Commencing the Quarter – Q2’24

We’re gearing up for Q2’24 Earnings Season. Next week, we’ll be publishing our 59th Issue of Inside The Buy-Side® Earnings Primer®, filled with interesting shifts in investor sentiment and perceived executive tone, capital deployment preferences, and recession expectations.

Further, be sure to join us for our upcoming The Big So What™ – Q2’24 Earnings Season webinar on Wednesday, July 17th from 12:00 PM – 12:45 PM EST, where I’ll cover our Earnings Primer® research and emerging trends from our channel checks.

This week, our Thought Leadership covers:

- Key Events this week

- Q2’24 Earnings Communication Summary, based on a review of company earnings to date

Key Events

Employment

- The U.S. added 206,000 nonfarm payrolls last month, slightly beating expectations of 200,000, though less than the downwardly revised gain of 218,000 in May. The unemployment rate climbed to 4.1%, above May’s 4.0% rate and above the 4.0% estimate. The unemployment rate is now tied for the highest level since October 2021. (Source: Labor Department)

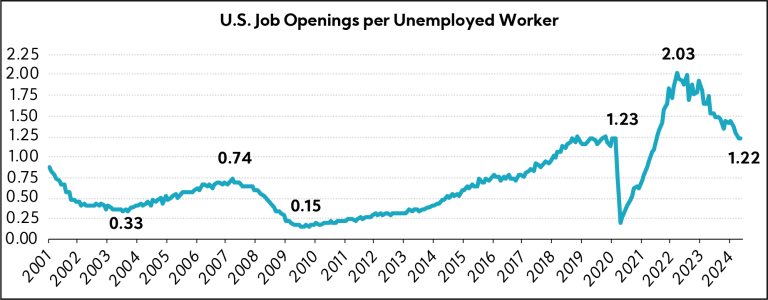

- U.S. job openings rose to 8.14M in May from 7.92M in April, surpassing analyst expectations of 7.91M, following two months of outsized declines. The Job Openings and Labor Turnover Survey, or” JOLTS” report, showed there were 1.22 vacancies for every unemployed person in May, unchanged from April, and the lowest vacancy-to-unemployment ratio since June 2021. The ratio is now slightly above its pre-pandemic average of 1.19 in 2019. (Source: Labor Department)

- Initial jobless claims, a proxy for layoffs, increased by 4,000 to 238,000 last week while the four-week moving average for jobless claims rose 2,250 to 238,500; continuing claims, which reflect the number of people seeking ongoing unemployment benefits, rose for the ninth straight week to 1.86M, the most since November 2021. (Source: Labor Department)

Services

- A measure of U.S. services sector activity slumped to a four-year low in June amid a sharp drop in orders, hinting at a loss of momentum in the economy at the end of the second quarter. The Institute for Supply Management (ISS) said its nonmanufacturing purchasing managers (PMI) index dropped to 48.8 last month, the lowest level since May 2020, from 53.8 in May. It was the second time this year that the PMI has dropped below 50, which indicates contraction in the services sector. (Source: Reuters)

Monetary Policy

- During remarks delivered in Sintra, Portugal this week for the European Central Bank’s annual Forum on Central Banking, Federal Reserve Chair Jerome Powell said he was pleased with how inflation had resumed a downtrend following a rebound at the start of the year. but that policymakers need to be more sure of the sustainability of that trend before lowering interest rates. He said the economy had made “significant,” and “real” progress, though declined to say whether he was setting the table for a September cut.” (Source: WSJ)

U.S. Supreme Court

- The Supreme Court ruled Monday that Donald Trump has “presumptive immunity” for official acts that were within his constitutional powers as president, complicating but not killing special counsel Jack Smith’s election interference case. In a 6-3 ruling falling along ideological lines, the majority also ruled that Trump is not immune for “unofficial acts,” and “not everything the President does is official.” (Source: Supreme Court of the United States)

Q2'24 Earnings Communication Summary

As we do every quarter, we analyzed the earnings communication trends of 30 off-cycle companies reporting between June 3 and July 3, 2024, to identify important themes and precedence. These companies span market cap sizes and sectors.

In line with preliminary findings from our Inside The Buy-Side® Earnings Primer® — to be released next week — commentary from recent earnings calls reveals a pullback toward more neutral sentiment and tempered (albeit not overly pessimistic) outlooks. This marks a shift from the first six months of the year when executives widely anticipated a rate cut environment to fuel expected stronger performance in the latter half of 2024.

Inflation and economic instability, amplified by the upcoming elections, have resulted in selective spending and heightened financial anxiety among consumers, particularly among low-income shoppers. Pricing power is under pressure, and retail and consumer-facing companies are responding with aggressive promotions to maintain customer loyalty and drive traffic, despite the pressure on margins.

Demand remains “consistent” across various sectors, though not blockbuster. The technology sector, particularly in AI and infrastructure, continues to see positive momentum, while traditional segments like construction and manufacturing anticipate benefits from ongoing and future government infrastructure spending. However, certain verticals, such as office and commercial construction, continue to be mired in an economic slowdown.

Geographically, the European market continues to be beset by geopolitical uncertainties and high costs, with consumer confidence remaining low. Furthermore, China is experiencing “souring” fundamentals as store traffic declines weigh on sales. Mexico stands out as a relative bright spot, attracting strong investment in manufacturing and supply chain opportunities as the country benefits from palpable nearshoring trends.

Earnings Topics

Key trends from our analysis of 30 off-cycle earnings calls include:

Executive Sentiment Sees an Injection of Cautiousness amid Mixed Economic Signals, a Continued High Interest Rate Environment, and Election-induced Uncertainty; ‘It’s Hard to Forecast What the Economy is Going to Do’

- Concentrix ($4.3B, Technology, Information Technology Services): “In terms of the macro, we’re not seeing really any change. We’re not seeing it improving. We’re not seeing it declining. And that’s a global comment. We’re seeing things fairly stable and steady and, clearly, any positive changes coming to that, we expect to benefit from it based on the share that we have within our client base.”

- Paychex ($42.4B, Industrials, Staffing & Employment Services): “On the macro area, what we continue to see is growth and moderate growth. We continue to see wage inflation cool. I would tell you, in May in our report, we had the biggest one month [Small Jobs Index] increase there. We’re not seeing any signs of a recession or hearing from our clients or seeing layoffs or those type of things that we would typically see in a recessionary period.”

- Progress Software ($2.4B, Technology, Software – Infrastructure): “On the business side, people are being very cautious, and they will continue to be cautious. I shouldn’t do any macro stuff ever, but I think that interest rates are not coming down soon, and people will be watchful about what they spend. I think they will spend on important stuff that is truly mission critical, which makes me feel good about our business.”

- Worthington Enterprises ($2.3B, Industrials, Metal Fabrication): “It’s hard to forecast what the economy is going to do; there are pluses and minuses that are impacting our businesses in material ways. One, we have a lot of infrastructure spending from the government that’s still coming through the pipeline, that’s a positive. We have interest rates, which is impacting the housing market and slowing repair and remodel there, which is a negative. Employment is holding up pretty good, but consumers are dialing back some of their discretionary spend. So, I don’t know whether that’s a neutral. Financial markets are still pretty strong. There are puts and takes that solve for somewhat of a steady economy with a little bit of noise here and there in different products and different markets.”

Back Half

- Five Below ($5.9B, Consumer Cyclical, Specialty Retail): “As we get past the election and into the fourth quarter, the pressure should start to subside from what we’re seeing today. But make no doubts about it: the lower-end customer is really being stretched, and we’ve got to deliver value, and we’ve got to really display that in how we go to market, when you walk in the store, and with what you see. But all that’s in flight right now and I expect to see some of those changes improve by back half of the year.”

- GMS ($3.2B, Industrials, Building Products & Equipment): “My hopeful side on single-family [construction] would have been that we would have started to at least get an indication that rates were coming down by now. And of course, it seems like higher for longer, although maybe there’s some September relief. I doubt it. Probably, post the election, we’ll start seeing some rate relief, which is good for next year.“

- Patterson Companies ($2.1B, Healthcare, Medical Distribution): “As we look here into the new fiscal year, we’re being fairly cautious in our outlook here in the near term in a year where there’s not necessarily a macroeconomic catalyst that we’re projecting at this point, we’re expecting it to be fairly modest in our FY2025 guide.”

- KB Home ($5.0B, Consumer Cyclical, Residential Construction): “As we talked about earlier in the year, we, like most people, had an expectation of rates coming down and being able to reduce some of the mortgage interest rate incentives that we’ve had out there. That, unfortunately, has not happened as of this point, and that put a little bit of pressure on the back-end margins. We are seeing some mix shift in deliveries in the back half of the year, but we’re pretty happy that we’ve been able to raise, incrementally, the full year gross margin outlook for the company despite some of those headwinds.”

Execs Transmit Consumer Anxiety as Selective Spending Habits Among Low-Income Shoppers Intensifies; Retail and Consumer-Facing Companies Push Promotions and Emphasize Value Proposition

- McCormic ($18.7B, Consumer Defensive, Packaged Foods): “Consumers continue to exhibit value-seeking behavior. Financial anxiety remains elevated, particularly in the United States, and especially with mid- to low-income households due to the compounding impact of inflation. In addition, inflation in the foodservice channel is leading to softness in food-away-from-home consumption and impacting restaurant traffic. Volumes on the retail side, particularly in the center-of-store, remain soft. Consumers continue to buy just what they need and make more frequent trips to the store. On the other hand, they are increasingly shopping the perimeter and continuing to cook at home.”

- NIKE ($113.4B, Consumer Cyclical, Footwear & Accessories): “This quarter, we saw softer traffic in our factory stores, highlighting increasing pressure being felt by the value consumer.”

- General Mills ($35.1B, Consumer Defensive, Package Foods): “About 86% to 87% of food is now eaten at home. And given the challenges consumers are facing with inflation, we would expect that to continue.”

- Walgreens Boots Alliance ($9.7B, Healthcare, Pharmaceutical Retailers): “In U.S. Retail Pharmacy, we witnessed continued pressure on the U.S. consumer. Our customers have become increasingly selective and price sensitive in their purchases. In response, we invested in targeted promotion and price decisions, which have driven traffic and will generate improved customer loyalty, but they weigh on near-term profitability as we refine our approach. “

- Casey’s General Stores ($13.5B, Consumer Cyclical, Specialty Retail): “From a risk standpoint, I would say that I feel really good about where we’re at with the consumer. The consumer health is probably the single biggest risk and that’s a risk for everyone in retail.”

- Dave & Buster’s Entertainment ($1.5B, Communication Services, Entertainment): “One of the trends that we’ve noticed in the business that we discussed last quarter was on our lower income consumers, there was more weakness there versus moderate- and high-income. We continue to finetune our marketing approach and get smarter about targeting the right guest and delivering the right message to that guest. One of the things that we’ve been very encouraged by is, as we’ve started to focus on midweek promotions, we’ve been able to recapture some of the low-income consumers.”

Companies Report ‘Consistent’ and ‘Moderate’ Volume for Now; AI and Infrastructure Tailwinds Continue to Underpin Optimism

- Autodesk ($53.1B, Technology, Software- Application): “Overall, end market demand has remained pretty consistent over many quarters. Macroeconomic and one-off factors, like the Hollywood strike, have dragged on new business growth and continue to drag on revenue growth.”

- FedEx ($72.2B, Industrials, Integrated Freight & Logistics): “While we saw modest yield improvement and signs of volume stabilization across segments, we have not yet seen a notable increase in demand.”

- FactSet Research Systems ($15.9B, Financial Services, Financial Data & Stock Exchanges): “If we look at what we expect for the year, the underlying demand for our products remains steady. On a growth basis, we are in line with last year. So, we’re selling as much as we were last year. So, it’s not a demand problem. But that being said, we have had a number of one-time cancels that we’ve talked about. So, the impact has been on higher erosion which we believe is, in part, obviously driven by the market.”

- Lennar ($39.0B, Consumer Cyclical, Residential Construction): “As interest rates subside and normalize, and if the Fed is actually going to begin to cut rates, we believe the pent-up demand will be activated, and we will be well prepared. If not, we will continue to produce volume and add to market supply. For that, we are well prepared.”

- Micron Technology ($151.7B, Technology, Semiconductors): “On the data center side, we have been saying for some time that we expect the data center demand to start returning in the first half of calendar 2024, and that has been pretty much on target. And as the second calendar quarter or third fiscal quarter continued, we saw a strengthening of that demand in the data center, and that strong trend has continued, mainly driven by AI. It started with a lot of demand coming from AI. And then we have started to see some early signs of improvement in demand in traditional servers, and that kind of demand improvement is continuing, so that’s a positive sign.”

- Argan ($1.0B, Industrials, Engineering & Construction): “It would be hard to ignore the many recent reports citing the actual and expected significant increases in energy demand and power consumption. Energy infrastructure worldwide needs to be expanded and strengthened to meet anticipated increased capacity demands, particularly as more data centers come online to support AI applications which consume very high amounts of energy.”

- Apogee Enterprises ($1.4B, Industrials, Building Products & Equipment): “We expect continued headwinds in some construction market verticals, including office and commercial. Declines in the Architectural Billing Index point to a slowdown in construction activity. This will likely pressure volumes and/or pricing in our architectural segments. On the positive side, we anticipate continued growth in institutional and infrastructure projects, supported by significant government funding.”

- Acuity Brands ($7.5B, Industrials, Electrical Equipment & Parts): “When we look ahead, infrastructure continues to show positive signs. It’s not landing yet, but the quoting activity is really strong. So, as we look ahead, we have the portfolio to service that business and see that as an opportunity for us.”

- Lindsay ($1.2B, Industrials, Farm & Heavy Construction Machinery): “We anticipate our infrastructure business will benefit over time as U.S. infrastructure spending increases under the Infrastructure Investments and Jobs Act. We’ve also only recently seen this funding flow to the market and believe we’re in the early stages of a multi-year growth trajectory for domestic infrastructure spending with additional promising opportunities globally.”

Amid Pricing Pressures and Persistent Inflation, Execs Turn Challenges into Opportunities by Enhancing Value Propositions to Capture Market Share; Digital Capabilities / AI Continue to be Deployed to Enable Greater Efficiency

- H.B. Fuller ($4.2B, Basic Materials, Specialty Chemicals): “Particularly in an environment like this when customers are very cost-sensitive, they will ask for help on their product. Typically, what we will do where it makes sense, is to work with them to replace certain raw materials within their existing formula with others that are lower cost or come from different suppliers in order to reduce the overall price we can offer that customer on that product. So, we’re lowering our cost as we do that, we’re sharing it with the customer, and there’s not a margin impact to us, but you will see a pricing impact start to occur.”

- Apogee Enterprises ($1.4B, Industrials, Building Products & Equipment): “Primarily, what we see is we see a lot of pricing pressure as volume is softening. End market demand is putting pressure on volumes. We’re trying to titrate our pricing and it’s getting pushed down. And so, we think there is going to be some pressure on pricing that’s going to push down margins consecutively, as we look at the rest of the quarters sequentially in the year.”

- UniFirst ($3.1B, Industrials, Specialty Business Services): “When we talk about the more challenging pricing environment, it’s primarily inflation emerging from this inflationary period. I think about it from how we’re managing our vendors and after multiple years of higher cost, we’re putting more programs out to bid with our vendors. And you’re seeing some of that in general in the marketplace and that’s leading to somewhat of a more challenging pricing environment, which probably isn’t surprising.”

- MSC Industrial Direct ($4.4B, Industrials, Industrial Distribution): “In terms of the pricing environment more generally, it’s interesting because you sort of have two competing factors going on. On the one hand, no question, inflation has proven to be a bit stickier than expected. So, there are some pockets where costs remain elevated. At the same time, we’re seeing a phenomenon that [I’ve] seen pretty much through my career, it happens like clockwork: every time the demand environment softens, customers have more time to shop, and so they’re more scrutinous of everything that goes out the door. There’s more reopening of Requests for Proposals. So, on the one hand, you have a little bit stickier inflation, which should buoy the pricing environment. On the other hand, the competitive environment is intense when it’s soft.”

- Paychex ($42.3B, Industrials, Staffing & Employment Services): “We’ve been focused on our cost savings initiatives, really trying to find ways to continue to enhance our digital capabilities, find ways to be more productive, more efficient, while making investments in the business to prepare for this, really focused on not letting new costs in the business.”

- Lindsay ($1.2B, Industrials, Farm & Heavy Construction Machinery): “For us, the biggest thing is the ability to react to market changes both up and down without really having to flex the labor like we have in the past and incur the additional head count and overtime and things like that. So, it just provides less reliance on the labor through the additional automation and things like that.”

- John Wiley & Sons ($2.3B, Communication Services, Publishing): “We’re already deploying AI to materially improve office productivity and customer service as we begin to transform how we work. In customer service, for example, we’re already seeing cost savings and reductions in handle time through the latest AI augmentation and automated processes.”

From Low Visibility to Consumer Caution to Promotional Challenges, Elections in the U.S. and EU Leave a Series of Hurdles and Opportunities in Their Wake; Expect Analyst Questions on Upcoming Calls

- MSC Industrial Direct ($4.4B, Industrials, Industrial Distribution): “Visibility in our business is generally pretty limited because we are such a short-cycle business. It’s probably more limited than usual; gearing up towards an election isn’t helping things. You’ve got a lot of people in wait-and-see mode. And that, combined with interest rates not being reduced, people are cautious. Certainly, beyond November, I think that’ll be the next big milestone.”

- Quanex Building Products ($1.0B, Industrials, Building Products & Equipment): “With this being an election year, a lot of consumers are on hold saying, ‘Why would I invest in buying something where when I don’t know what the end result will be for any sort of economic incentives or housing regulations?’ So, I think the consumer in Europe has been a little more on hold and much more conservative with their spending than we’ve seen in the U.S. And that’s definitely drove softness.”

- Victoria’s Secret ($1.3B, Consumer Cyclical, Apparel Retail): “I don’t think it’s appropriate for us yet to start to think about letting up on promotion. And the reason I say that is, as we move into the fall season, I think it’s fair to assume the environment could continue to be challenging from a consumer standpoint. We’re going to head into a national election cycle which, again, from a media standpoint and how we break through, will continue to challenge the business or challenge retail in general.”

Analyst Questions

- FedEx ($72.0B, Industrials, Integrated Freight & Logistics): “We’ve got some elections coming up and just curious how big of an issue tariffs have been as part of your customer discussions to date and maybe more specifically just given your commentary around China e-commerce, you’ve got a couple of big direct e-comm customers, so can you maybe remind us of how big they are right now as a percentage of your book and what’s the risk to volumes here if there is a change in trade policy?”

- Academy Sports and Outdoors ($3.7B, Consumer Cyclical, Specialty Retail): “In terms of the improvement in the back half, can you talk a little more specifically about the categories that you expect to turn positive? And to what extent are you expecting maybe the hunt [business] category to see some lift around the election?”

- nCino ($3.6B, Technology, Software – Application): “As you think about potential catalysts on the horizon, driving demand and bookings over maybe the next 6 to 12 months, can you contextualize the importance of the different variables in play between some of the more obvious ones like rates, the U.S. presidential election, and broader urgency that AI is putting on the industry to innovate? How would you rank order the importance among those?”

The EU and UK Face Continued Challenges amid Geopolitical Uncertainty and High Costs, While China Sees Declining Consumer Sentiment and Traffic; In LATAM, Mexico Emerges as a Bright Spot with Strong Investment in Manufacturing and Supply Chain Opportunities, But Exhibits Mixed Consumer Trends along with Brazil

Europe

- Commercial Metals Company ($6.1B, Basic Materials, Steel): “Conditions in Europe are difficult as we’ve said on the last several calls. We wouldn’t preclude growth in Europe, but given the situation that we’re facing, growth in Europe would have to be very compelling now and we’d have to have a clear pathway to returns that are substantially in excess of our cost of capital because the risk profile of that market, as we’ve seen over the last couple of years, is more challenging.”

- PVH ($5.7B, Consumer Cyclical, Apparel Manufacturing): “As we shared previously, we have seen tough macro conditions, especially in our two biggest markets, the UK and Germany, where consumer sentiment is challenged and our wholesale partners are cautious.”

- Quanex Building Products ($0.9B, Industrials, Building Products & Equipment): “In Europe, market dynamics pose a greater challenge. Both the UK and continental European markets have experienced significant softness. We anticipate that market improvements in Europe will lag behind North America due to ongoing geopolitical conflict, sustained pressure on energy costs and various governmental elections…The key drivers are obviously consumer confidence. You had longer pressures on energy cost, and that’s definitely drove softness. And then you couple that with some of the higher inflation and the fact that you’ve obviously got a war that’s in their backyard. And there’s a lot more uncertainty than we see here in the U.S.”

China

- General Mills ($35.2B, Consumer Defensive, Packaged Foods): “China, after a strong start to the year, we saw a real souring or downturn in consumer sentiment in the quarter that had a negative impact on our shop traffic for Häagen-Dazs and our premium dumpling business.“

- NIKE ($113.6B, Consumer Cyclical, Footwear & Accessories): “We experienced meaningful shifts in consumer traffic in key markets, particularly in Greater China, where brick-and-mortar traffic declined as much as double-digits versus the prior year. We also continue to see uneven trends in EMEA and other markets around the world.”

- McCormick ($18.7B, Consumer Defensive, Packaged Foods): “In China, our Food Away from Home business, which is included in APAC Consumer, was impacted by slower demand in the first half of the year, and we continue to expect China Consumer sales to be flat with 2023 for the full year.”

LATAM

- Worthington Steel ($1.6B, Basic Materials, Steel): “We’re most excited about the investments that we have that we’ve been talking quite a bit about in Mexico for our focus factory expansion for electric vehicles. That project is on time and on budget. The building is nearly complete. We’ve installed the first press and are working on the next three.”

- FedEx ($72.1B, Industrials, Integrated Freight & Logistics): “We are able to react very quickly, much faster than manufacturing can move. And so, the supply chain pattern changes [i.e., nearshoring], actually works in our favor in many ways because the only companies that have established networks that connect all these countries can actually do these things. So, for example, when our manufacturing moves to Mexico, we have a significant presence in Mexico and the United States. In fact, on our competitive set, we are the only one who can say that with conviction. So, while we see the overall trade trends flatten out [i.e., China], there are opportunities as supply chain patterns change.”

- Lindsay ($1.2B, Industrials, Farm & Heavy Construction Machinery): “We’ve continued to see a decline in Brazil due to suppressed commodity prices and limited access to capital, ultimately tempering overall demand in the short term. Tragic flooding in the South has also hindered order activity in that region.”

- Brown-Forman ($20.0B, Consumer Defensive, Beverages): “As it relates to Mexico, the consumer continues to be slowing down in spending, and we’ve been talking about that in our business, and you can see that through el Jimador and Herradura performance. Brazil, we continue to deliver LSD growth there because our Jack Daniel’s Tennessee Apple is being really well-received with the consumers, and it’s driving market share gains, but the consumer takeaway there is it is slowing a bit as well.”

In Closing

Off-cycle earnings reports are corroborating what we’re hearing more broadly and the investor sentiment captured in our Inside The Buy-Side® Earnings Primer® Q2’24 survey — a less optimistic, more neutral tone owing to a higher-for-longer interest rate environment and elections — which are casting a pall on consumer and business spending.

The “back half” narrative is beginning to see cracks and while the certainty that will come with the outcome in November in the U.S. should be a shot in the arm, will it be enough to overcome current uneasiness and support expected growth in 2024? We are already having conversations on pre-announcements and will be acutely tracking annual guidance trends.

We hope you find our primary research timely, insightful, and actionable, beginning with today’s “Commencing the Quarter” and throughout the Q2’24 earnings season as we report on emerging trends and share our data-driven insights.

Be on the lookout next week for our Q2’24 Earnings Primer®, which we’ll publish on Thursday, July 11!