Retail Shareholders

Retail Shareholders White Paper

Click here to download a copy

Setting the Stage

Retail shareholders — often defined as individual, non-professional investors who buy and sell securities — have always been a part of the investment landscape. However, their influence and presence have grown substantially in recent years, and more and more of our clients are asking whether they should and how to effectively engage with this dynamic group, tailor communication strategies to their needs, and understand the motivations that drive their investment decisions.

To start, retail shareholders can be categorized based on various criteria, including their investment strategies, financial status, or the frequency of their trading activities. Unlike institutional investors who manage money on behalf of clients, retail investors are everyday people making investment decisions using their own money.

Retail Investor

Type

Characteristics

Individual

High-Net-Worth

Day Traders

Swing Traders

Understanding the behavior of retail shareholders is not always a straightforward exercise. At times, retail traders act rationally, basing their decisions on market research, trends, and sound financial principles. However, influenced by emotions, social media, or prevailing market sentiment, they can also exhibit irrational behavior, driving market fluctuations that may seem disconnected from company fundamentals.

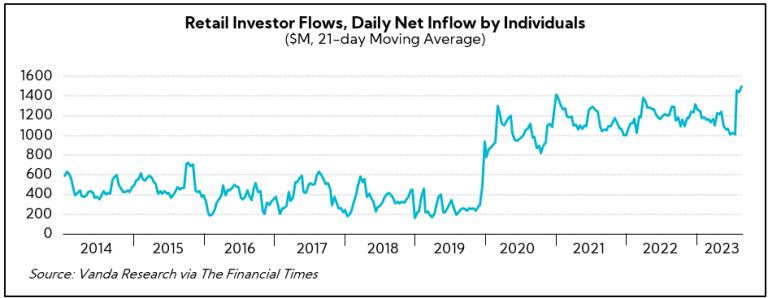

Bolstered by pandemic-era market conditions such as low interest rates, stimulus checks, and increased employee downtime at home, it has become well-documented that 2020 brought forth a wave of retail investment and the movement has held firm. Indeed, 2023 net inflows by individual investors have since surpassed 2020 and 2021 highs, with recent hype around artificial intelligence and fear-of-missing-out (a.k.a., “FOMO”) on the 2023 rally after heavy losses in 2022 likely leading to the recent spike in June.

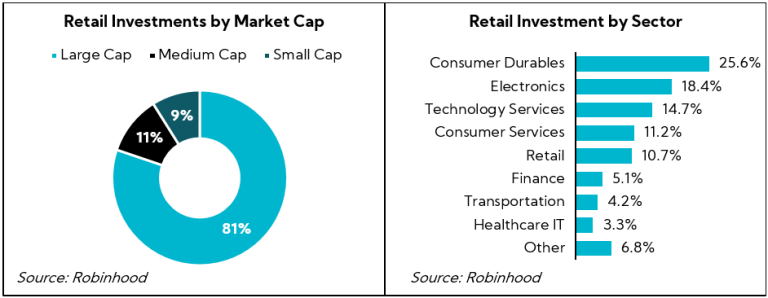

So where is the money going? According to Robinhood, the darling of the retail brokerage firms that rose to fame during the pandemic, large-cap companies dominate the mindshare and wallet of retail investment. Among the most popular sectors include consumer and technology.

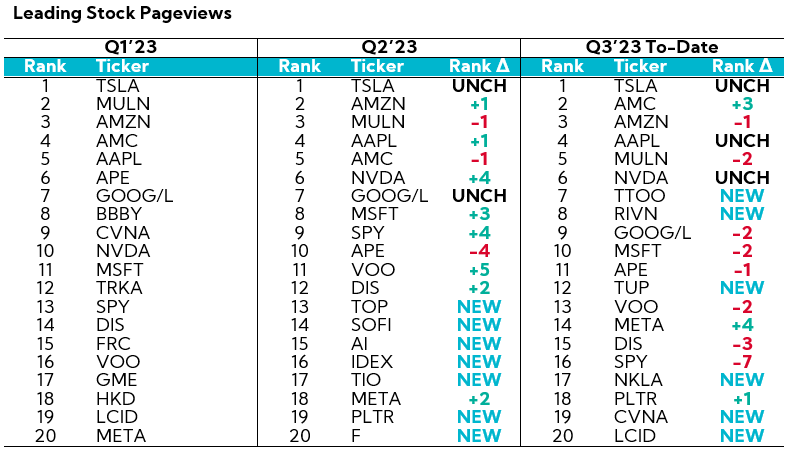

Further, the technological era is driving retail interest to new heights. According to Public, a retail-focused brokerage much like Robinhood, Q2 saw a wave of interest in AI-focused company pageviews. Thus far in Q3, renewed interest has concentrated in EV and alternative fuel automakers companies such Nikola Motor (NKLA), Lucid Motor (LCID), and Rivian (RIVN), not to mention Tesla (TSLA) which remains the leading retail stock across almost all observed retail metrics (pageviews, stock volume, social media mentions, etc.).

While pageviews aren’t a direct or definitive indicator of purchasing intentions, they do imply and highlight areas where retail investors are seeking deeper insights into a company’s history and fundamental performance.

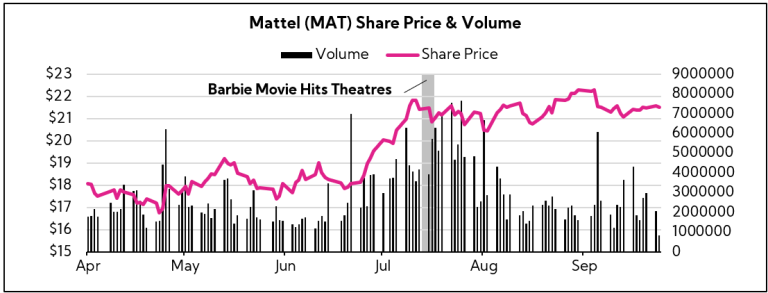

Sometimes, it’s good ole’ fashioned marketing that drums up retail interest. To name a recent example, in the months leading up to the Barbie movies’ debut, Mattel’s stock received an influx of new investment, with volumes (and shares) steadily ticking up through box office weekend. Since then, shares have remained elevated, trading just 5% shy and 40% above their 52-week high and low, respectively1.

As Mattel chairman and CEO Ynon Kreiz commented, “This was not just about making a movie. This was about creating a cultural event and leveraging our brands in a way that we’ve never done before.”

Factors Contributing to an Increase in Retail Shareholder Activity

It was not too long ago when retail brokerage accounts charged meaningful commissions for trades both in and out of stocks that could eat away at returns, especially on smaller-valued trades. Today, most brokerage accounts offer commission-less trading and real-time stock quotes (once the sacred domain of only institutional investors). Increased competition among brokerage firms and the continued proliferation of internet-based trading platforms have further democratized trading for non-institutional investors, both in terms of real-time information flow and the minimum capital required to open an account and trade shares.

Technology innovations and developments continue to reinforce trends toward retail investing, including the following:

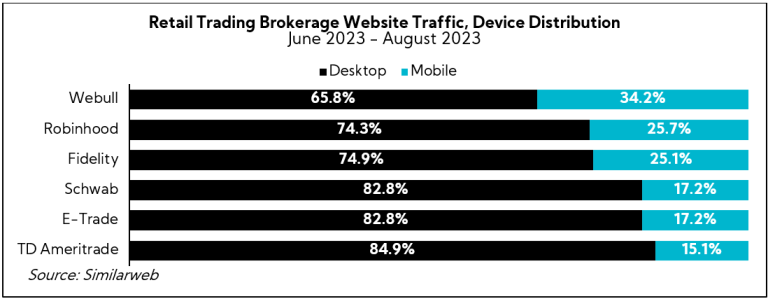

- Mobile trading, offering flexibility, convenience, and ease of user experience; notably, website traffic data of some of the most popular retail trading platforms show a meaningful proportion of website visits coming from mobile, excluding the use of apps

- Fractional shares trading, enabling investors to purchase previously inaccessible, expensive stocks without needing to wait for the company to split shares

- Decline of defined benefit pensions, now largely replaced with defined contribution plans (e.g., 401K) and the proliferation of IRAs driving individuals to take control of their retirement savings

- Algorithmic trading, with AI applications, albeit still in their infancy, now being widely implemented and rolled out to retail users (e.g., Composer, a retail-focused brokerage platform that enables traders to leverage AI and popular algorithmic trading techniques to build custom algorithm strategies without needing to code)

- Rise of third-party retail sentiment platforms, which capture and analyze the collective mood and opinions of individual investors; examples include StockTwits, Say Technologies, and Troop, the latter two of which enable companies to interact directly with retail shareholders to deliver messages, such as encouraging to vote on an upcoming proxy

- ‘Finfluencing’ (Financial Influencing), as social media’s impact becomes directly linked to buying decisions on platforms such as X (formally known as Twitter), Reddit, and TikTok; interestingly, ‘finfluencing’ has highlighted a gray area in modern securities laws as “a finfluencer’s statements may not be factually untrue or clearly deceptive, but they can be interpreted as misleading depending on the context and the particular beliefs held by the finfluencer’s social media followers”2

The Elephant in the Room — Meme Stocks

Speaking of social media, much has been written about the meme stock phenomenon, and a great deal of it continues to perplex both seasoned financiers and casual observers alike. This unique convergence of social media influence, retail investor enthusiasm, and unconventional market movements represents a nascent frontier in market dynamics. It underscores the power of collective sentiment in an age where information, whether rooted in deep analysis or playful banter, travels at light speed. In fact, there’s now a full-length feature film (cautionary tale?) dedicated to the 2021 GameStop fiasco, Dumb Money, including stars Shailene Woodley, Seth Rogan, and Pete Davidson.

While traditional market theories attempt to grapple with these unprecedented shifts, the meme stock saga offers a clear testament to the evolving landscape of investing, where digital communities and emotions can play as significant a role as fundamentals and technicals. In fact, there are retail platforms such as Quiver Quantitative that actively track “meme” stocks and create rankings based on social media mentions and failure to deliver (FTD) data… some unchartered territory.

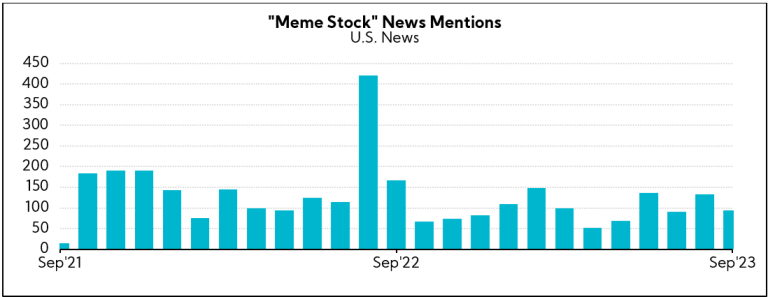

Indeed, since “meme stock” first captured the national zeitgeist in 2021, news mentions have continued to percolate despite peaking in August of last year during the Bed Bath & Beyond meme craze. Absent any meaningful regulation, of which there has been some (e.g., shortening the standard settlement cycles, effective May of 2024), it seems the strategy is here to stay.

Retail investing in the modern era is still in the early innings. For companies looking to educate themselves about their retail shareholder base and deciding to what extent to engage with them, there are several things to consider:

Retail Shareholder Focus Considerations

Upsides

Long-term Oriented (excl. Day- and Momentum-Traders)

Retail shareholders often have a personal connection to the stocks they buy, which can lead them to hold onto shares for longer durations, thus providing greater stability. They are also less likely to hyper-analyze quarterly reports compared to institutional investors.

Emotionally Invested

Their investments often tie back to personal beliefs, interests, or experiences. This makes them more receptive to storytelling and brand narratives than just pure financial fundamentals. Their emotional connection can also lead to increased brand loyalty and advocacy.

Liquidity

For companies with lower liquidity, having a wider pool of retail investors can boost trading volumes, facilitating easier busy and selling of shares

Downsides

Often Financially Unsophisticated

Many retail shareholders may require a higher degree of communication and explanation to make complex financial information and company operations more digestible.

Vulnerable to Misinformation

Given their potential susceptibility to myths, rumors, and the persuasive powers of influential figures on social platforms, retail shareholders might at times make investment decisions based on misinformation.

Exhibit Herd Behavior

Retail shareholders can sometimes exhibit ‘herd behavior’, whereby they make investment decisions based on the actions of the majority rather than individual analysis, potentially leading to sudden stock price fluctuations. Think Jim Cramer’s Mad Money on CNBC.

Nameless and Faceless

Unlike institutional investors who often have direct lines of communication with companies and must publicly file their holdings, retail shareholders are usually small and anonymous to the company’s management, making it much more difficult to ascertain their identity and motives.

Engaging With the Modern Retail Shareholder

Notably, for many companies, the retail investor cohort is going to be small and immaterial, but it remains a growing faction of which to be aware and informed. For companies with more meaningful retail followship or those wanting to educate investors at all levels, below are selected strategies to consider.

- Monitor retail sentiment: Staying apprised of current retail sentiment is easier said than done. Forums such as Finviz, Reddit, Seeking Alpha, Stocktwits, X, Discord, and Yahoo! Finance are among the more prominent retail chat platforms to regularly monitor for any material, non-public information or unverified rumors. While we do not recommend engaging with retail investors on these platforms (and it has been done), consult legal counsel if the information would indicate an internal leak or may require your company to file a new Form 8-K with the SEC to update any material public information. On a case-by-case basis, consider the potential benefits of leveraging the earnings call to clarify focus areas and/or allay concerns in a non-direct, broad-based communication approach.

- Develop educational content, such as company factsheets or quarterly one-pagers: Providing company factsheets or one-pagers that are updated quarterly offers an easy-to-access snapshot of your company’s performance and vision at a glance. This helps to break down complex information into digestible formats, aiding investment decisions for retail and institutional investors alike.

- Leverage digital platforms: Build a robust online investor relations presence and ensure that your company’s IR section is accessible and intuitive. Regularly update content and ensure navigation is seamless for even the least tech-savvy investors.

- Webinars & Fireside Chats: Regularly schedule and promote webinars and fireside chats; use email promotions, easy-to-access links, and/or QR codes to ensure your investors, including retail, are informed and can pencil the events into their calendars (or ideally click a button to add to their calendar of choice).

- Engaging Videos: Apart from product overviews, consider including behind-the-scenes clips showcasing company culture, interviews with key team members, and testimonials from satisfied partners or customers; animated explainer videos can help distill complex processes or technologies into easily digestible content.

- Mobile Optimization: Ensure the IR section is fully optimized for mobile devices, allowing investors to access information on the go, with features like touch-friendly buttons (we often come across IR websites with broken links!) and easily viewable financial documents.

In Closing

While the lion’s share of market-moving investment is still driven by institutional holdings, the ripples created by retail shareholders over the past few years are increasingly being felt, prompting reflection by many within the institutional investor and issuer community. All signs seem to point to more, not less, retail shareholder involvement in the capital markets ecosystem in the future. And rightfully so: the democratization of investment tools and resources means that the modern retail shareholder is better equipped than ever to learn about your company. For IR leaders, this underscores the importance of transparent communication and sometimes novel forms of engagement, catering to a segment that’s growing in both size and significance. And don’t forget — individual employees are also part of the retail fabric, making easy-to-understand, educational communication critical to engaging this group at deeper levels.

- As of 9/25 Close Price

Source: Sue S. Guan of Columbia Law School; Blog post: Finfluencers and the Reasonable Retail Investor