This Week in Earnings – Q2'24

The Sector Beat: U.S. Banks

Over the last two weeks, we’ve published our ground-breaking Inside The Buy-Side® research – Earnings Primer® last Thursday and Industrial Sentiment Survey® yesterday. In both, we identified one of the largest reversals in sentiment over the past 5 years – from bullish to neutral, as well as other interesting findings that indicate the back-half narrative is wobbling. We hope you find our research and recommendations timely and insightful as you prepare for your earnings announcement.

In today’s thought leadership, we cover:

- Key Events this week

- Key Insights from our 59th issue of Inside The Buy-Side® Earnings Primer®, published last Thursday, July 11th

Spotlight on U.S. Banks in The Sector Beat, which provides valuable insight into the U.S. economy, consumer, and deal environment

Key Events

Retail

- U.S. retail sales were unchanged in June from the prior month, higher than the expected 0.4% decrease and after an upwardly revised 0.3% increase in May; excluding auto-related receipts, retail sales rose 0.4%, also ahead of the estimate for a 0.1% increase. (Source: Commerce Department)

Housing

- Total housing starts increased 3% to a 1.35M annualized rate in June, driven by a 19.6% surge in multifamily construction. Starts of single-family homes fell for the fourth consecutive month. Building permits, a proxy of future construction activity, rose 3.4% to a 1.45M annual rate, also driven by a pickup in applications for multifamily projects, while authorizations for single-family homes decreased 2.3% to the slowest pace in more than a year. (Source: Commerce Department)

Monetary Policy

- Federal Reserve Chair Jerome Powell avoided sending a clear signal about when the central bank would begin to cut interest rates even as he welcomed a recent cool-down in inflation. “Today I’m not going to be sending any signals one way or the other on any particular meeting,” Powell said while speaking at the Economic Club of Washington on Monday. “Just to ruin the fun right at the beginning.” (Source: NYT)

- The European Central Bank held interest rates steady but kept the door open to further reductions this year. The ECB lowered its key interest rate by a quarter point last month, to 3.75%, widening a policy gap with the Federal Reserve, which held interest rates steady in a range between 5.25% and 5.5% for a seventh consecutive meeting. (Source: WSJ)

U.S. Politics

- After surviving a weekend assassination attempt, former President Donald Trump named Sen. J.D. Vance of Ohio as his running mate, settling on a much younger partner who could help appeal to working-class voters in critical Midwest battleground states. If Trump is elected, Vance, who turns 40 in August, would be one of the youngest vice presidents in history and one with just two years of elected experience. He is a figure closely associated with the style and views of Trump’s conservative, populist movement. (Source: WSJ)

Key Insights

Following last quarter’s survey that found increasing optimism amid positive year-over-year earnings expectations and easing recessionary concerns, the Voice of Investor® captured in this quarter’s survey registers a tempering of bullishness and more neutral sentiment, though outright bearishness remains at bay. Despite increased concerns over the consumer, the political landscape, and the economy, including cooling expectations for 2024 U.S. GDP growth, surveyed financial professionals largely expect Q2’24 results to be in line with both last quarter and relative to consensus, and annual guides to be maintained.

Based on survey responses from 73 participants globally from June 6 to July 3, 2024, comprising 30% sell side and 70% buy side representing equity assets of ~$2.2T:

Bullish Investor Sentiment Recedes to More Neutral Territory while Executive Tone Described as Less Rosy; While Expectations for Q2 Moderate Somewhat, Most Anticipate In-Line-with-Consensus Performances and Annual Guides to Hold Steady

- 35% report current sentiment as Bullish or Neutral to Bullish, down from 52% QoQ, with more investors, 41%, characterizing views as Neutral, up from 30%

- Concurrently, executive tone is described as less optimistic, with 41% now perceived as Neutral to Bullish or Bullish, a decrease from 64%

- Taken together, QoQ changes in investor sentiment and executive tone represent one of the top four largest pullbacks in optimism over the prior 5-year period; still, outright Bearishness remains at bay

- Most, 53%, expect earnings results to be In Line with consensus; around the edges, those expecting misses ticks slightly higher

- For Q2 Revenue, EPS, Margins, and FCF, most contributors expect Stable to Improving sequential performances, albeit those in the Improving camp are lower across all KPIs QoQ

- 60%+ anticipate companies will Maintain annual guides, but commentary indicates burgeoning concerns around 2H 2024

- Top areas to address on earnings calls include margins, growth, and, emerging as a leaderboard topic this quarter, spending and investment priorities

Recessionary Concerns Resurface as 2024 U.S. GDP Growth Expectations Moderate; Geopolitical and Political Risks Top Concerns this Quarter in Addition to Consumer Health, which Sees a Notable Jump

- Respondents expecting a recession increases for the first time after four consecutive quarters of improving sentiment — from 39% last quarter to 56%

- More investors, 49%, now expect 2024 U.S. GDP to be In Line with 2023, up from 39% QoQ; those expecting a Higher annual GDP figure decline from 56% at the end of last year to 21%

- 56% cite geopolitical risk as the leading concern, marking the largest QoQ increase, followed by U.S. election turbulence; recessionary concerns, not seen on the leaderboard since Q2’23, make a comeback, while apprehension over consumer health jumps

- 51% expect consumer confidence to Worsen over the next six months, an increase from 35% QoQ

- Investors are weighting margins and growth generally equal at this time, though focus toward the latter increased from 38% to 49%; to that end, views on growth and margins across the survey are decidedly split, reflecting mixed perspectives toward the trajectory of the economy

- A bright spot, 62% believe we have moved past inventory destocking

- As for global economies, India garners the most definitively positive outlook over the next six months, followed by Eastern Europe and the U.S., while views on UK’s strength sputter

Additional Channel Checks of Growing Unease Emerge as Debt Paydown Remains the Leading Preferred Use of Cash while Support for Conserving Cash Jumps; Respondents Continue to Point to Tech and Healthcare as Market Favorites, While REITs Extend Bearish Margin

- Investors have not abandoned their conservatism as Debt Paydown remains the top preferred use by 60%, roughly in line with the prior two quarters

- Those favoring a 2.0x or lower Net Debt-to-EBITDA ratio increased to 70% from the 57% level registered last survey

- Reinvestment is a close second preferred use at 57%, up from 53% QoQ, while more support Maintaining current levels of growth capex versus Increasing

- Notably, Dry Powder (aka cash hoarding) doubles in interest to 32% as the third preferred cash usage

- Despite somewhat tempered views from the bullish highs captured last quarter, support remains intact for most sectors

- Bulls continue to embrace Tech and Healthcare

- REITs remain out-of-favor

- Mixed sentiment is most evident in Energy, which registers #3 among most bullish sectors, while simultaneously seeing the largest influx of bears QoQ

In case you missed it, you can access the link below for a replay of our webinar The Big So What™ – Q2’24 Earnings Season. Thank you to all who attended the session live and submitted questions!

The Sector Beat: U.S. Banks

This earnings season, U.S. Banks are reporting largely solid results relative to Street expectations with most posting Q2 beats on the top- and bottom-line. Broadly speaking, results have been buoyed by strength in capital markets and investment banking, which offset still-muted loan growth amid ongoing headwinds from inflation and higher rates. Echoing sentiment from Q1, executives expressed optimism around an expected pickup in M&A activity in the second half of 2024 with some suggesting Q2 may mark the low point for net interest income (NII).

While deposit flight in search of yield remains a challenge, executives note pressures there have been abating. Views regarding the U.S. consumer remain largely sanguine, though a stark divide is noted between higher earners, who continue to spend, and lower income groups feeling the strain from inflation and higher rates. While commercial real estate (CRE) remains a soft spot, executives have downplayed challenges, noting they are “manageable”. Election uncertainty — both in the U.S. and abroad — also garnered attention as a topic of interest during conference calls, in line with findings from our Q2’24 Inside The Buy-Side® Earnings Primer® published last week.

Taken together, recent economic indicators, the sustained strength of the U.S. economy, and CRE workouts moving ahead with some steam are supporting increased confidence among bank executives who suggest that conditions will coast into more normal territory as in the back of this year and into the next. However, nearly all remain cautious in their macroeconomic commentary, mindful of the geopolitical risks that continue to loom large and a “stabilizing” consumer lending backdrop.

Market Reaction

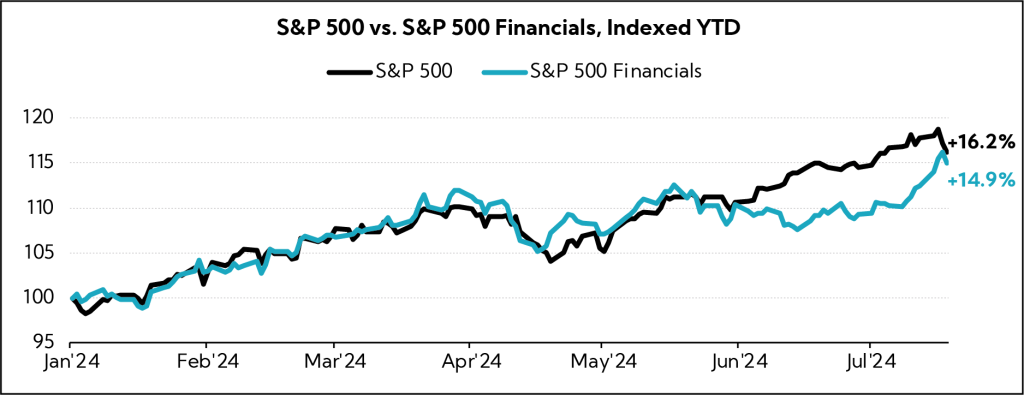

Market reaction has been mostly positive with stocks putting in varied-but-solid performances against a somewhat high bar as the group has rallied in the runup to earnings season. The S&P 500 Financial sector (which has appreciated 5% in the month of July, alone) is now up nearly 15% YTD1, only narrowly lagging the S&P 500. Coming into Q2 reporting season, analysts had largely flagged expectations for a favorable capital markets backdrop to outweigh the impact from drops in net interest income.

Key Earnings Call Themes

A Return to Normalcy on the Horizon? Cooling Inflation and Renewed Equity and Deal Market Strength Spark Confidence, though Execs Mull Over Persistent Uncertainties, Including High Interest Rates and the Impending U.S. Election

- Citigroup ($127.5B): “Looking at the macro environment as we enter the second half of the year, the U.S. is still the world’s most structurally sound economy. After a break in progress, inflation now appears back on a downward trajectory.Services spending has remained on an upward trend, although there were clear signs of a softening labor market and the tightening of the consumer budget. And of course, you might have heard there is an election in November. In Europe, while rate cuts have begun, the region’s lack of competitiveness continues to be a drag on growth. In Asia, China is growing moderately, albeit with government stimulus, and their pivot to high-tech manufacturing is being challenged by tariffs on EVs and semiconductors.”

- Wells Fargo ($202.5B): “Looking ahead, overall, the U.S. economy remains strong, driven by a healthy labor market and solid growth. However, the economy is slowing and there are continued headwinds from still elevated inflation and elevated interest rates.”

- JPMorgan ($603.4B): “There has been some progress bringing inflation down, but there are still multiple inflationary forces in front of us: large fiscal deficits, infrastructure needs, restructuring of trade, and the remilitarization of the world. Therefore, inflation and interest rates may stay higher than the market expects.”

- Bank of New York Mellon ($48.3B): “We’re looking out and it seems to be some greater consensus than we’ve had for a little while around what might happen with the Fed in the fall. Across September and the balance of year, it’s easy to think somehow that the range of risks have somehow narrowed as a result of that. But there’s still a lot of uncertainty in the world. We’ve got a whole bunch of other types of geopolitical risks out in the world. We’re continuing to grind through elections that we’ve talked about through the course of the year. There are all sorts of other things happening. We’ve still got wars going on.”

- Bank of America ($345.8B): “It’s been a pretty unusual period in history where we’ve had an enormous change in the rate structure and in the fiscal stimulus and the effects now fading away to something more normal.”

- Morgan Stanley ($174.0B): “The Investment Banking backdrop continues to improve, led by the U.S. The advisory and underwriting pipelines are healthy across regions and sectors. Inflation data has continued to moderate, which has helped stabilize front-end rates and support boardroom confidence and sponsor reengagement.”

- Synchrony Financial ($20.9B): “We’re being a little bit more cautious with regard to how we think about the macro going forward until we see signs that inflation really is breaking through some of this stickiness and you see some health to those consumers.”

- PNC Financial Services ($70.0B): “This whole uncertainty as we come up into the election on what’s it going to look like from a regulatory basis, what am I allowed to invest in? Am I going to get it approved? All of that, there’s a lot of pent-up energy behind that, and we’ll see.”

- Interactive Brokers Group ($52.1B): “The lower interest rates obviously spur economic growth, but there is going to be a lot of uncertainty. We still have two wars…and in Europe, there is election season. We are going to have a new administration. There is a lot of uncertainty as to how that is going to play out, or what exactly that’s going to mean. Even if the Trump ticket wins the election, it’s unclear exactly what the impact is going to be, because there is a chatter about increased tariffs, which can in turn increase inflation.”

Stark Divide as High Earners Drive Spending, Offsetting Weakness in Lower Income Groups; Execs Point to 2H Stabilization of Charge-offs and Delinquencies

- JPMorgan ($603.4B): “When it comes to card charge-offs and delinquencies, there’s just not much to see there. It’s normalization, not deterioration. It’s in line with expectations. When you look specifically at spend patterns, you can see a little bit of evidence of behavior that’s consistent with weakness in the lower-income segments where you see a little bit of rotation on spend out of discretionary into non-discretionary.”

- Bank of America ($345.8B): “In previous calls, many of you’ve asked questions or commented upon the question about consumer net charge-offs and when would they stabilize in the second half of 2024. That expectation remains unchanged. This quarter’s net charge-offs were 59 bps. For context, this is stabilization of the rate. I will just remind you that prior to this quarter, I have to go all the way back to 2014 to see a charge-off rate of that high and that’s near when we were still emerging from the financial crisis.”

- Citigroup ($127.5B): “When we look across our consumer clients, only the highest income quartile has more savings than they did at the beginning of 2019, and it is the over 740 FICO score customers that are driving the spend growth and maintaining high payment rates. Lower FICO band customers are seeing sharper drops in payment rates and borrowing more as they are more acutely impacted by high inflation and interest rates. That said, we’re seeing signs of stabilization and delinquency performance across our Cards portfolio. There was good revolving balance and loan growth in both Branded Cards and Retail Services, and we continue to see differentiation in the Credit segment, with the lower income customers seeing pressure.”

- Morgan Stanley ($174.0B): “We’ve seen increased spending by higher net worth, and so higher income bands are certainly spending. We see that in the data alongside actual spending. We see that in purchases of homes. We see that in various tailored investments. So that cohort, so to speak, is using its cash in different ways and its various investment in different ways. So, I do think that that’s an interesting dynamic that’s playing out. I know that others have mentioned it within their portfolios as well. It’s something we’re seeing in our data.”

Economic Caution and Higher Interest Rates Continue to Mute Demand Despite Some Positive Signals; CRE Remains a Sore Spot, but is “Manageable”

- JPMorgan ($603.4B): “Demand for new loans remains muted as middle market and large corporate clients remain somewhat cautious due to the economic environment, and revolver utilization continues to be below pre-pandemic levels. Also, capital markets are open and are providing an alternative to traditional bank lending for these clients.”

- PNC Financial Services ($70.0B): “We are muting our loan growth assumption. We did that because we got tired of saying, ‘Hey, loan growth is going to come at some point,’ so we took it out of the forecast. If it shows up, we’ll benefit like everybody else. There’s a basis for some loan growth in the second half. But the important point is we’ve taken it out of our guidance.”

- Wells Fargo ($202.5B): “The higher interest rate environment and anticipation of rate cuts continued to result in tepid commercial loan demand, and we’ve not changed our underwriting standards to chase growth. While losses in the commercial real estate office portfolio increased in the second quarter after declining last quarter, they were in line with our expectations. As we have previously stated, commercial real estate office losses have been and will continue to be lumpy as we continue to work with clients. We continue to actively work to de-risk our office exposure, including a rigorous monitoring process.”

- ServisFirst Bancshares ($4.4B): “We’ve been waiting for the C&I to come back and we did see that this past quarter. We saw for a long time we had a double negative. We had people taking money out of their money market and checking accounts and making capital expenditures instead of borrowing from us. That’s a double hit. So now they’re back, borrowing money again for capital expenditure projects. We feel good about organic loan demand picking up with our existing customer base, which is what we’ve been needing. And of course…there’s a lot of CRE projects that are on permanent hold based on the higher interest rates.”

- Bank of America ($345.8B): “With regard to Commercial Real Estate…we continue to aggressively work through our loans and office portfolio. We saw a decrease in all the categories. A decrease in reservable criticized loans, a decrease in NPLs, and a decrease in net charge-offs. This supports our previous expectation that net charge-offs in the second half of 2024 will be lower than the first half of 2024.”

Trillions in Infrastructure Spend Expected as Integration Accelerates, Enhancing Productivity, Client Service, and Operational Efficiency; U.S. Bank Execs get Specific and Tout Use Case Examples

- BlackRock ($124.0B): “I talked about the confluence of power and AI and data centers. And I believe this is going to be one of the world’s biggest growth engines as we start trying to develop AI for everyone. AI, not just for the big powerful organizations, but AI utilization for everybody, for every country in the world. It is going to require trillions of dollars of investments. And our conversations with the hyperscalers, our conversations with governments, our conversations with the chiller suppliers, the cogeneration suppliers, the opportunity we have in infrastructure is way beyond what I’ve ever imagined, even just seven months ago when we were contemplating the [Global Infrastructure Partners] transaction and formalizing it.”

- Goldman Sachs ($162.0B): “Most companies around the world are focused on how you can create use cases that increase your productivity and if you think about our business as a professional service firm, a people business, where we have lots of very, very highly-productive people, creating tools that allow them to focus their productivity on things and advance their ability to serve clients for interactive markets is a very, very powerful tool. So, if you look across the scale of our business, you can think of lots of places where the capacity to use these tools, to take work that’s always been done on a more manual basis and a lot of very smart people to do that work to focus their attention on clients are quite obvious.”

- Bank of America ($345.8B): “Our recent example of our use of AI is our advisor client insights tool. We delivered more than 6M insights YTD to our Financial Advisors providing them proactive engagement with clients. AI has moved from cost savings ideas to enhancing the quality of our customer interactions.”

- Citigroup ($127.5B): “We’re learning from best practices and we’re using some great AI and other data tools that are helping to identify anomalies in data and data flows much quicker.”

- Wells Fargo ($202.5B): “There’s traditional AI and then there’s Gen AI. We have a huge number of use cases already embedded across the company with traditional AI and that is in marketing, it’s in credit decisioning, it’s in information that we provide bankers on both the wholesale and the consumer side about what customers could be willing or might be willing to entertain a discussion about…The new opportunity that exists with Gen AI is where AI creates something based upon whether it’s public data or our own data in terms of things that haven’t existed. We are most focused in the shorter-term on things that can drive efficiency but also contribute to quality of the experience for our customers.”

- Bank of New York Mellon ($48.3B): “We continue to automate. We continue to reduce manual processes, which ultimately will feed into head count and better quality jobs for our folks and better careers.”

As Market Conditions Improve, Executives Tout “Early Stages of a Multi-year Investment Banking-Led Cycle”

- JPMorgan ($603.4B): “The dialogue on equity capital markets is elevated and the dialogue on M&A is quite robust as well. All of those are good things that encourage us and make us hopeful that we could be seeing a better trend in this space.”

- Citigroup ($127.5B): “We expect the rate environment and the financing markets to continue to be accommodative, as well as to continue deal making, with M&A being a bit larger in the overall mix, although some of the regulatory elements have put a damper on part of that.”

- Morgan Stanley ($174.0B): “We’re seeing some tempering of the inflation prints and some normalization rates. We’re also beginning to see the market broaden out. We can now expect broader corporate finance activity to quicken, whether that is across the corporate community or sponsors or other institutions. And the early sign of this activity can be seen in the convertibles product. Global convertibles activity is up significantly. We’re also seeing bake-offs running at triple plus the YoY rate that they were at for certain sectors and for some of our client groups. We’ve been seeing now the launch of traditional IPOs and we’re seeing M&A pipeline kicking in. We’re in the early stages of a multi-year investment banking-led cycle.”

- Goldman Sachs ($162.0B): “Our investment banking backlog is up significantly this quarter. From what we’re seeing, we are in the early innings of a capital markets and M&A recovery…[and while] we definitely see momentum pick-up, we’re still operating at levels that are still significantly below 10-year averages, we’ve got another 20% to go to get to 10-year averages on M&A. One of the reasons why M&A activity is running below those averages is because sponsor activity is just starting to accelerate, and so especially given the environment that we’re in, you’re going to see that over the next few quarters and into 2025 the re-acceleration of sponsor activity.”

In Closing

While overall U.S. Bank performances were largely in the black, executives refrained from declaring a definitive turnaround. Many injected a sense of caution in their macroeconomic commentaries, commensurate with our observations from our prior Commencing the Quarter Thought Leadership report. Still, increased confidence amid continued capital market strength and percolating M&A deal activity is notable.

We will continue to monitor these and other evolving themes in our ongoing weekly earnings Sector Beat coverage to provide universally insightful information on the macroeconomic landscape and factors impacting market sentiment.

Up next week: Industrial Sector Beat.

- Source: FactSet as of 7/18/24