This Week in Earnings – Q2’24

The Sector Beat: Materials

With earnings season nearly complete, the Corbin team wants to express our gratitude to each client that continues to place trust in us as we navigate more volatile times and, with that, more uncertain investors.

Amidst this week’s market volatility, we observed an increase in sell side questions about a potential recession within the Q&A portion of earnings calls. We expect these questions to become more prevalent in discussions with analysts and investors in the coming weeks during remaining earnings calls, sell side conferences, and investor meetings.

Questions primarily centered around several key areas, including:

- Consumer demand and behavior, including preference shifts, trade-down activity, and any changes in demand elasticity across different product categories in response to economic pressures

- Industry and sector impacts, such as pinpointing where companies sit in the cycle and the ability of different areas of the economy to withstand economic turbulence

- Financial implications and preparedness (i.e., the “Downturn Playbook”), such as the potential impact of a recession on asset values, balance sheet preparedness and liquidity, and cost-cutting measures / efficiency initiatives to mitigate

- Strategic positioning and long-term planning, with analysts acutely focused on any shifts in investment and growth plans, as well as geographical priorities and trends

In today’s thought leadership, we cover:

- Key Events this week

- Earnings Snap, covering the S&P 500 stats to date

- Spotlight on Materials in The Sector Beat

Key Events

Employment

- Weekly jobless claims came to a seasonally adjusted 233,000, a decline of 17,000 from the previous week’s upwardly revised level and lower than the estimate for 240,000. While the top-line number helped allay some fears, the level of continuing claims, which run a week behind, edged up to 1.875 million, the highest since Nov. 27, 2021. (Source: Labor Department)

U.S. Treasury Yields

- U.S. Treasury yields rose Thursday as Wall Street assessed weekly jobless claims data that came in below expectations, easing concern from July’s payroll report last week that the labor market was weakening. The yield on the 10-year Treasury was around 4 bps at 4.004%. The yield on the benchmark is near its highest level since last Thursday, the day before July’s disappointing jobs report sent yields diving. (Source: CNBC)

Debt

- Total U.S. household debt levels edged up in Q2 but overall delinquency rates stabilized, indicating that borrowers are still in decent enough shape to support the economy. Overall debt levels rose by $109B, or 0.6%, in Q2 to $17.80T. Overall borrowing levels are now $3.7T above where they were at the end of 2019, before the onset of the coronavirus pandemic. (Source: Federal Reserve Bank)

Global Economies

- A week after Japan’s top central banker shook up global markets with comments about raising interest rates, one of his deputies walked them back Wednesday and promised not to raise rates when markets are unstable. The pledge by Bank of Japan Deputy Gov. Shinichi Uchida led to a sharp recovery in Tokyo stock prices and a fall in the yen. That moved markets closer to where they were before the July 31 news conference by Gov. Kazuo Ueda, in which he suggested he wanted to keep raising rates despite lackluster consumer spending in Japan. (Source: WSJ)

- India’s central bank left its policy rate unchanged in an attempt to rein in relatively high inflation driven partly by elevated food prices. Reserve Bank of India Gov. Shaktikanta Das said Thursday that the monetary-policy committee decided to maintain its policy repo rate at 6.50%. (Source: WSJ)

U.S. Politics

- Vice President Kamala Harris has picked Minnesota Gov. Tim Walz as her running mate. Their debut came at a raucous evening rally where Harris stressed the Midwesterner’s record of supporting policies popular with the Democratic base and organized labor. Harris hopes Walz will serve as a partner who can help win over working-class voters in the northern battleground states. (Source: WSJ)

S&P 500 Earnings Snap

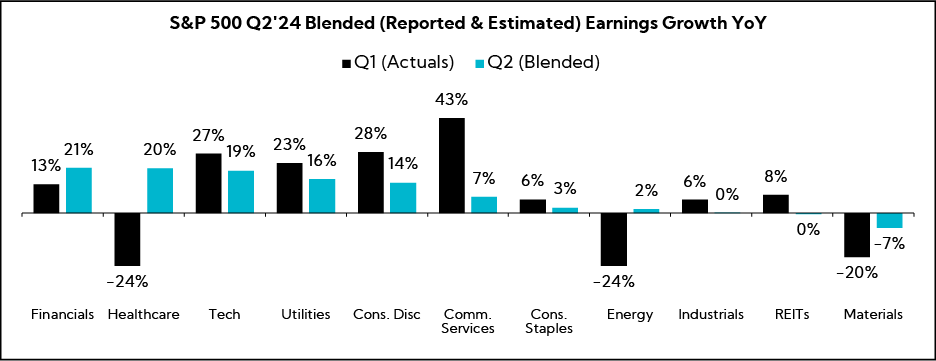

91% of the S&P 500 has reported earnings to date

Q2'24 Revenue Performance

- 59% have reported a positive revenue surprise, below the 1-year average (63%) and the 5-year average (69%)

- Blended revenue growth (combines actual reported results for companies and estimated results for companies yet to report) is 5.3%; this compares to last quarter’s 4.5%

- Companies are reporting revenue 1.1% above consensus estimates, in line with the 1-year average (+1.1%) but below the 5-year average (+2.0%)

Q2’24 EPS Performance

- 78% have reported a positive EPS surprise, in line with the 1-year average (78%) and slightly above the 5-year average (77%)

- Blended earnings growth (combines actual reported results for companies and estimated results for companies yet to report) is 12.4%; this compares to last quarter’s 10.4%

- Companies are reporting earnings 4.5% above consensus estimates, below the 1-year average (+6.5%) and the 5-year average (+8.6%)

The Sector Beat: Materials

Guidance Trends

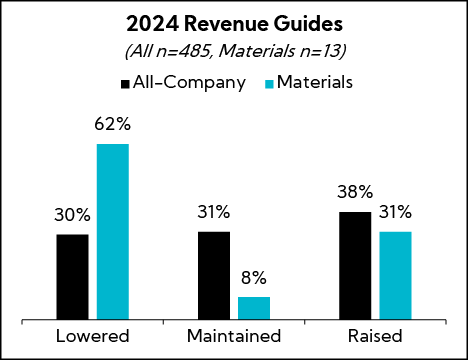

Each quarter, we analyze annual revenue and EPS guidance provided by Materials companies with market caps greater than $1B that have reported to date.1 Below are our findings.

For comparison purposes, we provide an “All-Company” benchmark, which tracks in real-time a basket of companies larger than $1B in market cap across all sectors that have reported earnings to date (n = 688).

Guidance Breakdown by Industry

| Industry | Number of Companies |

|---|---|

| Chemicals | 18 |

| Containers & Packaging | 9 |

| Construction Materials | 2 |

| Metals & Mining | 2 |

| Total | 31 |

Source: Corbin Advisors

Revenue Guidance

More Materials companies are lowering annual revenue guidance figures than the all-company average. Of note, the majority of those lowering guidance came from chemical companies, which also represent the largest contingent within the sector to provide guidance thus far.

Materials Guidance

- Companies that lowered guidance (n = 8)

- 88% lowered the bottom and top of the original range

- 12% lowered the top, but raised the bottom of the original range (i.e., tightened)

- Average midpoint of -6.3% growth YoY versus 1.4% last quarter

- Average spread decreased by 110 bps to 4.2%

- Only one company (Sealed Air) maintained guidance

- Companies that raised guidance (n = 4)

- 75% raised the bottom and top of the original range

- 25% raised the top, but maintained the bottom of the original range (i.e., widened)

- Average midpoint of 1.1% growth versus -0.4% last quarter

- Average spread increased by 10 bps to 3.2%

- Overall midpoints assume 1.1% annual growth, in line with analyst estimates, on average

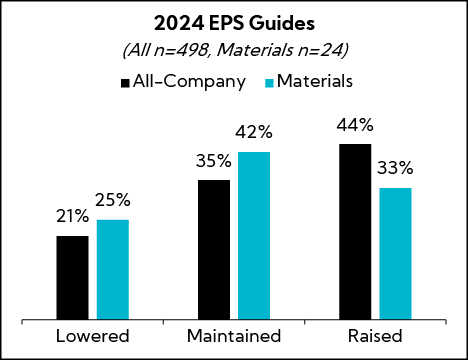

EPS Guidance

More Materials companies are maintaining annual EPS guides than raising or lowering, though 11% fewer are raising versus the benchmark.

Materials Guidance

- Companies that lowered guidance (n = 6)

- 83% lowered the bottom and top of the original range

- 17% lowered the top, but maintained the bottom of the original range (i.e., tightened)

- Average spread decreased from $0.49 to $0.29

- Companies that maintained guidance (n = 10)

- Average spread of $0.23

- Companies that raised guidance (n = 8)

- 75% raised the bottom and top of the original range

- 25% raised the bottom but maintained the top of the original range

- Average spread decreased from $0.34 to $0.19

Earnings Call Analysis

We analyzed the earnings calls for this group and the broader Materials sector universe to identify key themes.

In last quarter’s Materials Sector Beat, we reported that executive commentary reflected an industry still in flux, with varied outlooks across end markets but showing more signs of optimism for demand to normalize as the year progressed. In that regard, this quarter has “played out as expected” with destocking in the rearview and volumes getting a near-term boost from pockets of restocking. At the same time, some end markets remain challenged, and outlooks are tempered by a softening economic backdrop and persistent macro headwinds, including inflation, higher rates, election uncertainty, and ongoing geopolitical tensions.

As with last quarter, demand trends are mixed and vary across end markets. Indeed, while areas of restocking have recently been supportive of volumes, overall commentary reflects a demand environment that continues to be characterized as bottoming/stabilizing rather than accelerating, with many expecting these conditions to persist through the rest of the year. As such, the proportion of Materials companies lowering top-line guides is more than double the all-company benchmark.

Rather than counting on resurgent volumes, executives are squarely focused on controlling what they can control, highlighting expense management and productivity initiatives — and, in some cases, headcount reduction — that are starting to bear fruit and drive margin expansion. Meanwhile, commentary is more mixed around pricing and input costs; while some point to moderating inflation and improving pricing, others highlight pricing pressures (particularly in China and in end markets impacted by an increasingly price-conscious consumer) as well as idiosyncratic raw material challenges.

Finally, with elevated U.S. election (and policy) uncertainty, trade tensions and the impact from tariffs and anti-dumping measures remained top of mind, garnering further attention during analyst Q&A. Executives note that whoever wins in November, the expectation is for a heightened tariff enforcement environment, and executives are refreshing their playbooks accordingly.

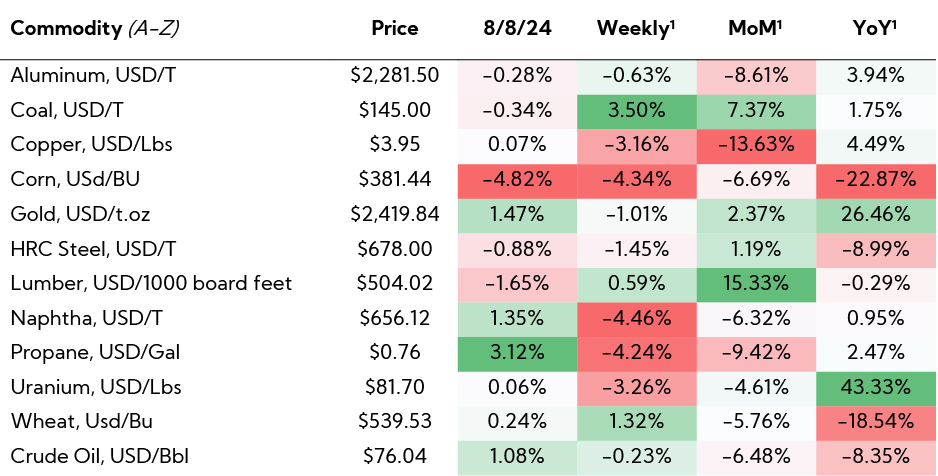

Market Reaction

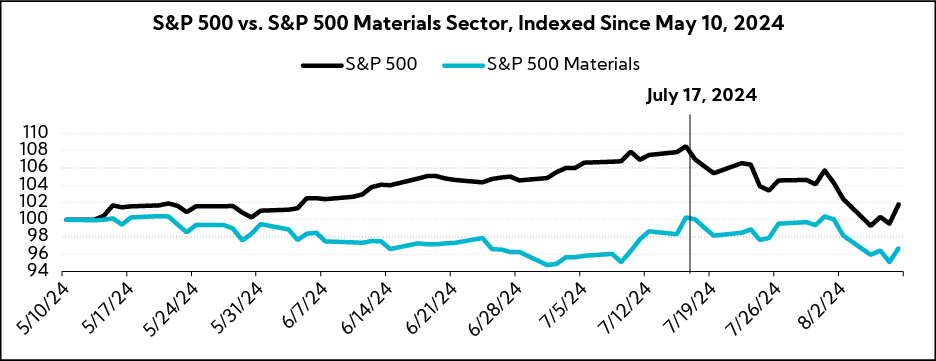

As of Thursday, the S&P 500 Materials sector was the worst performing group within the benchmark for the week, down roughly 1.5%. Furthermore, the sector is among the worst YTD performers for the index, up less than 4% and surpassing only Real Estate and Consumer Discretionary sectors.

Coming into the quarter, the Materials sector lagged the S&P 500 by ~7% since our last coverage on May 10th, though the sector has closed the gap somewhat of late amid recent market volatility. Since July 17th, the day the first S&P 500 Materials company, Steel Dynamics, reported earnings, the Materials sector is down roughly 3.5% versus 5% for the broader index.

Key Earnings Call Themes

Sector Challenges Have “Played Out as Expected”, though Execs are “Keeping a Close Eye” on Persistent Macro Headwinds; While Demand is Seen as Having Bottomed/Stabilized, Lack of Acceleration Has Prompted Lowered Revenue Guides for Some, but Interest Rate Relief Expected to be a Tailwind into 2025

- Dow ($37.3B, Chemicals): “In the near term, we expect macro dynamics to remain largely unchanged. While global manufacturing PMI has been positive since February 2024, the pace of the global economic recovery has decelerated slightly. This is primarily led by China where economic growth in Q2 was lower than the market expected. Overall, we continue to keep a close eye on the weight of inflation on the U.S. consumer, global interest rates, and geopolitical tensions.”

- Linde ($213.3B, Specialty Chemicals): “Last quarter, we described potential challenges in the industrial macro and for the most part it has played out as expected. That said, the current quarter experienced a 3% sequential volume growth. And while some of this relates to seasonality, certain regions had organic volume improvements. While this is a positive sign, we’re still not assuming any meaningful economic recovery in the guidance. Some may view this as overly cautious. But given the uncertain environment, I believe, it’s prudent to take this approach.”

- Nucor ($35.7B, Steel): “Taking a step back to reflect on the broader macro picture, while the U.S. economy appears to continue to avert a more pronounced downturn, it’s becoming more evident that activity has softened as the year has progressed. We’ve also seen an increase in imports YoY and a higher-for-longer interest rate environment may have tempered or delayed some marginal demand. The confluence of these factors is driving margin pressure on several of our products in the near term.”

- Eastman Chemical ($11.1B, Specialty Chemicals): “We went out at the beginning of the year with a very neutral approach about end markets being similar to last year but benefiting from destocking. That seems to be playing out as we expected at this stage. If the economy gets better, that’ll be upside. If the economy gets worse, there’ll be some risk within the range that we’ve given you.”

- Kaiser Aluminum ($1.1B, Aluminum): “While demand has remained relatively stable and strong prices have largely held throughout the first half of the year, we are anticipating typical seasonality in the second half of the year, which is expected to be a slight headwind to demand in subsequent shipments. Further, we continue to forecast modest price compression in our outlook.”

- RPM International ($14.9B, Specialty Chemicals): “We don’t see things deteriorating further. I think there’s been a rolling recession, notwithstanding all the headlines of the manufacturing sector. Anything that touched housing, you can see it. And that’s been accretive to our supply chain supplier base, so they’ve had a challenging year. I can’t speak to services or tech, but if you’re in manufacturing, the last 12 or 18 months have been challenging. We don’t see it getting worse.”

- Pactiv Evergreen ($1.8B, Packaging & Containers): “While we expect near-term end market weakness to persist through the remainder of the year, we remain optimistic about the actions we are taking to mitigate costs, drive operational improvements, and increase volumes during the second half of the year. We believe that the actions we have taken to build momentum in the second half of the year position us to achieve adjusted EBITDA within our new [lowered] full year guidance range.”

- Chemours ($2.7B, Specialty Chemicals): “Right now, what I would say is we see stable demand. Going into Q3, we believe we could sell similar sales as we did in Q3 of 2023. We definitely see the bottom is here. We have confidence with the potential for a Fed interest rate cut in September. And we think that’s going to bring some real confidence to consumers as we end the year.”

- PPG Industries ($27.6B, Specialty Chemicals): “There’s caution from our customers on affordability, interest rates, things that really drive some of the vehicle purchase behavior by consumers. You probably have your own prediction on interest rates, I have mine. But at some point, that should be a pressure that comes off of new car purchases. And I think our customers are just watching the same things very closely, inventories versus affordability and interest rates. But I do not see this as foreshadowing of a recession of any kind.”

Trends Through Q2 are Mixed and Vary by End Market, though Weakness is Noted for Many Across the Sector; Still, Most Assert Destocking has “Run Its Course”, With Chemicals and Packaging Companies Seeing Green Shoots for a Recovery

- Linde ($213.3B, Specialty Chemicals): “The S. market has been incredibly resilient. It surprised most people, but we are now seeing industrial activity being more sluggish. It is reflecting the softer demand growth that is there in the marketplace. A notable exception to that is hydrogen demand. That is a reflection of what’s happening in the chemicals and energy space.”

- Nucor ($35.7B, Steel): “There’s a lot of talk in the market that it’s softer and are we heading for a cliff. We don’t feel that way at all. Certainly, we’ve seen pricing move off historic highs of 2021, 2022, and even parts of 2023, but it’s moderated. We think we found some stability and this market has stabilized in most of our product groups from a demand picture. The back half of the year we expected to be relatively flat. From a demand picture, things are not too bad, and many of our products remain incredibly resilient.”

- Summit Materials ($6.7B, Building Materials): “Fortunately, when conditions cooperate, we are seeing activity pick up substantially. That is to say, we are cautiously optimistic that some or most of the lost volumes in markets like Houston can be recovered if we get a solid stretch of working days. In addition to weather, we are now reflecting an updated view on demand in geographies that are skewed towards commercial activity. If you recall, we had left open the possibility that with second-half rate relief, would come a second-half recovery in private end-market demand. While we think that situation is still on the table, we now think it’s more likely a 2025 scenario given a higher-for-longer interest rate environment and a notable lack of urgency to activate commercial jobs in some of our key markets like Salt Lake City and Phoenix.”

- Eagle Materials ($8.1B, Building Materials): “Regarding our demand outlook for our businesses, we see the cadence and timing of our business demand drivers vary, but we also see the outlook for each business continuing to skew to the upside.”

- Silgan ($5.3B, Packaging & Containers): “After several quarters of destocking trends for our food and beverage products, we are particularly encouraged that our customers’ order patterns appear to be returning to more normal levels, and as expected, have led to the positive inflection in our volume trends in Q2. As demand for our product continues to recouple with what had been a resilient end market demand, we expect this momentum to carry into the second half of the year.”

- Warrior Met Coal ($3.2B, Coking Coal): “From a market perspective, Q2 played out largely as we had expected, with softer demand and stronger supply from all regions, resulting in a weaker steelmaking coal price environment. We were hoping to see signs of improving demand towards the end of the quarter, which did not materialize.”

Destocking / Restocking

- DuPont ($32.4B, Specialty Chemicals): “As seen in our Q2 results, we are well into the recovery phase from last year’s inventory corrections in most key end markets and electronics may be setting up for a prolonged positive cycle.”

- Eastman Chemical ($11.1B, Specialty Chemicals): “The [consumer durables] market has been weak and continues to be weak. But we did see a significant amount of return in volume with the end of destocking. A huge amount of the hit that we took in 2023 was associated with the destocking. That volume has come back, and the very high margins that go with it, are certainly very helpful this year and will be going forward.”

- Westlake ($18.6B, Specialty Chemicals): “The destocking, we believe it is over. And more so is what the global economic conditions look like going forward. And with potential reduction in interest rate by the Fed should be a boost for the U.S. economy and global economy for the future quarters into next year.”

- Crown Holdings ($10.5B, Packaging & Containers): “[Regarding Europe], the destocking caught us and some others off-guard in Q4 and it was pretty sharp. So, we saw a little bit of that come back in Q1 and then Q2, especially early in the quarter. The fillers really came out of the gate hard in Q2 ahead of the summer tourism season and the Euro Cup. And it just feels like there’s a momentum here for whether it’s restocking or the preference for the fillers to use more and more aluminum to try to achieve a variety of sustainability goals.”

- Berry Global ($7.3B, Packaging & Containers): “The destocking has run its course in all meaningful categories for us. There’s certainly been some strengthening, but that is what we anticipated… [However], the actual demand overall has not greatly improved, and we don’t anticipate in the next month and a half that it’s going to dramatically change either. I do think there is reason to be optimistic that 2025 could see demand actually beginning to improve in some of these core non-discretionary consumer goods categories that make up a big piece of our business.”

Amid Largely Sluggish Volume Environment, Executives Point to Expense Management and Productivity Initiatives Coming to Fruition, Including Headcount Reductions for Some

- Nucor ($35.7B, Steel): “I’ll share a couple of other examples [of productivity enhancements] from a few of our operations. One is our mill in Memphis, Tennessee, where our team has embraced AI to optimize the production scheduling of a very complex steelmaking process. We’ve been able to reduce the man-hours committed to this process by about 80% through the use of AI. In addition to that, we also benefit from yield savings, reducing working capital, and operational efficiencies.”

- Ball ($19.2B, Packaging & Containers): “We continue to anticipate YoY earnings improvement during the second half of 2024, driven by improving operational efficiencies, lowering costs and effectively managing risk. We’re laser-focused on efficiency and operational excellence. We’re seeing those benefits. We’re running freight costs better. Our warehousing footprint is smaller. There are a lot of supply chain efficiencies that we’re benefiting from. You’ll see more of it as volumes grow.”

- DuPont ($32.4B, Specialty Chemicals): Our Q2 results were clearly encouraging. Volume recovery is a key driver of our improved Q2 financial performance. Additionally, our ongoing commitment to drive productivity and operational excellence, as well as continued savings from restructuring actions announced last November are contributing to top line growth, margin expansion, and cash flow improvement.”

- FMC ($7.6B, Agricultural Inputs): “Full year revenue and EBITDA guidance have been reduced to a slower demand recovery than we originally anticipated. To help mitigate the slower recovery in the second half, we have increased our cost saving targets and speed of execution. The lower guidance is more of a timing impact and is not a fundamental issue with the market or with FMC.”

- Materion ($2.3B, Other Industrial Metals & Mining): “We’re really proud of the work that the team has done in Electronic Materials to rightsize their cost structure while they’ve had some softer volumes. That’s given them a chance to really focus on operations and make sure that we’ve got the right organizational setup there. That really has helped prop up gross margins as we’ve moved through the downturn and now we’re starting to see things pick back up slightly.”

- Pactiv Evergreen ($1.8B, Packaging & Containers): “From an operating standpoint, and in response to a higher cost environment, we are focused on controlling what we can. Our commitment to positioning the business for more balanced and profitable growth is further emphasized by the actions we introduced today to reduce overhead cost through targeted headcount reductions and to curtail spending.”

- Reliance ($15.7B, Steel): “We’re continuously in each of our businesses looking at ways to become more efficient. We do have some of our businesses who recently have had to lay off some employees because their business volumes are down. That’s one of the ways that we manage our expenses, although, we do very much value our employees and the skills that they have. So, we try to retain them as long as we can. But sometimes, business conditions in certain markets require us to do some layoffs.”

Commentary is a Mixed Bag; While Some Highlight an Improving Pricing and Moderating Cost Environment, Others Face Competitive Pressures and Raw Material Challenges

- Knife River ($4.0B, Building Materials): “During Q2, we continue to see traction with price increases. YoY prices were up across all of our core product lines, with the exception of liquid asphalt, as we expected. We see pricing momentum in each geographic segment for aggregates and ready mix. So we are increasing our pricing assumptions for 2024 to HSD for those two product lines.”

- Linde ($213.3B, Specialty Chemicals): “Pricing continues to be robust in the Americas. We are seeing positive pricing, both in the U.S. as well as in our Latin American businesses. Both Americas and EMEA are tracking globally weighted CPI for their respective regions. In APAC, we’re finding pricing a little bit shorter at this point in time, and the push is to make sure we get that over the line. Obviously, China is in deflation, so that doesn’t help…On the industrials, merchant, and packaged, in particular, we are seeing positive pricing movement. It is, however, being offset by lower pricing on helium and rare gases, partly driven by lower demand from the electronics segment, and partly because we are seeing pressure of helium coming in from Russia into China, which has made China long on helium and has had an impact on pricing there. But beyond that, industrial pricing action continues to be strong, and I feel good about the momentum that the team has got over there.”

- Nucor ($35.7B, Steel): “We were challenged in the first half of this year by meaningfully higher levels of imports, which gained some market share and put pressure on pricing. This pressure on pricing has led our distribution customers to take a pretty cautious approach to purchasing as they try to right-size their inventories. All that said, we do see some bright spots as we think about the second half of the year. [Regarding costs], the most important thing for you to take note of is that input costs right now are moderating consistent with what you see with CPI or other indicators.”

- Ashland ($4.1B, Specialty Chemicals): “On pricing, we performed very well. Our margins are doing very well. We are market leaders here. We’re in a transition point. Just like when you have inflation, you have to move up prices, and it takes a while to work through. We’re now on the transition to the other end of the equation, and we’re managing through that.”

- Pactiv Evergreen ($1.8B, Packaging & Containers): “Pricing in Q2 generally reflected higher raw material cost pass-throughs compared to last year. As we’ve talked about on previous calls, we have reduced our raw material pass-through lag to reduce volatility in our earnings. Partially offsetting the higher raw material pass-throughs, pricing pressure was more acute during Q2. This dynamic was a result of our customers looking for ways to contain costs in light of increasing price competition across both segments, impacting several of our customer categories…We anticipate pricing to face increased pressure in the second half as our customers and end markets adjust to increased price sensitivity from consumers.”

- Berry Global ($7.3B, Packaging & Containers): “We have seen supply-side constraints around the world with areas that you will know in terms of transportation, getting through the Suez, and the Red Sea. We also have outages in North America that affected the markets to move price higher. So that just puts us a bit behind in terms of the timing of recovery of that, it’s not a long-term issue. When we look at the actual results of the business, our margins are better than we would have expected, and we see really strong momentum and performance on cost.”

- FMC ($7.6B, Agricultural Inputs): “In part, the stronger than initially planned volume growth was enabled by strategic pricing actions made during the quarter. The 10% price decline was mainly driven by three things: one, is competitive pressure, which is a normal market dynamic when demand starts to return; two, is a strategic intent to take back market positions in less differentiated products than we intentionally left to competitors by holding to a high price strategy when demand was low; and third, is one-time incentives to address high-cost inventory in the channel.”

- Summit Materials ($6.7B, Building Materials): “Our Q2 was characterized by strong pricing growth across lines of business with aggregates and cement up strongly in the period. This was offset, to varying degrees, by lower volumes. Fortunately, our 2024 profile is not volume-dependent, and as such, we remain confident in achieving our financial goals this year.”

Chinese “Dumping” Low-Cost Imports are Under the Microscope as Executives and Analysts Anticipate a Heightened Tariff Enforcement Environment

- Nucor ($35.7B, Steel): “Over the last 18 months, we’ve seen a material uptick in steel imported from Mexico and Canada to levels far above historic levels, contrary to the Section 232 agreements with both countries. It’s also clear that China and other countries have been evading the Section 232 tariffs and other duties by transshipping steel through our neighbors to the north and south…Fortunately, a few weeks ago, trade representatives from the US and Mexico announced an agreement designed to stop the flow of illegally imported steel from China and elsewhere. This was an important first step. However, more stringent efforts are needed. We also urge Congress to pass the Level the Playing Field Act 2.0…We appreciate the bipartisan support that exists for strong trade enforcement.”

- Warrior Met Coal ($3.2B, Coking Coal): “Other factors contributing to the weaker demand included Chinese steel exports at multi-year highs, and global steel prices declining for most of Q2, reflecting the softer steel demand across all regions. As a result, steelmaking coal prices extended the sharp decline that started in March. We saw two attempted price spikes during the second quarter that were short-lived as the market fundamentals were not supportive.”

- Cabot ($5.3B, Specialty Chemicals): “Around the world today in the West, there are [already] tariffs that are in place. For example, there are fairly significant tariffs today in the U.S. on Chinese tires. The elevated level of imports that we have seen is something that will likely create some back pressure in the form of more anti-dumping duties and pursuit of tariffs. We certainly could expect that to happen and to be implemented in some way.”

- Eastman Chemical ($11.1B, Specialty Chemicals): “I actually think tariffs are an issue no matter which person we have as a President. From a direct import point of view, our exposure on the Chinese side is not that great, which is a good thing. The bad thing is there are going to be reactions that you’re already seeing in Europe and the U.S.. And then, there will be response in China. We do expect that there’s some degree of tariff tension coming our way. China is about 10% of our revenue. We do have a playbook on how to manage through that that we developed in the 2018-2019 timeframe. That playbook was relatively effective. We’re updating it and being prepared if that scenario plays out.”

- Dow ($37.3B, Chemicals): “We’re doing scenario planning here to look at the impacts [of tariffs], and there are anti-dumping activities going on in different parts of the world because of challenges that we see from volumes being dropped into markets. And so there’s a lot of work going on behind the scene. We’ll get a clearer picture than that by the end of the year. But right now, I would say I haven’t seen any uptick in volumes or stocking because of that.”

In Closing

The Materials sector, a barometer for the broader economy, continues to reflect the complexities and challenges of the current economic landscape. While last quarter indicated a move towards slow but steady stabilization with hopes of a back-half recovery, commentary in Q2 earnings suggests many of the persistent challenges observed over the past few quarters have remained just that — persistent. This has led to downward pressure on top-line guides, particularly as companies grapple with ongoing inflation, interest rate headwinds, and demand that is not yet described as accelerating.

Still, as has been the case for many this quarter, the message coming out of the sector has been controlling what can be controlled, prioritizing expense management and productivity initiatives, and some “green shoots” are emerging in select areas.

Next week, we’ll be back with our Closing the Quarter piece to round out the Q2’24 reporting period.

- As of 8/8/24