Investor Day Webinar Recap

Extending a heartfelt thank you to all of you who attended our Investor Day webinar on Wednesday, as well as give a special shoutout to our esteemed panelists, Renee Campbell of Valmont, Calene Candela of Ryder System, and Tabitha Zane of TopBuild, for sharing their first-hand experiences, knowledge, and best practices. We are grateful for your partnership!

Throughout the hour, we received great audience questions, which led to a lively panelist discussion chock-full of insights, tips, and tricks for executing a best-in-class Investor Day. In case you missed it, today’s Thought Leadership summarizes the key themes and insights from the webinar.

To view the replay and presentation, please visit our Investor Day Webinar Replay site. We hope you find our content engaging and appreciate any feedback that you would like to share with us.

Setting the Stage

As discussed throughout our thought leadership event, an investor day is the ideal forum for companies to articulate their value proposition, showcase the breadth of the leadership team, and educate the Street on operations, end markets, and products. Moreover, they can help build credibility and trust by educating the financial community, addressing questions and concerns real-time, and presenting the company vision by means of articulating a clear long-term strategy linked to financial targets. To that end, be sure to check out our recent Thought Leadership piece on Long-term Financial Targets where we go in depth on this crucial ingredient to a successful event!

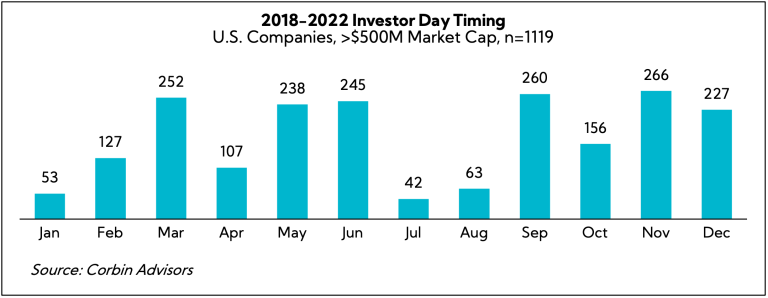

Indeed, the topic of investor days is timely for our clients here at Corbin. September kicks off the second most popular month of the year to host such an event, based on investor days conducted during the past five years.

Corbin’s Proprietary Research

Our research shows 94% of investors and analysts view investor days as a valuable use of their time when successfully executed, with most expecting companies to host one every two to three years irrespective of market cap. Notably, an impressive 76% of the investment community share with us that content presented at an investor day led to a buy decision or rating upgrade. As one of our investor day webinar panelists quipped, “This is your big Super Bowl moment.”

However, we often remind presenters that investor days are not a TED talk — you are not trying to inspire the audience to purse their dreams of becoming a rock star; you are trying to convince them that your stock is a compelling investment. Importantly, 71% of investors and analysts favor more substance with content-rich slides versus great graphics and fewer words (we know that that is diametrically opposite than how executives are taught to present, but Wall Street is a different beast). As a result, a proper amount of time spent crafting the messages, preparing leadership, and practicing Q&A is a critical success factor. Said plainly, investor days can be a work of art, but you have to carve out the white space to create and time to reflect.

In our experience, having helped our clients conduct hundreds of investor days, companies will generally want to book their venue of choice 6 to 12 months in advance, and exceptional events require an execution timeframe of at least 4 to 6 months. If you are concerned about attendance, our research shows that over 9 in 10 investors and analysts prefer the event to be held at a New York City Midtown location. While in-person attendance is a focus — and we spend a lot of our time outreaching to invites to achieve that — the real power is in the content and marketing tool that you are producing that has a long shelf life.

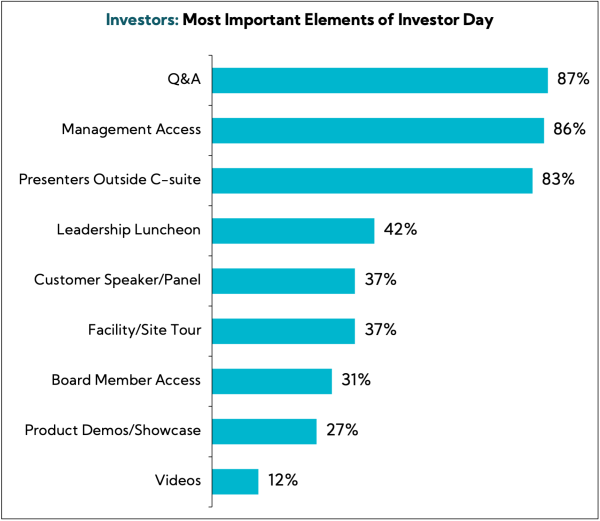

In terms of content, investors cite long-term strategy, capital allocation, and growth initiatives as the leading topics of interest, while Q&A, management access, and exposure to the bench are far and beyond the most important elements of the event. In this vein, two common mistakes we see from companies are:

- not including presenting leadership beyond the CEO and CFO, and

- running too long on prepared remarks and cutting the Q&A time short.

Not only does this leave the impression that the team is disorganized, but a limited Q&A session could signal that the company is shying away from answering questions from the crowd — which is the opposite of what you’re trying to accomplish at investor day! Best practice based on investor preference is to include two Q&A sessions during the event.

Webinar Recap

Executing a Best-in-Class Investor Day (And Also, What Not To Do)

As mentioned, our webinar included a lively panelist discussion featuring Renee Campbell, Calene Candela, and Tabitha Zane, moderated by Corbin’s own distinguished investor day gurus, Thang To and Rob Lockerman.

Panelists

Moderators

Q&A Summary

Below is a summary of the Q&A portion of the session with key themes and takeaways from the event.

Why Choose to Conduct an Investor Day?

Address Company Changes

- Unveil newly minted company strategy or pivot from previous approach

- Showcase new management team (e.g., their breadth of knowledge and history of execution)

- Educate on changes in company structure or M&A activity

Differentiate from Competitors

- Highlight key advantages (e.g., diverse or recurring revenue streams, sustainable profits, product or service differentiation, logistics and supply chain, etc.)

- Answer the time old question “What is your unique right to win?”

Conduct Information Deep Dives

- Arrange in-person roundtable discussions between management and investors, covering various topics

- Use product displays to educate investors and create memorable interactions

Explore Areas of Confusion

- Address points of concern and/or boiling points of discussion

How Can One Best Articulate Strategy or Value Propositions?

Simplify Key Messages and Reiterate Throughout

- Simplify the presentation with four to five key messages repeated throughout, avoiding industry jargon, and ensure all sub-points align with/link back to the overarching themes

- Organize the deck in a memorable format, using a consistent style to aid the audience

- “The deck should flow so that participants anticipate the next topic”

Provide Meat Around the Bone

- Ensure all content is relevant to the investment thesis

- “You don’t want to have empty calories in the presentation”

- Quantify initiatives, goals, and timeframes where feasible

- Emphasize relevant metrics and key drivers to not only add context, but provide clarity for modeling purposes

- Bring product launches alive via product showcases or short videos

Drill Down into Key Changes

- Expand upon previous investor day messaging (if relevant) by including the results/effects of significant changes, such as acquisitions or reasons for entering a new end market

Tailor Presentation to Management Strengths

- Capitalize on management’s strengths; certain executives may thrive in panel discussions or one-on-one settings rather than traditional on-stage presentations

Seek Outside Perspective

- Consider conducting a third-party review of the presentation, as it can be invaluable in pinpointing areas that may need further clarification

What Are the Best Ways to Reinforce Your Investment Thesis?

Create Robust Slides

- Ensure presentation slides are self-sufficient and don’t rely on voiceovers; this will help maintain the content’s relevance and usefulness for investors in the years to come

- Emphasize The Big So What®: “Why should investors choose to invest in your company?”

Exercise Transparency

- Embrace the day as an opportunity to address often overlooked aspects of the business which may not typically fit into the standard timeframe of an earnings call or investor conference

Generate a Storyline

- Employ tag lines and storytelling to effectively communicate long-term initiatives (e.g., sustainability efforts)

Emphasize the Long Term

- Maximize the compounding impact of an investor day and enhance resilience against short-term challenges by emphasizing long-term strategy and positive secular industry trends

Reiterate Thesis Throughout IR Materials

- Utilize earnings calls and investor conferences as occasions to reaffirm and provide updates on key messages, ensuring consistency

What Are Best Practices for Executing an Investor Day?

Plan Early

- Expect a demanding lead-up period and prepare for the possibility that everything may take more time than initially expected

- “You cannot get started on it soon enough”

Research Ahead of Time

- Gain an understanding of the investment community’s sentiment well in advance, identifying any gaps and areas of disconnect to better align messaging

- “The Perception Study insights were invaluable”

Emphasize Track Record

- Establish credibility by showcasing past achievements

- “Not everyone will believe what you say but they will believe what you do”

Practice, Practice, Practice!

- Perform both individual and group dry runs to not only refine commentary but also identify management strengths and weaknesses

- Thoroughly prepare management for the Q&A session; questions may vary, but many answers can be anticipated and prepared for in advance

- Provide management with a comprehensive understanding of Regulation Fair Disclosure

View Content Through a Long-term Lens

- Create the presentation with the approach that content will be utilized in future investor relations materials

- Aim for a presentation to remain relevant for 2-3 years

Participant Questions

What Are Some Thoughts on Hosting at the NYSE?

World-Class Venue for a Good Price

- Aside from symbolic importance, the exchange provides benefits such as enhanced investor accessibility, increased media exposure, strong technological infrastructure for seamless live streaming, and streamlined logistics due to their extensive experience hosting financial events

- For those listed on the NYSE, the event is free

Plan, and Plan Again

- Make the most of your interactions with the NYSE and ask if any events are happening right before or after your event; last-minute issues can be common, and it’s crucial to be well-prepared

- Consider hosting a breakfast prior to the investor day to provide a time buffer for attendees, which can reduce potential concerns about NYC downtown traffic, security, or other factors outside of your control

- Take the opportunity to ring the bell if available

What Are Metrics and Methods to Gauge Post-Investor Day Sentiment?

Review Sell-Side Notes

- Assess whether sell-side analysts have incorporated your investor day messaging into their reports; this can serve as an indicator of your messaging’s effectiveness

- Steer clear of placing excess emphasis on the immediate stock reaction; these events are compounding in nature, with positive effects extending over months and even years into the future

Monitor Shareholder Composition

- Measure shifts in the shareholder base (e.g., strong ESG messaging may result in an uptick in European investment)

Conduct An Impact Survey

- Conduct an Investor Day Impact Survey following the event (one of our hallmark solutions!); these can assist benchmarking performance, measure attendee satisfaction, and provide a platform to collect valuable feedback for future investor relations activities

What Are Some Thoughts on Hosting Within a Broader Annual Conference?

Consider Timing

- Take timing into account — hosting an investor day a week or so after other events may be effective; however, when events are tightly scheduled such as a conference, investor day, and possibly earnings reports in quick succession, it may negatively impact the quality of content and audience engagement

Ensure Message Consistency

- Verify whether messaging will be the same or different across events; inconsistent messaging can prove confusing for the investor community, potentially obscuring the investment thesis

How Can One Navigate Lack of a Strong Past Performance?

Acknowledge Lessons Learned & Emphasize Changes

- Emphasize transparency, ownership of past missteps, and present a clear forwarding-looking vision

- Showcase tangible actions taken to strengthen the company — “proof points”— that demonstrate a commitment to and renewed focus on achieving long-term success

- Ensure you communicate clear strategic milestones and, when achieved, communicate achievement – humble victory laps are important as investors want to invest with winners

Discuss Future Catalysts

- Look to the future by aligning lessons learned and strategic changes with emerging industry trends

TOP 5 BEST PRACTICES

Engaging management early and throughout process; reworking goals to be realistic “the numbers are the numbers” and scheduling multiple in-person working sessions, dry runs, and dress rehearsal in advance

Developing content-rich slides; ensuring long-term strategy and critical themes are woven throughout all presentations and messaging is forthright

Marketing the event to drive interest and attendance; issuing a press release announcing the event, leveraging earnings call to remind key constituents of the event, and issuing a press release the day of to highlight key themes

Offering attendees meaningful interaction with management (e.g., hosting a sit-down lunch after the formal presentations); provide classroom seating, Wi-Fi and outlets

Providing ample time for Q&A; incorporating multiple Q&A sessions (at least two, equating to a total of 45-60 minutes)

TOP 5 WORST PRACTICES

Presenting stale information, an unclear strategy and/or limited transparency; providing no long-term targets or view of the company

Exhibiting a defensive posture towards challenging questions or cutting Q&A short; having only CEO answer questions

Highlighting only CEO/CFO as presenters at Investor Day; no additional access to leadership (i.e., exposure to management “not frequently seen”)

Using excessive industry jargon or acronyms without appropriate explanation and creating slides with fewer words and only graphics

Hosting the Investor Day concurrently with announcing quarterly results

In Closing

Investor days are one of the most impactful company-led efforts out there and, in our experience, these equity story immersions have led to sustained re-ratings and, in certain cases, compounding over time. Why? Well, one is that it serves as a deep-dive education and what investors understand and know, they will appreciate more, buy into more, and be less apt to sell, and two, it serves as a forcing function internally for management to accelerate and drive a deeper and more robust strategy development process, crystallize the narrative, an reimagine the investment thesis.

We hope you find our research and insights timely, enriching, and actionable. As always, please reach out to me or a member of our Team if you are interested in learning more about how we may be able to help in your investor day journey.