This Week in Earnings – Q3'23

The Sector Beat: Consumer Discretionary

In today’s thought leadership, we cover:

- Key Events this week

- Earnings Snap, covering the S&P 500 stats to date

- Spotlight on Consumer Discretionary in The Sector Beat

Key Events

Manufacturing

- The ISM Manufacturing PMI® registered at 46.7 in October, 2.3% lower than the 49.0 recorded in September, representing the 12th consecutive month of contraction after a 30-month period of expansion. The New Orders Index remained in contraction territory at 45.5, 3.7% lower than in September. (Source: Institute for Supply Management)

Labor

- Nonfarm payrolls expanded by 150,000 in October, against the Dow Jones estimate for 170,000 and a sharp decline from the gain of 297,000 in September. The United Auto Workers strikes were primarily responsible for the gap as the impasse meant a net loss of jobs for the manufacturing industry. (Source: Labor Department)

- The unemployment rate rose to 3.9% in October, slightly above consensus estimates that the rate would hold steady at September’s 3.8%. (Source: Labor Department)

- Average hourly earnings, a key figure as the Federal Reserve fights inflation, rose 0.2% for the month and 4.1% on the year. (Source: Labor Department)

Interest Rates

- On Wednesday, U.S. officials voted unanimously to hold the Federal Funds rate steady at 5.25% to 5.5%. Federal Reserve Chair Jerome Powell hinted the central bank might be done raising interest rates for now but was careful not to rule out another increase after officials extended a pause in hikes. (Source: WSJ)

- The Bank of England’s policy makers left their key interest rate unchanged for the second straight meeting but said they don’t expect to ease policy soon. The BOE followed both the Federal Reserve and the European Central Bank in leaving its key rate unchanged, representing the first time that all three decided against an increase since December 2021, when the BOE became the first to start raising its key rate. (Source: WSJ)

Israel-Hamas War

- The GOP-controlled U.S. House of Representatives approved a $14.5B assistance package for Israel, though prospects of the bill passing the Senate are grim as the package required that the emergency aid be offset with cuts in government spending elsewhere. This comes as Israeli forces announced on Thursday they had successfully encircled Gaza City — the Gaza Strip’s main city — in their assault on Hamas, effectively splitting the Gaza strip in two. (Source: Reuters)

S&P 500 Earnings Snap

Covering the S&P 500 stats to date

80% of the S&P 500 has reported earnings to date.

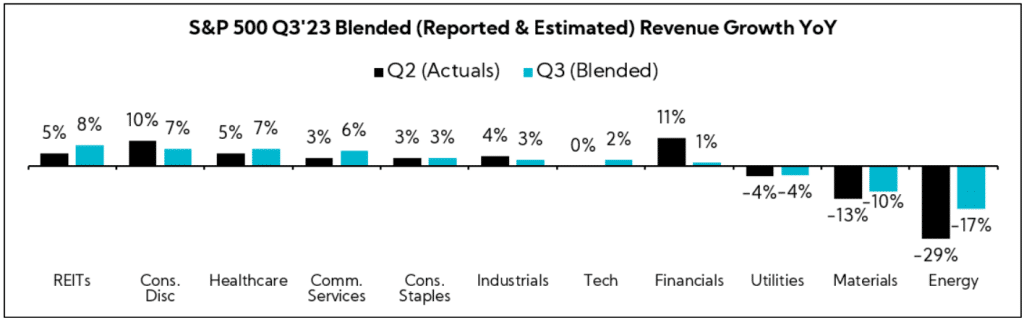

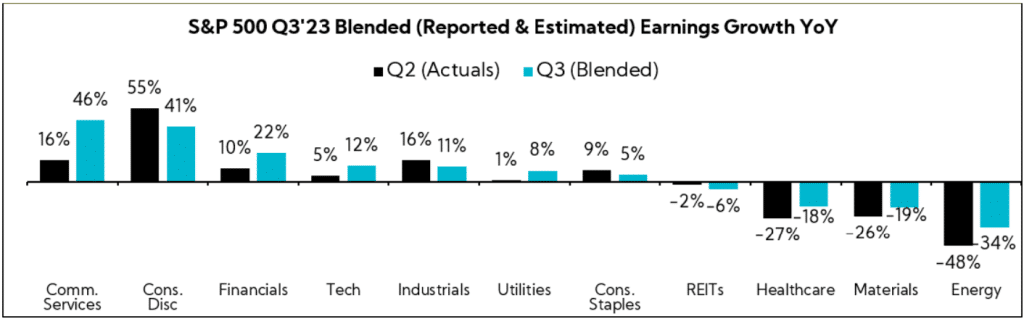

Q3'23 Revenue Performance

- 60% have reported a positive revenue surprise, below both the 1-year average (69%) and 5-year average (68%)

- Blended revenue growth (combines actual reported results for companies and estimated results for companies yet to report) is +1.2%

- Companies are reporting revenue 0.5% above consensus estimates, below the 1-year average (+2.1%) and the 5-year average (+2.0%)

Q3’23 EPS Performance

- 82% have reported a positive EPS surprise, above both the 1-year average (74%) and 5-year average (77%)

- Blended earnings growth (combines actual reported results for companies and estimated results for companies yet to report) is +5.7%

- Companies are reporting earnings 7.0% above consensus estimates, well above the 1-year average (+4.4%) but below the 5-year average (+8.5%)

The Sector Beat: Consumer Discretionary

Guidance Trends

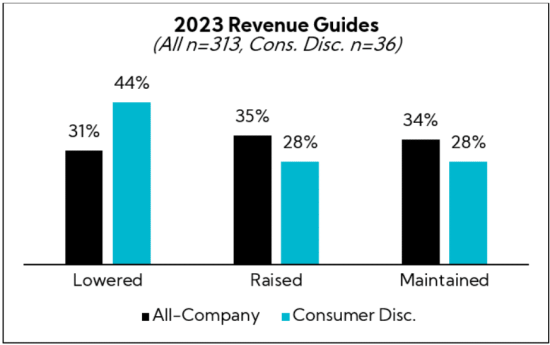

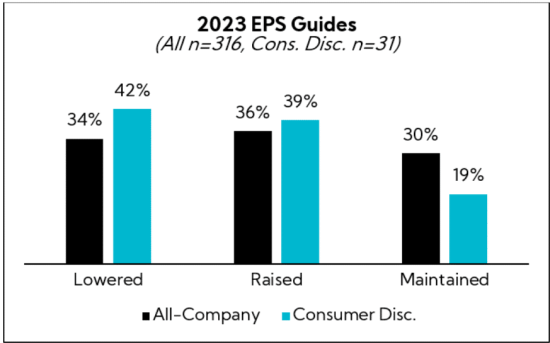

As we do every quarter, we analyzed annual revenue and EPS guidance provided by U.S. Consumer Discretionary companies with market caps greater than $500M that have reported to date.1 Below are our findings.

For comparison purposes, we provide an “All-Company” benchmark, which tracks in real-time2 all companies larger than $500M in market cap across all sectors that have reported since October 10.

Sector: Breakdown by Industry

On average, overarching trends indicate a greater number of Consumer Discretionary companies are lowering revenue and EPS guidance versus our All-Company benchmark — a clear reflection of the tightening financial constraints among consumers.

Revenue Guidance

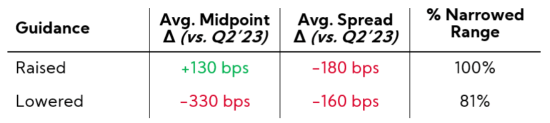

Consumer Discretionary companies that raised annual revenue guidance (n=10):

- 50% raised the bottom and top of the original range

- 40% raised the bottom and maintained the top of the original range

- 10% raised the bottom and lowered the top of the original range

Consumer Discretionary companies that maintained annual revenue guidance(n=10):

- 2023 growth guides range from -11% to +20%, with an average midpoint of +5.7%

Consumer Discretionary companies that lowered annual revenue guidance (n=16):

- 63% lowered the bottom and top of the original range

- 37% maintained the bottom and lowered the top of the original range

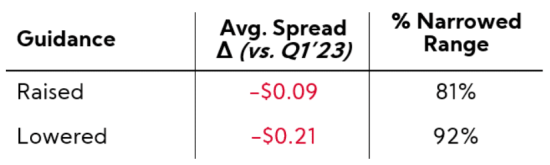

EPS Guidance

Companies that raised annual EPS guidance (n = 12):

- 58% raised the bottom and top of the original range

- 25% raised the bottom and lowered the top of the original range

- 17% raised the bottom and maintained the top of the original range

- Average spreads tightened from $0.21 last quarter to $0.14 this quarter

Companies that maintained annual EPS guidance (n = 6):

- Average spread of $0.37

Companies that lowered annual EPS guidance (n = 13):

- 84% lowered the bottom and top of the original range

- 8% maintained the bottom and lowered the top of the original range

- 8% raised the bottom and lowered the top of the original range

- Average spreads tightened from $0.42 last quarter to $0.24 this quarter

Earnings Call Analysis

We analyzed the earnings calls for this group and the broader Consumer Discretionary universe to identify key themes.

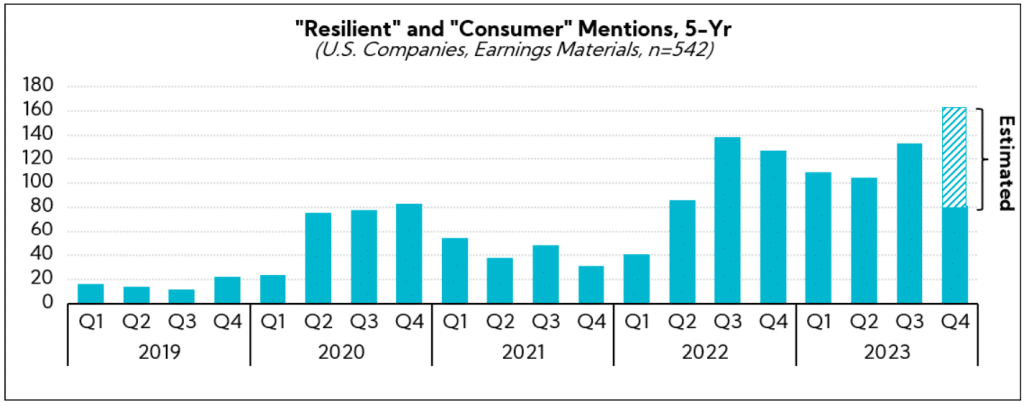

“Resilient” has been commonly used to describe the consumer for more than a year now — but don’t take our word for it — it’s in the data!3

But is the consumer truly resilient or is it time we alter the diagnosis? Based on this quarter’s executive commentary, guidance revisions, and our proprietary Voice of Investor® sentiment, our analysis shows that the more “resiliency” is evoked by executives, the worse the condition. Indeed, this quarter’s commentary felt more like an inflection point than in quarters past, particularly regarding forward looks.

While we are all aware by now of last week’s astounding 4.9% Q3 U.S. GDP print, the reality on the ground sounds a lot different than the credit-induced spending spree registered over the summer. Exiting Q3, executives largely cite weakening conditions, with commentary suggesting the demand outlook remains uncertain in the coming quarters.

Several counteracting forces are contributing to the murkiness, namely:

- An easing though still-sticky inflationary environment, flanked by persistent wage pressures

- Cost and operational improvements, undercut by waning pricing power

- Demand softness and trade-down activity, resulting in promotional marketing and increased competition

The collective net effect of these actions read more as a net negative on Consumer Discretionary companies than in prior quarters. Not to mention, several new headwinds — student loans, geopolitical conditions, and seemingly higher-for-longer rates — have dampened overall sentiment. As one executive noted, consumers are “buying what’s needed and only when it’s needed.”

This isn’t exclusively a U.S. phenomenon. China and Europe commentary is squarely mixed, with the former cited as being “volatile” and the latter remaining “difficult” to predict.

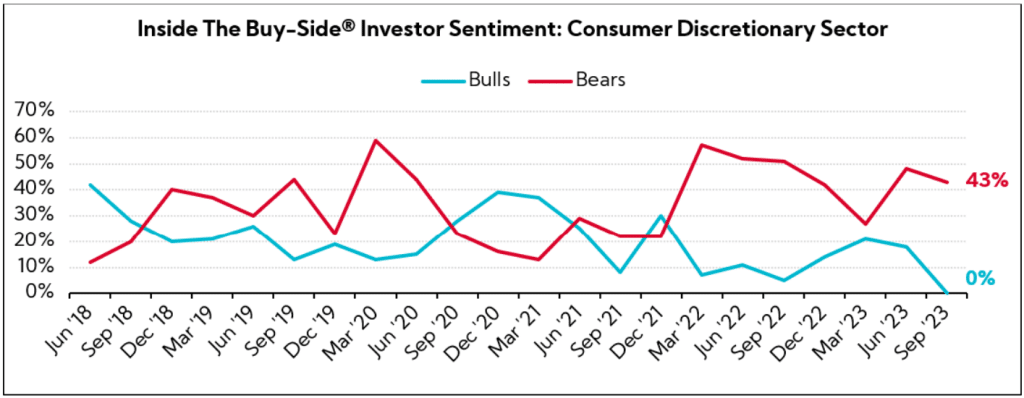

Notably, our Q3’23 Inside The Buy-Side® Earnings Primer® registered zero bullish sentiment for Consumer Discretionary heading into the quarter — a survey first, and an indication that the Street is increasingly predicting fallout.

Key Earnings Call Themes

Consumers Pull the Purse Strings Tighter; Executives Note Leaner Spending Habits and Trade-down Activity, Particularly Among Lower-income Shoppers

- Carter’s (FY Q3’23 – $2.5B, Apparel Retail): “Given the financial strain on families with young children, we believe more consumers are cautious on spending, buying what’s needed and only when it’s needed. Store visits are more intentional and fulfill the need for immediacy. We have a very high conversion rate in our stores. Many are coming to buy, not browse.”

- Frontdoor (FY Q3’23 – $2.6B, Personal Services): “The current macroeconomic environment has resulted in a pullback in consumer demand for home warranties. In the near-term and prior to our rebrand early next year, we will be tactical with our approach. We will continue to utilize our discounting strategy, which is evolving to maximize demand conversion. And in Q4, we are increasing the actual marketing spend behind our American Home Shield brand to drive brand awareness.”

- Tractor Supply Company (FY Q3’23 – $21.3B, Specialty Retail): “They are shopping us and at record levels. That said, when they’re shopping us, they are spending a little bit less on items per basket, to the tune of a low-single digit headwind and they’re pulling back a little bit on discretionary. Those are consistent themes that we’ve had for the last few quarters. We haven’t seen any acceleration in that. It’s really been more of a consistent theme.”

Trade-downs, Lower Income

- Yum! Brands (FY Q3’23 – $34.8B, Restaurants): “It’s well documented that there is more pressure on the U.S. consumers’ loan payments coming due, and certainly, our industry has softened a little bit, but the industry is doing better than most…if we break down the Taco Bell stores in the United States by income demographic, we see really consistent 2% to 3% transaction growth across all income levels…that speaks to the way Taco Bell can play value with things like the $5 box and how also in a pressured consumer environment, we’re probably benefiting a little bit from some trade-down in those higher-income trade areas. So, our lens on the consumer is obviously biased, but we’re putting up strong results.”

- Chipotle Mexican Grill (FY Q3’23 – $55.7B, Restaurants): “We’re reading the same things you are, and the consumer is clearly under pressure with inflation over the past year and pretty much everything with gas and groceries and really across-the-board high interest rates. We continue to do well not just across our income levels but with the lower income. They’re really hanging in there at about the same level as our medium and high-income level. So, the Chipotle value where we haven’t raised prices in over a year until this latest action, is coming through and people are choosing to dine at Chipotle because we are very affordable.”

- LiveWire (FY Q3’23 – $2.0B, Auto Manufacturers): “We see a lot of customers sitting on the sidelines…even those with high credit worthiness, looking at the level of the rates and saying that having a certain amount of rate shock and saying we’re not going to pay those level of rates based also on how many years and many decades of lower rates…And then for our more credit challenged customers or customers at a different income level…just a limit of affordability within their month to month budget.”

- McDonald’s (FY Q3’23 – $194.2B, Restaurants): “Specific to the U.S., we’ve been talking about how the consumer is more discriminating because of all of the price pressures that they’re facing, as well as interest rates, things like that. What you end up seeing is that the pressure is felt more on the lower-income consumer. And so, one of the things that we saw industry-wide is that that low income consumer, which we would say is $45,000 and under, was negative from an industry standpoint…we’re going to need to continue to keep a close eye on that $45,000-and-under consumer, because of the pressure that they’re feeling there, and make sure that we’re offering value, but hopefully the industry stays disciplined as well on pricing.”

- Wingstop (FY Q3’23 – $5.9B, Restaurants): “As lower-income consumers pull back from those higher frequency QSR occasions, or even as higher-income consumers trade down into dining visits, Wingstop is uniquely positioned to gain more new guests and introduce them to that indulgent, high-quality occasion that our core consumers have come to appreciate over the years.”

Still “Levers to Pull” as Executives Tout Improved Cost Structures and Easing Inflation, Though Price Tags Expected to Drop as Demand Drifts

Productivity & Cost Reductions

- Frontdoor (FY Q3’23 – $2.6B, Personal Services): “As we think about going forward, we’re seeing these external factors normalize, but we’re also seeing the results of the hard work that our business has been doing manifesting and coming to life, and we expect that to continue in our margins as we look to Q4 and beyond.”

- Carter’s (FY Q3’23 – $2.5B, Apparel Retail): “We’ve done a lot of very good work, looking at our cost structure of the organization, I’m really pleased with how they’ve responded to the challenge. Everybody understands the environment that we’re in, and the best thing we can do is just keep ourselves as lean as possible.”

- Brunswick (FY Q3’23 – $5.0B, Recreational Vehicles): “We began to work on operating expenses very quickly this year as market conditions unfolded and pulled out significant expenses. That was obviously progressive during the year…as we see the market softer and generally, market softer across recreation and beyond, the customer supply dynamics change. We’re able to influence pricing somewhat more. We pivoted people from whatever they were doing this year to work more on getting COGS reductions, design cost reductions, negotiate cost reductions, all those kinds of things, including working on our operating expense lines as well. So, we still have plenty of levers to pull and we consistently demonstrated how effectively we’re doing that.”

- Patrick Industries (FY Q3’23 – $1.7B, Furnishings, Fixtures & Appliances): “As it relates to the margins, we expect a little bit of choppiness in Q4. As we look at 1H 2024, we’re still feeling like our margin profile is solid. The investments that we’ve made in automation without question are paying off…the team’s done an absolutely fantastic job of managing the business, taking out costs, relying on the automation to generate throughput and efficiency, and then continuous improvement initiatives that we’ve implemented across the spectrum continue to help drive those. So we’re going to stay focused on that. And the goal would be to continue to, again, drive efficiencies and throughput, and then really be able to leverage when we see the markets pick up.”

Pricing

- Brinker International (FY Q1’24 – $1.5B, Restaurants): “Pricing levels for the quarter remain elevated above more historical norms, but also are contributing nicely to improving our restaurant economics and restoring operating margins. As we move through the rest of the fiscal year, we will take less price with planned menu launches, and we’ll see year-over-year price levels drop further. While we believe we still have dry powder going forward, we plan to be more strategic in meeting the consumer where they’re willing to spend.”

- M/I Homes (FY Q3’23 – $2.5B, Residential Construction): “Our margins, they’ve really continued to be pretty strong. But, demand’s okay. It’s definitely been impacted a little bit recently with rates getting up, that 8% range. We feel pretty good about our pricing and our margins but there may very well be some pressure the next couple of quarters.”

- McDonald’s (FY Q3’23 – $194.2B, Restaurants): “This is the first time now in a number of quarters that our average pricing level has started to come down in terms of the rate of increase. That speaks to the fact that inflation is starting to come down. And, of course, we expect pricing to come down in line with how inflation’s coming down.”

Despite Diminishing Destocking and Hints of Wholesale Recovery, Path to ‘Normalized’ Inventory Levels Clouded by Murky Demand

- Newell Brands (FY Q3’23 – $2.8B, Household & Personal Products): “We believe that retailer inventory destocking is largely behind us at this point, for example. The underlying pressure that’s causing consumers to prioritize spending on food, essentials, and away from durable and discretionary categories, is harder to predict.”

- V.F. Corporation (FY Q3’23 – $5.6B, Apparel Manufacturing): “I’ll just say wholesale is super important in this business, and as much as I love direct-to-consumer (DTC), and we all do, the pendulum for a lot of companies in this industry swung too far over and there’s a reason why wholesale is in the marketplace and plays such an outsized role, it’s because consumers like to buy that way a lot of the time.”

- Skechers (FY Q3’23 – $7.3B, Footwear & Accessories): “We are encouraged by the positive signals we continue to see in the domestic wholesale marketplace, including requests for early deliveries, solid sell-throughs, healthier inventory levels, and most importantly, booking trends for the first part of 2024. After a difficult year, we are optimistic about the prospects of a return to growth in domestic wholesale in 2024.”

- Columbia Sportswear (FY Q3’23 – $4.7B, Apparel Manufacturing): “Retailers continue to take a cautious approach to managing inventory levels and placing orders. Fears of slowing consumer demand as well as the persistence of higher interest rates create lingering economic uncertainty. The effect of these headwinds is most pronounced in the U.S. and we’re starting to see similar conditions emerge in our Europe-direct markets and Canada. Geopolitical unrest is adding to this uncertainty.”

- Mattel (FY Q3’23 – $6.9B, Leisure): “It’s very difficult to say the impact in 2024. In the first half of 2023, we saw most of the inventory correction happened at retail. And in the context of our full-year guidance, it’s three to four points of headwind. Most of that occurred in the first half of 2023. And depending on what retailers do going into 2024, it’s hard to say that there will be a bounce back relative to that destocking.”

Pricing Levels are Largely Normalizing Though Pressure on Wages and Select Pockets of Higher Food Costs Linger

- Dana (FY Q3’23 – $1.7B, Auto Parts): “Cost inflation is moderating and pricing actions continue to mute the impact of inflation. As we stated last quarter, we do not expect to completely offset inflation as we close the year, but we are moving in a positive direction.”

- Wayfair (FY Q3’23 – $5.6B, Internet Retail): “With a considerable inflationary pressure across ocean freight and raw materials coming out of the system, there’s been no surprise to see pricing levels continue to come back down to a more normal range for the category.”

- LiveWire (FY Q3’23 – $2.0B, Auto Manufacturers): “Through the first nine months of the year, we have seen cost inflation generally in line with our expectations and continue to expect in aggregate about 1 to 2 points of inflation for the full year of 2023, compared to 4% in 2022. Labor and warehousing costs continue to be the primary drivers of inflation, with deflation and moderation expected within logistics, freight and raw materials.”

- TopBuild (FY Q3’23 – $8.2B, Engineering & Construction): “On the material front, we’ve seen inflation slow down and the price increase that was announced in Q4 has been pushed out. On the labor side, we are doing all we can to get after that with productivity.”

- Texas Roadhouse (FY Q3’23 – $6.8B, Restaurants): “The inflation for 2024 is all being pressured by beef and the rest of the basket is flat to deflationary. Beef is the driving force of our expected inflation next year.”

- Chipotle Mexican Grill (FY Q3’23 – $55.7B, Restaurants): “Predicting anything, especially inflation the last few years, has been very, very difficult. Right now, it looks like inflation is settling for both our ingredients and for labor in that call it three-ish percent, maybe between 3% and 4%, something like that. That’s a very normal environment if it stays at that 3% to 4% range, I think that’s just fine. We can operate very effectively in that environment.”

East Meets West as China and Europe Outlooks Remain Wildcards with Indicators Pointing in Both Directions

China

- Skechers (FY Q3’23 – $7.3B, Footwear & Accessories): “I would say the other wildcard in Q4 is going to be how some of the international markets perform, particularly China. That’s been a very difficult-to-read market for us on the quarters…There are certainly indicators going in both directions.”

- Gentex (FY Q3’23 – $6.9B, Auto Parts): “China is a little different. There has been an extreme amount of volatility in that marketplace. We’ve done well through that, but we also understand that there’s a lot of pressure on the original equipment manufacturers right now. There’re some concerns around profitability with those original equipment manufacturers; that’s one of the things that we look at and pay a lot of attention to is, what is the financial stability of the customer base? Our biggest concern there would be in the China market, not in the rest of the world.”

- Dana (FY Q3’23 – $1.7B, Auto Parts): “Asia will be slower, with China demand offsetting any growth expected in India.”

Europe

- V.F. Corporation (FY Q3’23 – $5.6B, Apparel Manufacturing): “There’s a lot going on [in Europe] from a geopolitical standpoint. Consumer sentiment remains difficult. A lot of caution is being deployed there. Maybe a little more so in the UK is what we’re seeing…We’re going to win whatever the environment is. We just think the environment is going to be a little bit tougher in the short term.”

- Mohawk Industries (FY Q3’23 – $5.3B, Furnishings, Fixtures, and Appliances): “Europe is really difficult to know what’s going to happen. The consumer confidence remains low and then it’s going to take something to help it move. And different than the United States and Europe, the average worker got much higher increases. So, they covered more inflation than we do. So, it’s really a confidence issue in Europe.”

- Visteon (FY Q3’23 – $3.1B, Auto Parts): “In Europe, the strong order backlog at our customers has normalized due to weaker consumer demand, resulting in vehicle production at our customers coming in lower than we had initially anticipated.”

The markets welcomed a pause in interest rate hikes after the Fed’s Wednesday briefing, but the net effect of higher-for-longer rates on the consumer is anything but reason to celebrate.

We expect the next few quarters will be very telling, particularly as consumers drift through the holiday season and executives prepare to provide their 2024 outlooks. Indeed, with less than two months remaining in 2023, investor attention is increasingly focused on expectations for next year.

- As of November 2, 2023

- The total number of companies in the all-company benchmarks are different across revenue and EPS charts and based on the data available and reported by companies at the time of our publication.

- “Collective mentions” constitute words appearing within 15 words of each other