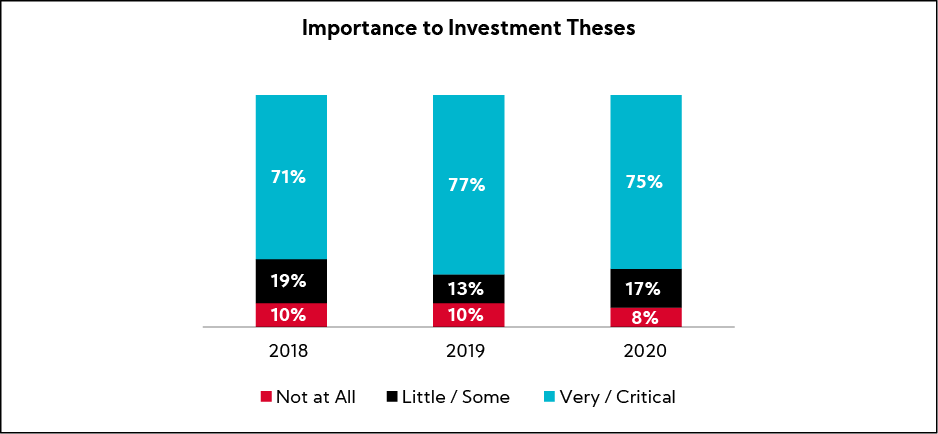

Governance

Governance has remained an important consideration for investors for many years. To that end, our research identifies that ~75% of institutional investors consider Governance Very Important to Critical to their investment thesis in any given year.

Analysis: Most Frequently Cited Governance Considerations during Interviews (Unaided)

- Executive-shareholder compensation alignment

- Board independence / separation of Chairman and CEO

- Board experience / background

- Board diversity

Word Cloud: Frequency of Occurrence during Interviews

“Governance is the biggest thing. If you have bad governance, like you seem to have at Tesla, that is terrible.” AllianceBernstein

“Governance is an important issue and definitely impacts the company with a proven correlation to share price.” BMO Asset Management

“Governance is something we always look at, so that is an important consideration.” Brown Advisory

“We like companies that have good corporate governance in politically-safe areas, where there is not much geopolitical risk, that have boards who listen to shareholders. They should be transparent and think about what is in the best interest of shareholders.” Invesco Advisers

“We look at ESG to see how companies rank and want to know why but the part that gets us is the governance because that is important.” JP Morgan Asset Management

In Closing

Our ongoing research provides evidence to support the narrative we all hear about the increasing importance of ESG. Investment approaches to incorporating ESG vary widely, and the Morningstar taxonomy helps to distinguish the “ESG Consideration” firms from the “Sustainability” firms.

Next week, we’ll outline the top funds within each of those areas, as well as the top asset managers our data shows place significant emphasis on ESG, so that your targeting efforts and conversations can be more informed and strategic.