This Week in Earnings – Q2’24

The Sector Beat: Consumer Discretionary

Peak earnings season shaped out to be a dynamic one, and today’s jobs data has added to investor concerns we identified in our most recent Q2’24 Inside The Buy-Side® Earnings Primer® publication. As a result, the S&P 500 saw its worst decline today since 2022, and the Fed-funds futures now sees a 71.5% chance of a 50 basis point cut in September.

In today’s thought leadership, we cover:

- Key Events this week

- Earnings Snap, covering the S&P 500 stats to date

- Spotlight on Consumer Discretionary in The Sector Beat

Key Events

Consumer Confidence

- U.S. consumer confidence rose in July to 100.3, above estimates of 99.7 and up from a downwardly revised 97.8 in June as improving expectations for the economy and labor market offset bleaker views of current conditions. A measure of expectations for the next six months climbed to 78.2 in July, the highest since January. (Source: The Conference Board)

Interest Rates

- The Federal Reserve held interest rates steady, but noted officials could cut interest rates at their meeting in September. While Federal Reserve Chairman Jerome Powell and his colleagues didn’t commit to any such move when they held rates steady on Wednesday, he appeared to suggest during a news conference after the meeting that a cut was more likely than not. Treasuries rallied with U.S. 2- and 10-year yields dropping to their lowest levels since February, partly ascribed to weaker economic data and concerns that the Fed could be late to the game with rate cuts. (Source: WSJ)

- The Bank of England cut its key interest rate for the first time in over four years. The U.K. central bank lowered its benchmark lending rate by 0.25% to 5% Thursday. (Source: Bank of England)

- For only the second time in nearly two decades, Japan’s central bank on Wednesday raised interest rates. The Japanese Central Bank increased its target policy rate to 0.25%, up from a range of 0% to 0.1%. The rate was last bumped up in March, when the bank raised interest rates for the first time since 2007. Guidance signaled further rate hikes on the cards if the July outlook scenario is realized. (Source: NYT)

Employment

- July nonfarm payrolls grew by 114,000 MoM, well below the expected 175,000 and June’s downwardly-revised 179,000. The Unemployment rate ticked higher to 4.3%, above consensus estimates of 4.1%. Average hourly earnings were up 3.6% in July from a year earlier — above the recent pace of inflation, but the smallest gain since May 2021. (Source: Labor Department)

- U.S. job openings fell modestly in June and data for the prior month was revised higher, suggesting the labor market continued to only gradually slow and was not in danger of rapidly weakening. The proportion of those who believed jobs were “not so plentiful” was also the highest since March 2021. Job openings in June stood at 8.18M, down from 8.23M openings in May but above the market expectation of 8.03M. (Source: Labor Department)

Global Economies

- Inflation unexpectedly heated up in the Eurozone this month, presenting a fresh challenge to policymakers looking for signs that eurozone price rises are easing sustainably. Consumer prices were 2.6% higher on year in July, picking up pace from in June and defying economists’ expectations for a slight decrease in inflation over the month. (Source: WSJ)

- China’s manufacturing activity contracted for a third month to a five-month low, easing to 49.4 in July from 49.5 in June, as factories grappled with falling new orders and low prices. Producers reported factory gate prices were at their worst in 13 months, while employment stayed in negative territory, with its sub-index last expanding in February 2023 and pointing to a weak domestic economy and China’s increasing reliance on exports for momentum. (Source: Reuters)

Geopolitics

- Israel said Tuesday it had killed Fuad Shukr, a top commander with the Lebanese militia Hezbollah, in an airstrike in Beirut, and Hamas political leader Ismail Haniyeh was killed in a mysterious strike just hours later in Tehran, an attack Iran blamed on Israel. Furthermore, Israel has determined that it killed top Hamas military commander Mohammed Deif in a July airstrike. The attacks provoked furious responses from Hezbollah and Iran and have sparked concerns of an escalatory spiral that could lead to a wider Middle East war. (Source: WSJ)

S&P 500 Earnings Snap

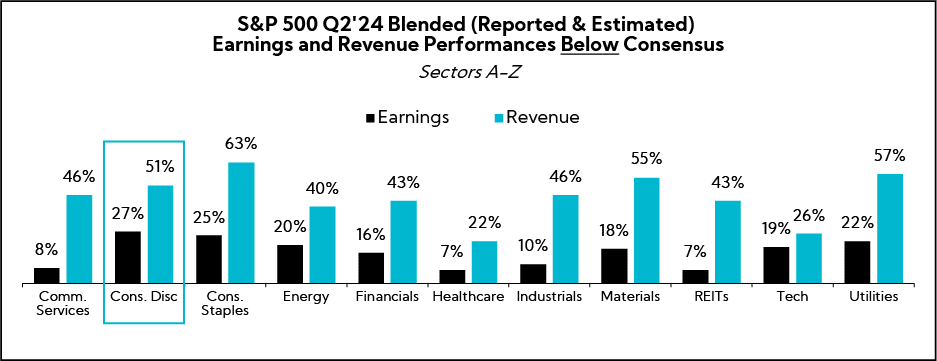

75% of the S&P 500 has reported earnings to date

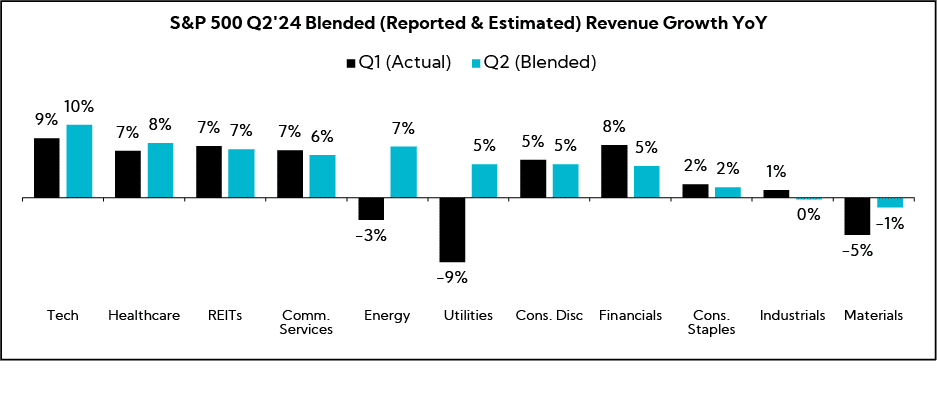

Q2'24 Revenue Performance

- 57% have reported a positive revenue surprise, below the 1-year average (63%) and the 5-year average (69%)

- Blended revenue growth (combines actual reported results for companies and estimated results for companies yet to report) is 5.1%; this compares to last quarter’s 4.5%

- Companies are reporting revenue 0.9% above consensus estimates, below the 1-year average (+1.1%) and the 5-year average (+2.0%)

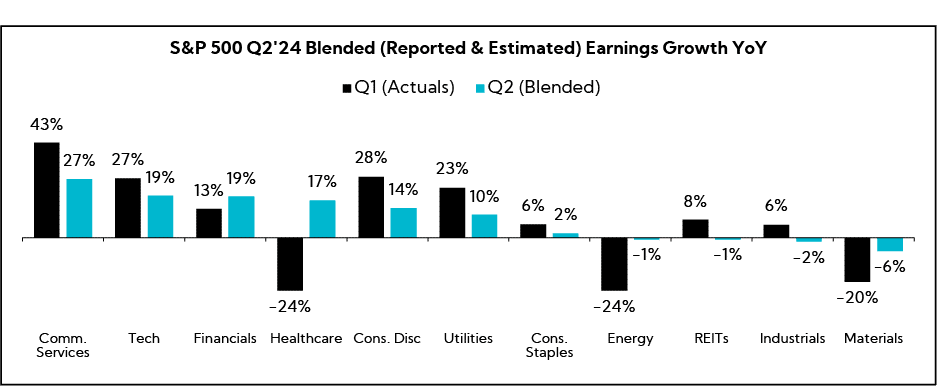

Q2’24 EPS Performance

- 79% have reported a positive EPS surprise, above the 1-year average (78%) and the 5-year average (77%)

- Blended earnings growth (combines actual reported results for companies and estimated results for companies yet to report) is 12.9%; this compares to last quarter’s 10.4%

- Companies are reporting earnings 3.6% above consensus estimates, below the 1-year average (+6.5%) and the 5-year average (+8.6%)

The Sector Beat: Consumer Discretionary

Guidance Trends

Each quarter, we analyze annual revenue and EPS guidance provided by Consumer Discretionary companies with market caps greater than $1B that have reported to date.1 Below are our findings.

For comparison purposes, we provide an “All-Company” benchmark, which tracks in real-time a basket of companies larger than $1B in market cap across all sectors that have reported earnings to date (n = 325).

Guidance Breakdown by Industry

| Industry | Number of Companies |

|---|---|

| Auto Components | 10 |

| Textiles, Apparel & Luxury Goods | 5 |

| Diversified Consumer Services | 5 |

| Hotels, Restaurants & Leisure | 4 |

| Household Durables | 4 |

| Distributors | 3 |

| Leisure Products | 3 |

| Specialty Retail | 2 |

| Automobiles | 1 |

| Broadline Retail | 1 |

| Total | 40 |

Source: Corbin Advisors

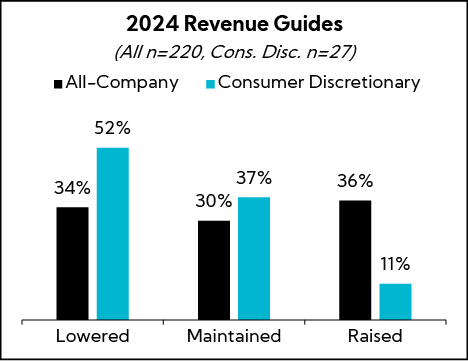

Revenue Guidance

More Consumer Discretionary companies are lowering annual revenue guidance figures than the all-company average, with far fewer raising, in general. Of note, the majority of those lowering guidance came from auto-exposed companies.

- Companies that lowered guidance (n = 14)

- 92% lowered the bottom and top of the original range

- 11% lowered the top, but raised the bottom of the original range (i.e., tightened)

- Average midpoint of -2.8% growth YoY versus 2.3% last quarter

- Average spread decreased by 50 bps to 2.5%

- Companies that maintained guidance (n = 10)

- Average midpoint of 2.8% growth

- Average spread of 3%

- Companies that raised guidance (n = 3)

- 67% raised the bottom and top of the original range

- 33% lowered the top, but raised the bottom of the original range (i.e., tightened)

- Average midpoint of 7.5% growth versus 6.6% last quarter

- Average spread decreased by 60 bps to 2.6%

- Overall midpoints assume 0.4% annual growth vs. 2.3% analyst estimates, on average

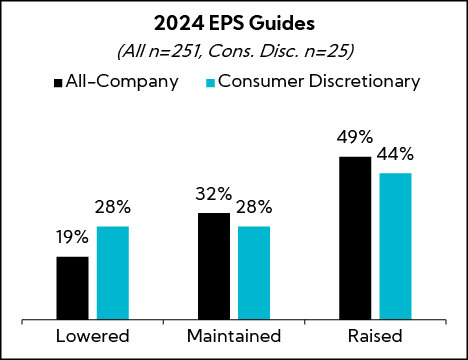

EPS Guidance

More Consumer Discretionary companies are raising annual EPS guides than maintaining or lowering, though 9% more are lowering versus the benchmark.

- Companies that raised guidance (n = 11)

- 82% raised the bottom and top of the original range

- 9% raised the bottom but maintained the top of the original range

- 9% raised the bottom but lowered the top of the original range (i.e. tightened)

- Average spread decreased from $0.51 to $0.47

- Companies that maintained guidance (n = 7)

- Average spread of $0.15

- Companies that lowered guidance (n = 7)

- 100% lowered the bottom and top of the original range

- Average spread decreased from $0.68 to $0.30

Earnings Call Analysis

We analyzed the earnings calls for this group and the broader Consumer Discretionary universe to identify key themes.

Executive mentions of consumer softness and a cautious discretionary spending environment remain prevalent this earnings season, a continuation of the trend exhibited last quarter.

Pricing pressures and competitive dynamics are intensifying, with demand patterns throughout Q2 remaining mixed across the sector. While travel, especially cruise lines, continues to show strong momentum as consumers prioritize travel and experiences over discretionary goods, some companies are noting a “broadening” of pressures extending to higher-income groups. They point to consumers becoming more vigilant about their spending choices amid inflation and higher interest rates. To that end, Europe and China were notable sore spots for many this quarter, and more Consumer Discretionary companies have lowered guidance than the all-company benchmarks.

Indeed, the sector’s performance relative to expectations has been lackluster. Despite reporting solid aggregate YoY growth figures for both revenue and earnings on an absolute basis (+4.8% and +13.6%, respectively), on a relative basis the S&P 500 Consumer Discretionary sector has the highest proportion of earnings results falling below consensus estimates (27%). It is also one of the few sectors, alongside Consumer Staples, Materials, and Utilities, where the majority of companies are reporting revenue figures below expectations.

While top-line dynamics are challenged, many companies are highlighting the positive impacts from productivity enhancements, moderating inflation, and reduced inventory expenses as favorable factors that resulted in EPS guidance raises. Additionally, although many executives anticipate weaker performance to persist through the second half of the year, there is also some optimism that potential Federal Reserve rate cuts beginning in September could provide relief for consumers (even before today’s market sell-off).

Market Reaction

Having come into earnings season already a big YTD laggard, the latest earnings performances for the S&P 500 Consumer Discretionary sector have failed to give the sector a lift. Indeed, the sector took another downturn on Friday after disappointing earnings results from Amazon (which accounts for approximately 20% of the sector’s weighting) where executives noted that “consumers are being careful with their spend, trading down, and looking for lower average selling price products.” Consumer Discretionary is now the only sector in the index to be negative on the year2.

Key Earnings Call Themes

Macro Headwinds Persist as Execs Note a Discerning Consumer; 2H Expected to Mirror 1H with Slight Optimism for Interest Rate Relief in September

- McDonalds ($190.3B, Restaurants): “Beginning last year we warned of a more discriminating consumer, particularly among lower income households, and as this year progressed those pressures have deepened and broadened. The quick-service restaurant sector has meaningfully slowed in the majority of our markets, and industry traffic has declined in major markets like the U.S., Australia, Canada, and Germany.”

- Carters ($2.2B, Apparel Retail): “Our consolidated sales have been under pressure since inflation ramped up to historic levels in 2022, because we believe that those we serve, families raising young children, have been under financial pressure and have reduced their discretionary spending where possible. Carter’s is working its way through a historic and challenging inflationary period.”

- Sketchers ($9.9B, Footwear Accessories): “Despite navigating headwinds from the supply-chain, regulatory obstacles in India, and a lackluster 618 holiday in China, we are encouraged by the continued positive response to our Comfort Technologies from consumers. We have improved visibility into the second half of the year and are adjusting up our full year guidance as a result. While the macro environment remains challenging with pressures on discretionary spending, Skechers’ commitment to delivering high-quality products at reasonable prices is resonating with consumers.”

- Whirlpool ($5.5B, Furnishings, Fixtures & Appliances): “[In North America] we’ve seen the downturn of consumer discretionary demand intensify since 2022, and existing home sales hit multi-decade lows in 2023 and 2024. With interest rate reductions, this will ease at some point, and we are well positioned to benefit from improving demand.”

- Brunswick ($5.4B, Recreational Vehicles): “On the external environment, with the majority of the retail selling season behind us, it is evident that the 2024 U.S. marine retail market is underperforming versus our initial expectations due to the continuing high interest rate environment. And while there is now a higher probability of interest rate relief beginning in September, this will be after the main selling season and will likely have a minor impact on 2024 and be more of a potential tailwind for 2025. Dealer sentiment is sequentially improving. However, the slower pacing of wholesale orders continues as the weaker retail environment drives a desire for more conservative inventory levels.”

- Columbia Sportswear ($4.8B, Apparel Manufacturing): “Looking across the global marketplace, there are many external risks and uncertainties; outdoor industry and U.S. consumer headwinds, geopolitical conflicts, supply chain disruptions, and upcoming elections in many of our major markets. These factors, among others, have the potential to impact consumer demand and our operations. We continue to monitor disruptions in the Red Sea. At this time, delays appear manageable, and the vast majority of our product line is expected to be delivered on time and in full.”

- Newell Brands ($3.5B, Household & Personal Products): “When we started this year, we knew that we were heading into a macro backdrop where we were expecting our categories to be down LSD, as consumers remain under pressure from the cumulative impact of inflation over the last several years. And that outlook in terms of category growth has not changed. It’s effectively what we’ve seen in the first half of the year and what we’re assuming in the back half of the year. And so far we haven’t seen anything to adjust that fundamental macro backdrop.”

- Crocs ($7.7B, Footwear & Accessories): “In terms of the back half, we are cautious. We definitely see the U.S. consumer behaving cautiously. We think our brand is well positioned relative to a cautious consumer environment. We excel at exceptional value. We give the consumer exceptional value, but we are planning the back half of North America from a Crocs revenue perspective, approximately flat.”

Interest Rates, Inflation, and Overall Consumer Caution Continue to Pressure Discretionary Spending

- LKQ ($10.7B, Auto Parts): “As we continued to see a reduction in repairable claims during Q2, we dug deeper into the market to further understand the drivers of this sequential decrease. While weather was a contributing factor to the reduction in Q1’s repairable claims, we further researched the impact of rising insurance costs and declining used car values on the consumer’s decision to repair their vehicle. We found the combination of these economic factors, rising insurance premiums and repair costs relative to the declining used car prices, had the largest aggregate effect.”

- Whirlpool ($5.5B, Furnishings, Fixtures & Appliances):“Our product mix in North America is impacted by low consumer sentiment and suppressed existing home sales. On the one hand, the replacement market is very strong, driven by higher appliance usage, and you’re also now comping against good baseline numbers. On the other side of that, the discretionary demand is the really weak side, even weaker than you would see right now on the overall industry numbers, quite a bit weaker.”

- Mohawk Industries ($9.9B, Furnishings, Fixtures & Appliances): “Our Q2 results exceeded our expectations despite soft market conditions around the globe… While the long-term demand for our products is strong, residential purchases across our geographies remains weak. Residential remodeling is under the greatest pressure as consumers defer large discretionary purchases due to inflation and uncertainties about the future.”

- Genuine Parts Company ($20.3B, Auto Parts): “Our Q2 results were below our expectations. The variance can be attributed to three key themes; weaker than anticipated customer demand in Industrial, accelerated softness in Europe, and choppy demand in the automotive aftermarket in the U.S. Many factors outside of our control, including higher interest rates, geopolitical uncertainty, and persistent inflation, are driving overall weaker customer demand.”

- Polaris ($4.5B, Recreational Vehicles): “We’ve seen consumer confidence weaken, especially for larger discretionary purchases and, as a result, the industry is seeing a lower retail. Additionally, dealers are conservatively managing their inventory due to the higher flooring costs, driven by higher interest rates and are reducing orders accordingly. As we said at the start of the year, dealer inventory was our anchor and, if we saw softer retail than we expected, we would adjust shipments accordingly to help protect dealers. We started that process in Q2 and have now adjusted our full year shipment outlook.”

- AutoNation ($7.4B, Auto & Truck Dealerships): “Used car demand remained relatively strong, certainly through the quarter, although demand by price point changed, the move into lower priced brands, but total demand volume is healthy. Our pace of used car inventory sourcing slowed significantly in the second half of June, now improving, and I expect it to return to normal levels of used car inventory in the second half of August.”

- ADT ($6.4B, Security and Protection Services): “We generated 212,000 gross new customer additions. This was down somewhat from the prior year as we remain disciplined with expenditures in the current environment. While fewer relocations generally lead to less consumer demand for new systems, they also provide some tailwind for customer retention. Our overall attrition was 12.9%, approximately flat, reflecting this benefit and our continued commitment to delivering superior service and some offsetting challenges driven by somewhat higher payment delinquencies and related cancellations.”

- eBay ($28.7B, Internet Retail): “The environment we’re in continues to be very uneven and dynamic, and we’re also seeing some specific one-off impacts as we think about this quarter with elevated YoY demand for summer travel, some one-off sort of global sports events which are making the month to month trends a little bit uneven. Specifically talking about the sort of international dynamics that we’re seeing, we continue to see a very uneven and dynamic environment particularly in Europe as discretionary spend is pressured.”

Softness Largely Reported with Some Broadening to Higher Income Groups; Still, Travel and Hospitality Industries Continue to Maintain Momentum, while Restaurant Performances Vary

- Carters ($2.2B, Apparel Retail): “Over the past two years, we saw a 6-to-7-point difference in our comparable store sales based on household incomes. Our stores, located in markets with annual household incomes over $100,000, comped meaningfully better than markets with household incomes of $70,000 or less. That 6-to-7-point spread narrowed to 2 points in Q2 of this year.”

- Tractor Supply ($27.7B, Specialty Retail): “Overall, the macroeconomic indicators that we all follow continue to be rather mixed for the consumer in Q2. While in line with our expectations at the beginning of the year, the health of the consumer is modestly more cautious than last quarter, but certainly still within the range of our forecast at the beginning of the year. Consumer spending on goods appears to be fatigued across income cohorts. While we’re seeing improvement in the consumer inflation rate, unemployment has ticked upwards to the highest rate since late 2021. Additionally, consumer sentiment and consumer confidence are both subdued and the consumer spending landscape continues to be rather choppy.”

- O’Reilly Automotive ($65.9B, Specialty Retail): “We still view the average consumer as relatively healthy with strong employment and wage rates underpinning the ability of our customers to invest in the repair and maintenance of their vehicles. However, we also believe we’re seeing some level of conservatism in how consumers are managing their spend as they face the cumulative impact of elevated price levels and uncertainty about the broader macroeconomic conditions.”

- Royal Caribbean ($39.4B, Travel Services): “Q2 exceeded our already elevated expectations. We have seen an incredibly robust booking and pricing environment across all our key itineraries, which is not only setting us up for success in the future periods, but also contributed to the outperformance in Q2. The strong demand environment is also translating into higher revenue and earnings expectations for the balance of the year.”

- Norwegian Cruise Line ($7.7B, Travel Services): “We are seeing absolutely zero decrease in onboard spend, no cracks, no deterioration. If anything, it continues to be strong and more long-term, I think there are fundamental things that work in our favor that make our business quite a bit more resilient than the hotel [business] on the ancillary/onboard spend category.”

- Marriott ($62.7B, Lodging): “[In the] U.S. and Canada, and frankly all other regions, ancillary spend was a hair softer than we anticipated. And I think it does show that the consumer in general is perhaps being a bit more judicious about the fancy dinner or going on the extra trip when they’re on a vacation, and that is really the only thing. It’s not trade-down in any meaningful way.”

- McDonalds ($190.3B, Restaurants): “We expect customers will continue to feel the pinch of the economy and a higher cost of living for at least the next several quarters in this very competitive landscape. What you’re seeing with the low-income consumer is in many cases they’re dropping out of the market, eating at home and finding other ways to economize. Our business performance reflects industry-wide challenges and the current context, one where customers are making thoughtful choices about when and where they eat.”

- Texas Roadhouse ($11.4B, Restaurants): “There has been significant discussion within the restaurant industry concerning the health of the consumer as well as the increased focus on promotions and discounting from others in the industry. Through the first half of the year, we have not seen a measurable impact on our overall business from these issues. Our guests do not appear to be changing their dining habits.”

- Chipotle ($73.4B, Restaurants): “The good news is we are seeing transaction growth from every income cohort which I think speaks to the strength of our brand and our value proposition. On California, we’ve seen a step-down in the industry. We’ve seen reports that there really has been a pullback in spending. We’ve seen it as well. There’s a macro impact of less spending in the restaurant. We raised prices by 100 bps, and we normally don’t see much resistance. [Instead], we saw a pullback that equaled the effect of menu price increase that we took, and it looks like that’s about equal to what the pullback in the industry is.”

More Tailwinds than Headwinds; Companies Highlight “Healthy” Levels, Reflecting Conservative Approach to Keep Inventory Fresh

- Mattel ($6.6B, Leisure): “Regarding our retailers and inventory levels, we think we’re in a very good position. We work very closely with our retail partners to make sure we’ve got the right level of inventory to satisfy consumer demand as we enter the back half and the holiday season. We’ve had good success in reducing owned inventory levels. Importantly, the inventory levels are high quality and well-positioned heading into the second half of the year.”

- Hasbro ($9.0B, Leisure): “Q2 was another good quarter. We saw strength in Gaming and digital licensing and landed where we expected within Consumer Products, while increasing operating margin and maintaining healthy inventory.”

- Brunswick ($5.4B, Recreational Vehicles): “As a result of heightened demand stimulation efforts focused on clearing more aged field inventory, our remaining field inventory is very fresh, with approximately 85% of units being current. We’re approaching the year-end with a conservative view on inventory. And when I say conservative, I mean, we’re at the low end of what we think is going to be necessary for 2025.”

- eBay ($28.7B, Internet Retail): “We’re seeing a really healthy level of inventory.”

- Columbia Sportswear ($4.8B, Apparel Manufacturing): “Inventory exiting the quarter was down 29% YoY, reflecting substantial progress in our inventory reduction efforts. The profit improvement program is on track to deliver between $75M and $90M in cost savings this year. We’re reducing expenses associated with carrying excess inventory and driving cost reductions in focused areas of the business.”

- O’Reilly Automotive ($65.9B, Specialty Retail): “Inventory per store finished the quarter at $767,000 which was up just under 1% from this time last year and 1.4% from the end of 2023. We continue to be pleased with the health of our supply chain and our store in-stock position remains strong. We plan to opportunistically add inventory in the back half of the year.”

Past Initiatives, Productivity Enhancements, and Moderating Inflation Helping Margins; Wages and Recently Higher Freight Rates Flagged as Near-term Headwinds

- Texas Roadhouse ($11.4B, Restaurants): “On the topic of inflation, we benefited in Q2 from lower commodity costs than we had forecasted. With regard to labor in Q2, wage and other inflation came in as expected. We believe the benefit of fully staffed restaurants with longer tenured Roadies should result in continued labor efficiency improvement through at least the end of this year… The bottom line for the rest of this year is a fantastic first half on margin and definite expectations for margin expansion YoY for the second half.”

- Chipotle ($73.4B, Restaurants):“For the quarter, restaurant-level margin was 28.9%, an increase of 140 bps YoY. We expect our margins will be under pressure for the next couple of quarters. Most, if not all, of this pressure is seasonal, temporary, or it’s an investment that we can offset through efficiencies, and we believe our industry-leading margin structure is still intact.”

- Starbucks ($84.1B, Restaurants): “Looking beyond our stores, we continue to realize new efficiencies, cost savings, and performance improvements across our end-to-end supply chain thanks to strong support from our suppliers and we see even more headroom. We are ahead of plan on productivity.”

- Whirlpool ($5.5B, Furnishings, Fixtures & Appliances): “[Regarding margins] we had a huge negative carryover from the promotional pricing in the first half. We corrected that with our actions in late April, which may become visible in June. And that explains the vast majority of improvement in the second half versus first half.”

- Sketchers ($9.9B, Footwear Accessories): “Although we are watching freight rates, we’ll have to keep in mind that as we progress throughout the year, there’s been some rate impact, obviously, from the Red Sea crisis. We have to balance that with the contractual rates we’re achieving, and we’ll monitor that. When you put all that into the model, ultimately, it would tell you that we don’t expect as much lift over the back-half of the year as we saw over the front half of the year, though that is consistent with what we had previously mentioned.”

- Mattel ($6.6B, Leisure): “Adjusted gross margin increased 430 bps to 49.2%. The improvement was driven by several factors. The Optimizing for Profitable Growth program added 120 bps as we continue to generate cost savings. Cost deflation, primarily driven by lower ocean freight, contributed 110 bps. Lower sales adjustments added 60 bps. Lower inventory management costs, primarily obsolescence and closeouts, added 40 bps, and other factors added 100 bps.”

- Columbia Sportswear ($4.8, Apparel Manufacturing): “We’ve also seen a spike in spot pricing for ocean freight in recent months. We utilize contracted pricing for the bulk of our ocean freight, which minimizes our exposure to spot pricing. With that said, we have noted an increase in peak season surcharges and our guidance incorporates our best estimate of the impact of these supply chain risks for the balance of the year.”

China Market Remains Challenging, with Execs Calling Out a Weak Consumer and “Intensified” Competition; Europe Characterized by a More Cautious Consumer, with “Broadening” of Discretionary Demand Softness

- Sketchers ($9.9B, Footwear Accessories): “In China, economic challenges weakened consumer demand across multiple industries, especially over the 618-holiday period… We believe China’s economic recovery will remain challenged in the near term, but we are confident in the long-term opportunity.”

- Starbucks ($84.1B, Restaurants): “China is one of our most notable international challenges. The competitive market dynamics in China are reflected in our recent results. We’ve continued to face a more cautious consumer spending and intensified competition. In the past year, unprecedented store expansion and a mass segment price war at the expense of comp and profitability have also caused significant disruptions to the operating environment.”

- Genuine Parts Company ($20.3B, Auto Parts): “We’ve seen a broadening in the moderation in demand across our geographies in Europe through the quarter. We believe this is driven by an incrementally more cautious consumer.”

- Starbucks ($84.1B, Restaurants): “In some European markets consumers are stretched.”

- LKQ ($10.7B, Auto Parts): “There were several factors behind the negative trend [in Europe], with economic conditions being the most significant component. Modest economic growth and high inflation across many of our markets, including the UK and Germany, have impacted demand, contributing to a YoY decline in overall volume.”

In Closing

The shift toward a more cautious tone among executives, first noted last quarter, has become even more pronounced in Q2 as Consumer Discretionary companies face fluctuating consumer buying habits. Guidance across the sector has been lowered at greater propensities than the rest of the S&P 500, and executives are largely reporting an increasingly discerning consumer, regardless of income level. While summer travel appears to be buoying some areas of the market, particularly in sectors related to leisure and experiences, there is a widespread acknowledgment of the challenges ahead. Years of inflation and high interest rates continue to weigh heavily on consumer sentiment, and many are adopting a more cautious outlook across the board with headwinds forecasted to last well into, if not through, the second half of the year.

We will continue to monitor these trends and more as we seek to support you, our valued clients, as we work through the quarter and the rest of the year.

- As of August 1, 2024

- As of midday Friday, August 2, 2024