Earnings Pre-Announcements

Recognizing there are crystal clear situations that warrant a pre-announcement – such as a force majeure scenario where the impact is known – today’s thought leadership focuses on the more subjective variety of pre-announcement: an earnings surprise.

Setting the Stage

As the third quarter soon comes to an end, this reporting season will be the final opportunity to manage expectations for full-year results. Indeed, and particularly amid an uncertain backdrop, the most common inquiry to Corbin’s Research Center of Excellence over the last three weeks has been on pre-announcements, specifically the pros/cons and investor expectations for such communication updates.

As you’ve likely seen us communicate previously, according to our proprietary research, expectations management is the X Factor in shareholder value creation and is directly linked to views on management credibility, which in turn is statistically correlated with transparency.

Best-in-class management teams not only demonstrate the ability to shape and control the narrative on a quarterly basis but methodically reframe discussions with investors and analysts to focus on the long term. Actively monitoring sell side and buy side expectations and approaching conversations with a relatively high level of transparency, coupled with proactively addressing disconnects in a timely manner, builds management credibility.

Moreover, guidance and outlooks play a leading role in supporting managed expectations as the absence of such forces investors and analysts to rely on their own assessment, which is never nearly as informed as a company’s own. Management credibility erosion can ensure if results are materially different from company-issued guidance and/or consensus.

Company Analysis

To provide perspective on recent pre-announcement trends in the context of today’s environment, we analyzed 26 companies that issued preliminary results or provided an off- cycle business update over the last two quarters:

- At the median, companies issued a pre-announcement ~20 days prior to earnings

- 31% issued 14-19 days in advance of earnings, 31% 20-28 days, and the remainder across a range of times

- Of the companies that provide annual guidance, 78% addressed on annual guidance in the pre-announcement

- 28% Lowered guidance

- 17% Reaffirmed

- 22% Raised

- One company issued guidance and one withdrew

Investor Views

A communication tool in your investor relations arsenal when earnings expectations are misaligned with your company’s reality is pre-announcing. These preemptive announcements are typically made in the weeks prior to the regularly scheduled earnings release and webcast, and theoretically serve to broadly inform the investment community on a meaningful quarterly performance beat or miss (significantly more prevalent) in a Reg- FD compliant manner.

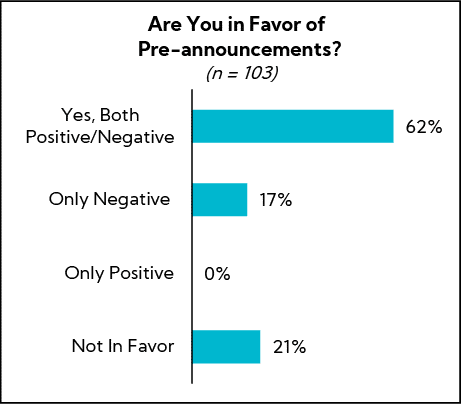

- The majority of surveyed investors, 79%, believe it is appropriate to pre-announce when results are expected to be materially different than company-issued guidance, not sell side consensus, with 62% favoring this approach irrespective of the direction of the delta (positive / negative)

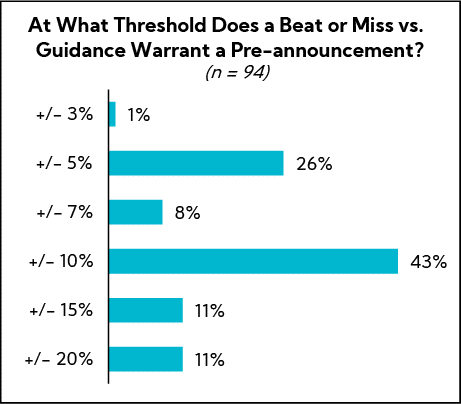

- More, 43%, note a 10% beat/miss above revenue or earnings guidance is the threshold that warrants a pre-announcement

- Still, 34% believe a 5-7% beat/miss is appropriate

Investor Commentary

“When things change, the sooner the better, caveated with the fact that if you change it too often and go down or up too often, it becomes a loss of credibility. As soon as it is pretty sure, positive and confident, then yes, you have to. If your end markets are deteriorating because of slowing growth, you have to do something proactive to offset that. You can often change your guidance along with positive steps.”

“I prefer companies preannounce. The longer that you sit on surprising news, the more opportunity there is there for abuse. I am generally in favor of greater transparency. If there is something that the company is ready to announce and is just holding it back until their earnings, I would advocate preannouncing.”

“If it is a big enough risk, it’s worth pre-announcing.”

“I think that getting out front on a miss will generally boost companies’ credibility with investors. One exception may be if a factor has uniformly affected the entire sector, there’s probably not any real benefit in putting the news out there early.”

Every pre-announcement has its own set of facts and assumptions and should be evaluated on a case-by-case basis. These are decisions not to be made lightly as they have both immediate and long-term implications. Today, we will focus on the miss scenario. When we advise clients on this matter, we take into consideration several dimensions:

1. Context

It’s important to understand the whole picture and specifically whether the miss is a company-specific issue or due to a broader, more universal cause – in today’s case, pockets of slowing economic growth that are affecting entire sectors. We look at many factors to build the situational analysis framework that we’ll leverage to determine whether a pre-announcement is warranted, including but not limited to:

- The company’s guidance policy and cadence – quarterly or annual – as well as current consensus

- What the company communicated on the prior earnings call and webcasted conferences regarding forward-looking views, specifically whether management appropriately foreshadowed the softness they are now experiencing

- Public and paid-for industry research that provides a data-based depiction of the economic landscape to determine whether the shortfall seen by the company is unique to it or the entire market / sector

2. Confidence

Often, questions as to whether a company should pre-announce a miss are based on a limited set of data obtained in the last month of the quarter. This information is generally directionally accurate but tends to move around and is often a narrower depiction of the overarching quarterly performance story.

In some cases, it has ended with the weakness in question being offset by strength in other areas, resulting in a net no-impact-to-guidance scenario. Again, it’s important to look at the bigger picture.

- Are internal channel checks and analysis pointing to weakness across the board or is performance mixed, with some bright spots? Do we understand all the moving pieces and where each will settle?

- Does the lowered guide accurately reflect all the puts and takes of the quarter?

- Can we ensure this new guidance will not change a few weeks later when we formally announce earnings?

3. Precedence

When a company pre-announces, it sets a precedent, while an unintentional outcome is communicating a set of parameters that investors and analysts will rely on as a benchmark. Should those parameters be triggered in the future and no pre- announcement made, questions can ensue as investors and analysts try to decode the company’s policy on pre-announcing. This can lead to confusion and erode credibility.

4. Desired Outcome

Earnings is serious business for investors and analysts and they require a robust set of facts and information, both absolute and relative, to assess the full picture. The pre-announcement, by its very nature, is a perfunctory filing. Unlike a regularly scheduled earnings event, where you have a set of materials that reinforces key messages, including the press release, presentation, and prepared remarks, the pre- announcement is typically a one-paragraph, or at most, a one-page statement. It does not allow for the necessary voiceover that supports investor and analyst understanding about the bigger picture nor does it yield a public forum to answer questions. In fact, pre- announcements most often occur during the quiet period, precluding companies from answering the follow-on questions that surround such an announcement.

In these cases, the well-intentioned decision to be transparent must be weighed against the potential outcome of communicating a subset of information that casts a spotlight on the negative, results in more questions than answers, and forces investors to make a judgement call without the full set of facts.

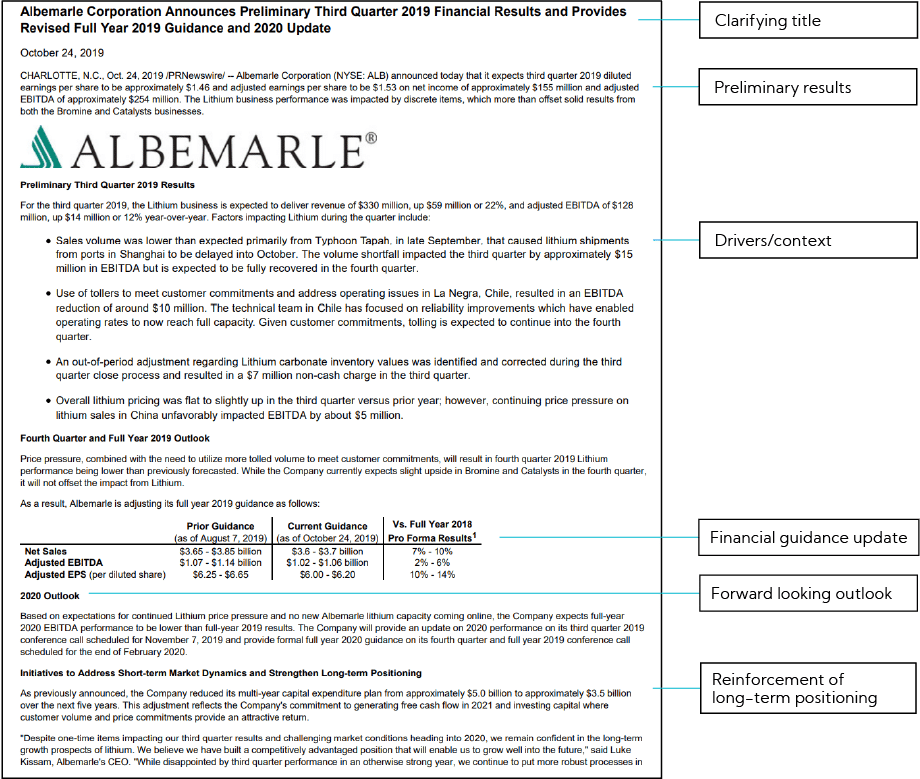

As much as possible, you want to control the narrative and that often requires a more robust level of information, including the updated guide, color into the factors driving the change, and how to interpret the new information in the context of the company’s big picture.

Selected Pros and Cons

- Conveys transparency from management and can serve to build credibility; investors appreciate the proactive communication – one of the most important considerations

- From a technical benefit, potentially reduces speculation and/or volatility associated with rumors / misinformation

- Limits “full story” disclosure; no prepared remarks / voiceover to provide further detail and color

- May “double-tax” information; investors will be reminded of the unfavorable conditions during subsequent earnings call

- In absence of earnings prepared remarks and Q&A, limits ability to address investor questions

- Sets precedent for future pre- announcements

- Can severely damage management credibility if pre-announced guide differs (+/-) from what is communicated in follow-on earnings

Best-in-Class Pre-announcement Example

In Closing

Throughout 19,000+ interviews with the investment community globally, the highest-performing companies in the Corbin Universe have never had expectations management identified as a leading company weakness. Conversely, this is one of the leading identified detractors of management credibility for companies that consistently miss expectations and/or guidance. Other leading companies with one blip in materially missing guidance also see this as a challenge for up to a year later, according to our research.

Pre-announcements can serve to manage expectations and build management credibility even in the face of a miss, but as noted, there are myriad factors to take into consideration

to achieve that desired outcome. Robust discussion and debate on the pros and cons are necessary to come to a responsible decision as each situation presents different facts, assumptions, and unintended consequences.

With deep experience assisting clients with methodically thinking through these complex situations, we are here to answer any questions you have on this topic.