Guidance

This week’s communication focuses on a hot topic and one which we’ve already had a lot of client dialogue – guidance! As is our practice, we’re conducting two surveys and primary research to continue to provide data-driven and insights-based counsel. Specifically, we have:

- Surveyed 81 investors and analysts on their preference and expectations for 2021 guidance – for companies entering Fiscal Year 2021 this quarter and those that will report Full Year 2021 early next year

- Surveyed 59 IROs across market caps and sectors on their initial expectations for 2021 guidance

- Analyzed 25 companies >$1B in market cap that have reported Q4 and Fiscal Year 2020 earnings in the last two months to identify initial 2021 guidance trends

Setting the Stage

A Quick Recap of Q1 and Q2

Leading up to and during Q1 earnings amid the COVID pandemic, 48% of the S&P 500 withdrew formal annual and/or quarterly guidance, led by Consumer Discretionary (93%), Industrials (77%) and Materials (73%). We then saw a step change in the level and type of guidance provided, as many companies began communicating monthly and, in some cases, weekly sales trends. This increased level of transparency during the crisis was encouraged by the SEC, which urged companies to provide a meaningful level of disclosure in lieu of traditional guidance. Furthermore, many companies outlined scenario analyses to assist investors in better understanding the potential range of outcomes, as well as more effectively manage expectations – an uncommon but best practice communication strategy we have encouraged our clients to employ as early as 2010 in the aftermath of the Great Recession.

As organizations acted with agility in Q2 to control the controllable, and visibility into the impact of COVID-19 became clearer for some, the number of companies maintaining withdrawn formal guidance decreased from 48% to 35% in Q2. Of the 175 S&P 500 companies that have yet to reinstate traditional guidance for 2020, most fall into the Consumer Discretionary (75%), REIT (52%), Material (47%) and Industrial (44%) sectors.

Investor Preferences and Expectations

As we noted in our “Close to the Quarter” communique in May, guidance has been a hot-button issue in recent years, garnering extensive media coverage in 2018 and 2019 as the Business Roundtable and its renowned leaders, Warren Buffett and Jamie Dimon, called to stop quarterly guidance, arguing companies should “be managed for long-term prosperity, not to meet the latest forecast.” In 2020, COVID led to an entirely different scenario, as many companies pivoted from annual to quarterly guides in the face of limited visibility and continued uncertainty.

With organizations announcing Q4 and full year results facing the dilemma of what to do about guidance now and the vast majority of companies thinking ahead to next quarter, where they will be faced with the same question, we surveyed 81 investors and analysts on their preference and expectations for 2021 guidance.

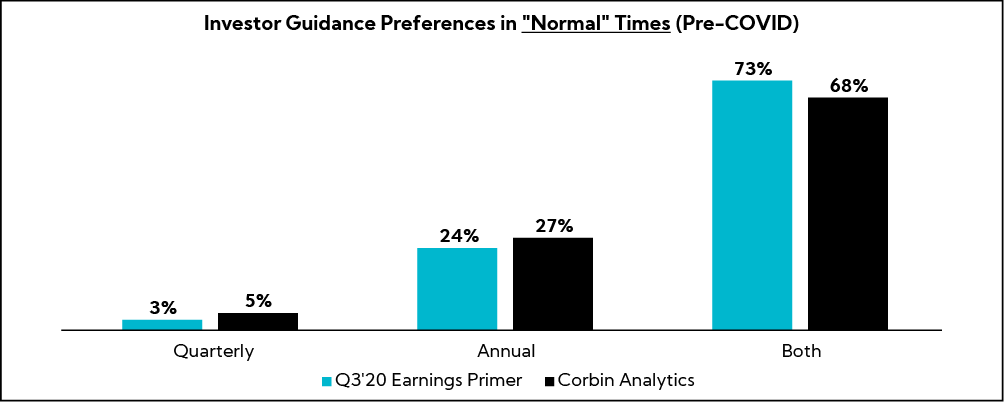

To baseline preferences, we polled investors on their preferred guidance cadence in “normal” times (i.e., pre-COVID). Notably, ~70% favor both quarterly and annual guidance, in line with our historical averages.

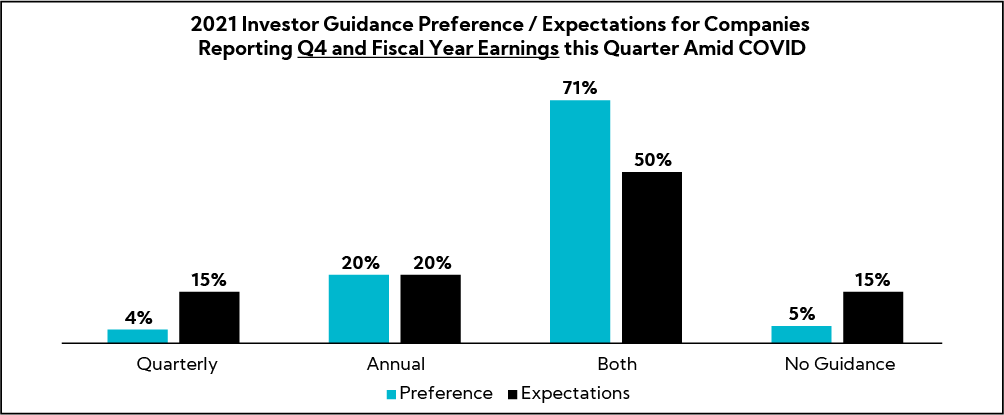

For companies reporting fourth quarter and fiscal year 2020 earnings this quarter, investors again prefer both quarterly and annual guidance. Recognizing that some will not revert to historical guidance practices, 15% of investors expect companies to either give quarterly only or provide no formal guidance at all.

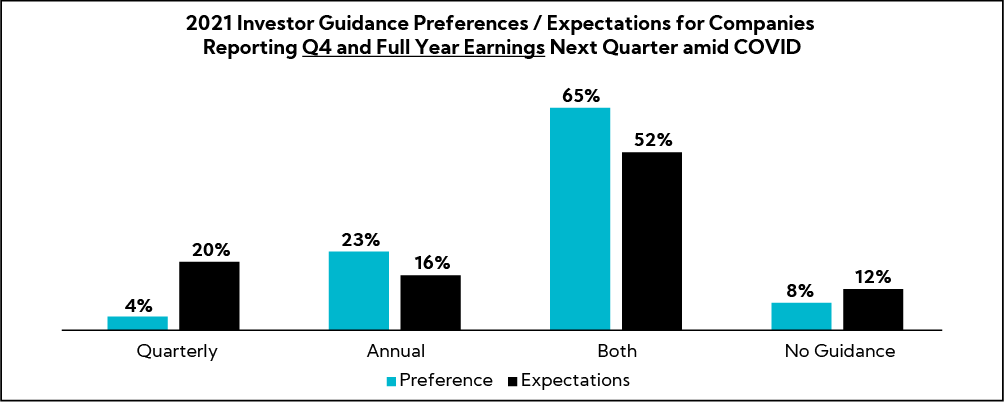

Similarly, for companies reporting fourth quarter and full year 2020 earnings next quarter, investors largely prefer, and more than half expect, companies to provide both quarterly and annual guidance. Notably, 20% expect companies to issue quarterly guidance only (compared to 4% preference).

IRO Expectations

To assess company and investor alignment, we surveyed 59 IROs across sectors and market caps (25% small cap, 44% mid-cap and 31% large cap) on their expected course of action around issuing guidance.

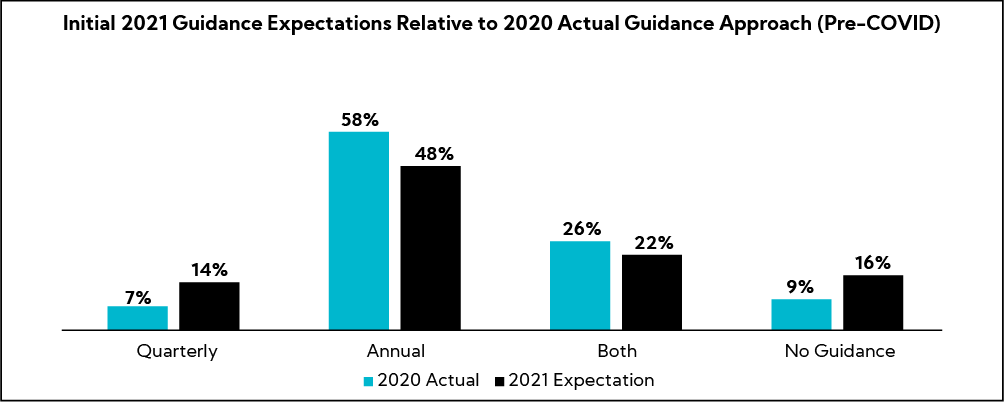

- Looking at pre-COVID practices, 58% report their companies issued annual only guidance, 7% quarterly only and 22% both quarterly and annual

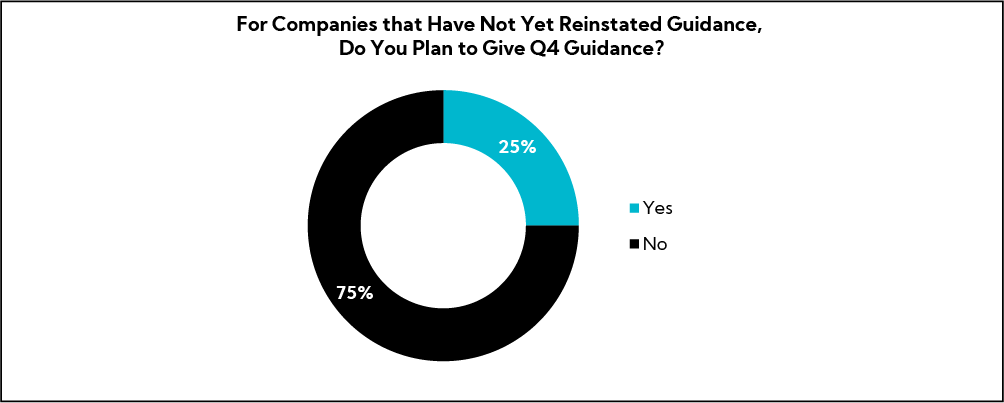

- For companies that have not yet reinstated guidance this year, 75% of surveyed IROs do not plan to issue quarterly (Q4) guidance

- Turning to full year 2021 outlooks, 48% believe their companies will provide annual guidance (compared to 58% last year), while 14% believe they will give quarterly only (compared to 7%) and 16% will provide no formal guidance (compared to 9%)

- Going a level deeper, for companies that gave annual guidance only in 2020, 78% believe they will follow the same practice for 2021, while only 14% (primarily industrial and tech companies) do not expect to give guidance next year

- For companies that issued quarterly and annual guidance in 2020, 64% expect to give both in 2021, while 18% expect to give just quarterly and 9% no guidance at all

- All companies that gave quarterly guidance historically affirm they expect to maintain this practice

- “Luckily, we have time to decide.”

- “Too early to decide.”

- “Still a bit uncertain. Looking at our historical guidance and taking this as an opportunity to change going forward.”

- “We will only give items that are not market dependent, like effective tax rate.”

- “If things remain as uncertain as they’ve been, may not issue annual.”

- “Won’t reinstate annual guidance until restaurant industry recovers.”

- “We will provide annual guidance for 2021 (consistent with historical practice). We may also give quarterly guidance (which we did not do pre-COVID but started in April 2020).”

- “We did not yet issue FY21 guidance (which began August 1), but will monitor market trends and plan to reissue as more companies go back to guidance.”

- “Our preference is to provide annual guidance for 2021 but we need more visibility before making that decision.”

- “We typically provide annual guidance. It was suspended in 1Q and I don’t foresee us reinstating until we get to December, when we provide an outlook into 2021.”

- “Historically, we only provided annual guidance; since April, we have continued to give annual guidance and added quarterly. We are baffled by the decision of so many companies to suspend guidance rather than provide more information than usual.”

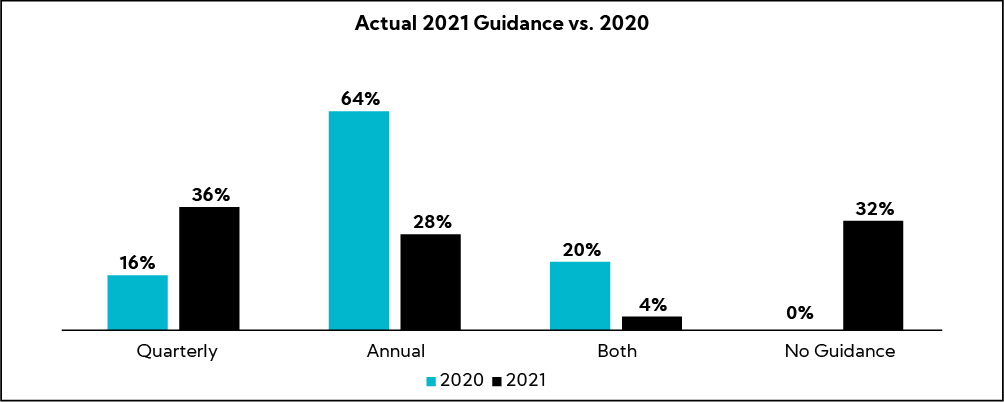

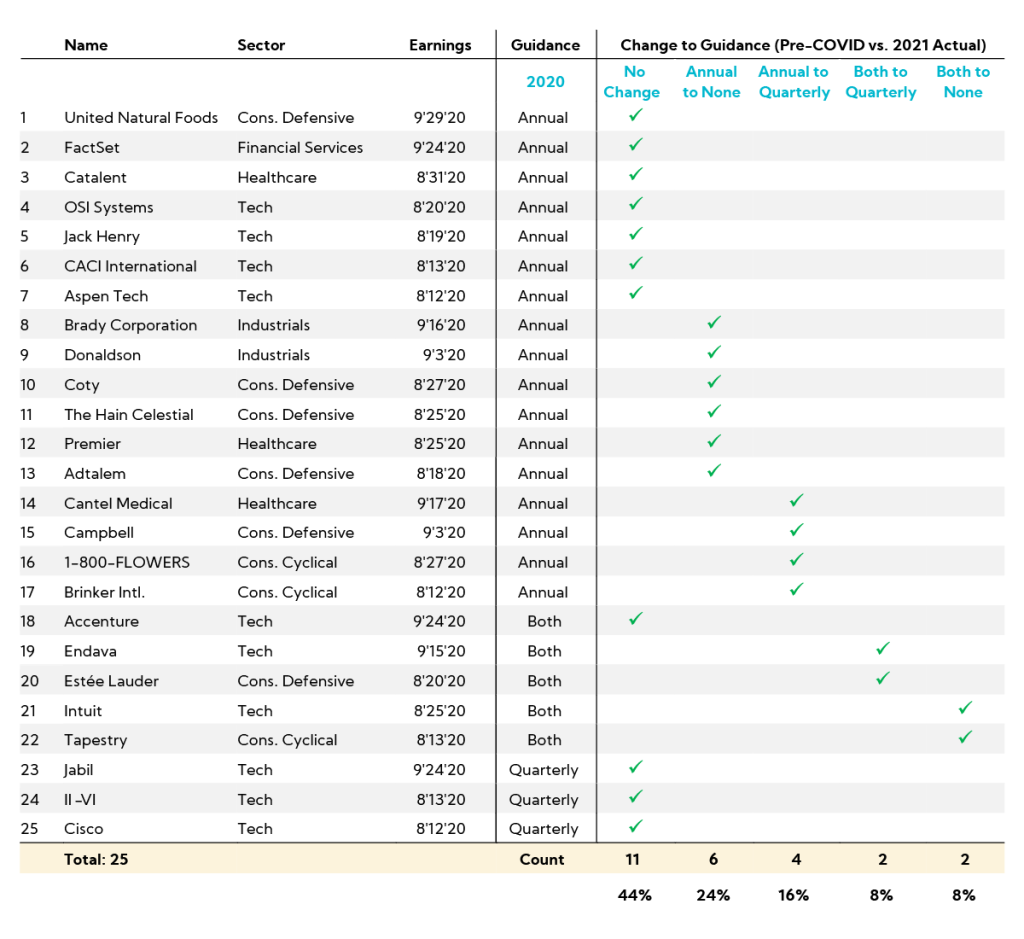

Recognizing timing and the broader macro backdrop plays heavily into upcoming guidance decisions, we analyzed 25 companies >$1B in market cap that have reported fourth quarter and fiscal year 2020 earnings in August or September to unearth early trends. Importantly, this group is heavily weighted toward Tech (40%) and Consumer Staples (24%) sectors, which have a relatively higher number of companies with fiscal year reporting cycles.

For 2020, 64% of the group issued annual guidance only pre-COVID but amid significant uncertainty, fewer than 30% have given annual guidance for fiscal year 2021, while 36% issued quarterly guidance compared to just 16% in 2020. Nearly one- third are not providing formal guidance for 2021, though these companies have increased the level of qualitative transparency around demand and sales expectations, specifically cadence, timing, year-over-year comparisons and end market trends.

Research Scope

“We are also mindful of the risk of a global recession and a likely slow recovery in employment as some businesses in Western markets remain closed and many government support measures taper off. Therefore, we are not providing explicit sales and EPS guidance for the full year. However, we can provide you with some underlying assumptions to help at least frame some of your expectations for the year.”

“We do expect to see progressive quarterly sales and profit improvement as retail doors reopen and traffic and travel gradually resumes, assuming no significant second wave occurs. Given this expectation, for the first half of the fiscal year, comparisons to our record performance in the prior first half will be difficult with sales and profit below prior year levels. While online is expected to perform strongly, the momentum for recovery in brick-and-mortar and travel retail will not be realized until later in the second half.”

“Conversely, we expect sales and profit to grow significantly in the second half of the year against a period of considerable COVID impacts, particularly in the fourth quarter. The inclusion of 6 months of incremental sales from the acquisition of Dr. Jart+ should add about 1 to 2 percentage points to sales growth for the fiscal year. Pricing is expected to add another 2 points of growth.”

“Our manufacturing capacity is back to near normal levels, and we expect our gross margin to recover accordingly. We expect to realize the full benefit from Leading Beauty Forward in fiscal 2021, and we will continue to maintain some of the COVID-19 cost controls as we progress through the first half of the year. These savings are expected to give us the flexibility to invest more in digital marketing and advertising to support innovation, recruit new consumers and drive brand awareness while also supporting our operating margin recovery.”

“As we look to fiscal 2021, the continuing effect of COVID-19 creates a volatile operating environment, making it difficult to provide a full year outlook at this time with sufficient certainty. However, I will provide some context as to how we view fiscal 2021 and how that view informs our first quarter fiscal 2021 guidance.”

“First off, while we operate in an uncertain environment, we will continue to focus on strong execution, which includes the continued investment and support of our brands, execution within the supply chain to meet the demand, and a continued focus on cost savings. More specifically, based on what we know now, we expect cost inflation within our supply chain to largely be offset by the continued productivity savings across the network. Additionally, we will continue to focus on our overall cost savings program, which includes enterprise- and value capture-related cost savings initiatives.”

“From a demand perspective, based on the current environment, we expect demand to remain elevated during the first half, although moderating from Q4 fiscal 2020, given a continued but decelerating tailwind from COVID-19 and the fact that many COVID-19-impacted products, like soup, have larger comparable bases as we head into the fall and winter.”

“Although we are making steady progress, the continued pressure to fully meet demand and full inventory replenishment within our supply chain will likely moderate the full upside in the first half. We also expect continued COVID-19-related costs, but at a moderated level compared to the fourth quarter as we improve efficiency and more effectively plan the business.”

“Moving on to the second half of fiscal 2021, and assuming a transition to a more normal environment, we will be lapping the significant pantry-load and onetime effect that COVID-19 had on our business in the second half of fiscal 2020. We are making every effort to mitigate that impact by retaining new households, sustaining consumer behaviors and new product innovation. Nonetheless, we do expect net sales to decline given the significant onetime nature of last year’s growth. In the back half of fiscal 2021, as we lap this past year’s COVID-19-related costs, we expect to have opportunity, although we expect those gains are not likely to fully offset the impact from volume declines.”

“In terms of our financial position, we feel good about where we ended the year. Our leverage ratio was 0.9x net debt to EBITDA. And in the fourth quarter, we paid off a term loan for $50 million, and we reduced borrowings on our revolver by $110 million. We proactively drew from our revolver in the early days of the pandemic as a way to bolster our liquidity out of an abundance of caution. While markets still are uncertain, we are confident in our current position and no longer feel the need for that extra layer of security. Receivables were down meaningfully from the prior year, which is what we expect in this environment. Inventory was also down, but we plan further improvements this year as we focus on leveling with demand. Our fourth quarter and full year 2020 cash conversion rates increased meaningfully to 165% and 103%, respectively, and we plan to exceed 100% again this year. Our fiscal ’21 assumptions for sales are directionally consistent with recent trends. Sales are expected to vary widely by geography and market, and sales of our replacement parts and products for new markets should continue to outperform the company average. Additionally, we expect sales during the first half of ’21 will be down versus the prior year due to the timing of when the pandemic began. We are seeing these sales trends play out in August, which we expect will be down about 10% from the prior year. Total sales for the month will also be down from July, but that’s typical seasonality.”

“Regional trends in August matched what we saw in the fourth quarter. Sales in the APAC region are performing the best versus the prior year, led by growth in China. Europe is faring better, due, in part, to currency, while the U.S. and Latin America remain under the most pressure. And as expected, we have pockets of relative strength from some of our more stable businesses, including Engine Aftermarket and Process Filtration, which are both up in Europe, while new equipment remains under more pressure.”

“In terms of fiscal ’21 gross margin, benefits from product mix and lower raw material costs should lessen as we compare against strong tailwinds in the prior year. At the same time, we will execute our optimization projects to position ourselves for long-term increases in gross margin. Our fiscal ’21 operating expenses will also have some puts and takes. Resetting our annual incentive compensation plan generates a headwind of about $13 million, and we are planning to make further investments in our strategic growth businesses and technology development. We plan to substantially offset these increases by controlling expenses, which will likely see some benefits from pandemic-related restrictions and comparing against a higher level of spend in the first half of the prior year. Should we see an opportunity that makes sense, we will also explore additional optimization initiatives.”

“Turning now to our outlook for fiscal year 2021. We operate in an environment that is in need of greater digital capabilities and differentiating solutions, which presents numerous opportunities for FactSet. For that reason and given the solid progress we have already made, we remain confident in our strategy of investing in content and technology and in our ability to drive growth with our clients and to operate efficiently. The current environment also gives us less visibility due to pandemic, economic and political factors that may well have an impact on our clients’ budgets for next year. Therefore, we remain cautious as we start our new fiscal year.”

“As Phil mentioned and as you can see in our press release from this morning, we expect ASV plus professional services for the year to increase between $55 million and $85 million over fiscal 2020. The remaining metrics listed on this slide all stem from our ASV ranges and reflect our planned investments. We will continue to execute at the same pace in content and technology, as outlined last September.”

“We believe momentum in our businesses from fiscal 2020 will carry us into fiscal 2021 with a number of tailwinds, including the strength in our analytics business as clients add our front-office solutions, performance and risk and APls to their workflows as well as continuing demand for our core data feeds and wealth tools. Additionally, we expect high client retention to continue and will serve as a solid base for research, buoyed by the continued demand for expanded content coverage in deep sector and private markets.”

“As highlighted earlier in the year, I want to give you some details of the external factors we think may impact our top line growth for 2021. First, delays in decision-making could cause longer sales cycles. While we built a strong pipeline and converted it with solid execution in 2020, we did experience situations in which larger and more complex deals required additional reviews, lengthening the time to close, especially in this virtual environment. We expect this may continue in 2021. Second, client budgets may tighten. The majority of our clients will finalize their 2021 budgets towards the end of this calendar year. Depending on the speed of a vaccine and economic recovery, clients may be cautious in their outlook and reduce or delay their spend. And third, a prolonged pandemic and virtual environment may slow new business growth. The strength of our sales force and our value proposition converted into key wins this year, proving that we can sell virtually. However, as pandemic-related uncertainty blunts decision-making, we acknowledge that clients may take longer to switch providers, and it may take more time to build new relationships virtually.”

While early indications reveal the majority of investors expect companies to return to historical guidance practices, and most IROs believe the same, many caveat that the situation remains fluid and “nothing is set in stone.”

For companies that have recently reported their fourth quarter and provided a view into 2021, only 44% have reinstated or maintained historical guidance practices. Indeed, careful consideration must be given to upcoming annual guidance communications with visibility, confidence in forecasting and broader trends just some of the determining factors.

Based on interviews with more than 14,000 investors, we’ve identified a correlation between transparency and management credibility, with credibility being the hallmark of best-in-class management. Our proprietary research confirms companies recognized by investors for providing greater levels of transparency are generally considered more credible. Furthermore, our research maintains expectations management is the X Factor in shareholder value creation, in that best-in-class management teams consistently demonstrate an ability to appropriately control the narrative and under promise and over deliver.

Leveraging deep research-based insights and experience, we have extensive expertise in guidance setting and strategy, as well as a track record in helping companies effectively manage expectations. Each company operates on a unique playing field with different dynamics. When it comes to guidance, there is no one-size-fits-all. The goal is always to provide the ideal level of transparency to effectively manage expectations and limit surprises (especially negative ones) all the while building management credibility quarter after quarter and year after year.