Capital Allocation Series: M&A

Part 1 of 2: Pre-Work is the Key Work

In today’s Thought Leadership, we’re diving into one of the most complex undertakings in the capital allocation stack: M&A. This edition marks part 1 of our two-part series where we’ll be exploring all things inorganic growth, including investment community preferences, corporate issuer trends, as well as best and worst practices.

To receive your copy of M&A: Investor Communication Roadmap for Success, please Click Here

Setting the Stage

Our proprietary research finds institutional investors, on average, are responsible for 45 core portfolio holdings while concurrently researching another 55 investment opportunities that fundamentally align with their firm and/or fund investment criteria.

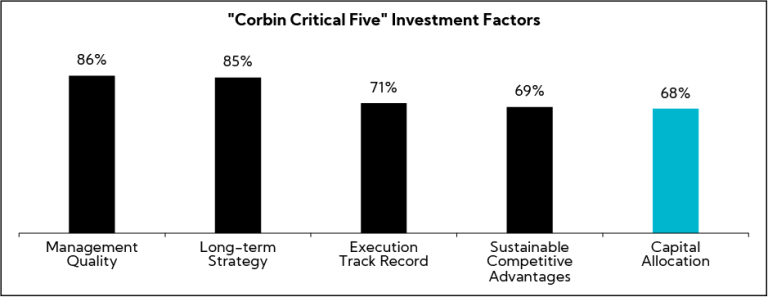

Following the Global Financial Crisis, free cash flow generation and effective capital deployment have continued to grow in importance and serve to positively differentiate best-in-class companies that have demonstrated strong, consistent prowess in this area. Indeed, according to our proprietary buy-side research spanning 16+ years and more than 22,500 interviews, Capital Allocation is one of the Corbin Critical Five investment factors, a distinguished group of measures cited as most important to institutional investors beyond quantitative assessments when selecting an investment among core holdings and opportunities.

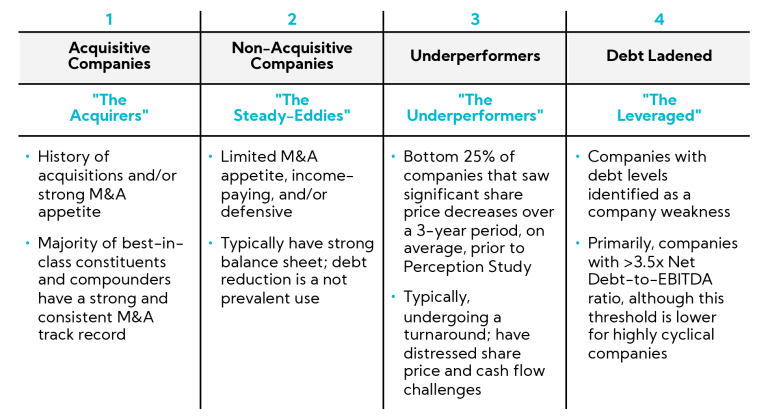

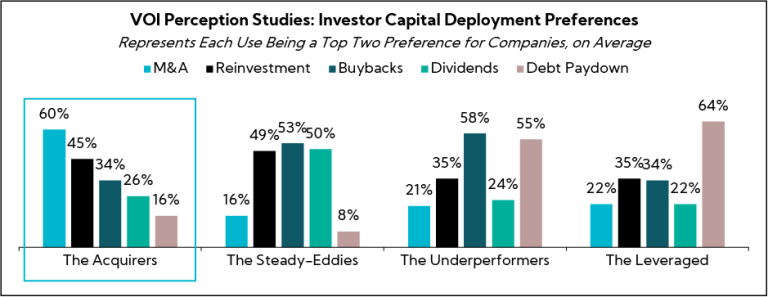

Of course, perspectives on capital deployment vary significantly across companies and investors, with history, timing, and context each playing integral roles in both decisions and assessments. However, when looking at institutional investor and analyst views on specific portfolio companies as part of our Voice of Investor® (VOI) Perception Study research, patterns emerge in preferred uses of cash based on certain company characteristics, which we have categorized into four distinct profiles:

Key Capital Allocation Profiles

Across our database, investment community capital deployment preferences for these profiles are shown in the below chart. Specifically, we’ll be focusing much of our analysis on the Acquisitive Companies (“The Acquirers”), which see the highest preference for deal activity from 60% of their investors and analysts, on average, but also for emerging acquirers that may come from the other capital allocation profile types.

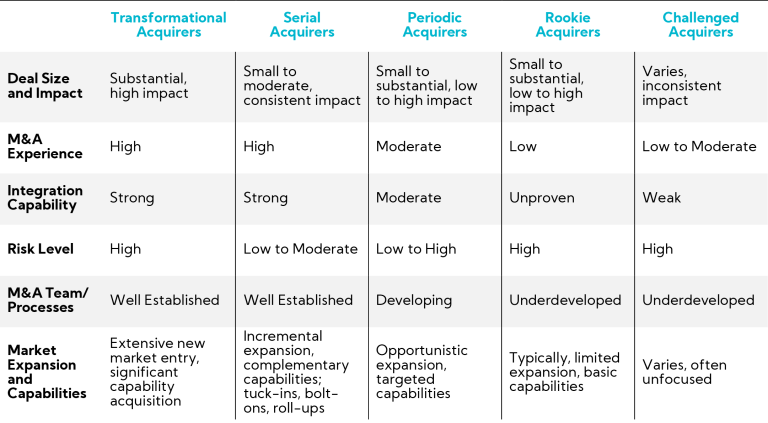

Within The Acquirers group, not all acquirers are created equal. Acquirers tend to fall within the following archetypes in the eyes of investors, which is a result of a company’s M&A objectives, history, and prowess:

- Transformational Acquirers: These companies pursue large, strategic acquisitions aimed at fundamentally altering or repositioning their business model, market position, or competitive landscape. They typically involve high-dollar value deals that significantly impact the acquirer’s operations, aiming to enter new markets, add new capabilities, or drastically change the company’s growth and/or margin trajectory. This strategy often requires substantial financial investment and comes with higher risk amid multi-faceted execution factors and given an inherently risk-averse investment community.

- Serial Acquirers: These companies frequently engage in bolt-on (target company operations remain intact) or tuck-in (target company is integrated completely into existing business) acquisitions to incrementally enhance or expand their existing operations. They usually have established M&A teams and processes, focusing on acquiring complementary businesses that can be integrated quickly and efficiently. Serial acquirers often operate in fragmented industries where they seek to consolidate market share through numerous smaller deals.

- Periodic Acquirers: These companies engage in acquisitions of varying sizes over infrequent timeframes, typically to plug gaps in the business model or to take advantage of opportunistic timing and pricing. Periodic Acquirers may not have a continuous M&A strategy but instead act strategically when the right opportunities arise, balancing the need to address specific business objectives with the financial and operational capacity to integrate new acquisitions.

- Rookie Acquirers: These companies have little to no previous M&A experience and are often undertaking their first sizeable acquisition. Typically targeting smaller companies or those in emerging markets, Rookie Acquirers often lack dedicated M&A talent or established processes. Their acquisitions are generally smaller in financial commitment compared to more experienced acquirers.

- Challenged Acquirers: These companies have a history of at least one problematic acquisition (or more) and have faced integration hiccups and performance challenges. They might be in the “doghouse” with previous acquisition attempts that did not meet expectations. Challenged acquirers often exhibit varied deal sizes and impacts, with strategies that may be perceived as unfocused or reactive. Despite having experience, their M&A processes may be lacking in efficiency and effectiveness, leading to a lack of credibility with The Street.

Characteristics by Acquirer Archetype

Putting the challenges associated with timing an acquisition and price paid versus benefits gained aside, our research finds that most companies employ a suboptimal communication approach around M&A, which is a critical factor in achieving the proverbial Roman Thumb Up or Thumb Down. Indeed, our research and experience find companies offer limited upfront “table-setting” on the capital deployment strategy, more often than not opt to under communicate versus over communicate when announcing transactions, and often cease communication once a deal closes or shortly thereafter. Based on our research into best-in-class companies and the holy grail of investment opportunities — the compounder — we have identified M&A as a critical ingredient in company outperformance.

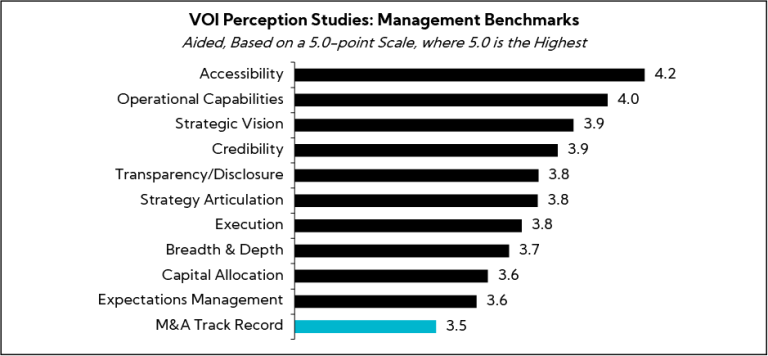

In our quest to effectively guide our clients to market outperformance by shining a light on the buy side psyche, we went directly to the source and analyzed investment community and corporate issuer trends to uncover insights behind M&A best (and worst) practices.

Methodology

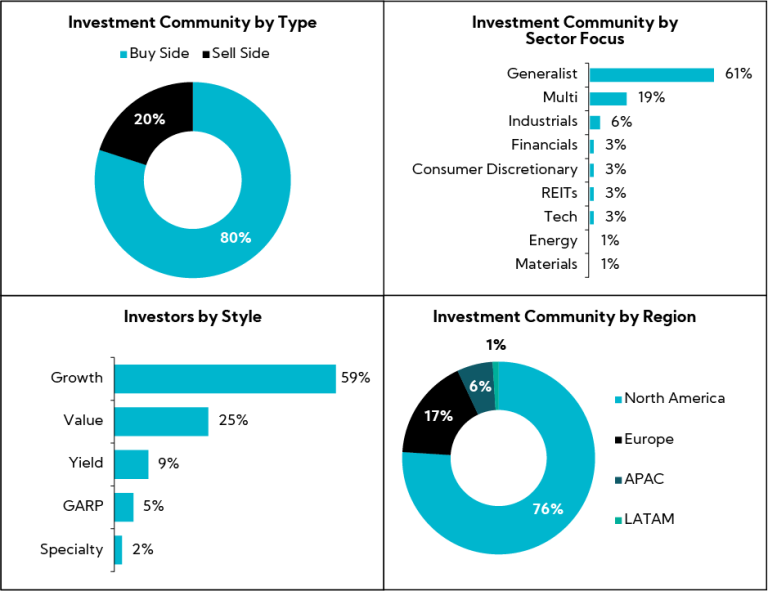

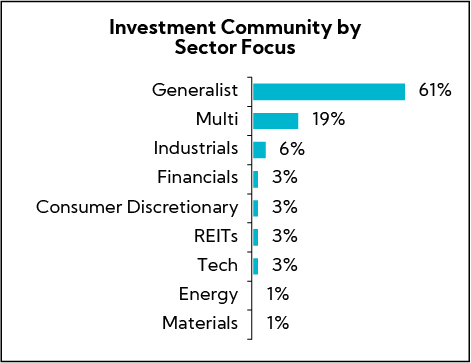

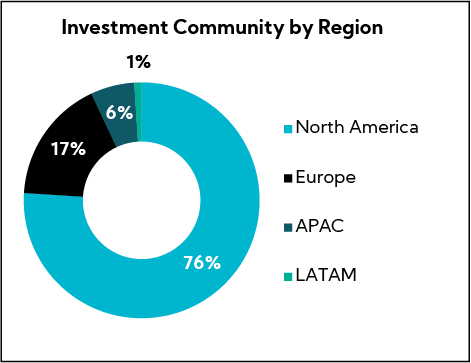

To evaluate emerging perspectives from institutional investors and analysts, we surveyed2 75 global investment community professionals about their M&A communication preferences. In aggregate, buy-side participants represent equity assets under management of ~$2.8T.

Broader perspectives are also included in our research around M&A from our Corbin Analytics database, comprised of more than 22,500 interviews globally over the last 16+ years. We run analyses on this extensive database and compare different cohorts, including the Corbin Universe, which encompasses over 900 companies across market caps and sectors.

Pre-Work is the Key Work

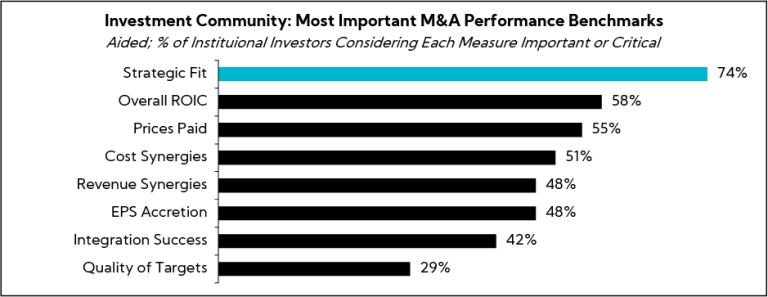

To identify characteristics critical for M&A execution and communication in the eyes of investors and where top performers excel, we asked investors to identify which measures are most important when measuring M&A success, assuming each is applicable to a deal. The result: Strategic Fit is by far the #1 determinant of M&A success, followed by Overall ROIC and Prices Paid. Notably, EPS accretion, typically within one full year after the deal closes, was once considered amongst the most critical measures in our ongoing research but is now #6.

How, exactly, do companies rally the investment community behind an acquisition and build appreciation for strategic fit? Furthermore, how can they ensure that their M&A activities are being perceived through the proper lens?

As the proceeding findings demonstrate, fostering investor buy-in and, subsequently, establishing credibility for acquisitions starts well before a deal is announced.

Instituting an M&A Framework

Wherever a company may fall within the acquirer archetypes, developing and regularly communicating an M&A framework is one of the most impactful steps a company can take to build confidence with the investment community. This framework should encompass both strategic and financial criteria and serve as an anchoring mechanism for which the company’s acquisition activities are evaluated and justified.

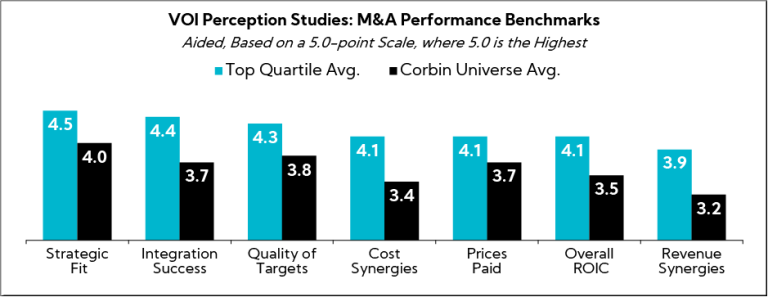

Of the companies that score in the top quartile of our Corbin Analytics database amongst normative M&A benchmarks, 88% have established M&A frameworks that are communicated regularly throughout investor materials. As shown in the chart below, this group outperforms across every normative M&A measure, led by —you guessed it — Strategic Fit.

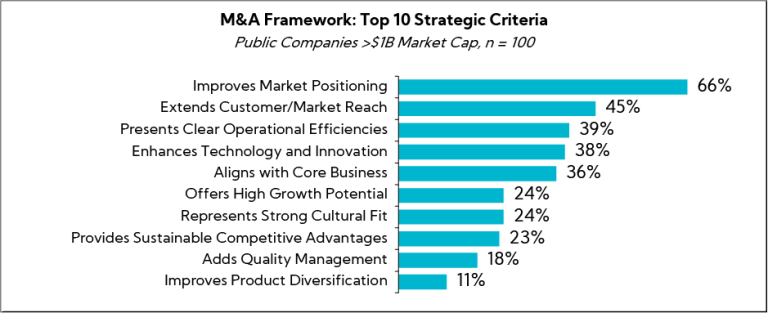

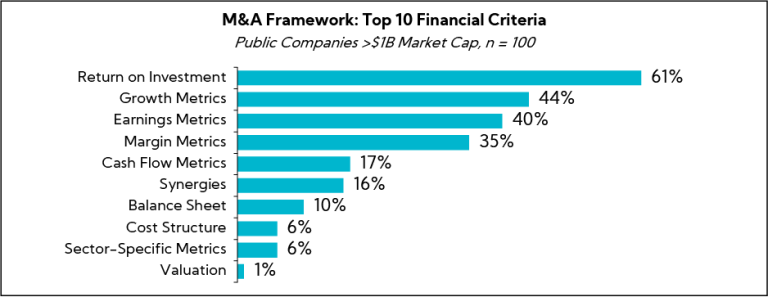

To garner insights into M&A framework elements, we conducted a randomized analysis of 100 M&A frameworks from public companies of at least $1B in market cap across all sectors. Our insights reveal Improving Market Positioning, Extending Customer Reach, and having Clear Operational Synergies are the most oft-cited strategic filters, whereas Return on Investment, Growth, and Earnings metrics represent leading financial benchmarks.

In comparison, when analyzing the M&A frameworks of companies within the top quartile of the Corbin Analytics database, a larger focus is placed on Enhancing Technology and Innovation and pursuing High Growth Potential targets from a strategic perspective, while Margin filters play a more prominent role within financial criteria.

Notably, several companies within the top quartile link their frameworks to Exposure to Favorable Growth Trends (e.g., sustainability), compared to only 7% of the broader group of 100. Additionally, 86% of top-quartile companies supplement their frameworks with an “M&A Scorecard” section, which benchmarks the strategic and financial filters highlighted within the framework against their acquisition history. Two companies go so far as to include an “M&A Operational Model” which detail the integration process, including timelines and key milestones.

In terms of communicated timeframes from the broader group, Earnings and Return on Investment metrics are most likely to be accompanied by timelines, incorporated by 24% and 20% of companies, respectively. The most common periods for each are as follows:

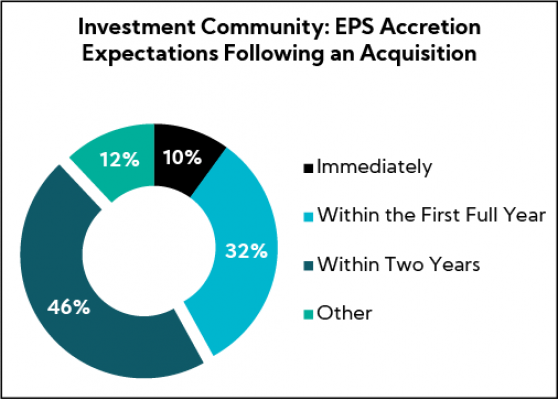

Digging a layer deeper, when asking the investment community about which timeframe they expect incremental EPS accretion following an acquisition, more, 46%, point to within two years of the close, though just under one-third assert their expectations are within the first full year.

Selected Investment Community Commentary:

“The timeframe depends on the nature of the acquisition. If you are consolidating the market, you expect to see some more immediate synergies on the revenue and cost side because you are gaining market share and increasing your pricing power. If it is more of an innovative technology or something that is going to take some time to cross-sell to your customers, integrate the technology, and then build a go-to market and see the results, sometimes it might take longer.” Buy Side, $130.5B EAUM

“It is good to see some progress in 12 months. This gets into how it was financed or paid for. With synergies, you want to see a little accretion within a year.” Buy Side, $65.7B EAUM

“You’d probably want to start seeing something within two years. There might be amortization issues, which might impact in terms of the benefits in year one. I think if you start pushing too much further than two years, then you’re going to the point where it’s dependent on all sorts of cost cuttings and reorganization, and then you’re getting into the territory of questioning if this is actually going to execute as management are anticipating it to. You want there to be some visibility around the uplift going forward, but you don’t want it to be a deal that’s done for a short-term gain.” Buy Side, $24.3B EAUM

“We’re investing on a multi-year horizon. If they’re not seeing the upside within a couple of years, then they made a mistake.” Buy Side, $798.0M EAUM

Knowing When an Acquisition Warrants More Robust Communications

Establishing the proper M&A framework and communicating it to The Street are great first steps, but knowing when and how to roll out the red carpet publicly for an acquisition announcement is equally important.

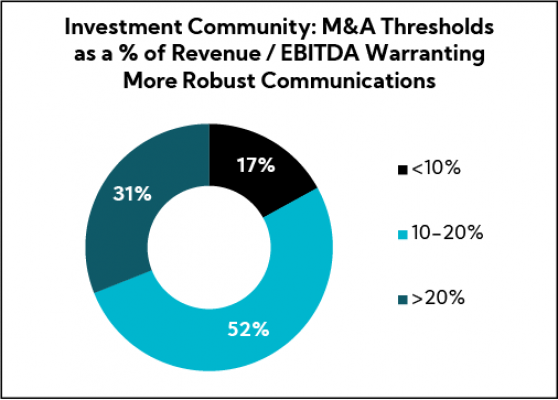

We asked the investment community to pinpoint at what percentage of revenue or EBITDA an acquisition warrants a webcast with prepared remarks, presentation, and Q&A. Our research finds the majority, 83%, coalesce around 10% or greater, with 52% placing the magic number in the 10-20% range.

Still, institutional investor expectations for robust communications surrounding an acquisition are not only limited to the size of the target company. Our experience shows there are additional situations in which proactively communicating to The Street serves to bolster perceptions — and assuage concerns — surrounding a deal.

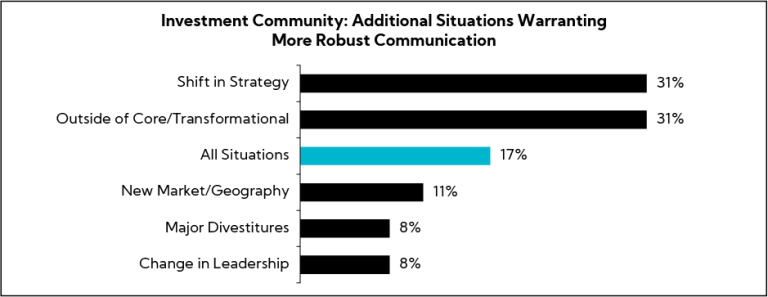

According to the investment community, a significant shift in strategy or acquisition that is outside of the core business are the most prevalent situations warranting more robust communications such as a webcast with prepared remarks, presentation, and Q&A. Notably, a small contingent, 17%, note all situations warrant a webcast, underscoring the importance of consistent and transparent communication regardless of the acquisition’s characteristics.

Selected Investment Community Commentary:

“If it is a big strategy shift, something away from the legacy or core business, or if a company is starting to take a different direction such as entering a new geography, it could be worth webcasting. Firstly, it warrants a webcast if it is sizeable or something that meaningfully changes the company leverage-wise and causes them to take on a lot more debt or have a meaningful impact on credit metrics, whether it is leverage going higher, margins taking a big cut, or maybe capex needs for the business step up.” Buy Side, $69.6B

“Anything outside of strategic scope or viewed to be a surprise from investors, anything material to the business strategy in the near/medium term.” Buy Side, $10.2B EAUM

“Every [transaction] should have a webcast so people can understand what’s going on. Information may not be available otherwise in terms of the structure of it then why and other things, unless you have a call with management. Usually, you start with understanding what’s going on, and that’s a good source for every M&A transaction.” Buy Side, $3.0B EAUM

“The most obvious one is transformative, but anything that deviates from a strategy and not just a bolt-on type of purchase I think would warrant some sort of explanation and then in my mind anything that involves a change in management or segments I think would trigger some questions. Funky financing or less straightforward financing would warrant a call if it were not well articulated in their releases.” Buy Side, N. $590M EAUM

As the title suggests, pre-work is the key work before announcing an acquisition. Proper preparation can make the difference between a successful reception and a challenging “wall of perception.” Below, we’ve outlined four key considerations:

- Maintain a Pulse on Investor Cash Deployment Preferences: Understanding shareholder views on capital deployment is one critical piece of the puzzle. While not a deal breaker, understanding sentiment allows you to more effectively target your transaction communication and address disconnects with your capital allocation strategy and investor preferences. Avoiding coming off as tone deaf and being as transparent as possible when bucking consensus can significantly enhance investor and analyst confidence and support. Regularly survey and engage with your investor base to stay updated on their evolving priorities. Importantly, also maintain a pulse on broad-based investor preferences based on the macro and valuations, which we capture in our ongoing Inside The Buy-Side® Earnings Primer®.

- Be Aware of Your M&A Archetype Perception: Knowing how your company is perceived within the M&A archetypes is essential. Whether your company is viewed as a Transformational, Serial, Periodic, Rookie, or Challenged Acquirer, investor reactions will vary based on your credibility and track record. Being realistic and not complacent about your position will aid in tailoring your communication strategy to better manage investor expectations.

- Institute and Regularly Communicate an M&A Framework: Establishing an M&A framework and communicating it frequently is one of the most impactful steps a company can take before undertaking a transaction. This framework should include both strategic and financial criteria and, as our research demonstrates. Regular communication of this framework will help prevent surprises and ultimately demonstrate a disciplined approach toward growth and value creation.

- When in Doubt About Whether or Not an Acquisition Warrants a Call, Err on the Side of Proactivity: Proactive communication is key to building and maintaining investor confidence. Our research on value creation in general finds robust communication solves many issues related to investor understanding, buy-in, and skepticism. The global investment community is highly fragmented and, as a public company, you are a steward of shareholder capital. If there is any uncertainty about whether an acquisition warrants a call, it is better to err on the side of proactivity. Hosting a call or webcast to discuss the acquisition and opening the floor to the investment community will only enhance the flow of communication and reinforce transparency. As you will always here us advise — control the controllable and own your own narrative! Is it more work? Yes! Does it mitigate risk and optimize value? Also, yes!

In Closing

Next week, we’ll be diving into the M&A communication journey from announcement to completion (and beyond), distilling common corporate issuer disclosure practices as well as what to expect from institutional investors and analysts. We hope you’ve found the first part of our M&A coverage from our Capital Allocation Series interesting and insightful! We’d appreciate hearing from you on this piece so thanks for your thoughts!

- Source: Harvard Business Review

- Survey timeframe: February – June 2024