Leadership Transitions

Leadership Transitions White Paper

Click here to download a copy

Setting the Stage

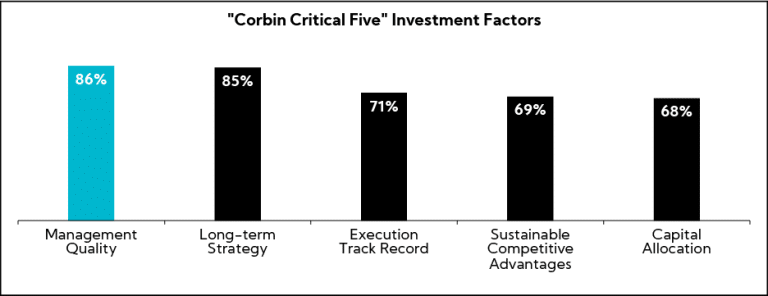

As institutional investors balance managing core holdings with evaluating new opportunities, leadership plays a pivotal role in influencing investment decisions. As you have heard us say many times before, according to our buy-side research spanning 16+ years and more than 24,000 interviews globally, Management Quality is the leading investment factor.

Methodology

Investor Perspectives

To evaluate preferences and expectations from institutional equity investors and analysts, we surveyed3 50 global professionals about leadership transitions

Corporate Practice

To evaluate communication practices, we conducted bespoke research on a randomized sample of 20 CEO transitions over the last five years across diverse sectors and ranging from 1,500 employees to 440,000 with market caps of $5.0B to $550B, respectively

Corbin Analytics Insights

To provide broader perspective on management, we provide insights from our Corbin Analytics database, which comprises data from Voice of Investor® interviews spanning 1,000+ companies

Key Insights and Analysis

While executive transitions come in many shapes and sizes — planned versus unplanned, clear on-deck successor vs. none, time on your side vs. not, and all offering unique internal dynamics — the ultimate goal is instilling stakeholder confidence and managing a change of this magnitude swiftly and effectively. Our Thought Leadership focuses on investor preferences and expectations for C-suite executive transitions, as well as common and best practices.

Instituting a Succession Plan and Showcasing Bench Strength

Successfully managing a leadership transition, particularly at the CEO level, is one of the most pivotal moments in a company’s lifecycle. Instituting a smooth, well-communicated succession plan ensures continuity, reduces uncertainty, and fosters investor confidence. Increasingly, more organizations are embracing this approach. In Q2 2024, 23% of CEO departures were enacted as a part of a succession plan — more than double the six-year average of 11%.4

A study by Harvard Business Review of the world’s 2,500 largest public companies found that organizations scrambling to replace departing CEOs forgo an average of $1.8 billion in shareholder value. Even more, research has also shown that 80% of analysts typically put an equity premium on companies that are perceived to have a strong CEO pipeline.5

However, effective planning goes well beyond a well-defined succession plan and identifying and ultimately naming the right candidate — an often overlooked success factor is providing investors and analysts exposure to the leadership bench. Introducing key leaders to the financial community in general and especially in advance of future leadership changes at the top, helps foster familiarity and trust while warding off concerns of “key person risk” should the CEO or CFO depart. Next-level leadership engagement with the Street serves to amplify management credibility and also provides necessary investor relations training for these executives. This is even more critical if there is a sole identified internal candidate. In the event a leadership transition results in an external hire, having confidence in the next level of leadership goes a long way in assuaging investor apprehension and concerns.

Selected Investment Community Commentary

“Best practice is a well-planned succession, which you signal with a reasonable amount of notice. In an ideal world, you have a succession at a period of time when the business is doing well rather than performing poorly, although it is hard to choose those moments. Poor business performance often requires a change in CEO for people to feel comfortable.”

“Surprises are never good to the extent a company can lay out a succession plan. Even if they do not identify the specific leaders, if the plan can be identified within a timeframe that avoids investor surprises, it is the biggest plus.”

“We would like to know if there is a bench and a plan.”

“The CEO and the Board should have a clear line of sight of when the CEO is going to retire, and best practice is to position the new CEO for that role regardless of what their title is. At that point, they are in training mode, and stakeholders are aware of the succession plan and who the new person is going to be.”

Nailing the Press Release

The press release announcing a leadership transition is the first opportunity to shape the narrative — not just about the incoming leader, but also about the nature of the transition itself. In some cases, it’s also an opportunity to reinforce strategy or telegraph a pivot in company direction. The financial community will closely scrutinize this initial communication for both the new leader’s credentials and the circumstances surrounding the transition.

Assuming a successor is named, best practice elements include:

- Highlights of the outgoing executive’s contributions

- Rationale for the successor’s selection

- Emphasis regarding the company’s preparedness for the transition

- Clear timelines regarding the effective date and role of the outgoing executive during the transition, if any

- An authentic quote from the outgoing leader underscoring confidence in their named successor

- A picture of the incoming executive

In situations where the transition was the result of an unplanned or abrupt departure due to illness, a personal matter, termination or resignation, the release is typically brief in nature but transparent, focusing on next steps and reassuring investors of the company’s ability to effectively manage the transition period. In our experience, it’s important to put stakeholder care ahead of company politics. Investors are inherently risk averse and can read between the lines; maintaining a neutral, professional tone is always advised.

Providing Proper Notice

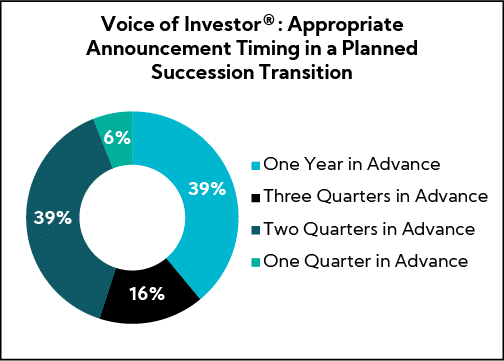

When executing a well-orchestrated succession plan, “effective date” timing is a critical factor in instilling confidence. For planned executive successions, 94% of surveyed investors favor at least two quarters notice for transitions, with an equal number split between two quarters and one year in advance.

Selected Investment Community Commentary

“If there is no advance, then it is not good news. A year is perfect, but three quarters is more than enough notice.”

“Is this a CEO or CFO who has been in place for a decade? The longer the CEO or CFO has been in place, the longer in advance I recommend succession be communicated, because it will seem like a bigger change. The bigger the change, the more time investors appreciate to digest the change and get to know the heir apparent to the CEO or CFO. As a guideline, if a CEO or CFO has been in place for five years, I recommend six months advance notice. If they have been in place 10 years or more, I recommend one year.”

“The more successful transitions have been at least two quarters. I have seen six months to a year, but six months is adequate.”

In practice, our analysis of 20 CEO transitions, 50% of which were planned successions, reveals that the average transition period from the initial announcement to the successor’s effective date is approximately 118 days, or four months.

Naming a Successor

As noted, 50% of companies in our analysis name a successor at the same time as announcing an executive’s departure, while the remaining companies disclose that a search has been initiated. In situations where a successor is not immediately named, companies announce the new leader in approximately 7 months, on average, ranging from 4 to 12 months.

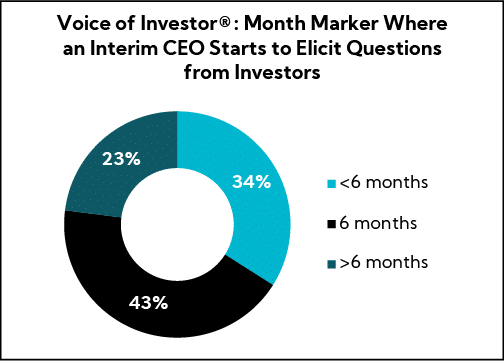

Continuing, 15% appoint an interim leader before naming a permanent successor. Important to note, more than three-quarters of investors believe an interim CEO should not remain in place for more than six months — 43% view six months as the upper limit, while 34% consider three to five months acceptable before concerns begin to arise.

Selected Investment Community Commentary

“Six months feels like a break point. If you’ve had an interim CEO for more than six months, it suggests you are having trouble finding a replacement. You do not want to go much beyond six months.”

“It is never good to have a true interim. If you are talking about a case where someone had a health issue or passed away, it is different. If you are making a change and have not figured it out and go to an interim situation, it is a bad look. If it is a situation that could not be avoided, it should not be beyond four or five months.”

“A lot of it depends on how complex the company is and how effectively things are running with the interim person. If we have to go six months and not have an update as to what is going on, I do not know if they are finding good candidates or if they are saying no and if so, why? What is going on and what should we expect? It is important. How much leeway does [an interim] CEO have? Sometimes they are babysitting and other times they are going out divesting businesses and doing more things than one might expect an interim to do.”

“Most CEO searches should be accomplished in under six months. Ideally, businesses have enough of a leadership bench that there are multiple successor options such that you are not starting from scratch. I have experienced some instances where companies have had a sudden CEO departure, and they need to start from scratch because they have not developed an adequate bench. Being leaderless for longer than six months is challenging.”

Expectations for Newly Appointed CEOs: Credentials

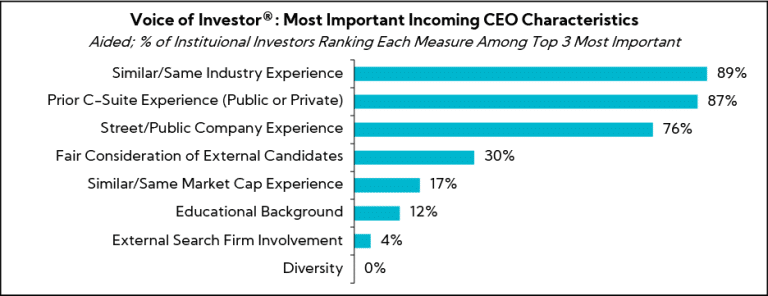

For newly appointed CEOs, the investment community shows clear preferences for specific qualifications and experiences. In particular, they prioritize Similar or Same Industry Experience, Prior C-Suite Experience (Public or Private), and Street/Public Company Experience.

Earnings Call Participation Following a CEO Transition Announcement, Where the Named Successor is Internal and There is a Transition Period for the Outgoing Chief

For situations where there is at least a one-quarter gap between the leadership transition announcement and the effective date, the successor almost always participates on the earnings call, including in both prepared remarks and Q&A.

Earnings Call Precedence Once a New CEO Is at the Helm

Once a new executive is officially in place, on the first earnings call following their effective date, it is best practice for new leaders to provide an introduction and pertinent background about themselves, why they are excited about the opportunity, and insights and observations from their listening tour with key stakeholders. While it is not expected that strategy changes will be made at this point, new leaders should be prepared to provide a big-picture view on strategy and — importantly — key priorities. Just as important is understanding the company’s track record and forecasting ability and with it, the need to effectively manage expectations. If taking down guidance is warranted, then do so. The mantra of the Street is under promise and over deliver and new executives are provided the benefit of the doubt in the first 12 months for make sweeping changes, as necessary, including “kitchen sinking it”, and it behooves executives to take advantage of this one-time get out of jail free card.

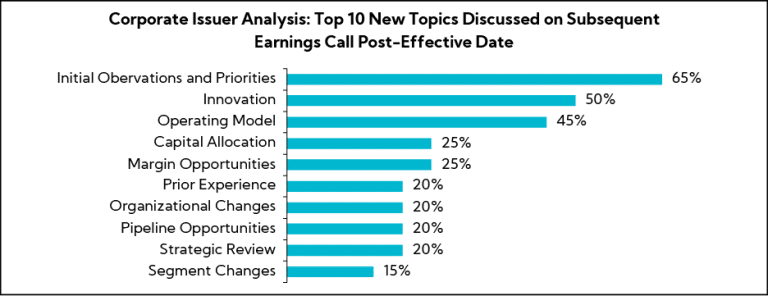

In our analysis, 65% introduce early observations and initial priorities. Topics such as Innovation and Operating Model rigor are most often addressed. Few commit to a strategic review or organizational changes at this time.

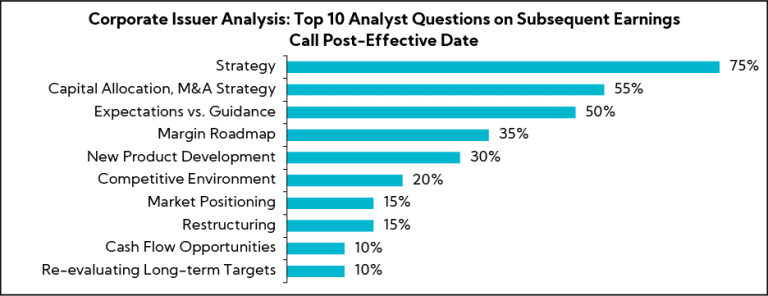

As for investment community interest, strategy, capital allocation — particularly around inorganic growth priorities and shifts — and expectations versus guidance are some of the most common Q&A topics raised by analysts during the initial earnings call.

Now that the transition and early expectations setting have occurred, the hard work begins in being recognized as a credible, respected, and ultimately best-in-class leader.

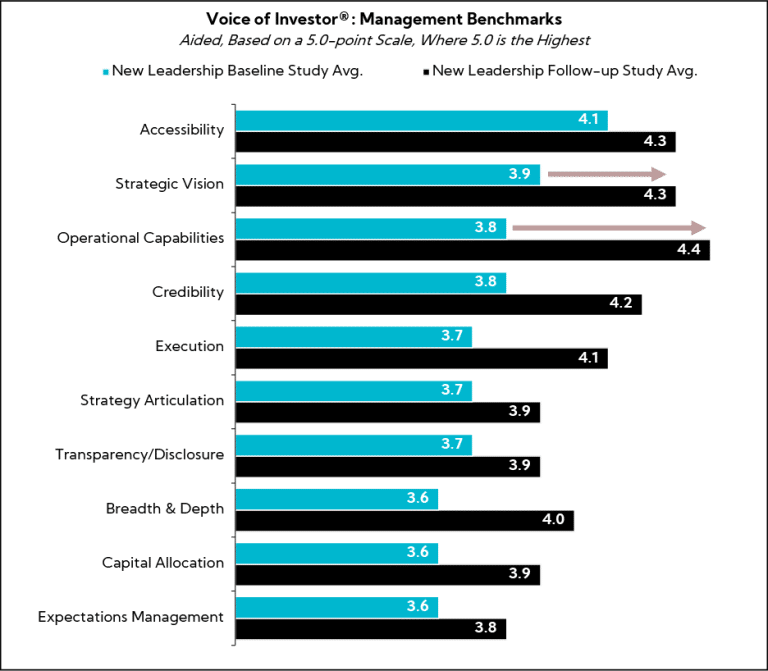

When evaluating management in their first Voice of Investor® Perception Study on normative management benchmarks, not surprisingly, new leaders receive lower normative ratings across all measures versus the New Leadership Follow-up Study averages, conducted 24 – 26 months after the initial leadership transition.

This skepticism reflects a “wait-and-see” approach we often hear from investors, who tend to withhold a vote of confidence until the new executive has proven their ability to implement strategy, manage operations effectively, and enhance performance. The largest gains are observed in areas such as Operational Capabilities and Strategic Vision.

Investor Focus Areas and Expectations for New Executives

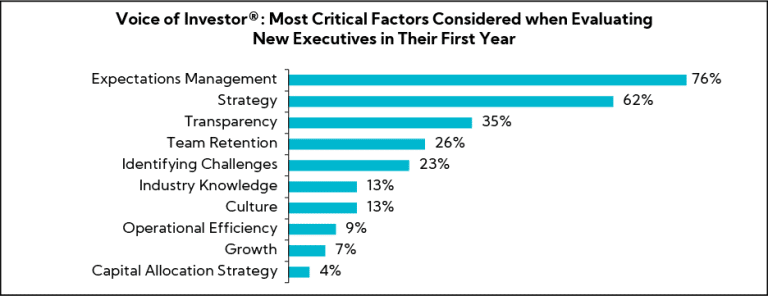

Following an executive transition announcement, Expectations Management is cited as the leading factor investors focus on when evaluating new executives in their first year, followed closely by Strategy.

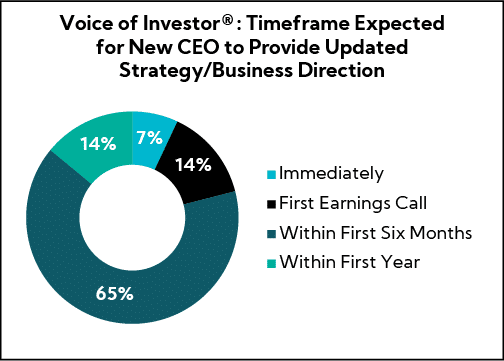

With strategy being considered among the most important determinants of year-one success, when asked about the ideal timeframe for successors to provide an updated strategy or business direction, 65% of the investment community expects this within the first six months. However, qualitative commentary underscores the importance of early observations and thoughts within the first three months.

Selected Investment Community Commentary

“Within the first three to six months, they should be able to provide an indication of the magnitude of changes they expect to make. If the expectation is for something more substantive, it should be within a year.”

“I expect a new CEO to provide an update on strategy or business direction in 6 to 12 months; before then is trivial, especially if the new CEO is completely new to the organization.”

“Within the first three months, there should be some commentary about the efforts underway to evaluate the business, so they can come to a strong conclusion on the strategy for the business or the strategy is already being strongly developed. I do not expect a full strategy to be done by then, but if it is an internal CEO, they have a good idea on a lot of things they want to see. It is a matter of getting the rest of the organization on board. If it is an external CEO, it takes a little time for them to truly understand the business they are in, so it will depend a little on the level of complication of the business.”

“If the new CEO was internally within the company, I expect them to provide a strategy or business direction update within one earnings call. If the previous CEO resigns unexpectedly and the new one comes in, there will be more flexibility. Credibility is a big thing. They should not be updating people or giving a strategy if they are not ready because it will come back to bite them in the long run.”

The value creation — or erosion — related to a leadership transition can be material. Below are actionable recommendations, as well as best and worst practices to ensure a successful leadership transition, instill investor confidence, and retain value:

In a Planned Succession, Provide Ample Time to Digest a Leadership Change

Recognizing companies are not always in control of the timing of a transition, in a planned succession, strive to provide sufficient time to process the leadership change. A notice period of 6–8 months is generally viewed as sufficient, but companies with longstanding executives should consider announcing even earlier in advance, such as one year. Include the opportunity for the departing executive to participate in a final earnings call; this will provide closure for the individual as well as for shareholders and analysts where relationships have been built. Above all else, avoid anything perceived as abrupt or unplanned.

When Possible, Expose the Investment Community to Potential Successors Early On

Providing early exposure to potential successors through earnings calls both in prepared remarks and Q&A. This practice not only showcases bench strength but also prepares executives for the “real world” in the event they are named successor. Industry conferences, plant/site visits, and investor days helps build familiarity and trust with investors and analysts, reinforcing credibility from the outset.

Additionally, it’s vital for new leaders, particularly those with no or limited Street-facing experience, to prioritize investor engagement. Getting out on the road to meet with key shareholders and analysts is not only good for the executive, but it’s also one of the top requests from the buy side. It’s important to be prepped and prepare for this engagement as first impressions matter! For executives new to IR, specialized training in this area6 is invaluable for learning how to effectively communicate with the Street on company direction and strategic priorities, financials, and capital allocation.

If Appointing an Interim Leader, Seek to Identify a Full-time Executive within 6 Months

Investors are generally comfortable with an interim CEO or CFO for up to 6 months — beyond that, concerns arise. If an interim leader is necessary, ensure clear communication about the timeline and the search process to keep investors informed.

Host an Investor Day or Strategy Update Webcast to Align the Street on Strategic Vision and Set the Stage for Value Creation

In our experience and research, strategy and capital allocation shifts are among the most critical areas requiring a timely yet thoughtful update. While these announcements shouldn’t be rushed, they must be communicated effectively. Within the first 12-18 months of a new executive’s tenure, it’s important to host an Investor Day to communicate the company’s direction — where it was, where it is, and where it is going — set financial targets, and outline the roadmap for value creation. This event offers an opportunity to present the updated strategic vision and long-term targets, highlight capital allocation priorities and growth initiatives, and introduce the leadership team in a structured, impactful way.

If hosting an Investor Day isn’t feasible in the recommended timeframe, consider hosting a shorter “Strategy Update” webcast. At the very least, leverage an earnings call to introduce key elements of the strategy. This is the least ideal platform given the noise and distraction surrounding earnings, which can work against companies announcing important, new information. While investors typically allow some flexibility during a leadership transition, transparent communication on strategy, long-term financial targets, and key changes are essential for setting the stage and building credibility through execution against what was said (i.e., “Say-Do”).

Conduct a Baseline Perception Study to Assess Current Playing Field and Expectations

A baseline perception study for new leadership is imperative in understanding investor expectations, garnering a fact-based view of current perceptions and sentiment, and helping to build a roadmap to maximize value and buy-in. Further, regularly conducting investor perception studies are a tried-and-true way of understanding evolving shareholder expectations. In fact, when asked as part of this analysis, 75% of the investment community express support for periodic perception studies.

In Closing

This week we commemorated 9/11, a day that we will never forget and a day, that no matter how many years pass by, is as clear as yesterday. As I shared with my team, let us not wait for another catastrophic tragedy to unite us. Let us do our part to stand together in love, respect, and faith in our country and each other.

- Spencer Stuart

- Russell Reynolds

- Survey timeframe: June – August 2024

- Source: Russell Reynolds CEO Turnover Index, Russell Reynolds CFO Turnover Index; Tracking began in 2018

- Deloitte

- Corbin Advisors offers training in this area through our Executive IR Immersion bootcamp and ongoing coaching