Investor Relations Strategy Benchmarking

In today’s thought leadership, we cover:

- Key Events this week

- Guidance Update, reflecting the growing number of companies lowering or withdrawing annual outlooks altogether

-

IR Strategy Benchmarking and goal development heading into 2022, including insights from 103 surveyed IROs

Key Events

COVID-19 Update

- More than 227M total COVID-19 cases are reported as of this morning, with more than 4.6M deaths worldwide (Source: John Hopkins); the U.S. is seeing about 151,000 new daily cases, on average, over the last 7 days

- More than 5.8B doses of the vaccines have been administered, including 54% of the U.S. being fully vaccinated, trailing more than 15 countries and led by Portugal (82%) and the United Arab Emirates (80%) (Source: World Data)

- FDA panel to weigh COVID-19 booster shots as health officials debate need; anything short of a full-throated endorsement could complicate the Biden administration’s plan to begin distributing extra shots next week to bolster immunity among the vaccinated and counter highly transmissible variants of the virus such as Delta (Source: WSJ)

- COVID-19 lockdowns in Asia deepen commodity supply-chain pain; Palm-oil plantations and coffee farms struggle with labor shortages and transportation curbs as cases surge; Prices for each of these commodities have risen to multiyear highs in recent months, adding costs that are being passed on to consumers. (Source: WSJ)

Key Economic Events

- U.S. jobless claims rose slightly last week but remained near a pandemic low, as layoffs stabilize amid an economic slowdown tied to rising coronavirus cases; initial unemployment claims rose to 332,000 last week from a pandemic low of 312,000 a week earlier, the Labor Department reported Thursday; the four-week moving average for claims, which smooths out weekly volatility, fell to 335,750, the lowest level since March 2020. (Source: WSJ)

- Consumer prices in August rose 5.3% from a year ago and 0.3% from July, the Labor Department reported Tuesday; the 5.3% annual increase still keeps inflation at its hottest level in about 13 years, though the August numbers indicate the pace may be abating (Source: CNBC)

Guidance Update

Supply chain disruption, inflation, and weather events have greatly impacted companies this quarter and a growing number have issued updated guidance or withdrawn previous guidance. Selected examples below:

- Ecolab (Specialty Chemicals – $64.0B): “[Due to Hurricane Ida], the company will see a short- term impact on EPS due to higher delivered product costs, temporary customer closures as well as temporary disruption at one of its major production facilities…While we are still assessing the situation and our corrective actions, we currently believe that the impact from Hurricane Ida will be close to the estimated $0.15 negative impact from the Texas freeze, with a significant impact in Q3.”

- PPG Industries (Specialty Chemicals – $35.6B): “Expect sales volumes in Q3’21 will be lower by $225M to $275M, compared to what the company anticipated at the start of Q3 [expected low-single digit]. Sales volumes are being impacted by the increasing disruptions in commodity supplies; further reductions in customer production due to certain parts shortages such as semi-conductor chips; and continuing logistics and transportation challenges in many regions…the company has elected to withdraw previously communicated financial guidance for Q3 and full-year 2021.”

- Sherwin-Williams (Specialty Chemicals – $78.5B): “Lowers Q3’21 consolidated net sales guidance to be up or down by a low-single digit percentage over Q3’20; Persistent and industry-wide raw material availability issues have not improved as anticipated, impacting our ability to fully meet the strong demand. Raw material availability negatively impacted consolidated sales by ~ 3.5% in our Q2, and we previously communicated that we anticipated less of an impact in the third quarter. We are now expecting raw material availability, including the unfavorable impact of Hurricane Ida, to negatively impact our third quarter consolidated sales by a high-single digit percentage; Full year 2021 consolidated net sales guidance remains unchanged.”

- The Timken Company (Industrials – $5.2B): “Expect lower sales and earnings in the second half of 2021, compared to the company’s prior expectations. Timken’s results are being impacted by unabating customer and supply chain disruptions and related manufacturing inefficiencies, as well as continued inflationary pressures across the enterprise. Given the unpredictability of the current environment, Timken is withdrawing its full year 2021 financial outlook, which was last updated on August 2, 2021.”

- Pactiv Evergreen (Packaging & Containers – $1.9B): “Revising the full fiscal year 2021 Adjusted EBITDA guidance to $550M [expected $630M – $645M]. The continued increase in raw materials costs…as well as increased transportation costs, has delayed our ability to recover these costs into 2022. Second, recent weather events including Tropical Storm Fred and resulting floods have slowed the recovery of operations at our mills…Third, the continuing labor shortage is expected to impact volumes by constraining the Company’s ability to increase production.”

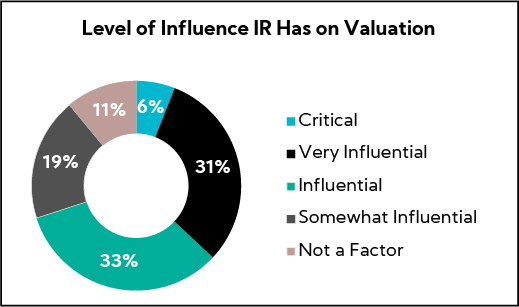

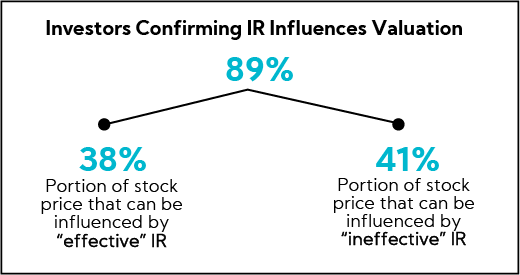

As many of you have heard us say before, determining a security’s valuation is a complex exercise based on multiple variables. According to our research, 89% of investors confirm investor relations is a critical valuation factor, and can influence share price by ~40%, on average – positively or negatively. IR is a team sport where the CEO and CFO set the tone, tenor, and level of transparency and investors attest there is no substitute for interacting directly with executive leadership.

Based on our proprietary research and more than 16,000 interviews conducted with the buy side, we characterize best-in-class IR as a top-down team effort providing:

- Forthright and robust communication, founded in a deep knowledge of the business, industry, and company financials

- A high level of transparency and disclosure, which includes relevant in-depth color and key metrics on the business and comprehensive educational communication materials

- Active investor engagement, with an emphasis on consistent, proactive marketing, including NDRs, sell side through conference participation, access to the C-suite and next-level management, and timely responsiveness to investors and analysts

- Effective expectations management, or what we consider the X Factor, including actively monitoring sell side estimates and buy side sentiment, and proactively addressing disconnects in a timely manner, using the appropriate channels

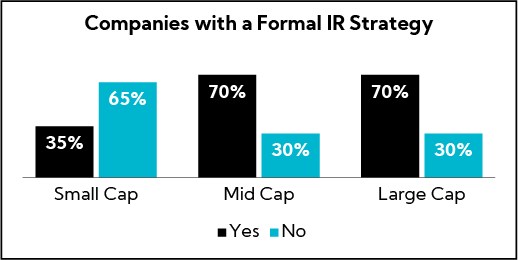

Key to driving a higher valuation is a deliberate and methodical approach to investor communication and engagement. What gets measured gets done, so companies must develop an IR strategy with specific goals and milestones. However, in a survey of 103 IROs globally across market caps and sectors, only 57% of companies report having a formal IR strategy in place, with small caps disparately impacting that percentage, though 3 out of every 10 mid- and large-cap company also do not have formal strategies.

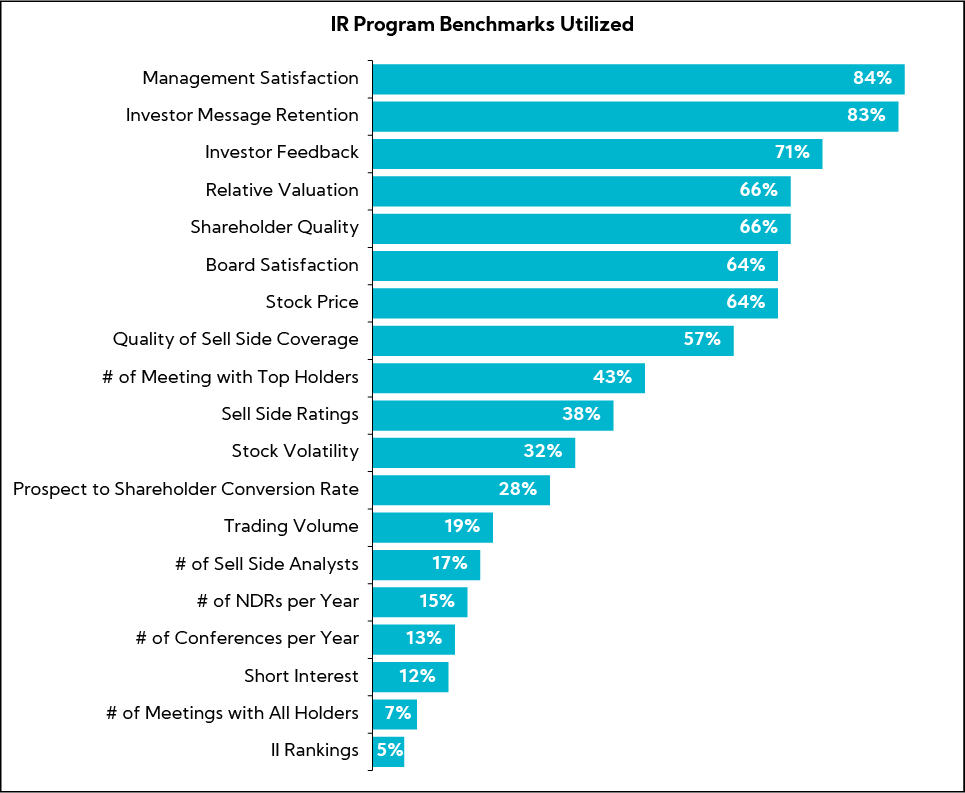

As we approach the fourth quarter, it’s the ideal time to begin developing the IR strategy for 2022 and beyond. According to our research, spanning well over a decade, companies with IR strategies utilize a series of subjective and objective measures to benchmark success, with the leading measures being:

- Management satisfaction

- Investor message retention

- Investor feedback

- Relative valuation

- Shareholder quality

Deepen Understanding of Your Investment Story via the Most Influential Communication Channels

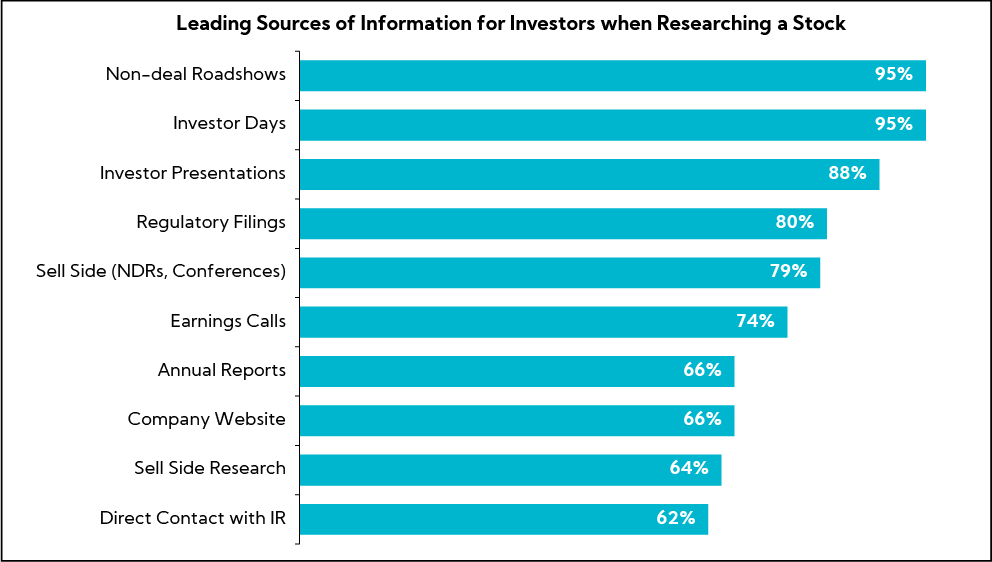

To drive management satisfaction and investor message retention (and ultimately a higher valuation), success starts with communicating through the channels most widely utilized by the investment community, anchored by non-deal roadshows, investor days/focused investor days and the investor presentation.

Non-deal Roadshows

Based on our research, management should spend more of their time participating in qualified non-deal roadshows than industry conferences, where they have the unique opportunity to meet with investors in a one-on-one setting. This is now a more efficient effort given the positive impact COVID has had on digital communication. Every meeting is an opportunity to influence an investor’s view and convert them into a shareholder (or bigger one). IR can play a critical role in cultivating high-fit prospective investors and ensuring current shareholders, both top and underweight, remain up to date on the investment story.

Investor Days

The investor day is the leading opportunity to broadly and deeply educate the financial community on the equity story and investment thesis, provide quality access to leadership, and set the narrative and expectations for the next several years. In a recent survey, 50% of investors note they are able to currently travel to in-person investor days, with 86% expecting to do so in 2022, though this is largely contingent on COVID-19 variants. While day-of attendance is important, the investor day webcast and presentation will become the leading source of information for investors globally over the months and years that follow. That said, it’s important that investor day presentations provide “101”- to “401”-level content, ensuring investors both new to and familiar with your story walk away with a better understanding of and increased conviction in the investment. According to our research, best practice is to host investor days biennially no matter the market-cap size.

- Mini Investor Days: With the environment rapidly changing, if your company hosted an investor day in 2021, consider hosting focused investor days (e.g., business segment, topical) in 2022 to ensure the investment community remains engaged and up to date. The most common drivers of focused investor days are for segments not well understood, viewed as non-core or a newer business with significant growth potential leveraged to favorable megatrends / tailwinds. We recommend hosting virtually, even once travel returns to a more normal state, complemented by virtual or in-person site tours, as appropriate, depending on the status of COVID-19.

Standalone Investor Presentation

The investor presentation is viewed by investors as a leading source of information, equal in importance to meeting with executives, and is also the leading driver of buy side traffic to the IR website. Indeed, the investor presentation is one of the most effective marketing tools and demand generators. Based on our experience of re-rating companies, one of our core demand generation tools is marketing with the presentation; some of our innovative concepts include thematic presentation, such as a focus on capital allocation, including framework, history, execution proof points, impact, and priorities.

Sell Side Conferences

While sell side conferences remain a critical platform, participation should be focused on the best and highest quality as measured by the most influential, presenting companies and buy side attendees. Within each industry, there are typically 4 to 6 must-attend conferences. Consider attending those occurring closer to quarter-end that provide a Reg-FD compliant platform to disseminate new information in the event you need to manage expectations.

Earnings Calls

The earnings call is one of the most powerful tools within a company’s investor communication toolbox to broadly and clearly disseminate essential information to the financial community. Four times a year, management should leverage this platform to demonstrate execution against the communicated plan, reinforce strategy, address knowledge gaps and misperceptions, and educate the financial community on company fundamentals. In the event operating performance falls short of expectations, the call – when executed well – can play a critical role in mitigating concern and rebuilding management credibility. This is also a key opportunity to provide increased exposure to the bench; for example, including business segment leaders in Q&A, which can serve as a useful alternative if in-person events remain challenged due to COVID-19

Digital Content

While not yet a primary investor source of information, with the increasing importance of digital presence amid COVID-19, we see opportunity for companies to develop educational videos that are placed on the homepage of the IR website and proactively disseminated as part of a larger annual IR marketing strategy that reinforce strategy, strengths and competitive advantages, culture, and other key elements of the investment thesis.

Social Media

LinkedIn is another increasingly influential channel we have championed as an impactful way to communicate with investors and analysts, among ither key constituents. Whether it’s company or C-suite leadership representation, linking in with key constituents and publishing content that reinforces the equity brand story and investment thesis deepens understanding, influences sentiment, and increases engagement.

Communicate Effectively to a Targeted Financial Audience

Key to achieving a premium valuation is a deliberate, research-driven approach to investor engagement that focuses on identifying qualified targets (i.e., underweight shareholders and prospects with significant purchase potential) and cultivating relationships.

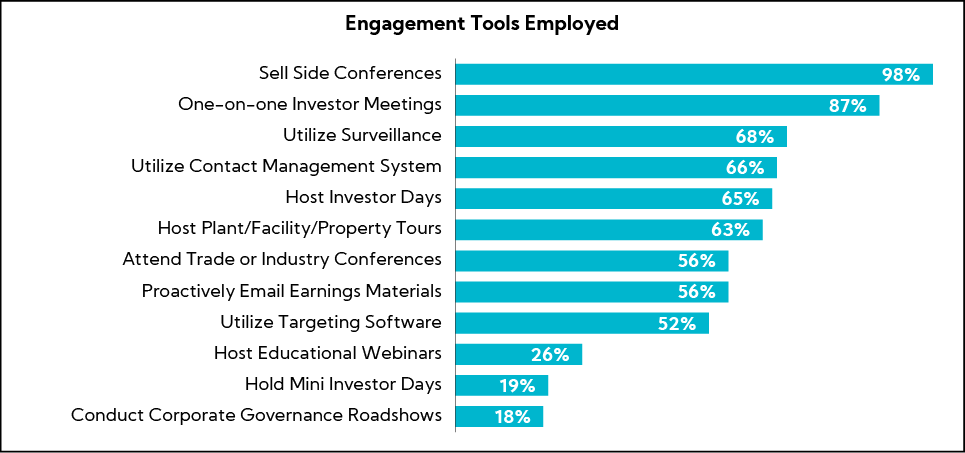

As noted, while companies must continue to engage with the most influential sell side analysts, we recommend emphasizing non-deal roadshows and proactive one-on-one engagement. Efforts should focus on maintaining and strengthening the top 30 active and passive relationships and identifying an additional 20 priority underweight and prospective investors.

According to our ongoing IR research, only 23% of companies across market caps report having a formal targeting strategy, while nearly two-thirds report relying on the sell side, indicating significant opportunity to develop an internal approach to cultivating shareholders.

Moreover, nearly 100% of companies attend sell side conferences, save for a few early-stage biotechs and, while nearly 9 out of every 10 companies are hosting one-on-one investor meetings, our research indicates many are relying on the sell side, resulting in frustrated executives with lower-quality conversations. Finally, our findings reveal that most companies are not leveraging high-impact valuation rerating tools, including educational webinars and mini investor days.

As our research finds 37% of investors, we speak with do not leverage the sell side for corporate access, up from 22% in 2015, this places the onus on IR to proactively target investors that align with the trajectory of the company. We recommend:

- Execute a formal investor targeting analysis to identify high-fit underweight and prospective investors based on position, purchasing power, peer holdings, and investment history; proactively reach out or leverage a third-party to identify appropriates contacts

- Develop a marketing strategy with clear initiatives to generate demand and specific time-stamped goals

- Follow-up with both high-priority underweight shareholders and prospective investors post-earnings and ask if they would like to set up time to address any questions they may have; periodically check in as to remain top of mind

- Prioritize and follow-up with high priority prospective investors who exhibit a genuine interest in on a quarterly basis; provide reasonable one-on-one access to management and ensure they remain current on the investment story

- “Get out on the road” (virtual or otherwise)

In Closing

As investors continue to drink out of the proverbial fire hydrant – on average, they are responsible for 45 core portfolio holdings while concurrently researching another 55 investment opportunities that fundamentally fit their firm and/or fund investment criteria – 2022 IR strategies amid an uncertain environment must be developed to “cut through the noise” and position your differentiated investment story, tied to clear goals and benchmarks.