This Week in Earnings – Q3’24

The Sector Beat: Materials

What a week…especially for the markets as uncertainty was removed, further supported by a 25-bps cut shot in the arm. And of course, earnings season rolls on, with a new spate of releases, which continue to paint an increasingly challenging market. With Tuesday’s outcome behind us, 2025 is squarely in focus.

We’ll be covering this theme and more in next week’s “Closing the Quarter” Thought Leadership.

In today’s thought leadership, we cover:

- Key Events this week

- Earnings Snap, covering the S&P 500 stats to date

- Spotlight on Materials in The Sector Beat

Key Events

U.S. Election

- Donald Trump will return to the White House after winning the U.S. Presidential Election on Tuesday. Vice President Kamala Harris formally conceded on Wednesday, with Trump at 295 electoral votes as of Friday (clearing the 270 needed). Republicans are also poised to hold a majority in the Senate, while control of the House remains undecided with several districts still too close to call. (Source: Associated Press)

- Market reaction was decisive on Wednesday, with the election outcome providing investors with widely sought certainty. The S&P 500 rallied 2.5%, its best post-Election Day performance on record, while the Dow jumped 3.6%, its biggest post-election gain since 1896. Meanwhile, the VIX – Wall Street’s “fear gauge” – fell by the most since August. (Source: Barron’s, Bloomberg)

Monetary Policy

- The Bank of England cut interest rates by 25 bps on Thursday for only the second time since 2020, as widely expected. The central bank indicated future reductions were likely to be gradual, seeing higher inflation and growth after the new government’s first budget. The Monetary Policy Committee voted 8-1 to cut interest rates to 4.75% from 5%. (Source: Reuters)

- The Federal Reserve cut interest rates by 25 bps on Thursday, in line with expectations, as policymakers took note of a job market that has “generally eased” while inflation continues to move towards the U.S. central bank’s 2% target. This comes after September’s 50 bp rate cut, bringing the policy rate down to the 4.50%-4.75% range. (Source: Reuters)

Labor

- Initial jobless claims, an indicator of layoffs, rose to 221,000 for the week ending November 2, aligning with expectations and marking an increase of 3,000 from the prior week’s adjusted level. The 4-week moving average dropped to 227,250, down by 9,750 from the previous week’s revised average. (Source: Labor Department)

Economic Activity

- ISM Services PMI registered 56.0 for October, the fourth consecutive month of expansion and highest level since July 2022. The services sector has now been in expansion for 50 of the past 53 months. Note, the report follows last week’s weaker ISM Manufacturing report that fell to 46.5 in October, down from September’s 47.2 and marking the lowest reading of 2024. Manufacturing activity has now been in contraction territory for 23 of the past 24 months. (Source: Institute for Supply Management)

S&P 500 Earnings Snap

90% of the S&P 500 has reported earnings to date

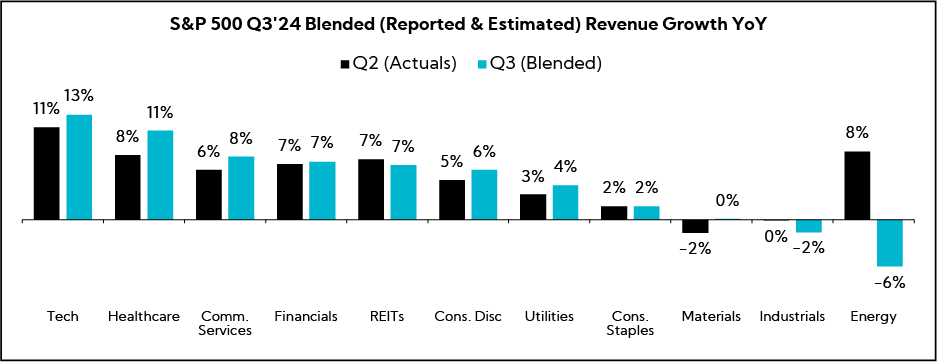

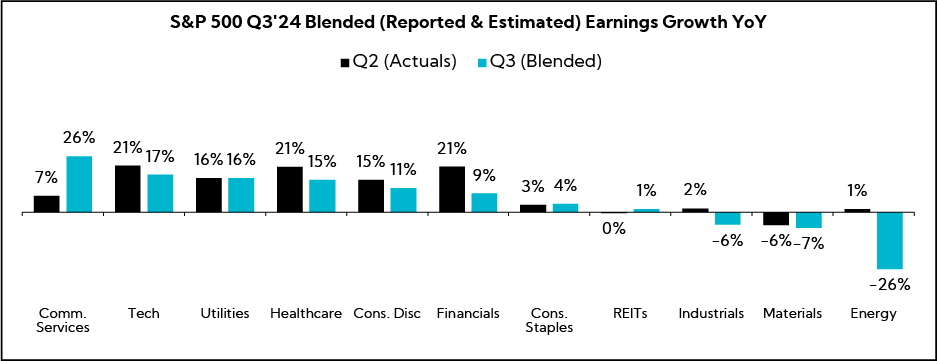

Q3'24 Revenue Performance

- 60% have reported a positive revenue surprise, below the 1-year average (63%) and the 5-year average (69%)

- Blended revenue growth (combines actual reported results for companies and estimated results for companies yet to report) is 5.3%; this compares to last quarter’s 5.5%

- Companies are reporting revenue 1.6% above consensus estimates, above the 1-year average (+1.1%) but below the 5-year average (+2.0%)

Q3’24 EPS Performance

- 76% have reported a positive EPS surprise, below the 1-year average (78%) and the 5-year average (77%)

- Blended earnings growth (combines actual reported results for companies and estimated results for companies yet to report) is 8.6%; this compares to last quarter’s 13.2%

- Companies are reporting earnings 7.8% above consensus estimates, above the 1-year average (+6.5%) but below the 5-year average (+8.6%)

The Sector Beat: Materials

Guidance Trends

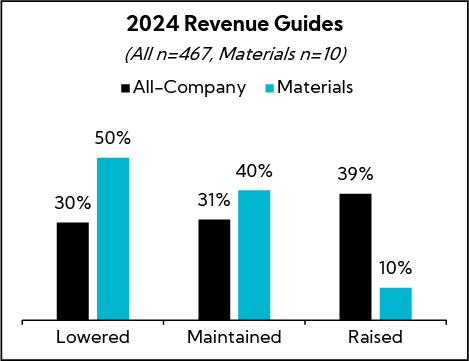

Each quarter, we analyze annual revenue and EPS guidance provided by Materials companies with market caps greater than $1B that have reported to date.1 Below are our findings.

For comparison purposes, we provide an “All-Company” benchmark, which tracks in real-time a basket of companies larger than $1B in market cap across all sectors that have reported earnings to date (n = 647).

Guidance Breakdown by Industry

| Industry | Number of Companies |

|---|---|

| Chemicals | 15 |

| Containers & Packaging | 7 |

| Construction Materials | 2 |

| Metals & Mining | 2 |

| Total | 26 |

Source: Corbin Advisors

Annual Revenue Guidance2

More Materials companies are lowering annual revenue guidance, largely driven by Chemicals, than the All-Company average (50% vs. 30%, respectively). Additionally, significantly fewer Materials companies are raising revenue guidance compared to the benchmark (10% vs. 39%), while a similar proportion is maintaining guidance (40% vs. 31%).

- Companies that lowered guidance (n = 5)

- 60% lowered the top and bottom of the original range

- 20% lowered the top, but raised the bottom of the original range

- 20% lowered the top, but maintained the bottom of the original range

- Average midpoint of -0.3% growth YoY versus 0.8% last quarter

- Average spread decreased by 160 bps to 1.5%

- Companies that maintained guidance (n = 4)

- Median midpoint of -6.0% growth YoY

- Average spread of 4.7%

- Only one company (International Flavors & Fragrances) raised guidance

- Raising the top and of the original range

- Midpoint of -1.2% growth YoY vs -2.5% last quarter

- Spread decreased by 80 bps to 0.9%

- Overall, midpoints assume -4.9% annual growth, roughly in line with analyst estimates of -5.1%, on average

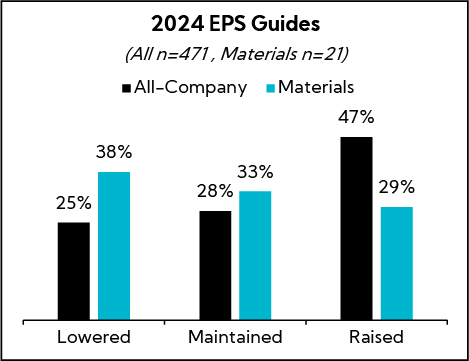

Annual EPS Guidance

More Materials companies are lowering annual EPS guides than the All-Company average (38% vs. 25%, respectively). Additionally, fewer Materials companies are raising guidance compared to the overall average (29% vs. 47%), while a similar proportion is maintaining guidance (33% vs. 28%).

- Companies that lowered guidance (n = 8)

- 75% lowered the top and bottom of the original range

- 13% lowered the top, but maintained the bottom of the original range

- 13% lowered the top, but raised the bottom of the original range

- Average spread decreased from $0.26 to $0.12

- Companies that maintained guidance (n = 7)

- Average spread of $0.22

- Companies that raised guidance (n = 6)

- 33% raised the top and bottom of the original range

- 33% raised the bottom, but maintained the top of the original range

- 33% raised the bottom, but lowered the top of the original range

- Average spread decreased from $0.25 to $0.15

Earnings Call Analysis

We analyzed the earnings calls for this group and the broader Materials sector universe to identify key themes.

This earnings season, executive commentary across the Materials sector reflects a continuation of downbeat trends observed, with executives navigating choppy conditions and elevated macro uncertainty. While performances and outlooks vary by end market, a challenging operating environment persists, with near-term outlooks clouded by myriad factors, including ongoing geopolitical tensions and the eventual outcome of the U.S. presidential election.

Although this week’s Trump victory brings a dose of clarity, executives broadly see challenging current market conditions persisting through year end. Furthermore, despite some cautious optimism for a more supportive economic backdrop next year with the Fed and other central banks seen moving forward with rate cuts alongside China stimulus efforts, executives remain wary of calling the timing of an eventual demand recovery, with hopes more tilted toward the back half of 2025.

Indeed, with reporting season for the sector largely complete, Materials are delivering EPS beats at the lowest rate of any sector, with just 56% topping consensus estimates, compared with 76% for the S&P 500. Additionally, 63% of Materials companies in the S&P 500 are reporting revenue below consensus, compared with 40% for the broader index. Additionally, Materials companies are lowering EPS and revenue guidance at a significantly faster clip than our All-Company average.

Given the challenging environment and uncertain outlook, companies continue to emphasize efforts to protect or expand margins through operational efficiency, productivity gains, rationalization, and expense management. To that end, a number of Materials companies highlight progress with previously introduced cost reduction programs, with some rolling out additional measures. Indeed, one such company, Celanese, pointed to a deterioration of market conditions in the quarter, prompting the firm to temporarily cut its dividend by 95% to support its deleveraging efforts.

Spotlight on Tariffs

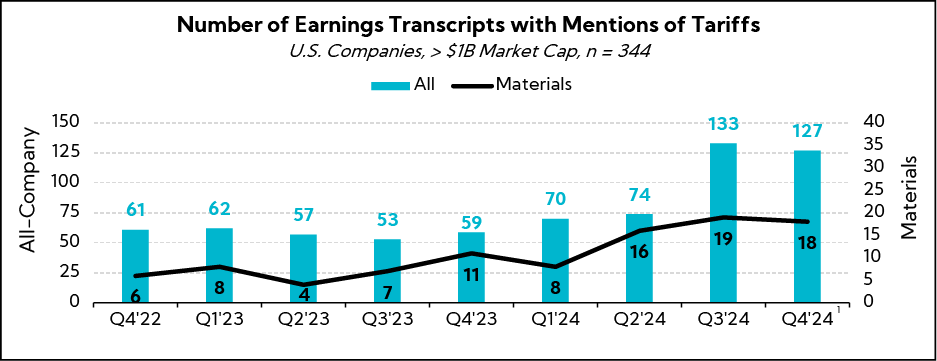

Furthermore, with heightened focus on the U.S. election and potential policy actions, commentary around global trade featured heavily during earnings calls, with “tariff” mentions spiking, both for Materials and the broader U.S. corporate landscape. Of note, Steel companies projected optimism for stronger enforcement of trade regulations in 2025, regardless of the election outcome.

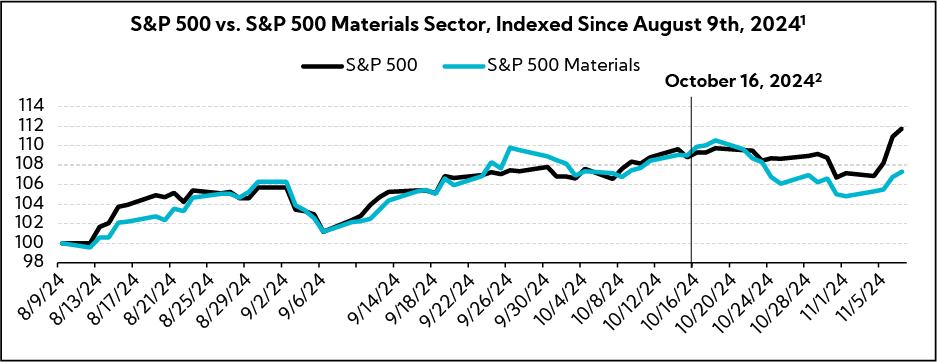

Market Reaction

While a number of groups within the sector got a sizable post-Election Day bump on Wednesday (Steel names, in particular), the Materials sector remains a YTD laggard relative the broader S&P 500, up roughly 11% on the year as of Thursday’s close, compared with ~25% for the benchmark.

Notably, the sector had closely tracked the S&P 500 since our Q2 publication in August, before diverging to the downside with the onset of earnings in mid-October. Since October 16, when the first S&P 500 Materials companies began reporting, the sector is down 2.3% compared with the 2.2% gain posted by the Index over that span.

Key Earnings Call Themes

Challenging Market Conditions Persist, with Few Pockets of Strength; Execs Point to Near-term Uncertainty on Multiple Fronts, but Are Hopeful for Greater Clarity in the New Year

- Linde Plc ($219.2B, Specialty Chemicals): “We anticipated sluggish industrial activity this quarter, and it played out as expected. Looking ahead, I have concerns regarding continued economic weakness, so we’ve taken a series of proactive actions, including targeted cost reductions. It affects approximately 2% of the workforce globally and is expected to be mostly completed in the next few months.”

- Eastman Chemicals ($11.7B, Specialty Chemicals): “There’s a lot of uncertainty in the macro economy. You’ve got the election coming up. You have instability in the Middle East. Without a doubt, we see it in Q4. Brands and retailers are being cautious right now. They’re uncertain about where the economy is headed, so they’re being a little bit careful. We need to get to January, past the election and some of these uncertainties, and see how the economy looks. We’ll provide you a good update on the Q4 call.”

- Celanese ($10.2B, Chemicals): “For 2025, there’s so much uncertainty. While we are going to take a lot of steps to help ourselves, to really control what we can control, there are a lot of open questions out there around 2025, [such as] whether the market environment gets better or deteriorates and what we see in terms of interest rates. And it’s just simply too early to speak with any authority about 2025.”

- Steel Dynamics ($20.6B, Steel): “Heading into Q4, we’re going to see the normal seasonality that you typically see in anything that’s tied to construction. But as we look at 2025, there’s opportunity for not just price support, but price appreciation, as we’ve talked about interest rate changes and additional demand coming from public funding, etc. We’re feeling really good with the steady aspect of what we’ve seen in the last 6-9 months. And now, we’ll just get through the Q4 seasonality and then head toward what we think is going to be a really robust 2025.”

- Sherwin-Williams ($94.3B, Specialty Chemicals): “In a Q3 characterized by ongoing choppy demand, Sherwin-Williams grew consolidated sales, expanded gross margin, and grew diluted EPS and EBITDA. We continued to invest in the quarter to capitalize on what we see as unprecedented long-term share gain opportunity. We are maintaining our full-year EPS guidance. We recognize the current range is wider than typical entering a Q4. This range accounts for several variables that are hard to forecast precisely over the next two months, including timing of demand related to recovery from Hurricanes Helene and Milton, and the potential for extended holiday shutdowns among our industrial customers.”

Industrial and Auto Remain Weak Globally, While Secular Trends —Electrification, AI Data Centers — Offset Weakness for Some; Hope Remains for a Gradual Demand Recovery Next Year with Help from Additional Rate Cuts and Post-election Clarity, But with the Timing Uncertain

- Sherwin-Williams ($94.3B, Specialty Chemicals): “The single largest variable heading into next year is the timing and pacing of a true inflection in the demand While several signals are beginning to move from red to yellow, and some from yellow to green, our initial view is that demand is likely to remain choppy in 1H25. Sherwin-Williams is incredibly well positioned in each of our targeted end markets. We are confident we will outperform the market in all environments, and significantly so when demand becomes more robust.”

- Dow Inc (33.5B, Chemicals): “We continue to experience muted demand across some end markets and regions with the greatest pressure in Europe and China. Global manufacturing PMI has been decelerating over the past three months, and consumer spending remains pressured by persistent inflation. That said, we’re monitoring the impact of rate cuts in the U.S. and Europe, as well as recent stimulus plans in China to boost economic activity, which could provide some positive momentum for 2025.”

- Eastman Chemicals ($11.7B, Specialty Chemicals): “The macro is clearly uncertain right now. What we do know at this point is that customer inventory destocking is over, and we’re reconnected to primary demand. We can also say that in what we call our stable markets – things like personal care, aviation, water treatment, ag – those markets have been steadily growing at modest rates this year, and we expect that to continue into next year. The discretionary markets – which are auto, housing, consumer durables – that’s where demand has not really improved very much.”

- Cleveland-Cliffs ($5.6B, Steel): “North American automotive build rates in Q3 were the lowest since the depths of the semiconductor shortage a few years ago, with only 3.75M units built during the quarter. With our position as a large automotive supplier, this drove our shipments, average selling prices, and unit margins down QoQ. And compounding this, our non-automotive business also saw continued weakness in demand and pricing, both in flat rolled and plate.”

- Celanese ($10.2B, Chemicals): “In Q3, we faced a severely constrained demand environment that, in some cases like auto, degraded swiftly. We expect demand conditions to worsen in Q4, as automotive and industrial segments react to recent dynamics by seasonally destocking at heavier than normal levels. While we expect this destocking to be temporary, we will significantly slow our production to match this demand level. Celanese will continue to take actions commensurate with the current demand environment.”

- Freeport-McMoRan ($67.3B, Copper): “At the micro level, we continue to see secular demand trends associated with electrification, providing strong demand for copper and offsetting the impact of a cyclical slowdown. In the U.S., our customers continue to report strong demand for power cable and building wire associated with substantial investment in electrical infrastructure and AI data centers. This growing sector more than offset weakness in traditional demand sectors, residential construction, and autos.”

Interest Rates

- Nucor ($39.6B, Steel): “While the broader U.S. economy continues to be resilient, decreased steel demand from several of our end use markets, along with higher import volumes, has put pressure on our margins throughout the year. The Federal Reserve’s recent actions are a good start, but it will likely take more time, more rate relief, and looser lending conditions before we start to see the flow through effect in the construction, industrial and consumer durables market that are so impactful to steel demand.”

- Steel Dynamics ($20.6B, Steel): “As interest rates decline and public funding begins to be distributed post-election and into 2025, we expect to see increased fixed asset investment and corresponding demand drivers for steel and steel fabrication products next year.”

- Eastman Chemicals ($11.7B, Specialty Chemicals): “Lower interest rates are for sure going to help improve the affordability of cars, affordability of homes. When interest rates start to become more affordable, which we expect will happen through next year at some point, that will certainly drive upside for us.”

- Element Solutions ($6.7B, Specialty Chemicals): “It remains to be seen whether interest rate cuts in the U.S. and Europe, as well as Chinese stimulus, will prove to be a tailwind for large industrial sectors like construction and automotive that have remained weak for much of 2024.”

- The Chemours Company ($3.1B, Specialty Chemicals): “There’s not really a sign of market recovery, but we’re very excited about the interest rate reductions in the U.S. We’ll see what happens this week with the Fed, and also some [rate] reductions in Europe.”

U.S. Election

- Cleveland-Cliffs ($5.6B, Steel): “As far as volume, we believe that as soon as we have a little more clarity, which should happen in the next few days [following] the election, customers will start placing orders and things will start to heat up I am anticipating a very strong Q1 and believe we are going to have volumes back to normal by 1H of next year.”

- Alpha Metallurgical Resources ($3.1B, Coking Coal): “We remain hopeful. And I think once we get past the election next week, maybe some things will start taking shape as far as people positioning, seeing where economic activity starts growing back up in different areas of the world. But for right now, our view for planning purposes is it’s going to look a little bit like what we’re currently seeing.”

- Vulcan Materials ($38.5B, Building Materials): “If you talk to our customers and the large general contractors, they’re bidding a lot of work, but nobody’s pushing the button. I think that with the election being over, interest rates easing, hopefully in 2H of next year, we’ll see some of these come off the sideline. But there is a lot pent up out there that’s kind of a ‘wait and see’. So, we hope that a number of factors helps ease that and impact 2H of 2025, but probably a bigger impact on 2026.”

Amid Sluggish Volume Environment, Execs Highlight Operational Efficiency, Productivity Enhancements, and Cost Reduction Measures (Past and Present)

- DuPont de Nemours ($35.8B, Specialty Chemicals): “We took a lot of restructuring actions earlier this year. We’re seeing the benefit of those. We’re driving productivity and operational excellence. We took a lot of actions, especially on the plant fixed-cost front, as we saw the volumes decline last year. And we’ve done a really nice job of keeping those out as volumes have recovered. So that’s also driving a piece of our margin recovery.”

- Cleveland-Cliffs ($5.6B, Steel): “[For unit cost], we were down $40 a ton versus our guide of $30, and that’s really difficult to do. That comes from improved operational efficiencies and just continuing to be disciplined. These Q3 costs are the lowest level since 2021. So, we’re going to continue to bring cost down.”

- The Chemours Company ($3.1B, Specialty Chemicals): “Favorable product mix on top of additional cost reduction efforts should continue to drive improvements in APM’s margins as we head into next year.”

- Quaker Chemical ($3.2B, Specialty Chemicals): “We’re planning to build on the progress we’ve made over the last couple of years, so holding on and continuing to operate at our target margin range. We continue to optimize the organization, find efficiencies so that we’re successful regardless of the macro environment – as we’ve talked about before, control the things that we can control.”

- Element Solutions ($6.7B, Specialty Chemicals): “We have an ongoing productivity effort to make the business better every quarter. If you look at the margins in our I&S segment, in a declining volume environment we’re driving margins favorably and growing earnings. And that’s a testament to what we’re doing to make the business better.”

Cost Reduction Programs

- PPG Industries ($29.1B, Specialty Chemicals): “We have announced a comprehensive restructuring program to eliminate associated stranded costs from these transactions, and separately, to enable footprint rationalization, specifically in Europe and a few other global coatings businesses. This program will deliver approximately $175M once fully implemented, including savings of $60M in 2025. These self-help actions reflect our ongoing commitment to aggressively manage our controllables.”

- International Paper ($20.4B, Packaging & Containers): “We will drive profitable growth by being the low-cost producer and the most reliable and innovative sustainable packaging solutions provider in North America and EMEA. We’re using our 80/20 approach to guide investments and align resources, to win with our most attractive customers, reduce complexity and cost around the company, and drive transformational performance.”

- Westlake ($17.6B, Specialty Chemicals): “During Q3, we continued to make progress on our company-wide cost savings initiative with approximately $35M of savings delivered during the quarter. These savings combined with those achieved in 1H of 2024 total ~$120M of long-term cost reductions from the first three quarters of 2024 toward our full year target of $125M to $150M.”

- Celanese ($10.2B, Chemicals): “To further help us navigate this challenging environment, we have identified and will take additional bold actions to strengthen earnings and cash generation. We have a strong track record of delivery and operational excellence and are confident that we are taking the right actions. For example, we are significantly slowing production to match demand in Q4 and implementing further cost reductions, particularly in SG&A.”

- Hunstman ($3.6B, Chemicals): “We continue to look at all of our production sites and examine our cost structures, supply agreements and operating rates. For the end of the year, we will be initiating a further $50M cost reduction program in our global Polyurethanes business. This is in addition to the $280M in costs we’ve taken out of the entire company over the past few years.”

- The Chemours Company ($3.1B, Specialty Chemicals): “Starting with operational excellence, we can achieve incremental run rate cost savings of greater than $250M across the company starting next year through 2027. This overall cost savings plan comprises an additional $100M cost savings program under our TT Transformation Plan and $150M in targeted savings. Given the cyclicality of our industry, cost management must be part of our DNA.”

- O-I Glass ($2.0B, Packaging & Containers): “With regard to driving productivity, we are working to take out all redundant and low profitability capacity. Significantly increasing productivity is the cornerstone of the turnaround of the business. We are evaluating the closure of at least 7% of capacity by mid-2025 to reduce the fixed cost base of the network. The closure of unprofitable and redundant capacity should generate more than $100M of annualized savings. As part of this evaluation, we have already announced the closure of approximately 4% of capacity, which should benefit 2025 results.”

Mentions Jump Heading into the U.S. Election, With Execs Closely Monitoring Evolving Global Trade Dynamics; Steel Industry Looking Forward to Stronger Enforcement of Trade Regulations After Year of Pricing Pressure from Imports

- Nucor ($39.6B, Steel): “There’s been a lot of attention on trade recently, so let me touch on that topic now. Nucor, along with other domestic steel producers, continues to advocate for the vigorous enforcement of trade laws. The recent surge in high emissions imported steel continues to negatively affect both domestic steel prices and mill utilization rates. As a result, Nucor recently joined several other steel producers in filing cases against imports from 10 nations. With the 2024 presidential election just two weeks away, we believe the American steel industry is well-positioned regardless of the outcome. After years of work by our industry, there is now bipartisan consensus that strong trade enforcement is a priority and that we need to fix our trading relationship with China.”

- Steel Dynamics ($20.6B, Steel): “Underlying steel demand remains steady, but a surge in steel imports put pressure on the supply dynamics in certain product areas, specifically for coated flat rolled steel products. In response, we levied a trade case, and we expect to get a preliminary ruling from the ITC in a few weeks.”

- Dow Inc (33.5B, Chemicals): “We see tariffs today in some of the businesses that we participate in. And we are still net exporter in general out of the U.S. Gulf Coast because of the very strong competitive advantages that we have here. The large markets, China, in particular, is still an importer and is going to be an importer for quite some time. So that will exist. In most of the other markets, we’re in the market to be a domestic player. So we’re in Europe for Europe. And for the assets that we have in China, we’re in China for China. There’s a lot of discussion going on around tariffs. We’re typically not in the crosshairs of some of the issues that are national security related, so it doesn’t have a particular impact on us.”

- Cabot Corp ($5.9B, Specialty Chemicals): “We’ve seen recently tariffs imposed in Mexico, for example, on Chinese passenger car and light truck tires. Those just went into effect last month, and then more recently, anti-dumping duties imposed by the U.S. on Thai truck tires, TBR Tires. And so, certainly some pushback to the elevated level of tire imports on the trade and tariff front. It’s a dynamic situation and one that we’re watching and managing closely.”

- Kaiser Aluminum ($1.4B, Aluminum): “[Regarding tariffs], anything that helps strengthen North America manufacturing is going to be a big positive for us. You’ve seen some momentum move on those tariffs. We’ve seen Canada and Mexico impose 25% tariff levels as opposed to what were maybe 10% earlier. So that momentum is building, and I believe ultimately stronger North America manufacturing will do nothing but strengthen this company.”

- Sherwin-Williams ($94.3B, Specialty Chemicals): “Epoxy resins were also up in the quarter, and there are some additional tariffs that might come in and impact that. We haven’t seen that propylene or epoxy necessarily impact our basket meaningfully yet, but we’re watching it very closely, and we’ll see where it goes as we get into the next year.”

In Closing

While the equity markets got a shot in the arm this week from the U.S. election, results from the Materials sector this earnings season are yet another reminder that the market is not the economy. Indeed, the sector continued to reflect the complexities and challenges of the current economic landscape. Many of the headwinds called out last quarter persisted in Q3, with executives pointing to expectations for further choppiness into year end.

Not only has this led to an elevated level of earnings misses and lowered guides across the sector, but companies have been leaning further into cost-cutting and restructuring efforts, including layoffs, to navigate through the trough (something we will be diving into deeper next week). In addition, though the U.S. election may have removed a near-term overhang for investors, uncertainty around tariffs and trade will take time to be resolved (another topic we will cover). Amid these shifting dynamics, the message coming out of the Materials sector continues to be one of focusing on what you can control.

Next week, we’ll be back with our “Closing the Quarter” piece to round out the Q3’24 reporting period.

- As of 11/7/24

Relatively few Materials companies guide on annual revenues; more typically provide EPS guidance