This Week in Earnings – Q3'23

The Sector Beat: Industrials

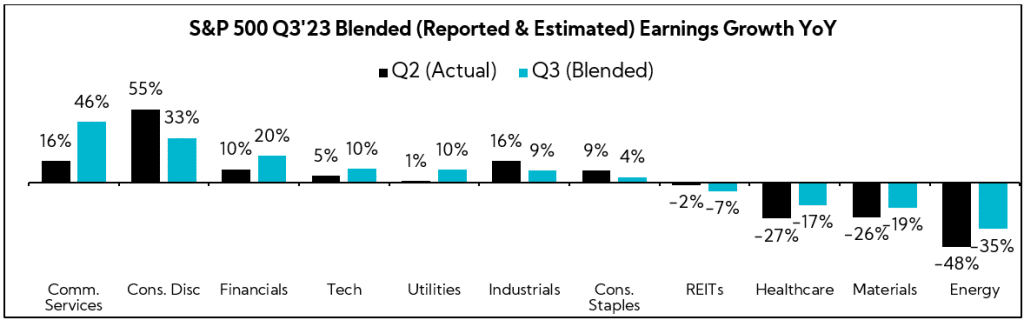

Earnings season is moving fast and furious with the latest batch of results and guides indicating more pronounced weakness than what the markets were expecting and certainly relative to the strong Q2 GDP print published this week.

The macro backdrop can turn on a dime, and the carefree, spendthrift ways of summer has seemingly been replaced with a healthy dose of seriousness in September and a palatable slowing across certain sectors, most notably in Materials and Energy. Activism is on the rise and strategic investor relations has never been more important in preserving and creating value. What investors don’t fully understand, they will sell. What they don’t know, they won’t buy. But for the most part, institutional investors must be fully invested in the market and dislocation, like what we’re seeing now, creates opportunity. With over $12.6 trillion in active equity assets under management just in the U.S. alone, your ability to capture investor mindshare [and wallet] is well within your control and in front of you. And we’re here to help.

In today’s thought leadership, we cover:

- Key Events this week

- Earnings Snap, covering the S&P 500 stats to date

- Spotlight on Industrials in The Sector Beat

Key Events

GDP Growth

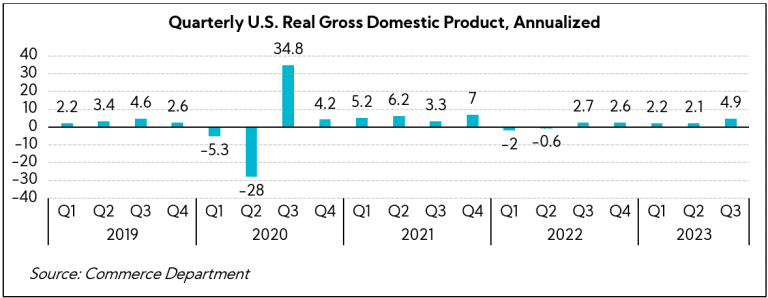

- U.S. GDP grew at a 4.9% annual pace in the third quarter, up from an unrevised 2.1% pace in the second quarter and better than estimated 4.7%. The sharp increase came due to contributions from consumer spending, increased inventories, exports, residential investment, and government spending. The GDP increase marked the biggest gain since the fourth quarter of 2021. (Source: Commerce Department)

Yield

- The yield on the U.S. 10-year Treasury note touched 5% on Monday for the first time in 16 years, after climbing rapidly in recent weeks. That is among many borrowing costs — including mortgages, credit cards, as well as auto and business loans — that could slow the surprisingly resilient economy. (Source: WSJ)

U.S. Government

- Republicans unanimously elected Rep. Mike Johnson as the 56th speaker of the House on Wednesday. His election ends three weeks of leaderless chaos in the House after conservatives ousted Kevin McCarthy. While not the party’s top choice for the gavel, Johnson was backed by former president Donald Trump. (Source: NBC)

Unions

- The United Auto Workers (UAW) union reached a tentative labor deal on Wednesday with Ford, the first of Detroit’s Big Three car manufacturers to negotiate a settlement to strikes joined by 45,000 workers since mid-September. The proposed accord, which UAW’s leadership must still approve, provides a 25% wage hike over the 4.5-year contract, starting with an initial increase of 11%. The Ford deal, which could help create a template for settlements of parallel UAW strikes against General Motors and Chrysler parent Stellantis, would amount to total pay hikes of more than 33% after including compounding and cost-of-living mechanisms. (Source: Reuters)

Europe

- The European Central Bank held interest rates steady at 4%, ending a historic run of 10 consecutive rate increases as Europe’s currency union teeters on the brink of recession and uncertainty around the global economy rises. Officials signaled that they might not need to raise rates further, repeating language first used at their last policy statement in September. The euro and eurozone bond yields edged lower shortly after the ECB’s policy statement. (Source: WSJ)

Oil

- The global benchmark Brent fell to near $88 a barrel following a run of trading that has seen prices swing in a range of more than $2 for each of the last eight sessions. Oil fell as a drop in wider financial markets and softer real-world prices dented gains from Israel’s planned ground invasion of Gaza. (Source: Bloomberg)

S&P 500 Earnings Snap

Covering the S&P 500 stats to date

Q3'23 Revenue Performance

- 49% of the S&P 500 has reported earnings to date

- 60% have reported a positive revenue surprise, below both the 1-year average (69%) and 5-year average (68%)

- Blended revenue growth (combines actual reported results for companies and estimated results for companies yet to report) is +1.4%

- Companies are reporting revenue 1.0% above consensus estimates, below the 1-year average (+2.1%) and the 5-year average (+2.0%)

Q3'23 EPS Performance

- 78% have reported a positive EPS surprise, above the 1-year average (74%) and slightly above the 5-year average (77%)

- Blended earnings growth (combines actual reported results for companies and estimated results for companies yet to report) is +4.3%

- Companies are reporting earnings 7.9% above consensus estimates, well above the 1-year average (+4.4%) but below the 5-year average (+8.5%)

The Sector Beat: Industrials

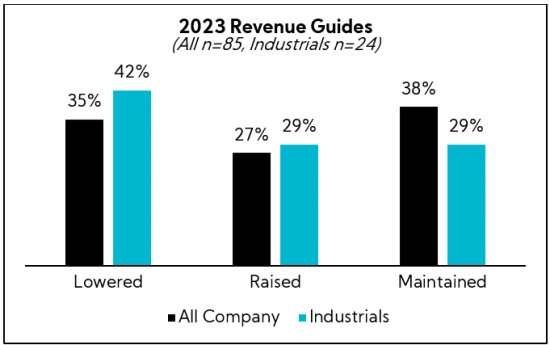

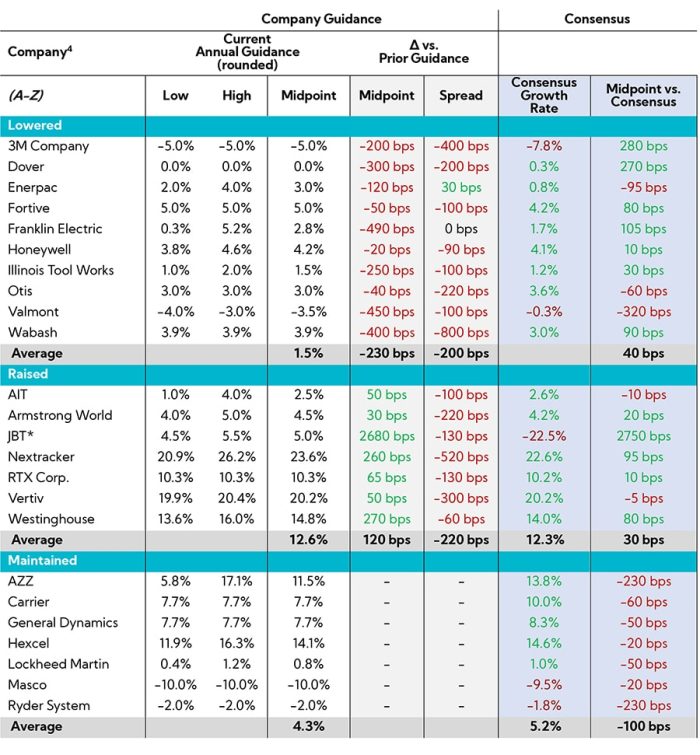

Guidance Trends

As we do every quarter, we analyzed annual revenue and EPS guidance provided by 30 industrial companies with market caps greater than $500M that have reported to date.1 Below are our findings.2

For comparison purposes, we are providing an “All-Company” benchmark, which represents all companies above $500M market cap and across all sectors that have reported since September 26, which we track in real time.3

Industrial Sector: Breakdown by Industry

On average, the overarching trends are that Industrials are lowering revenue guidance above the All-Company benchmark and raising EPS outlooks at higher levels.

Revenue Guidance

- Companies that raised guidance (n = 7):

- 42% raised the bottom and maintained the top of the original range

- 29% raised the bottom and top of the original range

- 29% raised the bottom and lowered the top of the original range

- Average spreads decreased from 4.0% to 1.8%, respectively

- Companies that maintained guidance (n = 7):

- Average spread of 2.4%

- Companies that lowered guidance (n = 10):

- 50% lowered the bottom and top of the original range

- 30% lowered the top and maintained the bottom of the original range

- 20% lowered the top but raised the bottom

- Overall midpoints assume 5.2% annual growth vs. 5.3% analyst estimates, on average

- According to our recent Industrial Sentiment Survey® published last Thursday, investors were expecting 2023 industrial organic growth rates of 5.3%, on average, heading into earnings season

Annual Revenue Guidance

EPS Guidance

- Companies that raised guidance (n = 14):

- 100% raised the bottom and top of the original range

- Average spreads decreased from $0.29 to $0.15, respectively

- Companies that maintained guidance (n = 8):

- Average spread of $0.28

- Companies that lowered guidance (n = 7):

- 57% lowered the bottom and top of the original range

- 29% lowered the top and maintained the bottom of the original range

- One company raised the bottom but lowered the top

Annual Adjusted5 EPS Guidance

Earnings Call Analysis

Further, we analyzed the earnings calls for this group and the broader industrial universe to identify key themes.

As we noted last week in our Inside The Buy-Side® Industrial Sentiment Survey®, our survey found more investor and executive alignment overall than in prior quarters, but with waning enthusiasm across both camps as most shifted into neutral. Heading into Q3’23 earnings season, Industrial investor sequential performance expectations were for results in line with last quarter and analyst estimates, with the level of those expecting QoQ improvement falling to the lowest level since Q4 of last year.

Industrial earnings call commentary reveals waning executive confidence. While results thus far indicate generally stable — even positive — sequential performances, executives across various sub-sectors express caution for the remainder of 2023 and into the first half of 2024.

As the latest U.S. GDP results showed, consumer spending through the third quarter kept keepin’ on. That said, the GDP print is backward-looking, and largely reflects summertime consumer spending which, as we have reported, added to the largest gap between consumer credit and savings rates in modern history.

As such, many industrials note they are watching consumer activity with a keen eye, along with various other moving targets including geopolitical uncertainty, wage inflation, destocking trends, and softening pricing power. To that end, companies have managed to bolster margins thus far through a combination of cost cutting and input pressure stabilization. While some have succeeded in implementing price increases without compromising orders, cursory indications of waning pricing power, fueled by softening inflation, suggest that future price increases will need to be more modest and strategic.

As the economy adjusts to a “higher for longer” interest rate backdrop, industrials note project activity has softened. Though organic growth investments continue to remain the primary focus, companies are keeping a watchful eye on M&A should opportunities materialize, while balancing the impact of today’s higher cost of debt capital.

Key Earnings Call Themes

Macro Challenges Anticipated to Persist into 2024 as Interest Rates Hinder New Project Starts; Meanwhile Freight Recession Appears Poised for Improvement, But Still “Not All Peaches and Cream”

- Norfolk Southern (FY Q3’23 – $42.2B, Railroads): “For Q4, we expect to see slow volume recovery amid uncertain economic conditions. September presented us with some encouraging data that the contraction in manufacturing is slowing and onshoring to the U.S. is on the rise. However, we remain cautious in our optimism as uncertainty surrounding future Fed actions, strike outcomes, and geopolitical tension is very pronounced.”

- Otis Worldwide (FY Q3’23 – $31.1B, Specialty Industrial Machinery): “We now believe the New Equipment market in the Americas is going to be down mid-teens, and we’re really seeing that with the highest impact being interest rates remaining high. It is impacting new project starts. We’ve seen that in the most recent ABI and Dodge data. So we’re watching that closely. We expect infrastructure to pick up as we go into 2024.”

- Dover (FY Q3’23 – $18.2B, Specialty Industrial Machinery): “I don’t want to get on a personal soapbox, but the amount of liquidity that’s being withdrawn is going to show up somewhere. This notion that we’re all going to wait on the government to bail us out because there’s a wave of government spending coming, I find that a problematic strategy.”

- Franklin Electric (FY Q3’23 – $3.9B, Specialty Industrial Machinery): “We expect the broader macroeconomic conditions, including higher interest rates and availability of construction labor, will continue to weigh on the timing of new station builds into 2024.”

- Simpson Manufacturing (FY Q3’23 – $5.5B, Lumber & Wood Production): “September started to slow down a little bit and October is a little soft. On a consolidated level, fourth quarter will be above prior year fourth quarter. And then when we look out into next year, what we’re hearing from our customers is the first half is expected to be a little soft. Second half is expected to pick up depending upon interest rate [and] the economy.”

- MSC Industrial Direct (FY Q4’23 – $5.3B, Industrial Distribution): “We experienced a deceleration in our average daily sales in September. The softening trend is not surprising given IP readings, sentiment survey results, and macro news as companies and consumers deal with the effects of sustained higher interest rates and recessionary fears.”

Freight Recession

- Knight-Swift Transportation (FY Q3’23 – $8.0B, Trucking): “On the truckload side, the announcements of failures and rumors of more seem to be increasing by the week as of late. It’s taken a lot to get to this point being so deep along the bottom of this current cycle. But the market is beginning to show signs of sensitivity to when supply suddenly leaves. However, we are not seeing enough of that kind of activity or enough supply leave and/or enough strength in volumes to move rates to a meaningful inflection position right now. But it does appear that the stage has been set for positive rate pressure in the next bid season.”

- J.B. Hunt (FY Q3’23 – $17.4B, Integrated Freight & Logistics): “We have been in a challenging freight environment or a freight recession, largely driven by excess inventory and the supply chain. As we sit here today, we see further evidence of this trend and most notably in our intermodal business, which is at the forefront of the North American supply chain. To be clear, we are not at a point yet to say we’re out of the freight recession, but we do feel like we’re coming out of it. Directionally, we are seeing signs of things moving in a positive direction.”

- Rush Enterprises (FY Q3’23 – $2.9B, Auto & Truck Dealerships): “I was just with a lot of customers last week and it was not all peaches and cream everywhere. We still expect that market hopefully back sometime maybe April next year. It’s still bubbling along. I hope it’s on the bottom. The small guys are still getting pushed out with the rise in fuel prices that we had.”

Reduced Discretionary Spending Finds Itself Amplified by Reluctance to Restock Inventory; Meanwhile Despite the Recent Ford Agreement, UAW Strikes Far-reaching, Prompting Cautious Guidance and Vigilance

- Crane (FY Q3’23 – $5.3B, Specialty Industrial Machinery): “I would say nothing material has changed overall in the demand profile. We saw some nice uptick in the quarter, which was a good…but it doesn’t change that underlying trend that we had been talking about all year. Instead of fundamental orders inflecting negative here in September, October, it’s probably going to happen in December. But the overall trend is going to happen the way we suggested and then revert, to go negative next year and then revert back at the end of 2024.”

- Armstrong World Industries (FY Q3’23 – $3.3B, Building Products & Equipment): “Overall, the level of uncertainty remains in the marketplace. Even though the uncertainty was driving a lot of the back half expectations for a softer economic condition that didn’t materialize, given the geopolitical issues and interest rates, there’s still some uncertainty around their overall impact on the economy. And that gives pause, especially the discretionary area of renovation work.”

- 3M (FY Q3’23 – $49.4B, Conglomerates): “Our category broadly in consumer is exposed to shifting discretionary spend. So that continues to be part of the consumer story. Back-to-school was muted…and as we look ahead, I would say we’re looking at the uncertainty around what happens for the holiday season as well. And again, there’s a broader story around consumer retail for us, the shift of spending from discretionary products into areas like food, and experience kinds of spending, that trend has continued.”

Destocking

- CSX (FY Q3’23 – $59.0B, Railroads): “In my opinion, a lot of the businesses we touch have been in recession for the last year and many of them are at cyclical lows, and maybe went beyond that with the destocking that occurred.”

- J.B. Hunt (FY Q3’23 – $17.4B, Integrated Freight & Logistics): “We’ve talked about inventory destocking and the role that played in demand in our industry for several quarters now. We’re confident that that pressure relieved during the third quarter. Questions remain about the U.S. economy. What’s going to happen to the consumer? What will demand be as we head into 2024?”

- Dover (FY Q3’23 – $18.2B, Specialty Industrial Machinery): “Our channel partners are, in certain cases, below normal holding pattern, and that is because of the cost of carry with interest rates. There’s a dynamic now because of higher interest rates of everybody trying to liquidate working capital because of the cost of that working capital, us included by the way. And we’re in a little bit of a standoff in certain end markets where we would argue that inventories are down too low, but we are not going to incentivize revenue into the system either through price or through terms.”

- Franklin Electric (FY Q3’23 – $3.9B, Specialty Industrial Machinery): “While underlying demand in our core markets remained solid, with higher interest rates and trading costs, customers are more sensitive to inventory levels. With improved lead times and delivery performance, we have higher confidence in the availability of products when they need them as well. As a result, just like us, they are reducing inventory levels.”

UAW Strikes

- 3M (FY Q3’23 – $49.4B, Conglomerates): “We’re staying connected on what happens week to week. It’s something that’s an important part of our global automotive business. It’s had some impact, but relatively small impact to this point. Again, we’re watching it closely as we move ahead.”

- MSC Industrial Direct (FY Q4’23 – $5.3B, Industrial Distribution): “Conversations with our sales team suggest that we were more acutely impacted in September and October by the extended reach of the UAW strikes. While we have some direct exposure, this headwind is magnified when accounting for our indirect exposure, including job shops and machine shops, many of whom service the auto industry. We’ve since received a steady flow of reports of customers clamping down on spend and taking temporary breaks from production.”

- Illinois Tool Works (FY Q3’23 – $68.3B, Specialty Industrial Machinery): “Given the uncertainty around Auto and the fact that the strike is now in the sixth week here, we decided that we take a more prudent approach [to guidance], which is basically based on what we’re seeing in our businesses right now, maybe with room for things deteriorating a little bit further from where they are today.”

- Union Pacific (FY Q3’23 – $125.1B, Railroads): “We are watching closely the ongoing UAW negotiations and the negative impact they are having on fourth quarter volumes as the strikes persist.”

Despite Lower Demand and Signs of Downward Pricing Pressure, Execs Holding Firm on Margin Rates, Helped by Pockets of Deflation

Pricing

- Owens Corning (FY Q3’23 – $9.8B, Building Products & Equipment): “We’re facing some downward price pressure incrementally. We’re also very conscious and focused on managing our inventories and our working capital to generate strong cash flow. So we are going to manage those inventories against this current demand environment. That is going to lead to some incremental production downtimes.”

- Dover (FY Q3’23 – $18.2B, Specialty Industrial Machinery): “In a dire demand environment, if I point back to how we performed during the COVID period, we’ve got the ability to flex the cost structure. As it relates to pricing, we fundamentally believe that inventory position is going to be incredibly important as it relates to pricing as it goes into 2024, and that’s why we’re taking a little bit of hard medicine here between now and the end of the year of not to incentivize demand through pricing action. We’ve done a lot of hard work of moving the margins up here and we’re keeping these margins.”

- Watsco (FY Q3’23 – $13.7B, Industrial Distribution): “There is a concern of an elasticity issue here where we’re going to reach a point where a consumer can’t afford [our product]. I still feel like this is a necessity of life that people have to have heat, have to have cool. The consumer so far has been fairly resilient as far as taking care of what I would consider to be an absolute need for life, if you will.”

- MSA Safety (FY Q3’23 – $6.3B, Security & Protection Services): “We plan on a global basis to have a price increase in January. The price increase will be a bit more moderated than we’ve had in the past, as we’ve seen costs go up in a more moderated manner. So, we continue to expect to keep pace with our cost, and that’s part of the equation of that gross profit piece and keeping that in alignment.”

Inflation

- CSX (FY Q3’23 – $59.0B, Railroads): “In terms of production, supply, and operations, at least on the inflationary side, it’s early; but it’s fair to say that we’ll start to see some normalization of the inflationary pressures from this year. So, we had mid-single-digit inflation this year. It’ll probably be a little bit less than that, but certainly higher than the five-year average as some of those outside service contracts are based on lagging indicators or labor indices that are going to reset.”

- Illinois Tool Works (FY Q3’23 – $68.3B, Specialty Industrial Machinery): “There’s still some pressure on the costs side, on the labor side, components, as well as energy. That said, we’ve made some good progress. Price is holding, and we’re seeing a little bit of deflation on the commodity side. So these would be the metals, in particular, which drove the stronger performance here on price/cost in Q3.”

- Armstrong World Industries (FY Q3’23 – $3.3B, Building Products & Equipment): “We experienced better-than-expected freight and energy costs, so some deflation. Raws were about as expected. I’d say looking forward on a full-year basis, we’re now outlooking for total input costs about flattish, so maybe some slight inflation there versus prior year in percentage terms with raw materials in that high single-digit range.”

- Otis Worldwide (FY Q3’23 – $31.1B, Specialty Industrial Machinery): “Inflation on the Service side, while we have had wage inflation, we know we need to offset that with productivity. And what we’ve been doing with price has been fairly significant.”

Companies Prioritize Organic Growth, Innovation, and Technology Investments; M&A is Increasingly on the Radar Should a Market Dislocation Create Opportunities

- 3M (FY Q3’23 – $49.4B, Conglomerates): “Our first priority for capital allocation is going to be investing in organic growth, in R&D, and capex and really thinking of and targeting high-growth market spaces, places where we can differentiate ourselves with our innovation capabilities, where we can be aligned to emerging market trends.”

- Lindsay (FY Q4’23 – $1.4B, Farm & Heavy Construction Machinery): “It starts with supporting our organic growth opportunities. And we’ve talked about capital being part of that, potentially capacity expansion in places like Brazil and Turkey. We’re also looking at global investments in modernization, Industry 4.0, and productivity improvements in our factories. So, we are anticipating in 2024 that we’re going to increase our capital expenditures. And then longer term, as things settle down in Ukraine, Russia as an example, there’s opportunities for other geographical expansion. But then from there, M&A is clearly a priority.”

- Rush Enterprises (FY Q3’23 – $2.9B, Auto & Truck Dealerships): “I don’t see us returning whatever the FCF is next year. I don’t see us returning much more than 55%. I want to make sure I’ve got some money in case M&A comes along. I don’t have any great M&A right now, but I have a feeling with the downturn typically some M&A might show up.”

- MSA Safety (FY Q3’23 – $6.3B, Security & Protection Services): “The [M&A] market is active. I would say we’ve had the normal post-Labor Day surge of activity. Prices, if you have maybe a two-year mindset, they have come down a bit, which is good, because the cost to do a deal has gone up. So, that should enable, again, if the financials hit, for some things to happen.”

Citing Stable Demand That is More Moderate Than the U.S., Companies See Some Encouraging Signs, Though Inflation and Geopolitical Uncertainty Remain Factors

- Otis Worldwide (FY Q3’23 – $31.1B, Specialty Industrial Machinery): “Inflation is still pretty high in Europe. Not as high as last year, but not too far off from there. And most of our contracts are right now in negotiation, and they’re obviously linked to an index. So we feel pretty good about the pricing increase in Europe next year could be around the MSD level again. So that’s really encouraging.”

- Owens Corning (FY Q3’23 – $9.8B, Building Products & Equipment): “We’ve been sequentially stable in terms of European demand. We see good stability into Q4. We need the economies in Europe to really sort through inflation and interest rates and perhaps also Ukraine for us to see a return to where we were in the first half of last year.”

- Paccar (FY Q3’23 – $44.2B, Farm & Heavy Construction Machinery): “It feels like the general economies over there feel a bit more moderated than they are here. And so, there’s probably more contemplation going on within the customer base there.”

- John Bean Technologies (FY Q3’23 – $3.3B, Specialty Industrial Machinery):“What we have seen in Europe over the last 30 days and at the end of the quarter and as we entered Q4 here, some strengthening in Northern Europe, which has been the weakest area for the last several quarters in Europe in general, while Southern Europe has been a little bit stronger. So, we are starting to see some benefits there. Germany still remains pretty tepid. But as a whole, in terms of where we’re penetrated in our product lines, we are seeing some pickup in activity.”

So far, while Q3 prints for industrials are faring generally well, calls for softening conditions through the remainder of the year are prevalent. We’re seeing revenue guides adjusted lower at rates outpacing the all-sector averages, and cautious outlooks through the first half of 2024. Still, companies are controlling what they can and focusing on the margin, and that confidence has translated into notable EPS hikes across the sector.

We’ll continue to provide insights into the different sectors as earnings season rolls on.

- As of 12pm on Oct 26, 2023

- A small number of the 30 companies tracked do not report revenue and/or EPS guidance, reflected in the “n” throughout

- The total number of companies in the All-Company benchmarks vary across revenue and EPS based on guidance practice

- AAL, CR, GE, KNX, UAL, ALK did not provide revenue guidance

- Non-GAAP figures reported by the individual companies analyzed