ESG Update

This week, our Thought Leadership is geared towards keeping you apprised of a key ESG development, as well as build on previous communications relating to our recommendation to develop ESG into a competitive advantage and ensure institutional investors are educated on your program – where you are currently and where you plan to go.

ESG Announcement

This past Friday, five framework and standard-setting institutions announced a partnership to “work towards a comprehensive [ESG] reporting system.” These five institutions – CDP, Climate Disclosure Standards Board (CDSB), Global Reporting Initiative (GRI), International Integrated Reporting Council (IIRC) and Sustainability Accounting Standards Board (SASB) (and backed by the Impact Management Project, World Economic Forum and Deloitte) – announced this collaboration with intent to provide:

- Joint market guidance on how frameworks and standards can be applied in a complementary and additive way

- A joint vision of how these elements could complement financial generally accepted accounting principles (Financial GAAP) and serve as a natural starting point for progress towards a more coherent, comprehensive corporate reporting system

- A joint commitment to drive toward this goal, through an ongoing program of deeper collaboration, and a stated willingness to engage closely with other interested stakeholders.

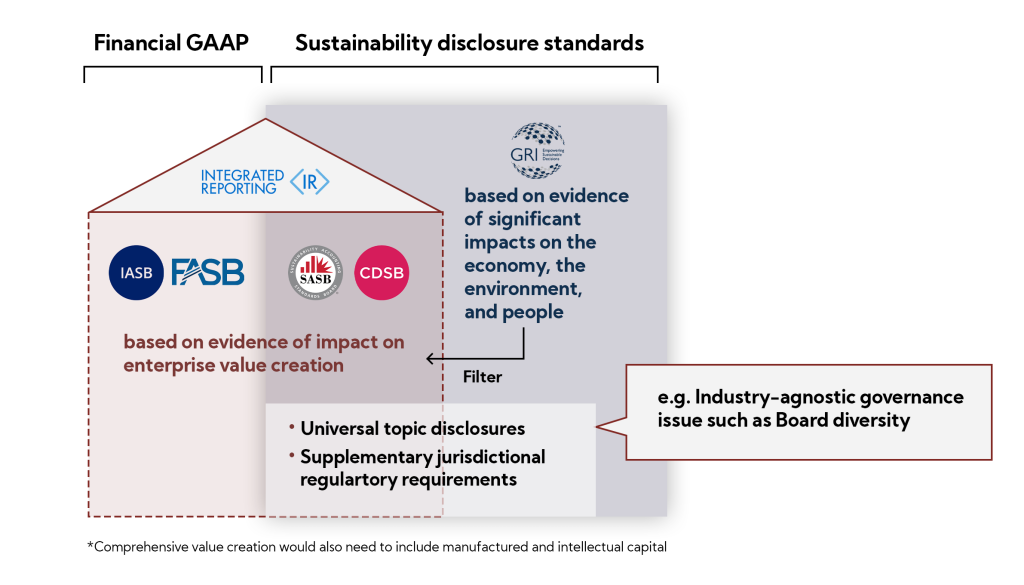

Together, these institutions have two objectives:

- Establish a globally agreed set of sustainability topics and related disclosure requirements, based on evidence of demand among various stakeholders for a disclosure solution

- Apply a filter that identifies, from the agreed set of sustainability topics and their related disclosure requirements, those topics which are reasonably likely to affect a typical company’s financial condition (e.g., its balance sheet), operating performance (e.g., its income statement) or risk profile (e.g., its market valuation and cost of capital) in different industries

The resulting standards would enable companies to collect information about performance on a given sustainability topic once but provide relevant information to different users through appropriate communication channels (e.g., sustainability reports, annual integrated reports, websites).

According to their statement, sustainability disclosure that is material for enterprise value creation should ideally be disclosed along with information that is already reflected in the annual financial accounts. It is therefore highly desirable for all these relevant standards to be housed under one roof (see Figure below). This would connect sustainability disclosure standards focused on enterprise value creation to Financial GAAP, with integrated reporting as the conceptual framework linking such sustainability disclosures and Financial GAAP.

This is a significant leap forward for an industry that has shown limited connectivity. According to our proprietary research, nearly 50% of investors note that lack of a standard is the most significant ESG-related frustration. Having conducted research with over 650 institutional investors globally on ESG in the last three years, and with 47% now considering ESG Very Important to Critical to their investment thesis, up from less than one-third in 2018, this step will be critical to addressing stakeholder needs heading into 2021 and beyond.

While some of the benefits of this coalition-driven move are evident, there remains a lot that is unknown, including to what level disclosure by corporates will be required. To be clear, the trend is moving in that direction, and will continue to be supported by asset managers globally, as they seek greater company-by-company standardization. The spotlight on corporate ESG efforts will continue to grow, potentially creating an environment where companies late to the game or in denial will be materially impacted from a valuation perspective.

ESG is the most dynamic and steadfast capital markets megatrend we have seen in recent years and we encourage our clients to continue to drive progress on this front and, equally important, ensure the work you are doing is well understood and appreciated by investors and analysts. ESG is not easy. It’s a complex structure and the playing field continues to evolve and change.

Remember that investors who factor ESG into their investment decisions, a growing number as we’ve reported, are looking for progress, not perfection.

We continue to work with clients on developing their ESG communication. In support of greater understanding and buy-in, there should be consistent and clear updates every quarter. Baseline communication is developing content-rich slides in your investor presentation that expounds upon this critical corporate initiative while best practice is creating a standalone ESG-dedicated presentation.

As we have noted in the past, nearly 60% of institutional investors report only reading a company Sustainability Report sometimes. With investors identifying the investor presentation as the most meaningful source of information, equal to meeting with management, the ESG-dedicated presentation aims to present information in an easy-to-digest and highly preferred format, ensuring investors walk away with a strong understanding of company focus areas, execution progress and goals.

We have deep experience in this area and are here to support value creation. Please reach out with questions.