Virtual Investor Day

At the onset of COVID-19, we recommended several research-based and best practice strategies to effectively engage with the financial community to build management credibility – we worked with many of you to develop and publish COVID-19 Business Update press releases and presentations. While the choice of “if” and “when” to communicate was a case-by-case situation given uncertainty at the time, we quickly shifted to a consistent and proactive communication strategy with investors through the summer months, encouraging clients to leverage and embrace the virtual platforms at their disposal – non-deal roadshows, sell side conferences, investor presentations and thematic presentations – to position themselves to investors as compelling and differentiated investments.

Recently, we’ve seen a recent step change in the number of companies seeking to hold virtual investor days in the final months of 2020 and early 2021, with many conversations centering around, “What does a best-in-class investor day now look like?”, “What should be the focus given the accelerated timeframe?” and “How do I keep investors engaged virtually?”

Our clients rely on us for research-based advice to inform decisions and, as such, we analyzed 30 virtual investor days across 10 sectors ranging from $130M to $82B in market cap from March through September to provide rich insights and support our recommendations.

Analysis

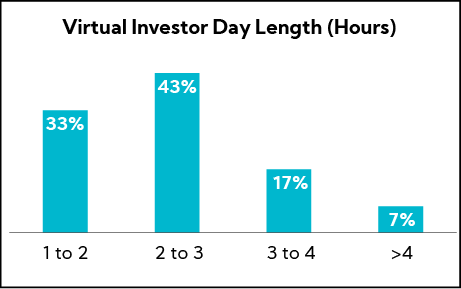

Over the past six months, we’ve seen that not all investor days are created equal, ranging from ~1 hour in length, including fireside chats and segment-dedicated presentations, to more robust presentations reaching 3 to 4 hours that provide a deep view of strategy, competitive advantages and customer testimonials.

The Following is an Overview of the Different Approaches We’ve Observed:

1-2 Hours

- Fireside chats

- Strategy and financial review only

- Dedicated to one segment or business focus area

- Typically led by CEO, CFO and 1-2 additional leaders (e.g., SVP of R&D)

2-3 Hours

- More robust presentation with instances of customer testimonial and/or product demo

- Generally, including either business segment overviews or key business advantages / new focus areas (e.g., innovation, marketing, HR)

- Led by CEO and CFO and typically included other C-suite and/or business presidents

>3 Hours

- Very robust presentation and generally included multiple Q&A sessions, as well as product demo and / or videos

- Addressed business segments / focus area and provided deep dives into key competitive advantages

- Typically included 6-8 presenters, emphasizing bench strength

Based on our primary analysis, we have identified the following themes from Virtual Investor Days:

Key Quick Facts

Average Length

2.5 Hours

Live Prepared Remarks

70%

Live Video for Q&A

67%

Speaker Visuals and Slides

57%

Use of Q&A Box to Submit Questions

70%

Educational Videos

43%

Client Testimonials / Fireside Chats

27%

Product Showcase

17%

Prepared Remarks and Presentation

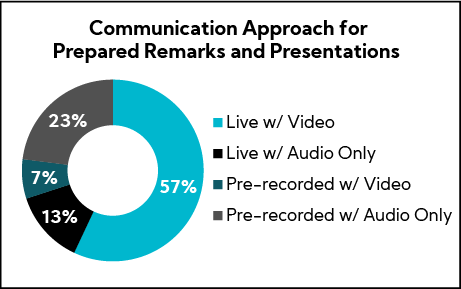

- 70% of companies held a live call, the overwhelming majority of which leveraged video, compared to 30% that pre-recorded

- Nearly 45% held an event that was 2 to 3 hours in length, while nearly one-quarter were >3 hours

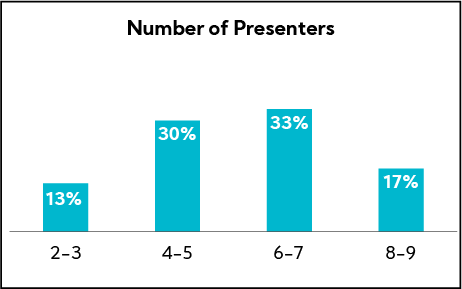

- 87% included at least 4 speakers, while half had 6 or more; those that utilized only 2 to 3 speakers largely focused on corporate strategy (CEO) and financial strategy (CFO) and held the event over a 1- to 2-hour timeframe

- 57% provided long-term financial performance targets, nearly one-third of which gave 3-year targets, one-quarter 5-year targets and the remainder no timeframe

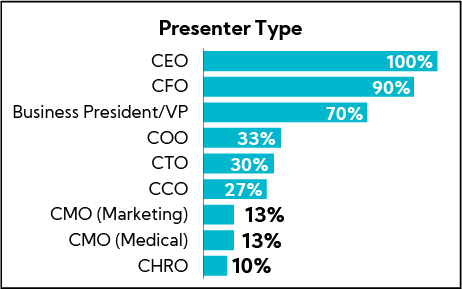

- In addition to the CEO and CFO, 70% included leadership outside the C-suite, typically a business segment or product head; ~30% included the Chief Technology Officer and / or Chief Commercial Officer, while slightly more than 10% had a Chief Marketing Officer or Chief Human Resources Officer present

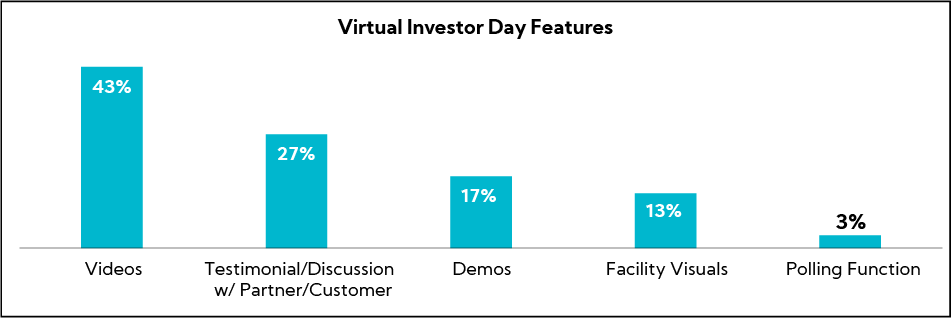

- The most common features utilized were videos (e.g., to describe the company’s purpose or showcase the culture), followed by customer / partner testimonials and product demos

Q&A

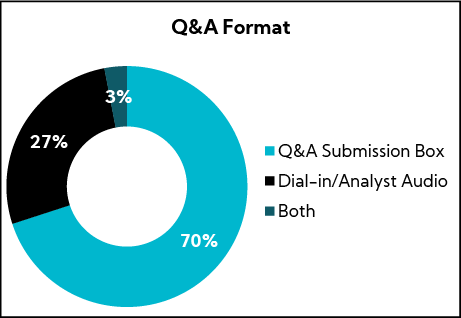

- 70% of companies provided a submission box for questions, while less than 30% utilized dial-in / analyst audio

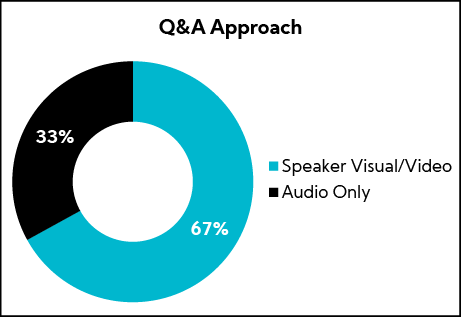

- Similarly, two-thirds provided video visuals of company speakers during the Q&A portion of the call

Prior to the COVID-19 pandemic, our proprietary research found 94% of investors and analysts viewed investor days as a valuable use of their time, when successfully executed. In our ongoing survey of 50 investors and analysts during the COVID-19 period, 100% believe virtual investor days are a good use of their time, again with the caveat they are executed well.

Our ongoing research and deep experience with investor days further supports our view that investor days are an even more critical communication channel now, as investors look for opportunities to which to commit capital. Indeed, investors in our ongoing survey universally encourage companies to communicate their long-term strategy and key initiatives, while 83% seek an update on the medium-term outlook and 60% encourage participation from next-level management.

These events continue to be best practice and yield significant return on investment in that they:

- Are the best channel to educate investors deeply and broadly, resulting in an improved understanding and more compelling view of the company as an investment

- Provide access to different levels of management, which is critical to greater investor buy-in

- Serve as a forcing function internally in that the process leads to crystallized strategy and messaging, and increased management alignment on key initiatives

- Create a reinforcing set of materials rich in content with a relatively long shelf life

Based on our experience executing close to 100 investor days, as well as ongoing conversations with the buy side, we continue to believe that the Investor Day – whether virtual or in-person – is the leading opportunity to broadly and deeply educate the financial community on the company story and investment thesis, provide quality access to leadership and set the narrative and expectations for the next 2-3 years. For us, the question is not how much content to “cut out” but rather, how we deliver the same level of impact in a way that best utilizes the platforms at our disposal while maintaining investor attention. And while day-of attendance is important, the Investor Day Video and Presentation will be even more critical post-event – it will become the leading source of information for both shareholders and prospective investors in the near- and mid-term.

The objective of an investor day – to inform, educate and reinforce “why you should invest now” – does not change whether we are in-person or virtual but, we need to think outside the box. Just two of our many ideas include:

- Posting and distributing a separate “101” presentation ahead of the event that baselines all investors and gives you the opportunity to focus on strategic content on the day of the event

- Including all content in the full Investor Day presentation but focusing your time on the slides / messages you want to convey while very quickly highlighting baseline content (e.g., 30 seconds) important for new-to-the-company investors

In any scenario, it’s important that Investor Day Presentations (or supplementals) provide “101” to “401” level content, ensuring investors both new to and familiar with the company walk away with a better understanding of and increased conviction in the investment – knowledge is power.

The following are best practice considerations:

Event Logistics and Tactics

Start Time and Length

- Hold the event in a time range that is most appropriate for your company; there is no one-size-fits-all approach and sometimes, less is not more

- The internal benefit of management alignment and message crystallization plus the after-the-fact opportunity of attracting investors to the story with rich content is more important than squeezing into a certain time window, in our view; there are many creative ways to produce an event that maintains investor attention

- Start early or late morning; surveyed investors are split on early and late morning timing, while none prefer the afternoon

Approach and Features

- For maximum uptake, live stream a video of the presenters and presentation; presenters can be pre-taped, allowing for a highly polished delivery and removing the inherent stress associated with going live (if you want it to look seamless, make sure you dress the same on the day of event, as Q&A will be live)

- Incorporate a live facility tour (e.g., client center, technology center, factory, science lab), which can reinforce competitive advantage and serve as a nice break between presentations; 80% of investors in our survey are open to real-time demos

- Conduct several Q&A sessions at appropriate points in the presentation flow; these should be well-organized and rehearsed, both from a technology execution and message delivery standpoint

- Include next-level leadership (C-suite outside of CEO and CFO, business segment leaders) with speaking roles; 50% of investors are keen on broader access despite being virtual

- Schedule individual meetings with the buy-side as a follow-up to the event to provide the access they would normally receive during the registration / breakfast period, breaks and at lunch; this is a “Corbin First” recommendation and 60% of investors we surveyed on this innovative concept affirm this is Very Important

Presentation and Delivery

Pre-event

- Conduct primary investor research (i.e., perception study) ahead of the event to ensure message alignment with targeted audience; this is a best practice in our experience

- Hold up to two virtual dry-run sessions in advance and a formal dress rehearsal the day prior; practice Q&A to ensure you message versus simply answer questions

Content

- Develop a clear investment thesis supported by key messages; reiterate themes throughout the presentation

- Tell your story – where you were, where you are and where you’re going

- Ensure long-term strategy is a consistent theme (i.e., corporate, business segment and financial); 100% of surveyed investors still consider long-term strategy a Very Important component of Investor Days

- Emphasize content over graphics: the deck must stand on its own without management voiceover; 71% of investors prefer content-rich slides versus graphic / image-rich slides

- Consider providing updated long-term financial performance targets; surveyed investors still prefer 3-year targets, and we agree based on our research and company-related experiences

In Closing

Over our nearly 14-year history, we have developed a deep expertise in buy side sentiment and behavior, as well as factors that impact valuation through our primary research encompassing over 14,000 interviews with investors and analysts and deep experience working with hundreds of companies. We specialize in investment thesis positioning and helping clients realize their value. And, we’ve built a track record of executing best-in-class investor days, resulting in sustained re-ratings.

As always, we hope you find our primary research, data-driven insights and thought leadership helpful and inspirational. Thank you for your time and continued partnership over the years.