Virtual Investor Day: Update

With the recent increase in the number of companies reaching out to us and inquiring about 2021 Investor Days, we are providing an update to our Virtual Investor Day research we shared in September. You rely on us for research-based insights to inform decisions and, as such, we analyzed 30 virtual investor days across 10 sectors, with companies ranging between $800M and $123B in market cap.

Setting the Stage

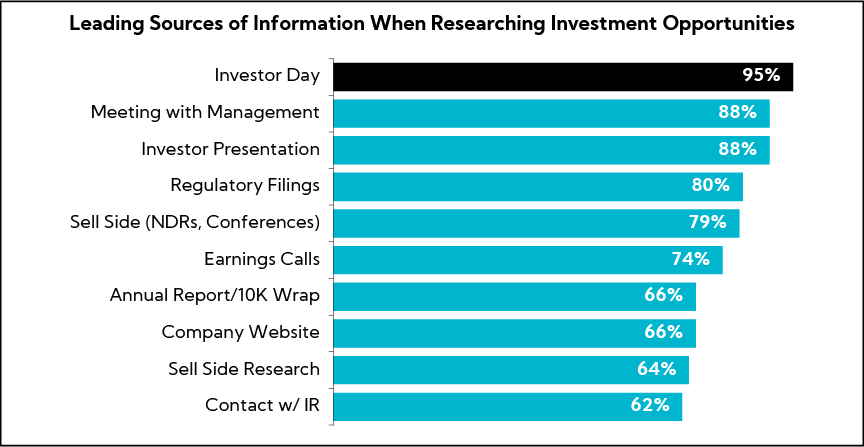

According to our proprietary research, Investor Days are considered the #1 source of information for investors and analysts when researching a stock, exceeding all other communication platforms, including meeting with management.

Prior to the COVID-19 pandemic, our proprietary research found 94% of investors and analysts viewed investor days as a valuable use of their time (when successfully executed). In our survey of 50 investors and analysts during the COVID-19 period, 100% believe virtual investor days are a good use of their time, again with the caveat they are executed well.

Indeed, our ongoing research and deep experience with investor days further supports our view that these investor-facing events are an even more critical communication channel now, as investors look for opportunities to commit capital.

These events continue to be best practice and yield significant return on investment in that they:

- Are the best channel to educate investors deeply and broadly, resulting in an improved understanding and more compelling view of the company as an investment

- Provide access to different levels of management, which is critical to greater investor buy-in

- Serve as a forcing function internally in that the process leads to crystallized strategy and messaging, and increased management alignment on key initiatives

- Create a reinforcing set of materials rich in content with a relatively long shelf life (i.e., 12-18 months)

Relative to our September Virtual Investor Day Thought Leadership publication, we have identified four key areas of difference in our analysis of recent Investor Days.

Investor Days Are Increasing in Length

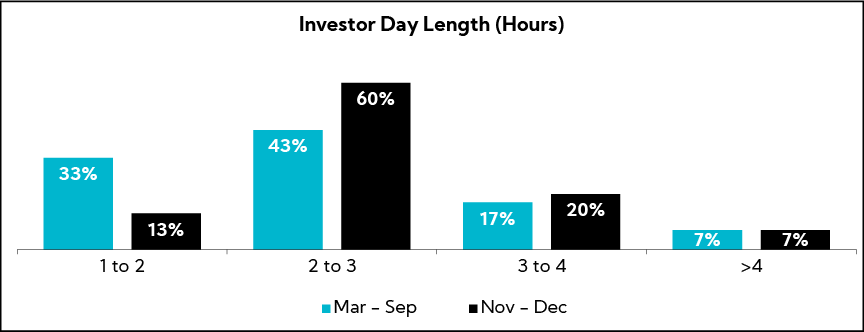

Between March and September, our initial analysis of 30 virtual Investor Days found events ranged from ~1 hour in length, including fireside chats and segment-dedicated presentations, to more robust presentations reaching 3 to 4 hours that provided a deep view of strategy, competitive advantages, and customer testimonials.

Our updated analysis of virtual Investor Days from November and December finds the length increasing, with fewer than 15% now in the 1- to 2-hour range and 60% occurring over a 2- to 3-hour span. Fireside chats, while a strong pivot at the onset of the pandemic, are no longer being utilized, as Investor Days are returning to a more normal state of formal presentations.

The Power of Technology Has Created More Optionality

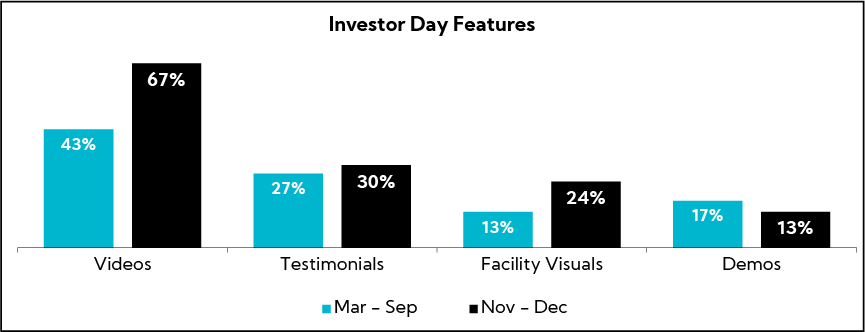

As corporates increasingly leverage technology, videos are being utilized by two-thirds of companies, up from just 43% in our previous analysis. Furthermore, facility visuals were part of nearly one-quarter of recent Investor Days, up from just 13% earlier in the pandemic. As you think about communicating competitive advantage, videos are powerful tools to showcase intangible concepts and/or important hard-to-get-to physical assets.

Visuals in Q&A Are the Norm

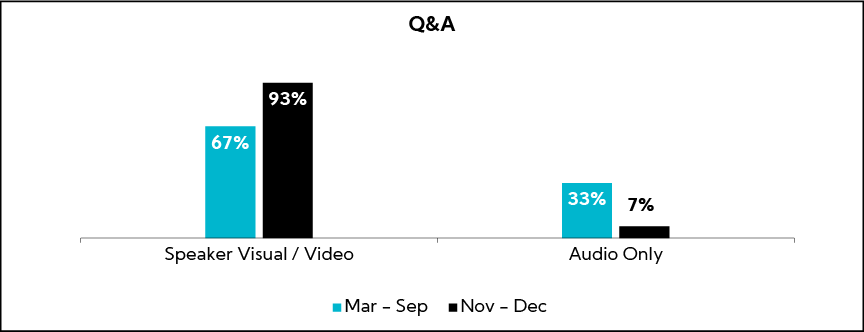

While our research continues to find consistent trends in terms of live vs. pre-recorded prepared remarks, about 65%/35%, respectively, a notable trend is that nearly all companies held live Q&A with a speaker visual / video (vs. audio only), compared to two-thirds in our previous research.

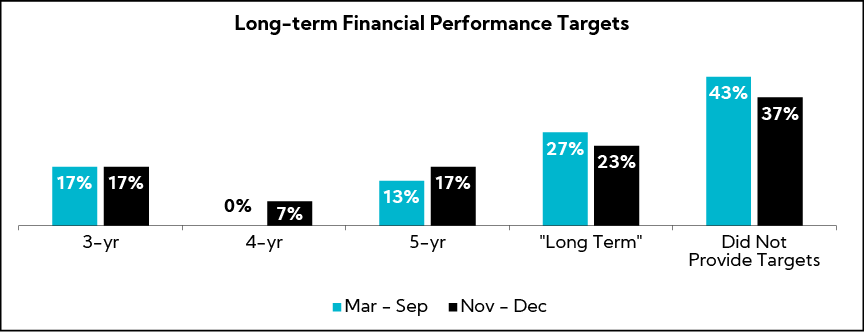

Long-term Financial Performance Targets

As those of you who have partnered with us on Investor Days know, developing and communicating a clear strategic framework that includes long-term financial performance targets and milestones is best practice. Helping investors understand the expected future impact and trajectory of your efforts leads to greater confidence and buy-in at the onset, as well as a host of other benefits, such as focusing investors on the long term. We do not take target setting lightly and work with clients to develop appropriate, reality-based indicators and assumptions that serve to build management credibility.

Our analysis reveals an increasing percentage of companies are providing long-term financial performance targets – 63% versus 57% previously. We think this is striking given the backdrop of the pandemic. And while timeframes vary with more companies outlining a financial framework to be achieved over the “long term”, our proprietary research finds the majority of investors, 60%, prefer 3-year timeframes.

In Closing

At the end of the day, a public company’s currency is its equity. Investors are capital allocators and, based on our extensive research, Investor Days – ones that are thoughtfully and strategically executed – serve as investment catalysts and set the stage for building management credibility.

These events – which should take place biennially – create a more knowledgeable and sophisticated consumer of your equity and provide the level of detail required to get comfortable with allocating meaningful capital. The level of due diligence that goes into making an acquisition is no different than that of making an investment from the buyside’s perspective. High quality, impact investors – like Fidelity, BlackRock, Capital Research, and so many others – have the capacity to allocate capital to an equity in the hundreds of millions to billions. It is reasonable that they require a certain level of information to invest with confidence. Investor Days provide that.

We have developed a deep expertise in buy side sentiment and behavior, as well as factors that impact valuation through primary research encompassing over 15,000 interviews with investors and analysts and deep experience working with hundreds of companies. Our currency is outcomes- based best practice. We specialize in investment thesis positioning and helping clients realize value. We’ve built a track record of executing best-in-class investor days and sustainably rerating companies. The holy grail of equity investing is finding compounders – a handle bestowed upon an uber elite group of companies – and I’m proud to say we have served as the catalyst to unleash that potential. One of the many ingredients – wouldn’t ya know – is Investor Days.