Long-term Financial Targets

Long-term Financial Targets White Paper

Click here to download a copy

Setting the Stage

When thoughtfully utilized, long-term targets influence key decisions and help shape the trajectory for growth and stability at a company. These targets are not just numbers; they represent a commitment to shareholders, a roadmap to fulfilling the company’s vision, and a benchmark against which The Street can measure progress. They also serve as an internal motivator.

According to our proprietary research, management quality is the leading investment factor for buy-side professionals. In an uncertain macro environment, the role of management credibility has never been more pivotal. Investors are increasingly leaning on companies to not only lay out a clear vision at their investor day, but to also delineate realistic, yet ambitious long-term strategic goals tied to financial targets that are grounded in both quantitative analyses and qualitative foresight.

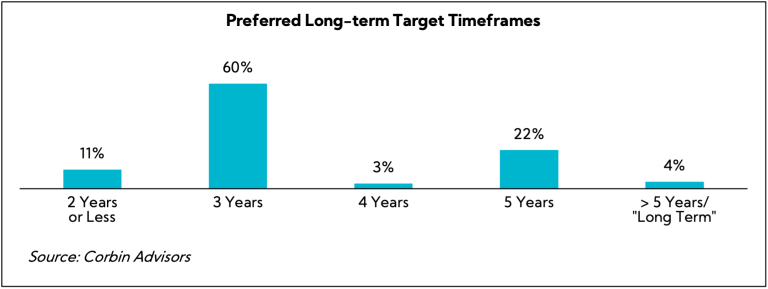

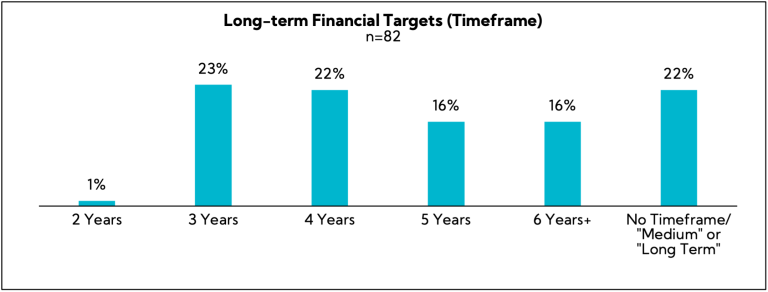

In fact, 90% of investors report that long-term targets are an important to critical element of an investor day. Further, our research shows that 60% of investors prefer three-year targets over any other timeframe.

Navigating the Risks and Rewards of Transparent Target Setting

Pros and Cons of Communicating Long-term Financial Targets

| Pros | |

|---|---|

| Focuses Investor Attention on Key Metrics | Directs investors' attention to the metrics that are most crucial for your company, fostering a deeper understanding of the organization's core operational and financial KPIs. |

| Balances Expectations with Realism | Helps to reel in extreme expectations or fears by providing reasonable ranges that are grounded in realistic assumptions. While resetting expectations through long-term targets can have a near-term impact on stock price, it sets management up to deliver over the long term, which builds credibility. |

| Facilitates Internal Alignment & Improves Metric Quality | Provides the company an opportunity to upgrade the quality and communication of the metrics shared with investors where needed, as senior leaders must come to a consensus over figures in the context of the broader strategy. |

| Grounds Quarterly Expectations | Facilitates a more rooted discussion on quarterly expectations by tying them to long-term assumptions, enabling a comprehensive view of the company's trajectory; in the event of a challenging quarter, can serve to quell concerns by reinforcing that the long-term trajectory remains intact. |

| Serves as a Foundation for Forward-Looking Discussions | Provides management with a robust foundation to refer back to during discussions on forward expectations and questions, ensuring consistency and clarity in communication over multiple reporting periods. |

| Enables Management to Build a “Say-Do” Track Record and Credibility | Strategy linked to credible expected financial outcomes is best practice and a glide path for value creation as management executes against and achieves goals outlined. |

| Cons | |

|---|---|

| Can Result in Confusion | Establishing and updating targets is more science than art. The way in which targets are communicated should be clear, immediately intuitive, and simple (i.e., do not provide too many metrics and avoid “long-term” as a timeframe, as there is no end). They should be married with assumptions and footnotes (i.e., clearly indicate whether targets include or exclude M&A). The opposite approach can result in lack of clarity, confusion, and a lot of follow-up questions. |

| Can Be Dismissed If Not Kept Front-and-Center | Long-term targets should play a role in investor communications periodically and will be brought up by investors and analysts, who use these goals as a measuring stick. Establishing long-term targets and never addressing them deprioritizes the importance they play in the investment thesis and can lead to an apathetic reaction when achieved. That’s a lot of work over a long period of time to not get credit! |

| Can Erode Investor Confidence and Management Credibility | Being overly aspirational, only to reset or miss targets, or pulling targets too quickly without bridging or explaining the rationale leveraging critical investor communication channels (i.e., earnings, investor days) can erode investor confidence and potentially mar management credibility. |

Long-term Target Deep Dive: An Analysis of 100 Investor Days

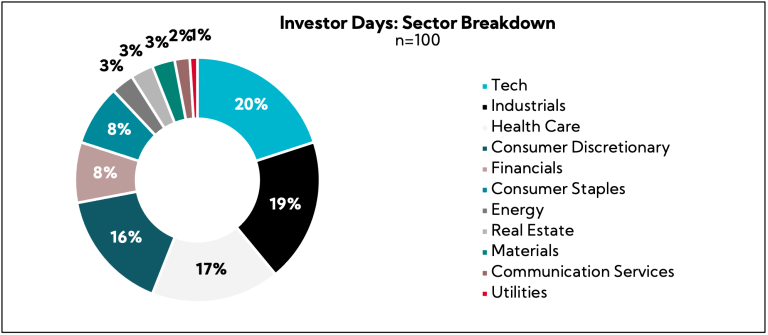

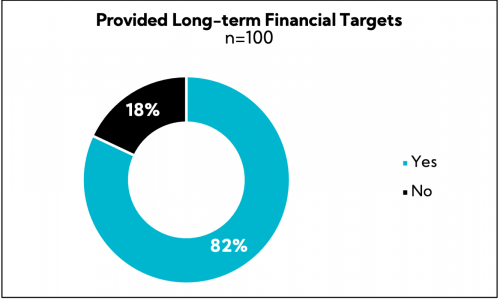

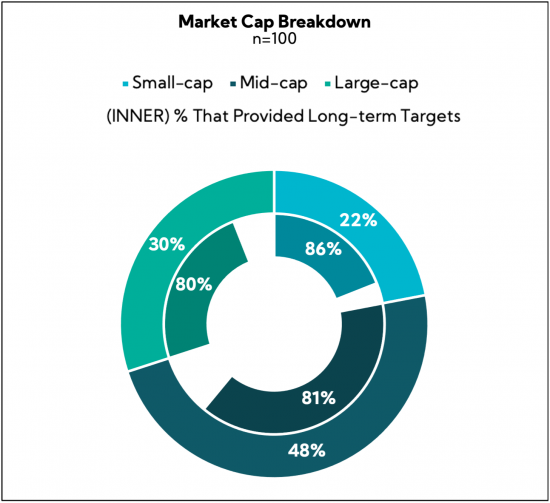

To better understand long-term financial target trends, we analyzed 100 investor days that have occurred in 2023 across market caps and sectors.

Key Findings

- 82% of companies that hosted investor days provided long-term financial targets

- Small caps were the largest proportion of companies to provide long-term targets, though at least 80% across all market caps communicated future financial goals

- Three-year timeframes are the most prevalent, in line with our broader investor preference research

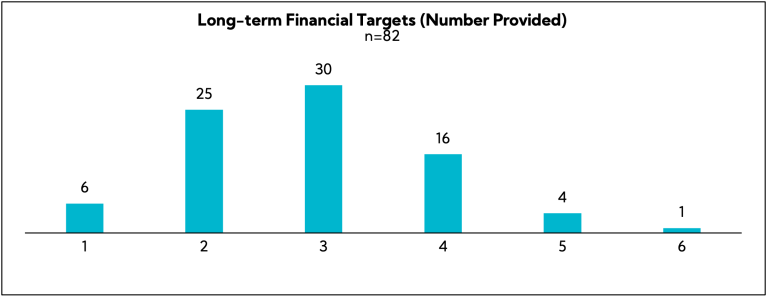

- Most companies provided three long-term financial metrics as targets

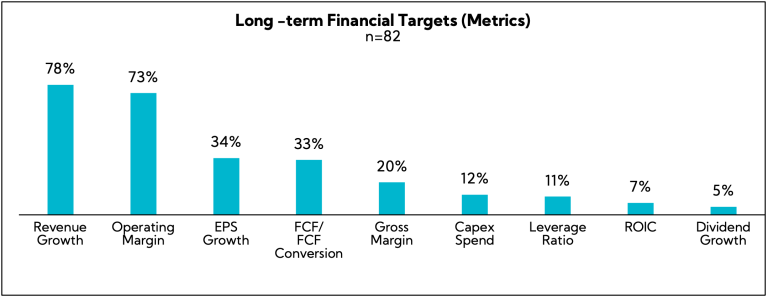

- Revenue growth and operating margin targets are the most oft-cited metrics provided by companies

When advising companies in the months and weeks leading up to investor day, we strongly encourage our clients to include long-term targets to any extent they can. Below, we have outlined selected best practices and recommended strategies to consider:

- Introduce targets in a public forum that allows for management voiceover. Presenting targets within the broader context of the company’s journey — where it has been, where it currently stands, and where it aims to go — helps convey a more comprehensive purpose beyond projections which may not seem tangible in black and white. Communicating the company’s economic value framework, inclusive of market opportunity; strategies to drive growth, profitability, and free cash flow; business model advantages; and capital deployment approach sets the stage for targets to be believed and achieved.

- Do not over commit by providing too many metrics or ones that are hard to predict. There is no “one size fits all” answer to what is appropriate for all companies to project in their targets. Think about what metrics are easier to predict and are the least likely to be affected by surprises in your business or by accounting factors. For example, metrics like EPS can be much harder to predict (and easier to manipulate) versus metrics like revenue due to the greater number of factors layered on top of it within the income statement. Companies with lumpier or more highly cyclical business models also need to think about whether the timeframe being projected provides a sufficient enough window to execute to plan and mitigate swings. Also remember, less can sometimes be more; the more metrics and information your company tries to force into its long-term target framework, the greater the probability of not hitting one or more of them.

- Provide achievable financial goals and communicate ranges where appropriate: To manage external expectations most effectively, publicly announced long-term targets should be reality-based yet offer a compelling view of the internal long-range plan. Consider using ranges or directional guidance (e.g., 7-10% organic growth or mid-single-digit organic growth) instead of specific points (e.g., 9%) to provide flexibility and cushion for achieving the high end that range. That said, do not provide a range that is too wide. There’s a buy-side saying, “you can drive a truck through that guidance,” implying an overly wide target range can be less valuable to investors than not providing any target at all.

- Outline baseline assumptions and scenario analyses. Articulating baseline assumptions that help investors understand internal inputs and sensitivity to external factors that drive performance is also best practice. This can be especially true during times of macro uncertainty. Things happen, and it is good practice to provide a balance in making claims about anything too far into the future.

- In the absence of long-term targets, articulate strategy milestones. As not every company may be equipped and/or comfortable providing traditional, long-term financial targets, consideration should be given to milestones that are outcomes of strategy execution and that provide a path to building a “say-do” track record. Examples include but are certainly not limited to revenue mix (e.g., portfolio, geographic, recurring revenue contribution); vitality index/new product development; shifting from unprofitable to profitable or from cash-burning to free-cash-flow generative; and net debt-to-EBITDA target range.

Establishing long-term targets is an iterative practice that serves as an internal forcing function. It requires buy-in from various stakeholders, from the executive team and board members to frontline managers who will be responsible for executing the strategies that help achieve these targets. The process demands a fine balance between aspiration and realism, quantitative modeling and human intelligence, and cultivating a vision that is both forward-looking and grounded in the current realities of the market and the organization’s capabilities — no easy feat!