Part 3: Analysis of ESG Mutual Funds and Investment Firms

Analysis of ESG mutual funds and investment firms to target

Our Primary Research and the ESG Investment Landscape

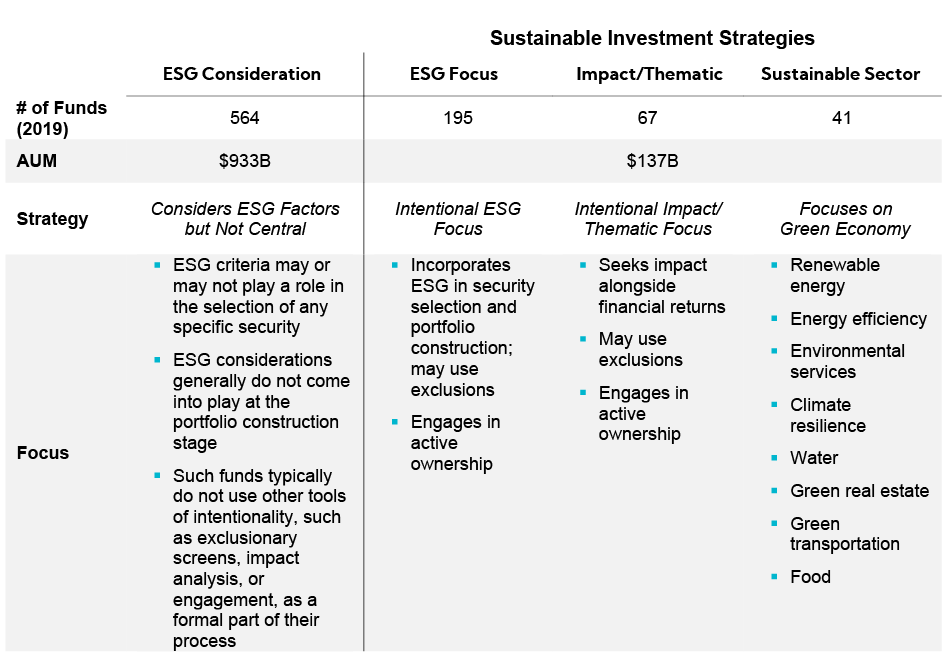

In Part 2: Our Primary Research on ESG, we outlined key insights from Morningstar’s widely read Sustainable Funds Landscape Report, which included a sustainable funds taxonomy and a very important distinction and point of clarity versus the 2019 report: what they call the “ESG Consideration” group, and what we view as the Generalist Portfolio Manager that incorporates ESG as a part of the investment process. As a quick recap:

- The number of conventional funds that now say they consider ESG factors (ESG Consideration group) has grown to 564 from 81 in 2018, with $933 billion AUM – this is ~4.5% of the $20.7 trillion held in the universe

- This compares to sustainable investment strategies, including ESG-focused, thematic and sustainable sector, which held $137.3 billion in total assets at the end of 2019, and was less than 1% of the $20.7 trillion held in the universe of mutual and ETF funds in the U.S.

The following from Morningstar distinctly separates two primary groups – ESG Consideration and Sustainable Investment Strategies.

Mutual Funds

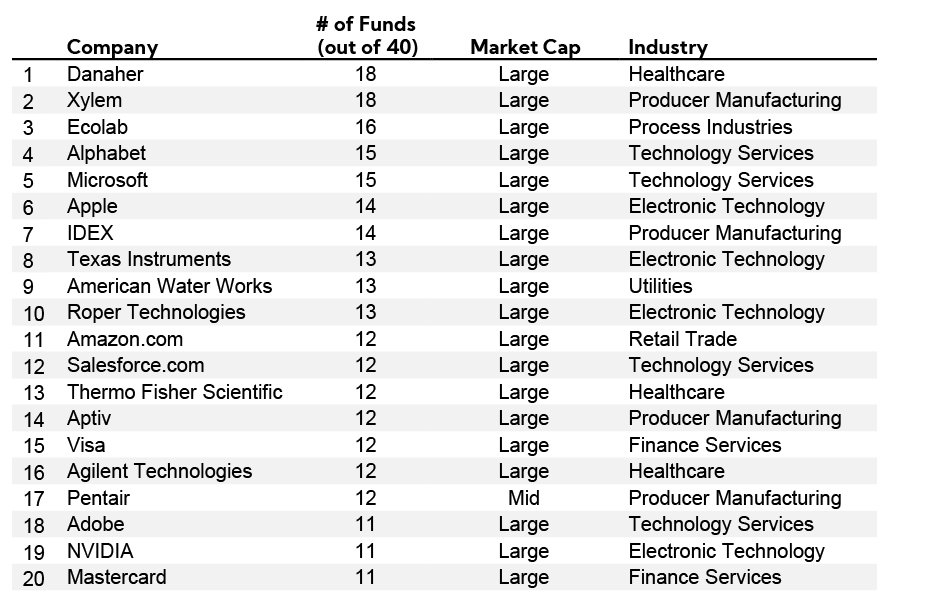

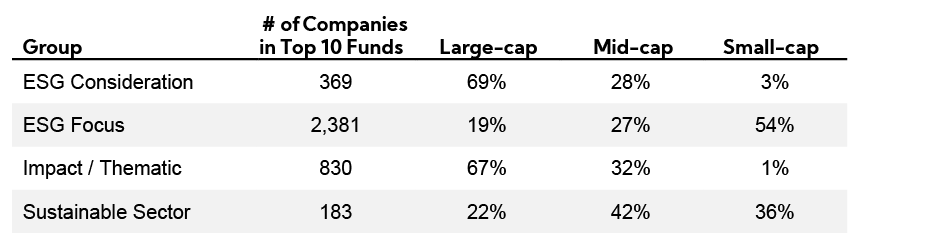

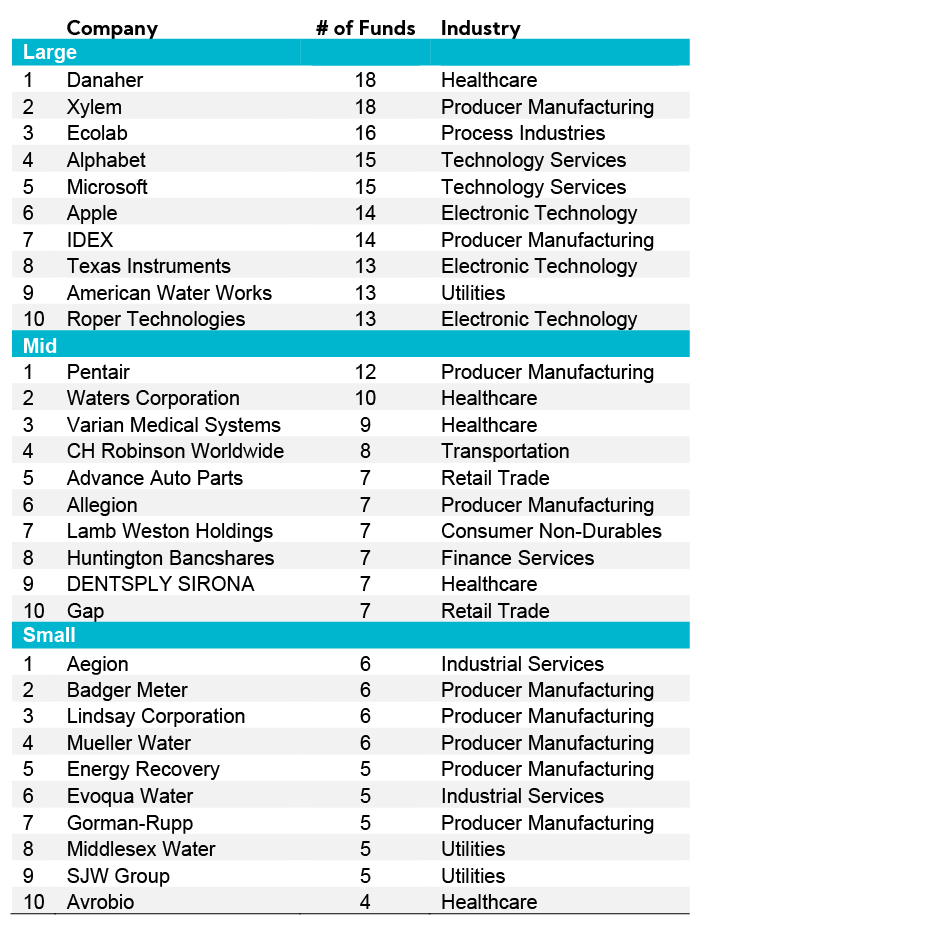

To understand the types of companies included across these four groups 1) ESG Consideration; 2) ESG Focus; 3) Impact/Thematic and 4) Sustainable Sector, we analyzed the top 10 funds from each (totaling 40 mutual funds).

Our analysis reveals the majority of mutual funds invested across these four ESG groups are heavily weighted toward large-cap companies and the following are the top 20 corporations most often included:

The top 20 companies, all large caps with the exception of Pentair, are holdings of 11 to 18 mutual funds of the 40 researched, with Danaher and Xylem the most represented. Please see Appendix, Exhibit A-D for top 10 mutual funds and companies by group.

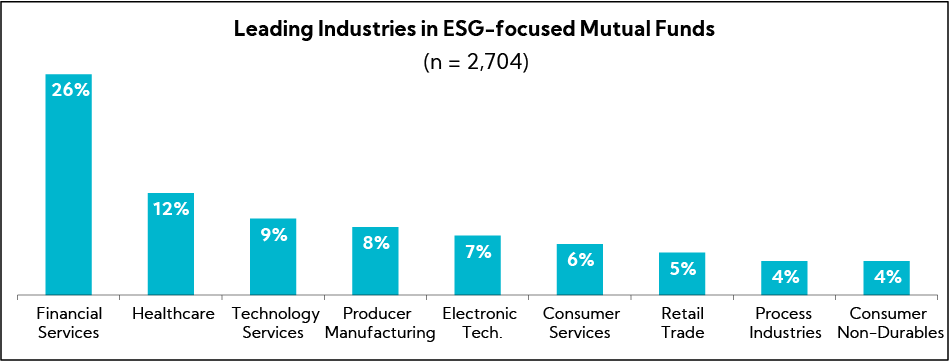

As well, the following are the most prolific industries represented:

More importantly, we wanted to understand the communication practices of companies included in these funds. To conduct an analysis inclusive of all market caps, we analyzed the top 10 small-, mid- and large-caps.

Top 10 by Market Cap

Our analysis reveals large caps across the board have the highest percentage of companies communicating ESG across platforms broadly, while small caps have the lowest percentage. Nearly all companies, with the exception of three small caps, have a dedicated sustainability/CSR section on the website and 73% have published a sustainability/CSR report in the last two years. Fewer companies, or 33%, have communicated ESG information in the Investor Presentation or Investor Day presentation, though those that have are generally the highest ranked of their respective market caps (e.g., Danaher and Xylem).

For those that do communicate ESG information in the Investor Presentation, on average, these companies largely have 1 to 2 slides with a high-level overview of their ESG framework, quantified goals and examples of recent traction.

Generalist Investors Incorporating ESG into Investment Process

As noted, ESG Consideration funds consider ESG a part of their process but have not made sustainability a central focus. ESG criteria may or may not play a role in the selection of any specific security, and ESG considerations generally do not come into play at the portfolio-construction stage. However, they consider ESG information as relevant to a more complete investment analysis.

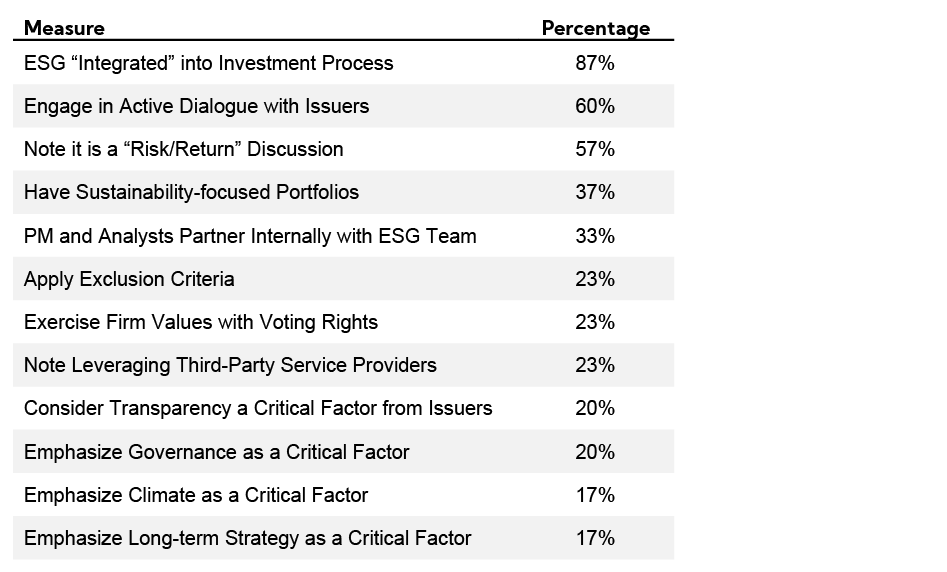

To identify which investment firms have consistently rated the importance of ESG highly over the last two years, we analyzed our proprietary database of more than 650 investors and identified 30 firms that rate ESG as “very important to critical” to their investment process.

The investment firms in this group comprise a mix of investment styles (37% growth, 30% value, 23% GARP and 10% other) and have more than $5.7 trillion in equity assets under management in aggregate.

Our analysis of their investment mandates reveals 3 top findings: 1) ESG is highly integrated into the investment process; 2) active engagement and dialogue with management is a critical factor; and 3) incorporating ESG into the investment process is a risk/return discussion.

In Closing

Through our comprehensive analysis, we intend for you to walk away with an understanding of the ESG mutual fund universe, including the communication practices of companies most commonly included in ESG mutual funds, as well as the investment firms that have demonstrated an alignment between ESG investment philosophy and buy-in from generalist portfolio managers and analysts – these are the firms where you are most likely to hear the topic of ESG in meetings, and those to consider as part of an ESG targeting strategy.

Next week will be the final ESG thought leadership piece in our four part mini-series, which will provide recommendations for your ESG strategy and include an Executive Summary of our research that can be utilized for engaging your boards, executives and other key stakeholders and equipping them with the know-how of the ESG landscape.

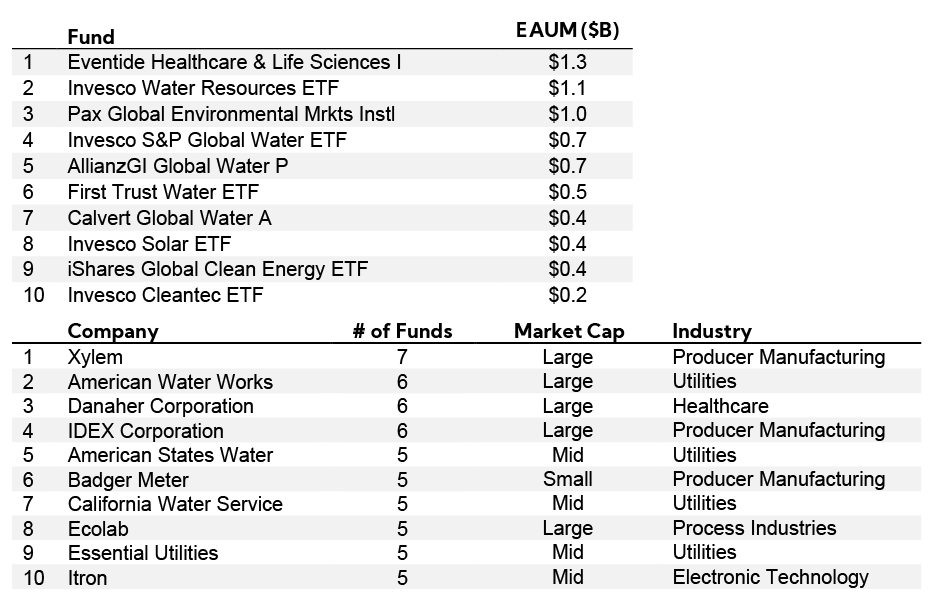

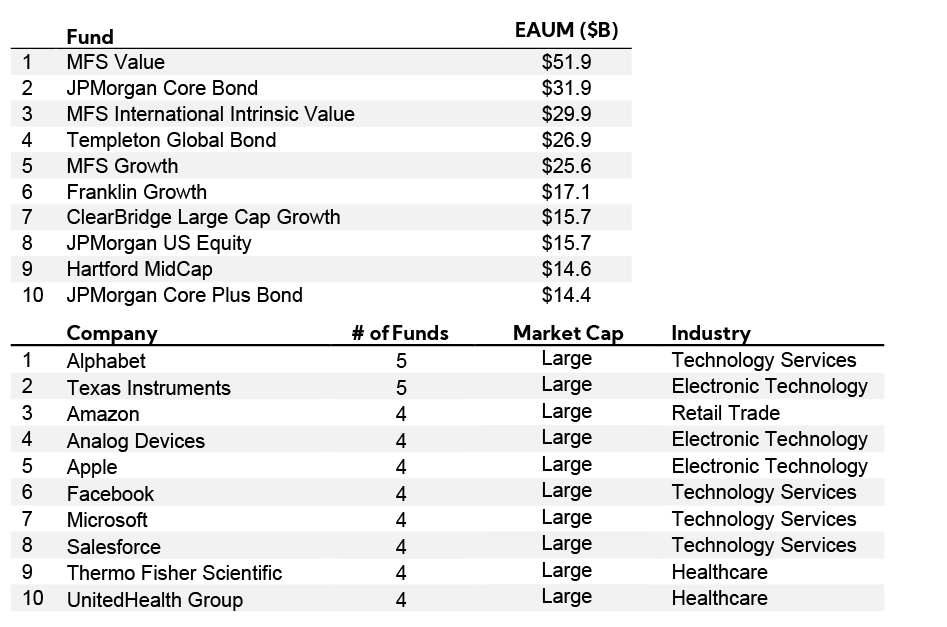

Appendix, Exhibit A-D

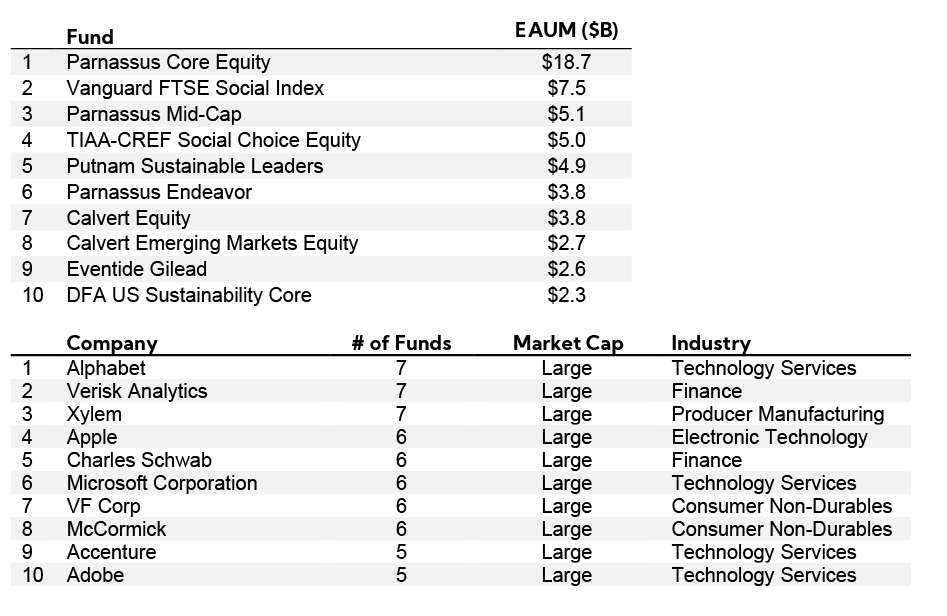

Exhibit A – “ESG Consideration” Top 10 Funds and Companies

Exhibit B – “ESG Focus” Top 10 Funds and Companies

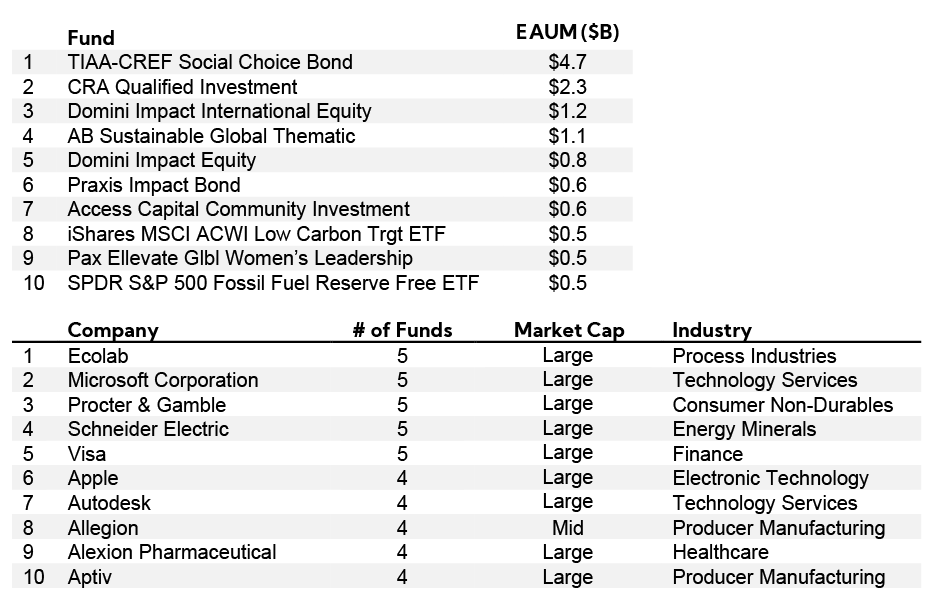

Exhibit C – “Impact/Thematic” Top 10 Funds and Companies

Exhibit D – “Sustainable Sector” Top 10 Funds and Companies