This Week in Earnings – Q3'24

The Sector Beat: Industirals

It’s been a nose-to-the-grindstone kind of week as earnings season rolls on in this choppy environment.

In today’s thought leadership, we cover:

- Key Events this week

- Earnings Snap, covering the S&P 500 stats to date

- Selected Insights from our 38th issue of Inside The Buy-Side® Industrial Sentiment Survey®, published last week

- Spotlight on Industrials in The Sector Beat

Key Events

Purchasing Managers’ Index (PMI)

- S&P Global flash U.S. Composite PMI rose to 54.3 for October month from a final reading of 54.0 in September. A reading above 50 indicates expansion in the private sector. Flash manufacturing PMI edged up 0.5 points MoM to 47.8, slightly ahead of 47.6 consensus, though in contraction territory for third-straight month. Flash services PMI came in at 55.3, up 0.1 MoM and better than consensus for 55.1, driven by largest rise in new business since April 2022. (Source: S&P Global)

Jobless Claims

- Initial claims for state unemployment benefits dropped 15,000 to a seasonally adjusted 227,000 for the week ended Oct. 19, below consensus for 242,000. Continuing claims rose 28,000 to a seasonally adjusted 1.897M during the week ending Oct. 12, above 1.878M consensus and highest level since November 2021. (Source: Labor Department)

Housing

- Existing-home sales in September fell 1% MoM to a seasonally adjusted annual rate of 3.84M, the lowest monthly rate since October 2010. On a YoY basis, home sales were down 3.5%. Economists polled by Reuters had forecast home resales would be unchanged at a rate of 3.86M units. (Source: National Association of Realtors)

- New home sales rose 4.1% MoM to a seasonally adjusted annual rate of 738K units last month, the highest level since May 2023. August was revised down to 709K units from a previously reported 716K units. (Source: Commerce Department’s Census Bureau)

Interest Rates

- The Bank of Canada cut rates by 50 bps on Wednesday, as widely expected, taking its policy rate to 3.75%. The decision follows three consecutive 25 bp rate cuts at the central bank’s prior meetings. Governor Macklem stated that “with inflation back to 2%, we want to see growth strengthen”, adding that “today’s interest rate decision should contribute to a pickup in demand.” (Source: Bank of Canada)

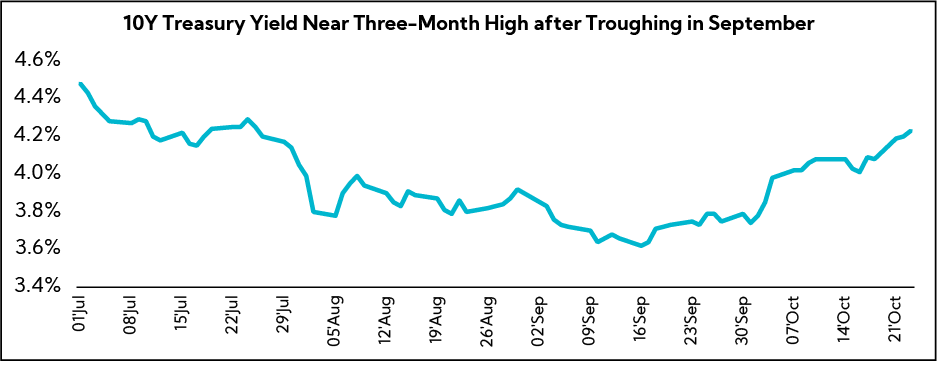

U.S. Treasury Yields

- 10-year Treasury yields reached their highest level in three months this week, briefly topping 4.2% and now having climbed ~60 bps since mid-September. Notably, rates troughed on Sep. 16, two days before the Fed kicked off its easing cycle with a 50 bp rate cut. The upward pressure on yields comes as market participants contend with the view that the Fed may be more cautious with the pace of rate cuts given recently solid economic data. In addition, the coming U.S. election, and related policy implications, has put renewed focus on the government’s mounting fiscal deficit. (Source: CNBC)

S&P 500 Earnings Snap

32% of the S&P 500 has reported earnings to date

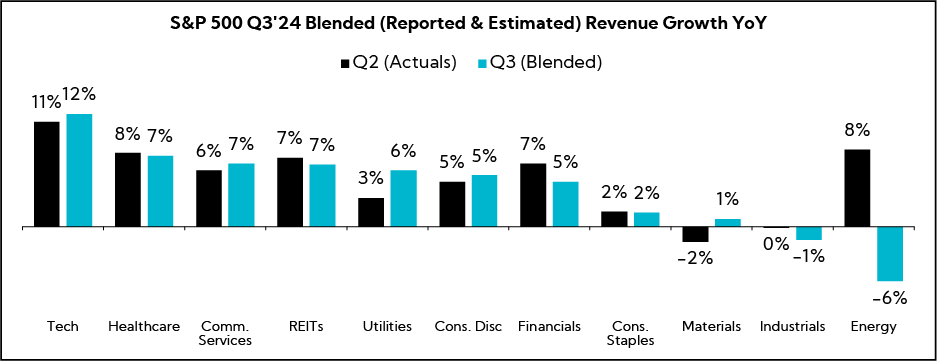

Q3'24 Revenue Performance

- 58% have reported a positive revenue surprise, below the 1-year average (63%) and the 5-year average (69%)

- Blended revenue growth (combines actual reported results for companies and estimated results for companies yet to report) is 4.2%; this compares to 5.5% on Oct. 1st

- Companies are reporting revenue 1.3% above consensus estimates, above the 1-year average (+1.1%) and below the 5-year average (+2.0%)

Q3’24 EPS Performance

- 79% have reported a positive EPS surprise, above the 1-year average (78%) and the 5-year average (77%)

- Blended earnings growth (combines actual reported results for companies and estimated results for companies yet to report) is 4.3%; this compares to 13.2% on Oct. 1st

- Companies are reporting earnings 6.0% above consensus estimates, below the 1-year average (+6.5%) and the 5-year average (+8.6%)

Selected Insights

Inside The Buy-Side® Q3’24 Industrial Sentiment Survey®

Following last quarter’s survey, which found a pullback in sentiment toward a more neutral stance, this quarter’s Industrial Sentiment Survey® reveals diverging views but with a notable increase in bears, as more investors brace for misses and lower top- and bottom-line guides.

However, hope springs eternal for 2025, supported by the view that we are largely past destocking and amid expectations for short-cycle order rates to accelerate over the next six months, along with Global PMI and Global Capex post-U.S. election.

Based on responses from 50 sector-dedicated participants globally, from August 19 to September 30, 2024, comprising 73% buy side and 27% sell side, and equity assets under management totaling ~$2.6T, including ~$334 billion invested in Industrials.

Mixed Sentiment Overall but with a Notable Increase in Bears, as More Investors Brace for Misses and Lower Top / Bottom Line Guides

- 40% characterize their sentiment as Bullish or Neutral to Bullish, up from 31% last quarter, while those reporting downbeat views increased to 30% from 22%, the highest level of bearishness captured since Jun. 2023

- Upbeat investors highlight government stimulus, reshoring, and the potential for short-cycle recovery in industrial demand, while skeptics believe stimulus benefits are over-estimated and not enough to offset a weak economy and political uncertainty

- Similarly, while 27% describe executive tone as Bullish or Neutral to Bullish, up from 16% QoQ, 35% characterize this group as Neutral to Bearish or Bearish, up from 21%

- More, 44%, anticipate Q3’24 earnings results to be Worse Than consensus, the highest level captured in three years; 39% expect In Line performances

- Regarding Q3 KPIs, more expect stronger YoY Revenue and FCF prints, while EPS sees a notable step down in confidence and Margins are anticipated to remain intact

- More than 50% are bracing for companies to lower annual Revenue and EPS guides

- Top areas to address on earnings calls include Demand/Order Rates, Margins/Pricing, Capital Allocation, and Labor Trends

Margins and Balance Sheet Strength Remain En Vogue as Industrial Weakness Persists Albeit at Lower Perceived Levels

- 64% report seeing broad-based industrial weakness at this time, down meaningfully from 94% last quarter, but still above the recent low of 47% registered in Q1’24

- Investors are nearly evenly divided on whether 2024 Industrial Organic Growth will be Higher, In Line, or Lower than in 2023

- 46% express More Concern with demand levels, down from 63% QoQ

- 61% prioritize margins over growth at this time, up from 48% last quarter, and the highest level registered in a year

- 42% report instances of companies continuing to pass on cost / increase price at the same level, down QoQ and meaningfully lower than the 76% captured in Q1’24

- Additionally, cost-cutting is observed at higher levels

- Debt Paydown jumps to the second-preferred cash usage, rising to 50% from 32% QoQ, while M&A recedes to 25% from 51%, as challenging-to-read demand trends weigh on near-term optimism

Hope on the Horizon amid Expectations for Global Capex to Strengthen Post-U.S. Election; Investors Report Net Buying

- 69% believe we have moved past destocking, up from 57% QoQ, though 82% report they are not seeing “what if” China tariff-induced restocking

- Looking ahead, 67% expect short-cycle order rates to Accelerate over the next six months, up from 33%

- Reinvestment remains the preferred use of cash, with 54% in support of increasing growth capex, up from 23%

- ~50% expect Global PMI and Global Capex to Improve over the next six months, but with 85% noting the U.S. Presidential election is delaying and/or negatively impacting larger capex projects

- Broadly bullish sentiment exists across nearly all industries, led by Defense, Building Products and Distribution; Water and Commercial Aero the only industries to see an increase in bears

- 50% report being Net Buyers and none are Net Sellers

- Government Policy, Reshoring/Nearshoring, and Robotics/Automation seen as compelling themes, while pure plays remain favored over conglomerates

- 76% consider mid-caps compelling followed by small-caps at 54%, compared with only 18% and 24% for large- and mega-caps, respectively

- AI not yet seen as a meaningful industrial theme, though 54% report seeing some level of adoption across their universe

The Sector Beat: Industrials

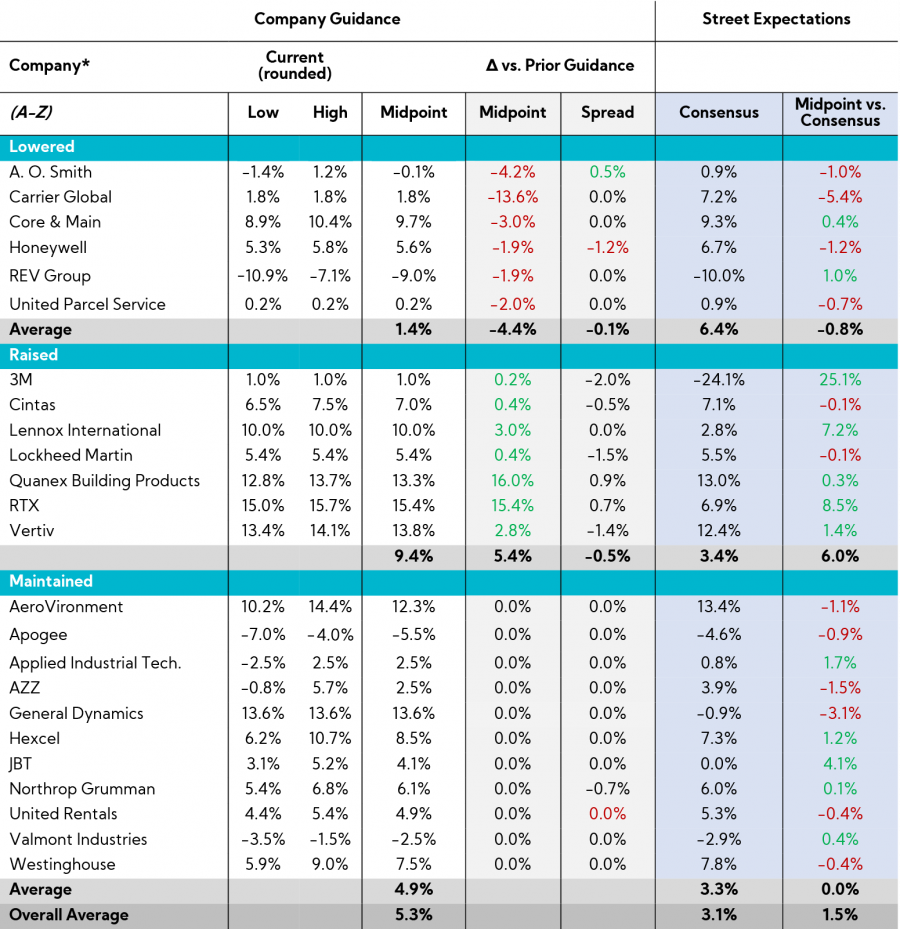

Guidance Trends

Each quarter, we analyze annual revenue and EPS guidance provided by Industrial companies with market caps greater than $1B that have reported to date.1 Below are our findings.

For comparison purposes, we provide an “All-Company” benchmark, which tracks in real-time a basket of companies larger than $1B in market cap across all sectors that have reported earnings to date (n = 170).

Guidance Breakdown by Industry

| Industry | Number of Companies |

|---|---|

| Aerospace & Defense | 6 |

| Building Products | 6 |

| Commercial Services & Supplies | 5 |

| Machinery | 4 |

| Trading Companies & Distributors | 4 |

| Passenger Airlines | 3 |

| Air Freight & Logistics | 2 |

| Industrial Conglomerates | 2 |

| Professional Services | 1 |

| Construction & Engineering | 1 |

| Electrical Equipment | 1 |

| Total | 35 |

Source: Corbin Advisors

Revenue Guidance

To date, nearly half of Industrials Maintained revenue guidance, slightly better than expected compared to the Industrial Sentiment Survey®, where more than half of investors expected Lowered revenue guidance. Still, similar to the All Company benchmark, there is a split in those raising or lowering outlooks. The majority of companies raising revenue guidance to date came from the Defense industry, or are leveraged to favorable secular trends (e.g., AI, energy transition).

Industrial Revenue Guidance

- Companies that lowered guidance (n = 6)

- 100% lowered the top and bottom of the original range

- Average midpoint of 1.4% growth versus 5.8% last quarter

- Average spread decreased by 10 bps to 1.4%

- Companies that maintained guidance (n = 11)

- Average midpoint of 9% growth

- Average spread of 0%

- Companies that raised guidance (n = 7)

- 71% raised the bottom and top of the original range

- 29% provided a single increased midpoint from the original range

- Average midpoint of 9.4% growth versus 4.0% last quarter

- Average spread decreased by 50 bps to 0.5%

- Overall midpoints assume 5.3% annual growth vs. 3.8% analyst estimates, on average

Annual Revenue Guidance Summary

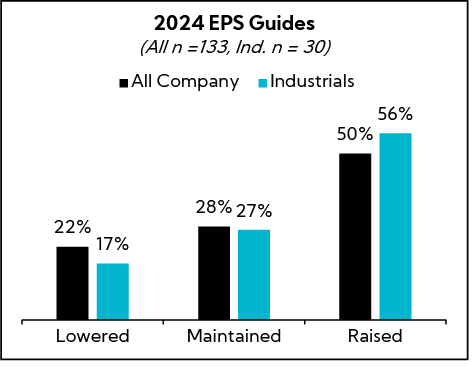

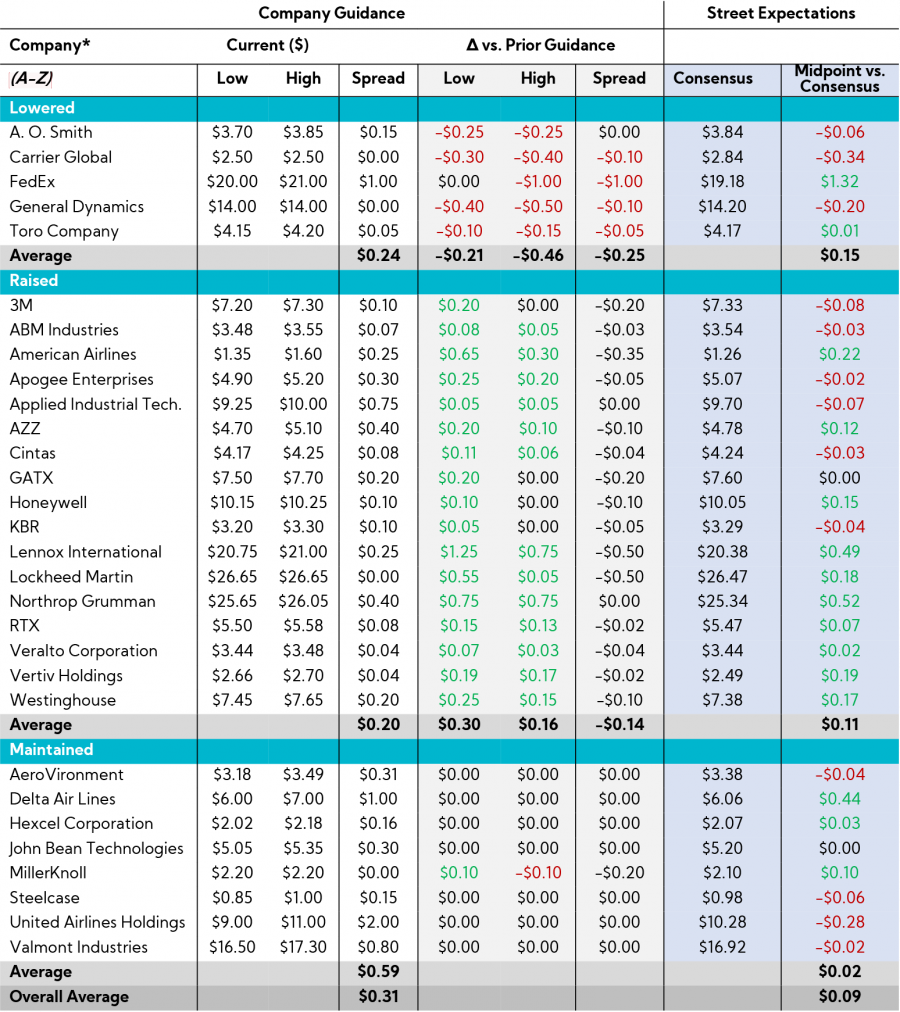

EPS Guidance

The majority of Industrial companies raised EPS guides, slightly above the broader All Company benchmark. Overall, those raising EPS guidance point to increased confidence in full-year outlooks following strong Q3 results driven by operational efficiency. Other factors cited include tax rate improvement, lower interest expense, acquisition/integration benefits, and reduced share count after buybacks.

Industrial EPS Guidance

- Companies that lowered guidance (n = 5)

- 80% lowered the top and bottom of the original range

- One company lowered the top and maintained the bottom

- Average spread decreased from $0.49 to $0.24

- Companies that raised guidance (n = 17)

- 76% raised the top and bottom of the original range

- 24% maintained the top and raised the bottom of the original range

- Average spread decreased from $0.33 to $0.20

- Companies that maintained guidance (n = 8)

- Average spread of $0.59; excluding airlines, the average spread is $0.29

Annual Adj. EPS Guidance Summary

Earnings Call Analysis

We also analyzed the earnings calls for this group and the broader Industrial universe to identify key themes.

While performances have varied from company to company, EPS beats for the roughly 45% of S&P 500 Industrials that have reported Q3 figures have so far come in at a healthy clip — 65% have topped consensus. That said, this trails the overall EPS beat rate for the S&P 500, which stands at 79%, with only Consumer Discretionary beating EPS estimates at a lower pace. Further, top-line results have tilted more towards misses, with 54% reporting Q3 revenue below consensus versus the broader index average of 43%.

As noted, while fewer Industrials are lowering annual revenue and EPS guidance than expected, executive tone is decidedly mixed depending on the industry and business trends. Government spending (infrastructure/defense) and other secular tailwinds (such as AI-driven demand, energy transition) continue to contribute to optimism on one hand, while subdued commentary elsewhere as a result of macro uncertainty, sluggish end markets, and a cautious consumer continue to weigh on sentiment on the other. What is certain, however, is that despite these challenges, many were able to deliver positive results through strategic initiatives, cost management, and operational efficiencies. “Outgrowth” and “outpacing soft industry growth” were commonly referenced, as executives tout above market strength in execution despite a soft top-line environment.

Companies across Aerospace & Defense, which contributed heavily toward the group of companies raising guidance, point to robust demand and record backlogs, but burgeoning concerns about future results due to the potential impact of the Boeing factory workers strike on the supply chain is starting to give some pause. While most in the group delivered another beat-and-raise outcome, the heightened uncertainty led at least one company (Hexcel) withdrawing previously issued mid-term guidance, and others implementing furloughs (Spirit AeroSystems). Similarly, while airline execs point to strong travel demand and an increasingly favorable capacity backdrop, some have tempered growth outlooks for 2025 given the likelihood they will not be receiving the aircraft they had planned for next year.

Meanwhile, the transportation group remains mired in a longer-than-expected freight recession, but with some signs of bottoming and cautious optimism for an eventual rebound in demand. At the same time, recent hurricanes in the Southeastern U.S. have disrupted those operating in the region, with cleanup and rebuild costs to remain a headwind into next year.

Further, given continuous mounting headwinds, commentary around 2025 is unsurprisingly noncommittal, with many executives seeking greater clarity on how the upcoming U.S. election will shake out and impact of heightened geopolitical turmoil.

Globally, trends are mixed. China remains under pressure amid downbeat consumer sentiment and a weak funding environment. While recently announced stimulus efforts offer hope for a demand recovery in 2025, early takes reflect an expectation for softness to persist through the rest of this year. European demand remains muted, while commentary around Latin America is mixed. India remains a relative bright spot.

In summary, Industrial executive tone is hitting a full octave of notes.

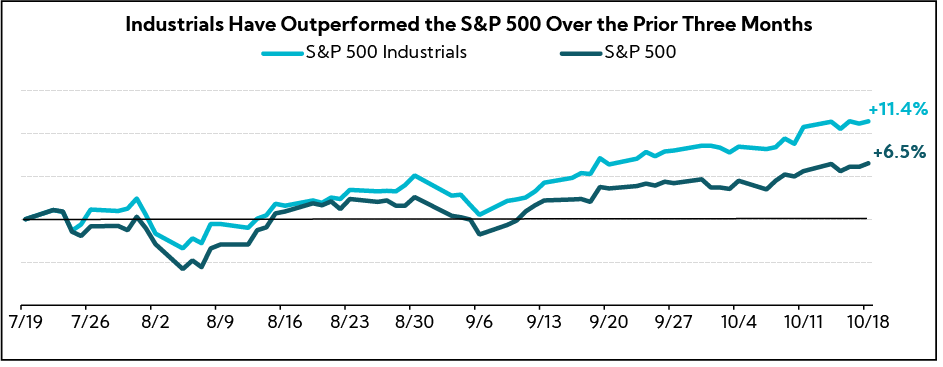

Market Reaction

The Industrial sector has lagged the broader S&P 500 this week, though it remains up roughly 19% YTD as of Thursday’s close and had outperformed the S&P 500 by roughly five percentage points over the three months coming into this week. While the sector has seen a healthy number of raised FY earnings guides, overall Q3 revenue beats have come in at lower clip relative to other sectors thus far.

This week’s relative underperformance can also be partly attributed to outsized positive contribution from Tesla (TSLA rallied 20%+ post-earnings) and Big Tech, which have boosted the cap-weighted S&P 500 benchmark; the equal-weight benchmark was still down more than 1.5% on the week through Thursday’s close. In addition, some notable post-earning selloffs among the Industrial sector’s top-weighted constituents (e.g., GE Aerospace, Honeywell) served as a drag on performance. Further, the surprise rejection of Boeing’s latest labor proposal on the part of the machinists’ union on Wednesday may have weighed on Aerospace & Defense sentiment.

Key Earnings Call Themes

Mixed Views but With Most Executives Commenting on a Continued “Soft” Industrial Environment; Companies Touting Outgrowth to Offset Weakness and Maintain Guides

- United Parcel Service ($118.4B, Integrated Freight & Logistics): “In the third quarter, we faced a macro environment that was slightly worse than we expected. In the U.S., online sales slowed and manufacturing activity was lower than we anticipated. This slowdown in manufacturing activity was also true outside of the U.S. as we continue to see lower industrial production weigh on volume in certain geographies. But the macro environment didn’t prevent us from growing revenue and profit as we leaned into the parts of the market that value our end-to-end network, and we drove expense leverage through ongoing productivity initiatives.”

- Simpson Manufacturing ($7.5B): “While our third quarter results reflected a challenging environment, we have outperformed U.S. housing starts by ~500 bps on a trailing 12 months’ basis as we’ve invested in improving the customer experience and expanding our offerings. We are focused on balancing our costs in the short term with our growth strategy until we see a rebound in housing starts”

- Enerpac Tool Group ($2.4B, Specialty Industrial Machinery): ”Although our top-line growth decelerated over the course of the year, we believe we continue to outpace the very soft general industrial marketplace, as evidenced by continued positive revenue growth.”

- Lennox International ($21.7B, Building Products & Equipment): “While we are generally optimistic about 2025 revenue growth, it is important to recognize our outlook can be impacted by several end market factors. Uncertain consumer confidence continues to pose challenges alongside a trend towards more value tier products, which may negatively impact mix.”

- AZZ ($2.3B, Specialty Business Services): “As we communicated during our first quarter call, we remain optimistic about public sector spending. Additionally, we believe the recent rate action by the Fed could spur growth in both consumer and private sector We continue to see secular growth trends in reshoring of manufacturing, a migration to aluminum and pre-painted steel, as well as the conversion from plastics to aluminum in the container space that will continue to benefit our businesses.”

- Honeywell ($137.3B, Conglomerates): “While we experienced some headwinds in the quarter, we are confident in our ability to weather the macroeconomic backdrop with the operational rigor you expect from Honeywell. We delivered segment margins and adjusted EPS above our guidance range in 3Q. We have adjusted our outlook to reflect the realities as we now see them in this macro. We continue to make steady progress towards our portfolio optimization as we close out the year.”

- Old Dominion Freight Line ($40.2B): “You have uncertainty, and typically when you look at election years, they haven’t been the best bright years, at least in recent history. There have been plenty of headlines, and we’ve had customer conversations as well, where people are being a bit conservative right now until they know what things may look like and what impact new policy directions may take. I think that’s something that is temporary. At some point, people have got to get back to looking at their business and how they want to grow and expand and do the things that creates freight, and that will create opportunities for us.”

Guidance

- Simpson Manufacturing ($7.5B): “We’ve certainly seen our customers have some real slowdowns in the Southeast from both the hurricanes. There’s also a little bit of concern that the storms are going to take labor that would normally go to new housing starts and take that to the repair and renovation piece. So, we haven’t really dialed in the specific guidance on how that’s going to impact us. But for our business that operates in that area, the forecast for Q4 is definitely lower than we thought it was going to be.”

- Honeywell ($137.3B, Conglomerates): “Given the current uncertainty in the environment across what we experienced…the wars, the upcoming elections in the U.S., and multiple factors, we thought prudent that we [provide 2025 guidance] in January when more facts are known.”

- Hexcel ($5.3B, Aerospace & Defense): “Whereas the overall aerospace supply chain seemed to be recovering in late 2023, new challenges and shortages have developed as 2024 has progressed. As our business is impacted by the near-term slowing of previously planned production rate ramps by our key customers, we now expect FY 2024 sales and adjusted EPS to be at the lower end of our 2024 guidance ranges and will benefit from lower tax rates. Further, given recent developments, the assumptions for future production rates that were the basis for our mid-term guidance in February 2024 are no longer valid. We are therefore withdrawing our previously issued mid-term guidance and will provide guidance for 2025, with our Q4 earnings in January.”

- RTX ($167.1B, Aerospace & Defense): “Demand across the business, including double-digit growth in commercial aftermarket and defense, remains robust, and drove 8% organic sales growth. Based on these results and our expectations for the remainder of the year, we are again raising our full year outlook for adjusted sales and EPS.”

- GE Aerospace ($191.1B, Aerospace & Defense): “Given the strength of our results, growing both profit and cash more than $1 billion YTD, combined with our Q4 expectations, we’re raising our full year guidance. We also continue to coordinate closely with Boeing and are committed to supporting them as they navigate their current dynamics.”

Trends Vary by End Market, With Executives Pointing to Strength in More Highly Valued Products, but a “Sluggish” Environment in Traditional Manufacturing; Transportation Still Slogging through Freight Recession, While Aerospace & Defense Execs Continue to Tout “Robust” Demand and Record Backlogs

- J.B. Hunt ($17.8B, Integrated Freight & Logistics): “We continue to navigate a challenging freight environment while remaining focused on what we can control around our cost, providing exceptional service to our customers, preparing for their future transportation needs, and maintaining our focus on safety. As discussed last quarter, we have seen a return to more normal seasonal demand patterns, as evidenced across our businesses in Q3. We’re going to maintain our focus on excellence for our customers, driving value, and we’re going to battle through the last part of this freight recession. There’s still too much trapped in the market. We need that market to really move more into equilibrium. We’re looking forward to seeing how that plays out into 2025.”

- A.O. Smith ($11.2B, Specialty Industrial Machinery): “It varies by market, but we have distributors that are low single digits up to some that are low single down. But the feedback we’re getting is things have slowed a little bit. Overall, the market is still holding up, but it’s going to be in that kind of flattish zone as we go forward. And [we] don’t see anything changing there right now based on customer feedback…and that goes for both our residential business and our commercial business.”

- CSX ($66.2B, Railroads): “At a high level, market conditions remain a bit mixed. We are seeing continued strength in some of our merchandise markets. And while truck rates appear to have bottomed, it remains a soft market. [In domestic intermodal/trucking], we’re safe to call that it feels like the bottoming. That gives us hope that we’ve reached what the inflection will be and look like. We expect, hopefully, a more normalized peak season, but that’s a watch item for us. We’re optimistic that that will occur, and we’re planning for that.”

- GE Aerospace ($191.1B, Aerospace & Defense): “Demand for our services and products remains robust, highlighted by departures up high single digits YTD and LEAP share of global narrowbody departures increasing over 20%. We’re taking steps with our suppliers to increase inputs. And within our own operations, to expand capacity, ensuring we’re positioned to meet this historic demand. We’re making progress with engine output increasing 22% QoQ, including commercial up 25% and defense up 8%.”

- RTX ($167.1B, Aerospace & Defense): “Demand is incredibly strong. If you think about the $16.6B of bookings this quarter, it’s fantastic. We’ve got some supply chain challenges that we’ve been dealing with. And as those continue to free up, then we’ll see the top line grow commensurately with that. Clearly, a strong backlog going forward. We’ve got to continue to work through the backlog that we have and that’s going to take some time. The supply chain is getting healthier. Capacity is being put into place. Demand is there. We just got to continue to work through this backlog.”

- Lockheed Martin ($137.5B, Aerospace & Defense): “The demand for Lockheed Martin systems and services remains robust across all four of our business areas. We ended Q3 with record backlog of more than $165B, reflecting a book-to-bill ratio of 1.3.“

- MSC Industrial Direct ($4.3B, Industrial Distribution): “Looking to fiscal 2025, the year begins with a continuation of the challenging outlook we faced in fiscal 2024. Conditions remain soft, as evidenced by IP readings, particularly for our top manufacturing end markets, the majority of which are contracting. Automotive and heavy truck, primary metals, fabricated metals, and machinery and equipment are all weak. Aerospace remained positive in the quarter, but expectations have been tempered due in part to the recent strikes in the sector.”

- Fastenal ($43.9B, Industrial Distribution): “The primary challenge remains sluggish end markets. Our reseller end market weakened markedly with daily sales declining 11.3% in Q3 versus declining 6.4% in Q2’24.”

Executives Offset Margin Pressure by Controlling the Controllable and Emphasizing Cost Controls and Pricing Discipline

- CSX ($66.2B, Railroads): “When you think about price/cost, we’ve been consistent saying that spread between dollars of price and cost of inflation has been positive all year long and about as positive as we’ve seen in the last decade. Overall, we do expect inflation to come down over time, and that would be reflected in some of our price. But we still look for ways to cover our costs and do those things in the right way, but really focus on delivering service. And if we deliver the right service and that service continues to improve, then customers see the value in that and we’re able to price for that service.”

- Enerpac Tool Group ($2.4B, Specialty Industrial Machinery): “There will be some pricing activity. I think it will be more muted than in recent years. Certainly, we’ll take pricing actions as needed to continue to cover and offset, if not more than offset, inflationary pressures that we have seen. And I‘d remind folks, we do continue to see an inflationary environment that’s decelerated, but it’s not deflationary. So there are pricing actions we need to take to cover inflationary costs.”

- RTX ($167.1B, Aerospace & Defense): “We’re working through the backlog where the pricing was not aligned with the cost inflation that we’ve experienced over the last few years and we’re seeing the international mix improve. It’s hard to put a number on it, but we’re going to see that margin improvement. We’re seeing it this year. We expect to see more of that next year.”

- 3M ($69.6B, Conglomerates): “I’m focusing on growth and margin expansion for sure, working the pedals across both of them. But as I step back, driving growth is also a margin driver because of the high drop-through we get on incremental volume. So, that’s kind of the way I see the future playing itself out.”

- J.B. Hunt ($17.8B, Integrated Freight & Logistics): “To update on our cost control efforts, we have made significant improvements across the business to right-size our cost structure, mostly evidenced in our Highway Services businesses, as both JBT and ICS improved their operating margins compared to the prior year period. We remain thoughtful in our approach to managing our costs, focusing on controlling what we can in the near term without jeopardizing our ability to support future growth and our aggregate earnings power potential.”

Boeing Machinists Strike Throws a Wrench in Aerospace & Defense Supply Chain; Onshoring and Supply Chain Stabilization Continues Elsewhere

- Old Dominion Freight Line ($40.2B, Trucking): “We continue to see nearshoring and reshoring activities. That creates a lot of freight demand and opportunity for LTL. We’ve benefited from that over time and would expect that both we and the industry will benefit from those trends.”

- Herc Holdings ($5.9B, Rental & Leasing Services): “When it comes to fleet investments in the quarter, the 34% increase YoY is more reflective of a return to normal seasonal delivery pattern this year, with the supply chain’s recovery.”

- Hexcel ($5.3B, Aerospace & Defense): “Despite the strong demand for new fuel-efficient planes, ongoing and new supply chain challenges, including the strike at Boeing, continue to disrupt planned increases and production rates. Coming out of 2023, there was a sense in the industry that we were finally achieving some stability after the pandemic. By late 2024, however, new challenges emerged in the supply chain, including the supply of engines, castings, seats, and landing gear to name just a few, that have pushed the recovery in production rates further to the right.”

- GE Aerospace ($191.1B, Aerospace & Defense): “Supply chain constraints impacted shipments across narrowbody and widebody, with total engine deliveries down 4%, including LEAP, down 6%.”

- RTX ($167.1B, Aerospace & Defense): “We obviously had a little bit of impact from the start of the strike as well. And what we’ve done is we’ve calibrated a level of impact here in the rest of the year going forward. We think we’ve got that reasonably calibrated. We do expect to resume some shipments later in the quarter. Boeing is going to want to ramp in 2025 and beyond. We want to make sure that all facets of the value stream are healthy enough to do that. So, we haven’t just stopped cold turkey; that just wouldn’t be healthy for the supply chain, wouldn’t be healthy for our factories. By and large, we’ve continued to take in material and build product because we want to be ready when the re-ramp arrives.”

- United Airlines ($24.4B, Airlines): “We’re more focused on the 787 delays, as you might expect us to be. We’re rooting for Boeing, and they are certainly making some smart decisions. But as we see delays on the 787s, we would expect that there’s a bias downward in CapEx if those delivery delays continue. We’re going to have fewer airplanes in the near term than we would have been hoping for, but our eye is focused on the long term. We want them to get through it and build a company that can work for the long term. And then I think we’re in a really good setup.”

China Weakness Continues and the Jury is Out on Stimulus Efforts; Europe Mostly Soft, Albeit with Signs of Recovery; Views on LatAm Vary by Industry, while India Remains a Pocket of Strength

China

- A.O. Smith ($11.2B, Specialty Industrial Machinery): “In China, we believe that the weakness we experienced in the market in Q3 will persist through the remainder of the year. While we are encouraged by the recently announced government stimulus programs, we expect minimal impact from the programs in 2024.“

- Graco ($13.8B, Specialty Industrial Machinery): “Hopefully at some point we get to an equilibrium level, and then business conditions are a little bit better for us in China than what we’ve had over the last 12 months or so. I don’t think that this stimulus is going to have a meaningful impact in the short term. Well, see what happens, but we certainly haven’t seen it so far in our results. Positively, you know, Japan seems to be doing pretty well. Korea is hanging in there and we’re also seeing growth in India.”

- Veralto ($26.6B, Pollution & Treatment Controls): “At an aggregate level, the year is playing out as we anticipated in China, really no meaningful recovery or change in sales and demand profile. We kind of are bouncing along the bottom. We continue to see challenges in funding at municipal customer sites. So, they had a very strong 2H’23, and that is not going to repeat here in 2024.”

Europe

- Honeywell ($137.3B, Conglomerates): “[We have seen] some pockets of recovery in Europe, not so much in China..we do see strong growth in India and Saudi Arabia. Those two countries are becoming catalysts of our growth.”

- PACCAR ($54.4B, Farm & Heavy Construction Machinery): “European volumes have been down a little bit more than the market this year. That was really [evident] in Central and Eastern Europe where the market has been more affected by the war in Ukraine and the economy is a lot slower there than in some other parts of Europe. We expect things to continue at that pace, more or less, as we enter next year and then we’ll see how it progresses during the year.”

- Carrier ($66.5B, Building Products & Equipment): “Orders for much of the year in Germany were constrained, in large part, because the government declared in February that subsidies would not be paid until October. We thought orders would start to pick up in Q3, which they did, just later in the quarter than we anticipated. Encouragingly, recent trends around orders and subsidy applications have improved.”

Latin America

- Lindsay ($1.4B, Farm & Heavy Construction Machinery): “In international irrigation market, softness in Brazil due to lower grower profitability and poor customer sentiment continues to persist. We expect tempered demand to continue in Brazil and Latin America until farm profitability and credit availability improve.”

- The Greenbriar Companies ($1.8B, Railroads): In Brazil, we are observing an increase in demand that aligns with expectations as customers finalize infrastructure investments and transition to purchasing of railcars.”

- Veralto ($26.6B, Pollution & Treatment Controls): “We’ve been really pleased with our performance in Latin America. And we’ve watched this region closely over the course of the last couple of years here. I think what we’re seeing there is the benefit of some reshoring or onshoring activity as some of the customers look to diversify their risk and insulate themselves from any sort of geographical constraints that they might see in China. But we’re also starting to see some benefit from privatization of water utilities in Brazil. This is a region for us to continue to stay focused on. As we said in our prepared remarks, Latin America represents 10% of our total sales, and it’s growing well for us.”

In Closing

As we noted coming into earnings season in our Q3’24 Inside The Buy-Side® Industrial Sentiment Survey®, executives and investors are contending with heightened uncertainty on multiple fronts, leading to a divergence in views as companies continue to navigate choppy waters.

While there is hope for a greater sense of clarity once past the U.S. election (less than two weeks away!), shifting policy implications remain a wild card, and geopolitical tensions have shown no signs of abating. In addition, the impact of Fed rate cuts will take time to be felt, while recent hurricanes in the Southeast and evolving labor actions are adding to near-term headwinds in some sectors.

As always, we will continue to highlight evolving themes in our ongoing weekly earnings The Sector Beat coverage to provide insightful information on the macroeconomic landscape and factors impacting market sentiment.

Up next week: Consumer Discretionary Sector Beat.

In case you missed it, you can access the link below for a replay of our webinar The Big So What™ – Q3’24 Earnings Season.

- As of 10/24/24