Closing the Quarter – Q2’24

In today’s thought leadership, we cover:

- Key Events this week

- Closing the Quarter Summary — Q2’24 performance and outlook, notable inflections, guidance moves and consensus shifts, and capital allocation

Key Events

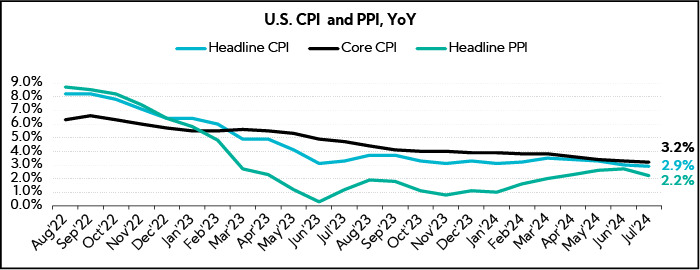

Inflation

- Inflation rose as expected in July, driven by higher housing-related costs. The Consumer-Price index, a broad-based measure of prices for goods and services, increased 0.2% for the month, putting the 12-month inflation rate at 2.9%, its lowest since March 2021. Excluding food and energy, the core CPI came in at a 0.2% monthly increase and a 3.2% annual rate, meeting expectations. (Source: Labor Department)

- July Producer Price Index (PPI) rose 0.1% MoM to 2.2% versus 0.2% expected, while core PPI was flat MoM against 0.2% forecast, the softest print since March. Import prices edged up 0.1% last month amid a modest rebound in the cost of energy products after being unchanged in June. In the 12 months through July, import prices increased 1.6% after rising 1.5% in June. The report strengthened expectations for a September interest rate cut from the Federal Reserve. (Source: Labor Department)

Retail Sales

- U.S. retail sales rose a seasonally adjusted 1% in July, a strong pickup from June when sales were revised down to a 0.2% decrease. In July, shoppers increased their spending in nearly every category, with strong spending at car dealerships, grocery stores, and on electronics. Economists had expected retail sales to rise just 0.3% in July. (Source: Commerce Department)

Labor

- Initial jobless claims, a proxy for layoffs, ticked lower to 227,000 for the week ending August 10, coming in below the estimated 235,000. This is the second week of declines for jobless claims, which has allayed some of the concerns from the weaker than expected July nonfarm payrolls report earlier this month. (Source: Labor Department)

Global Economies

- The U.K. economy grew by 0.6% in Q2, continuing the country’s cautious recession rebound. The reading was in line with expectations of economists and follows an expansion of 0.7% in Q1. (Source: CNBC)

Closing the Quarter Summary

Heading into earnings season, our Q2’24 Inside The Buy-Side® Earnings Primer® survey, published July 11, registered one of the largest pullbacks in sentiment in the last five years — from increasingly bullish sentiment over the prior two quarters to squarely neutral — though outright bearishness remained at bay.

Despite increased concerns over the consumer, the political landscape, and the economy, including cooling expectations for 2024 U.S. GDP growth, surveyed financial professionals largely expected Q2’24 results to be in line with both last quarter and relative to consensus, and annual guides to be maintained. Based on this specific finding and our channel checks with clients, we knew there would be a market dislocation as expectations were in discord with company realities. We appreciate the opportunity to support our advisory clients in navigating the quarter, with the ultimate goal of building management credibility.

With Q2’24 earnings — a season with a lot of hair and teeth — in the books, we “Close the Quarter” with some notable themes:

1. Earnings Performance

Q2 Earnings Prints Surprised to the Upside, though Top-Line Beats Settled Well Below the 5-Year Average

Overall, Q2 prints fared better than expected on the bottom line, though revenue performances were more mixed.

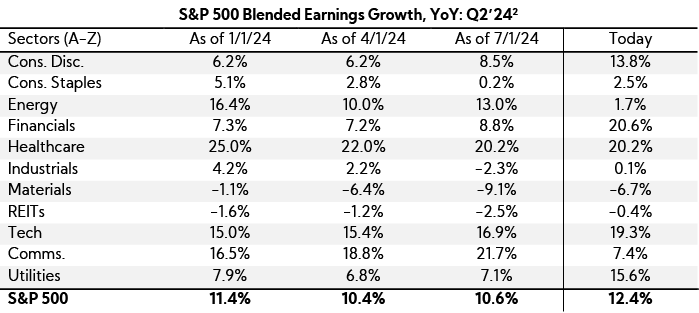

With over 90% of S&P 500 companies reporting earnings to date, the index is reporting YoY blended1 earnings growth of 12.4%, nearly 2% above the estimated rate heading into earnings (10.6% as of 7/1/24). Notably, 78% reported a positive EPS surprise, slightly above the 5-year average of 77%.

As for revenue, only 59% have reported positive top-line surprises, well below the 5-year average of 69%, with prints 1.1% above consensus estimates, again below the 5-year average of 2.0%. At least 40% of companies within the Index missed revenue consensus this quarter across all sectors, save for Energy (36%), Healthcare (24%), and Tech (23%).

Still, revenue actuals did post modest improvement relative to recent periods. The S&P 500 is reporting a YoY blended growth rate of 5.3%, up from 3.9% last quarter and 3.7% the quarter prior. However, much attention was paid to forward-looking commentary, which we cover in the subsequent section below.

2. Outlook

Executive Outlooks Heavily Influenced by the Macro, Namely Election Uncertainty, the Fed, and Geopolitics; the “Second Half” Growth Narrative Has Faded for Most, and Recessionary / Downturn Questions Spiked

Amid Q2 earnings season market volatility, attention quickly shifted to executives’ forward-looking commentary. Macroeconomic concerns, particularly the upcoming U.S. Presidential election and Federal Reserve actions, took center stage. Across sectors, companies expressed cautious optimism regarding a “hopeful” rate cut in 2024, though uncertainty remains high, especially with inflation challenges persisting and geopolitical risks elevating. Notably, many executives noted that customers are delaying growth initiatives / ordering until there is more clarity into who will control the White House.

- Array Technologies (Tech, $1.0B): “I do think on some of the order book momentum, there’s some hold-up waiting to see what potential impacts of the election may have on the longer-term renewable energy industry. Our internal view is, as evidenced by some of the news that came out today, there is a number of Republican congressmen that signed on to a letter requesting that the IRA not be defunded. The fact that over 75% of the benefits from the IRA today are being experienced by Republican controlled districts is an incredibly significant statistic. And these are about new jobs, factory openings, high-paying solar industry jobs. Generally speaking, some of the industry may be slowing down incoming orders, just trying to figure out what the potential impact will be.“

- Watts Water Technologies (Industrials, $1.2B): “As we anticipated, in this market, in any commercial construction markets, new construction, uncertainty always leads people to slow down projects. So, until the elections are over, clarity on interest rates, maybe some of the geopolitical risk, some of this stuff is just being held in at this point in time.”

- Hillenbrand (Industrials, $2.4B): “Right now, you’ve got geopolitical concerns, you’ve got interest rate concerns, you’ve got ongoing inflation concerns. And you add in what’s going to happen, for instance, in the U.S. with election and what does that mean for policy and trade, all of those concerns are mounting. And it’s causing people to take a step back and continue to watch and see how things work out over the next couple of quarters. And that’s really the slowdown that we saw this quarter at a significantly greater rate than we expected.”

- Meridian Link (Technology, $1.6B): “Though the interest rate outlook is improving, we expect the impact of anticipated rate cuts on our second half volumes and revenue to be gradual.”

- News Corp (Communication Services, $15.8B): “While prognostication is not our profession, we are hopeful that interest rate cuts by the Federal Reserve are imminent and will have a positive impact on affordability and liquidity in this stagnant market.“

- Rayonier (Real Estate, $4.4B): “We anticipate a potential rebound in end market demand following expected interest rate cuts later this year.“

- Choice Hotels International (Consumer Cyclical $5.8B): “If interest rate cuts occur in the near future as anticipated, we expect to return to a more robust new construction and transaction environment, which will translate to acceleration in our development pipeline.”

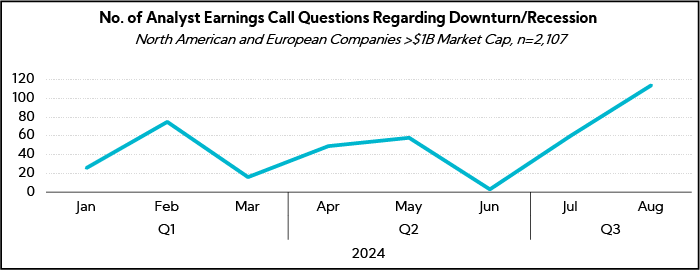

Interestingly, as we covered last week in our Materials Sector Beat, we observed an increase in sell side questions about a potential recession within the Q&A portion of earnings calls. We expect these questions to become more prevalent in discussions with analysts and investors in the coming weeks and months during sell side conferences and investor meetings. Questions primarily centered around the following areas:

- Consumer demand and behavior, including preference shifts, trade-down activity, and any changes in demand elasticity across different product categories in response to economic pressures

- Industry and sector impacts, such as pinpointing where companies sit in the cycle and the ability of different areas of the economy to withstand economic turbulence

- Financial implications and preparedness (i.e., the “Downturn Playbook”), such as the potential impact of a recession on asset values and KPIs, balance sheet preparedness and liquidity, and cost-cutting measures/efficiency initiatives to mitigate

- Strategic positioning and long-term planning, with analysts acutely focused on any shifts in investment and growth plans, as well as geographical priorities and trends

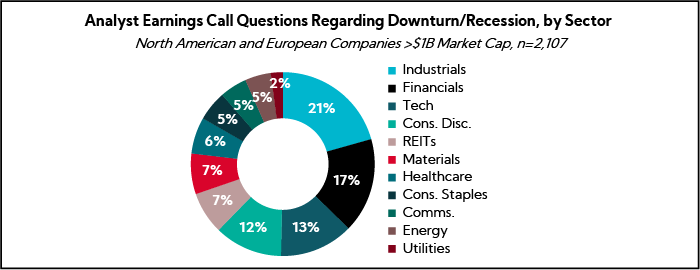

As the charts below indicate, these concerns have spiked meaningfully through August, reflecting a 63% increase QoQ3, particularly affecting the Industrials, Financials, and Tech sectors. For best-in-class communication tactics and examples, access our Downturn Playbook Thought Leadership

- Avis Budget (Industrials, $3.1B): “The narrative around potential recessionary fears has clearly changed in the last week or so, so I wanted to touch on that topic. First part of the question, can you give any color that you’ve seen in terms of forward bookings? The second aspect, again, in light of a maybe potential recessionary environment, how are you thinking about the potential impact to used vehicle values if we were to see a material decline in these values.”

- Hims & Hers Health (Consumer Staples, $3.5B): “I know you probably haven’t gotten this question in about a year now, but it seems like everyone’s thinking about this, at least today, a weakening economy and a potential recession. I’m curious if you’ve seen any signs out there of a slackening in consumer demand. And if so, if you can kind of describe where that slack might be coming in?”

- Axon Enterprise (Industrials, $28.4B): “As you know, there are fresh concerns on the macro economy. We potentially are going to go into some sort of recession. You all have a great slide in the investor deck that I think, in some respects, addresses this where it looks at this consistency in public safety spend over a long period of time. You’ve obviously been through a lot of cycles with the company, and it would just be great to hear your perspective as to what type of impacts maybe you’ve seen in the past. And as you look forward, what we might expect in part because the portfolio has also changed quite a bit, even if the customer base is somewhat similar?”

- Uber (Tech, $152.5B): “What would you expect to happen from Mobility if we do have a recession or a bigger downturn as far as maybe trade down or looking for lower price rides, the impact on bookings and profitability?”

- Molson Coors Beverage Company (Consumer Staples, $11.1B): “Can you comment on how prepared the company is for a scenario where you do have a light recession in the U.S. and the resiliency of the beer category within total alcohol?”

3. The Consumer

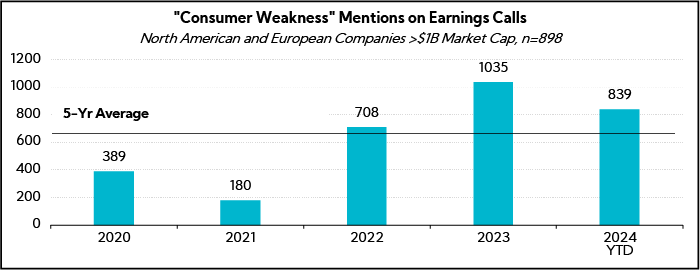

Consumer Pressures have “Deepened and Broadened”; “Consumer Weakness” Mentions Jump on Earnings Calls

Following our coverage last quarter of Consumer Discretionary earnings which identified low-income consumers pulling back harder on spending, at least across many restaurant and retail providers, a key theme that emerged this quarter revolved around an increasingly strained consumer, including early signs of spillover to previously robust pockets of the market and higher-income cohorts.

Although retail sales figures released this week exceeded expectations (we chalk this up to heavy July 4th and general summer promotional activity), executive commentary suggests a more challenging outlook ahead. For example, McDonald’s highlighted consumer pressures that have “deepened and broadened”, while several high-profile travel and entertainment companies indicated a slowdown in travel demand among U.S. consumers, an area that has been a notable post-COVID economic bright spot. Moreover, executives across a range of industries highlighted a cautious spending environment and delayed decisions as consumers continue to feel the pinch from inflation and higher rates.

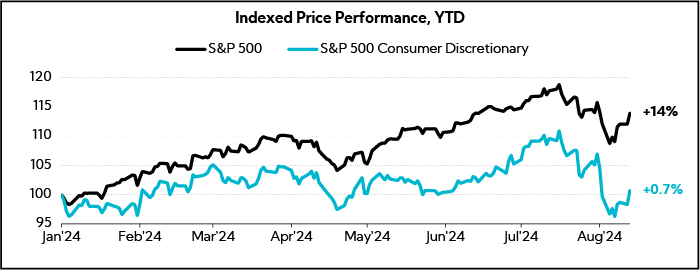

Consequently, “consumer weakness” mentions on earnings calls grew 25% this period3, and cumulative mentions YTD reflect a 13% uptick versus this time last year. Moreover, Consumer Discretionary is the worst performing sector within the S&P 500 index YTD, up less than 1% versus the benchmark’s 14%, and down nearly 5% since the beginning of July.

- McDonald’s (Restaurants, $194.1B): “Beginning last year, we warned of a more discriminating consumer, particularly among lower income households, and as this year progressed those pressures have deepened and broadened.”

- Amazon (Internet Retail, $1.8T): “We’re seeing lower average selling prices right now because customers continue to trade down on price when they can.”

- Home Depot (Home Improvement Retail, $355.3B): “During the quarter, higher interest rates and greater macroeconomic uncertainty pressured consumer demand more broadly resulting in weaker spend across home improvement.”

- Disney (Entertainment, $156.2B): “[Regarding the Experience business], I would call this a bit of a slowdown. The lower-income consumer is feeling a little bit of stress. The high-income consumer is traveling internationally a bit more. I think you’re just going to see more of a continuation of those trends.”

- Airbnb (Travel Services, $73.8B): “We are seeing shorter booking lead times globally and some signs of slowing demand from U.S. guests.”

- Expedia (Travel Services, $16.8B): “Entering Q3, we have seen a more challenging macro environment and a slowdown in travel demand consistent with recent commentary from others in the travel industry.”

- Booking Holdings (Travel Services, $119.8B): “Our gross bookings were negatively impacted by lower flight ticket prices, in line with the recent trends we have heard from many airlines.”

- Hilton (Lodging, $50.9B): “[Regarding the U.S. consumer], if you break it apart and segment, in the lower half [or maybe even] lower three quarters, they have less disposable income and capacity to do anything, including travel. You go up to the upper echelons and people still have pretty fat bank accounts. What we have seen YTD, and what we expect for the rest of the year, it’s not cratering in any way, but definitely softening.”

- Marriott (Lodging, $60.0B): “In the U.S. and Canada and, frankly, all of the other regions, ancillary spend was a hair softer than we anticipated. And I think it does show that the consumer in general is perhaps being a bit more judicious about the fancy dinner, or going on the extra trip when they’re on a vacation and that is really the only thing.”

- Host Hotels & Resorts (REIT – Hotel & Motel, $23.1B): “There has been weakened leisure at the lower end of the chain scale. I do think there is a bifurcation today between the high-end consumer who is still strong, but it’s moderating somewhat candidly, and the low-end consumer. And I think you’re seeing that in the earnings reports that are being printed this quarter. There’s a differentiation.”

- Hilton Grand Vacations (Resorts & Casinos, $3.6B): “There is pressure on the consumer, pressure to make commitments at the level of discretionary spending required to be part of our club. And talking to the sales teams, there’s just increased customer hesitancy. I think people are taking a more wait-and-see approach.”

- O’Reilly Automotive (Specialty Retail, $62.5B): “We’re seeing some level of conservatism in how consumers are managing their spend as they face the cumulative impact of elevated price levels and uncertainty about the broader macroeconomic conditions.”

- Hillenbrand (Specialty Industrial Machinery, $2.3B): “We’ve not seen customers cancel projects in the pipeline, but we have seen a similar trend of delayed investment decisions as customers balance new investments with inflationary pressures, higher interest rates, and softening consumer trends.”

- Teladoc (Health Information Systems, $1.2B): “We are seeing customer acquisition cost pressure broadly across many of our advertising channels, which suggests some broader macro weakening of the consumer.”

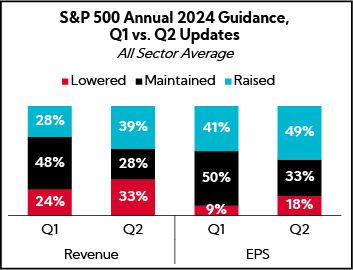

4. Guidance Moves and Consensus Shifts

While More Companies Raised EPS Guidance and Most Sectors Saw More Analysts Revising EPS Higher, Top-Line Expectations are More Mixed QoQ, with Growth Midpoints Decreasing, on Average

Guidance Moves

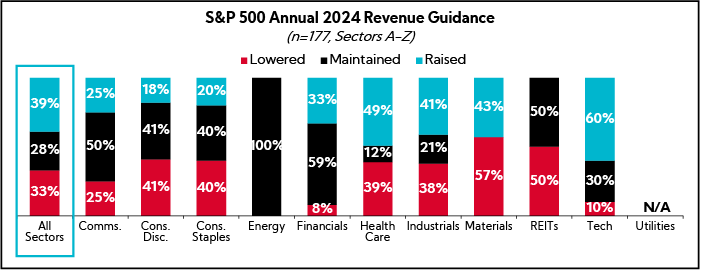

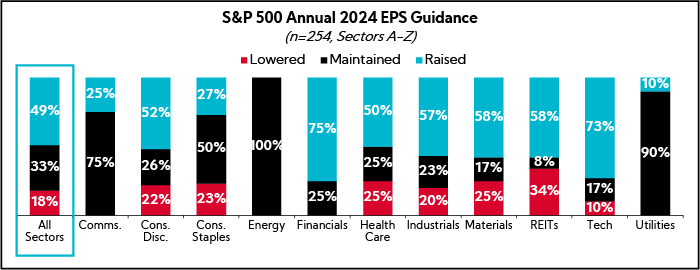

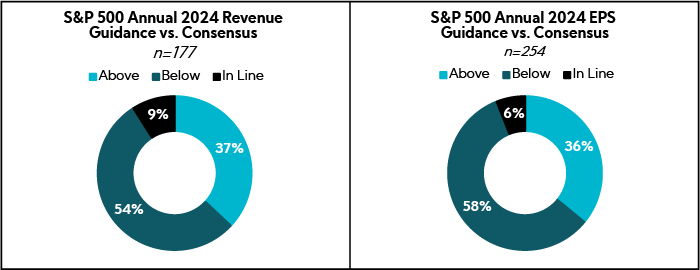

We analyzed annual revenue and EPS guidance trends across the S&P 500.4 Below are our findings.5

In general, fewer companies Maintained guides QoQ, making way for roughly equal proportions incrementally Raising or Lowering guides during Q2 across both metrics. Revenue guidance moves are more evenly mixed QoQ, while more companies are Raising EPS forecasts.

Revenue:

More companies, 39%, Raised annual guides, while 33% Lowered and 28% Maintained; however, midpoints assume 530 bps of growth, on average, down from 580 bps QoQ

- Notably, 81% of companies expect full year 2024 results to be above 2023 actuals, down from 88% last quarter

EPS:

Just under half of all companies, 49%, Raised annual guides, while 33% Maintained and 18% Lowered; average EPS spreads decreased $0.06 to $0.25

Relative to consensus figures, a majority of company forecasts for annual revenue and EPS rest below analyst estimates, though at least one-third are above.

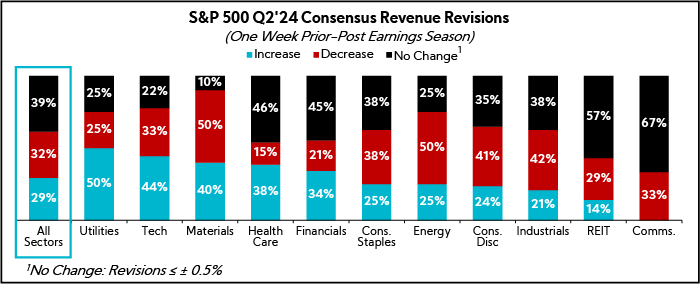

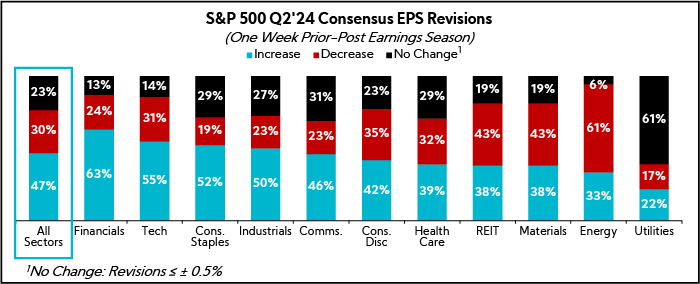

Consensus Shifts

When analyzing full year 2024 consensus shifts of the S&P 500 one week prior through one week post Q2 earnings announcements, analyst estimates reflect a mix of revenue projections alongside largely improving EPS outlooks.

The proportion of companies experiencing downwardly revised top-line expectations was 32% across all sectors, with 7 of the 11 sectors seeing more companies experiencing negative rather than positive adjustments. That said, more across the index saw estimates maintained (39%).

Meanwhile, most sectors saw more EPS estimates raised for companies than lowered, with the exception of REITs, Materials, and Energy, which experienced more decreases.

5. Capital Allocation

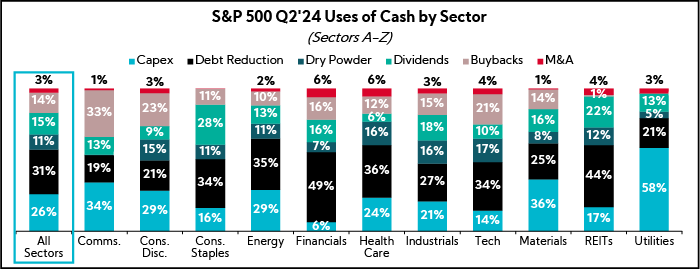

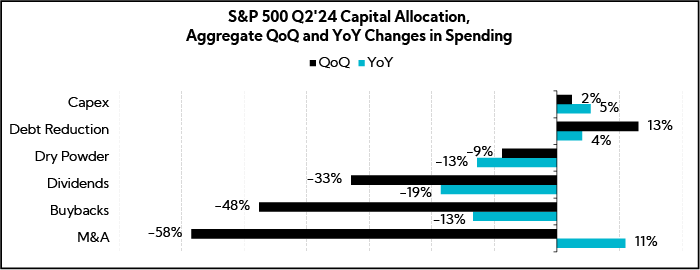

QoQ Cash Deployment Trends Reveal Early Signs of Capex Momentum and Modest M&A Value and Volume Improvement; Aggregate Dividend, Dry Powder, and Buyback Levels Shrink

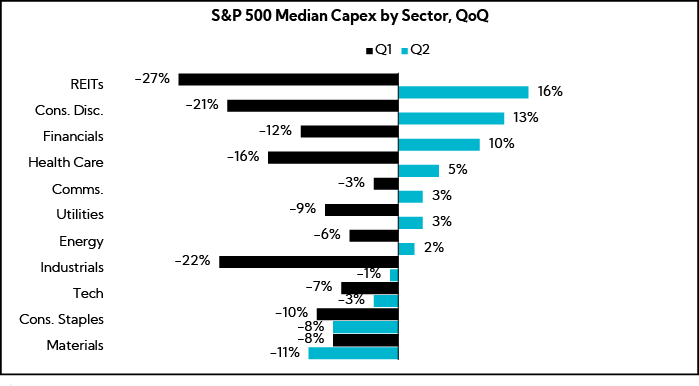

On a QoQ and YoY basis, S&P 500 capex increased 2% and 5%, respectively, representing the only capital allocation bucket outside of debt reduction to increase over both timeframes. Indeed, many sectors flipped positive QoQ, led by median investment boosts in REITs, Consumer Discretionary, and Financials sectors. Support for reinvestment continued to trend up and remained a close second preferred use of cash in our latest Q2’24 Inside The Buy-Side® Earnings Primer® survey, with more participants encouraging companies to maintain current levels of growth capex.

Continuing, debt reduction was the most meaningful proportion of spend this quarter on an equal-weighted sector average basis, underscoring increased concern about the economy. Indeed, the investment community pointed to debt reduction as the leading preferred use of cash this quarter, cited by 60% of the investment community in our latest survey, and thresholds for ideal Net Debt-to-EBITDA levels of 2.0x or less grew from 57% to 70% QoQ.

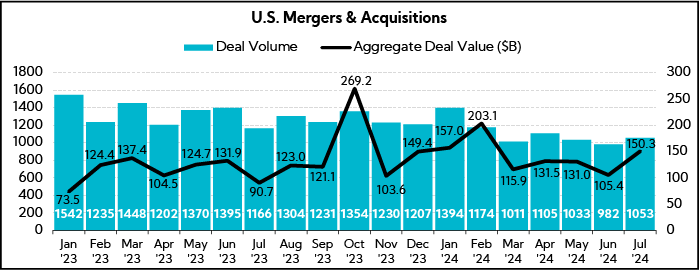

Sequentially, M&A experienced the largest decline (-58%) among the aggregate S&P 500 capital allocation buckets. Driving the large decrease was a steep QoQ comp after three large deals from AbbVie, Carrier Global, and Bristol-Meyers7 last quarter dwarfed the overall growth rate for the index. However, YoY, M&A comparisons remain 11% higher.

When taking a look at U.S. mergers more broadly, July deal values and volumes both increased 43% and 7% versus the prior-month period, respectively.

Of note, we’ll be coming out with our M&A Communication Journey whitepaper next month, so stay tuned!

Dividends, dry powder, and buybacks each saw pullbacks QoQ and YoY.

In Closing

As we wrap up our coverage of Q2’24 earnings season, it’s clear that commentary remains heavily influenced by macro factors like the election, the Fed’s actions, geopolitical risks, and shifting consumer behavior. While we “don’t want to own the macro,” as market volatility fuels fresh recession concerns, we do want to focus on what we can control in our messaging. As warranted, dusting off (or creating) the Downturn Playbook and providing Scenario Analyses that frame different scenarios and the actions your company will take are powerful communication tools in uncertain economic times like these. Indeed, they serve to provide guardrails (inherently, the Street is risk averse and often over rotates on the ‘worst case’) and calm anxiety, as information is knowledge.

Rather than attempting to predict or manage external forces, the most effective narratives emphasize what your company directly controls — customer focus and commitment, operational efficiency, strategic investments. Looking ahead, there is pent-up demand and companies should be preparing for the time when the pressure is released — an interest rate cut, an election outcome — and positioning their organization to be at the ready to capture that opportunity.

As always, we remain dedicated to providing you with timely insights and actionable strategies to navigate the ever-changing and now seemingly always complex environment. Thank you for your continued trust and partnership!

We’ll be taking the next three Fridays off, resuming after the Labor Day holiday. In the meantime, have a great weekend and enjoy the last two weeks of August when, around the world, the Street sleeps.

- Combines actual reported results for companies and estimated results for companies yet to report

- Source: LSEG I/B/E/S (Formerly Refinitiv)

- QoQ defined as Q1 and Q2 reporting periods, April-May and July-August MTD, respectively

- As of August 14, 2024

- Based on company guidance provided at the time of publication; total number of companies differ across revenue and EPS

- As of August 14, 2024; “All Sectors” figures are equal weighted sector averages

- Valued at $20B, $11B, and $9B, respectively, accounting for 47% of the aggregate spending levels in Q1’24