Economic Landscape Update & Earnings Q&A Prep

Following this week’s U.S. Fed rate increase of 75 basis points and the UK central bank raising interest rates to a 14-year high, while at the same time predicting its economy shrank for the second consecutive quarter, this week we’re talking the following relevant topics:

Pre-announcements Trends

Two weeks ago, we published our thought leadership on pre-announcement considerations and best practices, and since then we have seen a continued uptick in such announcements due to continued slowing demand and ongoing macro uncertainty. To monitor trends, we analyzed companies >$1B in market cap across sectors and identified at least 15 companies that have issued a formal pre-announcement or business update in the month of September.

Key Findings

Of the 15 companies that issued formal pre-announcements, 73% lowered at least one metric, while the remainder largely reaffirmed guidance

- 45% lowered EBIT/EBITDA, 36% revenue, 36% EPS, and 18% FCF

- Top sectors issuing pre-announcements include Basic Materials (40%), Consumer Discretionary (20%), Consumer Staples (20%), and Industrials (13%)

- Top factors cited include decelerating demand – particularly in Europe and Asia (53%), inflationary pressures (47%), supply chain disruption (33%), inventory management (20%), operational issues (20%), energy costs in Europe (13%), shifts in consumer behavior (13%), COVID-19 lockdowns in China (7%), and FX headwinds (7%)

In these pre-announcements, a consistent theme communicated was company-driven actions to offset pressures, including:

- Efficiency/optimization programs

- Managing and monitoring discretionary and overhead spending

- Actions to improve working capital

- Adjusting demand forecast and supply plans

Cost Cutting Measures

Company Layoffs

Over the last several months, expense management has become a more prominent theme and, with that, an increasing number of layoff announcements – both company-issued and originated by media.

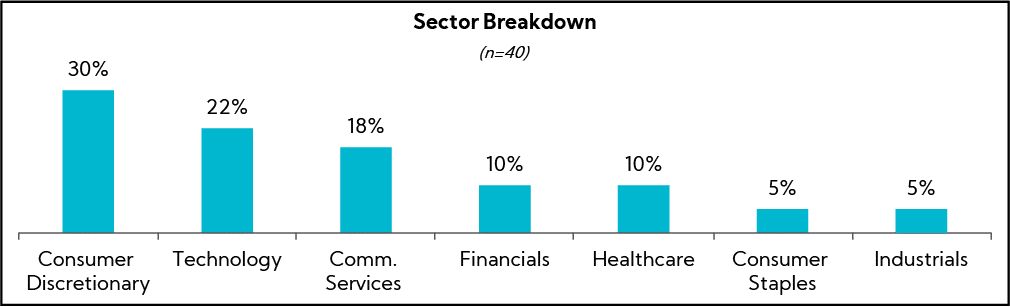

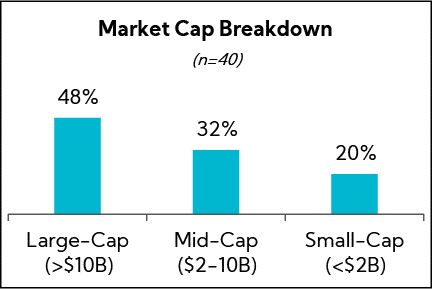

We identified and analyzed 40 companies >$500M that have reported layoffs since the beginning of August. Among these companies, 63% are laying off up to 5% of their workforce, and 17% above 15%.

Most reports have come from the Consumer Discretionary (30%), Technology (22%), and Communication Services (18%) sectors, particularly among large-cap companies.

Breakdown of the Companies that Disclosed the Number of Layoffs

| % of Workforce | % of Companies |

|---|---|

| <1% | 40% |

| 1-5% | 23% |

| 6-10% | 10% |

| 11-15% | 10% |

| >15% | 17% |

Source: Corbin Advisors

Selected Quotes

“Our team is too large for the environment we are now in, and unfortunately, we need to adjust. I take responsibility for the impact this decision will have on the nearly 900 Wayfairians who will be told today they are no longer a part of building our company’s future. Broadly, the changes we’re making fall into three categories: 1) thinning out management layers to enable team members to focus on execution, 2) aligning our work better with our strategic priorities, and 3) adjusting areas that have simply grown faster than our current revenue trajectory can support. We looked carefully at each decision.” Letter from Wayfair CEO to employees

“We’ve made the extremely difficult decision to restructure and reduce Twilio’s workforce by approximately 11% – teammates and friends who helped build Twilio. I’m not going to sugarcoat things. A layoff is the last thing we want to do, but I believe it’s wise and necessary. Twilio has grown at an astonishing rate over the past couple years. It was too fast, and without enough focus on our most important company priorities. I take responsibility for those decisions, as well as the difficult decision to do this layoff.” Letter from Twilio CEO to employees

“As we tackle all aspects of costs – from materials to those related to quality – we are informing some Ford teammates this week in the U.S., Canada and at FBS in India, that their positions are being eliminated. Overall, we are reducing our salaried workforce by about 2,000, as well as reducing agency personnel by about 1,000. These actions follow significant restructuring in Ford operations outside of North America over the past couple of years. We worked differently than in the past, examining each team’s shifting work statement connected to our Ford+ plan. We are eliminating work, as well as reorganizing and simplifying functions throughout the business. You will hear more specifics from the leaders of your area of the business later this week.” Memo from Ford Executive Chair and CEO to employees

“Unfortunately, given our current lower rate of revenue growth, it has become clear that we must reduce our cost structure to avoid incurring significant ongoing losses. While we have built substantial capital reserves and have made extensive efforts to avoid reductions in the size of our team by reducing spend in other areas, we must now face the consequences of our lower revenue growth and adapt to the market environment. As a result, we have made the difficult decision to reduce the size of our team by approximately 20%. The scale of these changes vary from team to team, depending upon the level of prioritization and investment needed to execute against our strategic priorities. The extent of this reduction should substantially reduce the risk of ever having to do this again, while balancing our desire to invest in our long-term future and reaccelerate our revenue growth.” Memo from Snap Inc. CEO to employees

Setting the Stage

With announcements of this ilk filling the airwaves, we turn our attention to the impact these will have on earnings and specifically Q&A on calls. According to our proprietary research, 90% of investors report the earnings call is an important or very important communication channel driving investment decisions. While prepared remarks are critical in influencing investor sentiment, the Q&A portion, particularly in times of greater economic uncertainty, can have even greater impact on perception of management and related credibility.

By employing a balanced, non-defensive, and helpful tone, showcasing a strong command of data and key business drivers, and providing clear and crisp responses that highlight strategy and opportunity, even in the face of slowing growth, executives can differentiate their investment brand.

Q&A Preparation

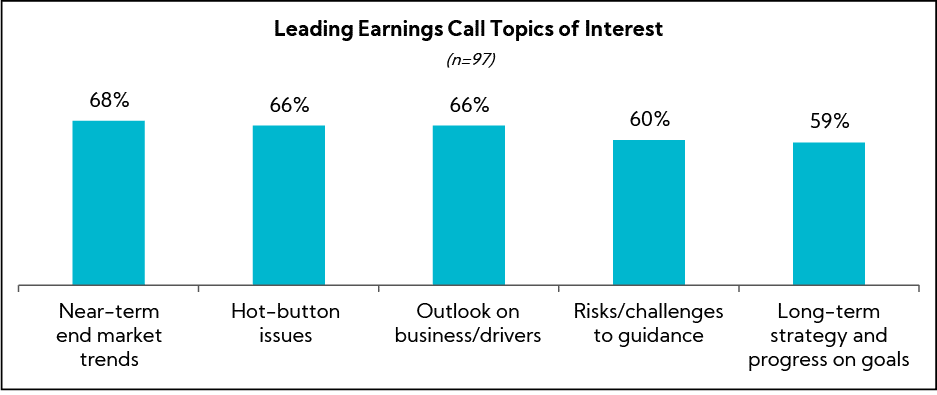

Important to note, the top factors investors are interested in hearing about during earnings calls regardless of the environment are around near-term end market trends, hot button issues (e.g., inflation, cost-cutting) and segment/business outlooks. As such, we expect a high number of questions this quarter around these key components.

An early read on our Q3’22 Inside The Buy-Side® Earnings Primer, which we will publish on October 13, sees the top hot-button issues to address as:

- Revenue trends, including FX impact

- Margins and impact of inflation

- Inventory dynamics

- Capital spending plans for balance of year and 2023

- Labor and anticipation of layoffs

Selected Q&A Best Practices

Be open and transparent

Investors are looking for companies, who have greater visibility into businesses and end markets, to help them understand what’s happening. The investment community always appreciates transparency but particularly in times of greater uncertainty, which helps to build management trust and credibility; focus on “what you know” and what is within your control.

Leverage Q&A to control the narrative

Do not simply answer questions but rather communicate messages and leave investors with confidence no matter the situation; for example, if inflation is having a significant impact, discuss key actions to offset, including continued price increases, or a downturn playbook. Avoid using throwaway phrases like, “It’s anybody’s guess what will happen” or “We just don’t know the impact.” Even if it’s true, memorializing it injects unnecessary uncertainty and often results in an analyst feeding frenzy of follow-up questions (AKA catch the falling knife syndrome)

Balance CEO / CFO participation and include additional leadership

As we noted in last week’s piece on bench strength, include relevant senior leadership outside the C-suite who can provide helpful granularity thereby injecting greater confidence that the company “has its arms around it”; this can be particularly helpful during time when investors are laser focused on execution and operations.

Tie responses back to the long-term strategy

While analyst questions typically focus on the next quarter and/or year and are generally founded in concern, assuage short-term fears by reinforcing company positioning and actions taken, as appropriate, while also reframing responses to underscore execution against long-term strategy and targets (if published).

Refrain from introducing new, critical information in Q&A

If you know the hot-button issues in advance, incorporate into prepared remarks versus waiting to address during Q&A. Messaging is often more comprehensive and complete when framed by the speaker whereas responding in the moment often results in key points being left unsaid or said in a way that is not as crisp. Proactively anticipating questions by addressing them upfront also builds credibility as it demonstrates management has its finger on the pulse.

Avoid repeating negative language

If you repeat negative language from the question asked in your response, then it becomes part of your narrative and is memorialized in the published transcript. Seek to neutralize radioactive questions by constructively reframing responses.

Stay constructive

Rather than simply answering “no” or “we’re not going to provide that”, which can be perceived as defensive, bridge the question to an area that helps the analyst and investors’ understanding. Always remain collegial and helpful, even amid negatively charged or derisive questioning.