Part 4: Building on Your ESG Function to Optimize and Accelerate the Sustainability Opportunity

Setting the Stage

ESG reporting is aimed at catering to a diverse range of stakeholders and presents an emerging frontier for many businesses. This complex endeavor has paved the way for a variety of new roles and responsibilities within organizations since the adoption of ESG as table stakes has accelerated over the past several years. However, this shift isn‘t merely about adding new job titles; it also entails the development of fresh processes and standards, necessitating a new operational paradigm that integrates ESG considerations into many facets of a company and its business.

Cultivating the ESG Function Takes Time and Resources, but Corporate and Investor Priorities are Clear: ESG is a Fundamental Undertaking

From supply chain management to communication, human resources, and beyond, ESG reporting and integration necessitates a systemic and holistic approach. As companies strive to keep pace with the evolving stakeholder preferences and regulatory landscapes — both at home and abroad — integrating ESG reporting has undoubtedly presented challenges and costs. However, these hurdles represent transformative opportunities, opening avenues for enhanced efficiency, stakeholder engagement, and long-term sustainable growth. In this light, the integration of ESG reporting is not just about overcoming challenges, but about harnessing them to drive positive change and corporate resilience. Tactical considerations include:

- ESG Staffing: The need for experts specializing in ESG issues has grown significantly. These specialists are responsible for overseeing and managing ESG goals, regulations, reporting, and stakeholder engagement. In addition, companies may need to invest in ongoing training and development for existing staff to ensure they are up-to-date with the latest in ESG practices and standards.

- Systems Upgrades: Adopting ESG practices often requires updating or overhauling existing technology. For instance, companies might need to implement new data collection and management systems to accurately track ESG metrics and progress toward established goals.

- Regulatory Compliance: As regulations around ESG continue to evolve both domestically and internationally, companies must stay abreast of governance issues to remain compliant.

- Supply Chain Management: Ensuring that the entire supply chain complies with ESG standards is a risk mitigation strategy. This might involve adopting fair trade practices, ensuring suppliers maintain safe and ethical working conditions, or minimizing the environmental impact of transportation and logistics as key customer requirements evolve, to name a few.

- Human Resources: ESG integration also impacts Human Resources, a key function of Human Capital Management (HCM). This can mean anything from promoting diversity, equity, and inclusion (DEI) in both hiring practices and in the workplace, to ensuring employee wellbeing and fair labor practices.

- Communication and Reporting: Issuers need to effectively communicate their ESG efforts to stakeholders, and our research demonstrates that publishing the ESG Report is only the first step. As investors are bombarded with information from every angle, corporates have been tasked with distilling this information down into consistent, authentic messaging and incorporating this framework and narrative throughout a variety of stakeholder communication channels.

Of course, the costs associated with these measures varies across market caps and sectors, along with the issuer’s commitment to measure and manage risks and opportunities identified through the materiality assessment process. While these costs and challenges can seem overwhelming and/or unnecessary, they are investments that can enable the future sustainability and success of the business.

Corbin’s View: These measures are not merely a cost of doing business, but an integral part of driving business growth and resilience. Our latest research shows:

- Over 90% of investors continue to place at least some importance on ESG when making investment decisions, the highest level ever recorded

- European-based investors are most likely to view ESG as a critical factor for all investments; as such, while global sustainable fund flows declined through Q1 2023, Europe continues to represent the vast majority of sustainable fund inflows1

- 54% of issuers note executives consider ESG very important to their company’s long-term success, up from 45% in 2021 and more than doubling since 2019

Below, we have outlined how issuers are optimizing their ESG processes and communications today to accelerate their sustainability function in lieu of dynamic investor expectations.

Investor and Corporate Views

As a reminder, to evaluate the emerging perspectives from both institutional investors and corporate issuers, we surveyed 155 buy-side professionals and 103 IR and C-suite executives globally from March 14 – May 17, 2023, across more than 30 focus areas relating to ESG. In aggregate, buy-side participants represent equity assets under management of ~$10.3T.

As the ESG Landscape Shifts, So Too Has Corporate Oversight and Responsibility

Companies have come a long way since we first started reporting on the ESG megatrend over a decade ago. As stakeholder interests have shifted and flowed, so too have the ways corporate issuers are addressing ESG measures.

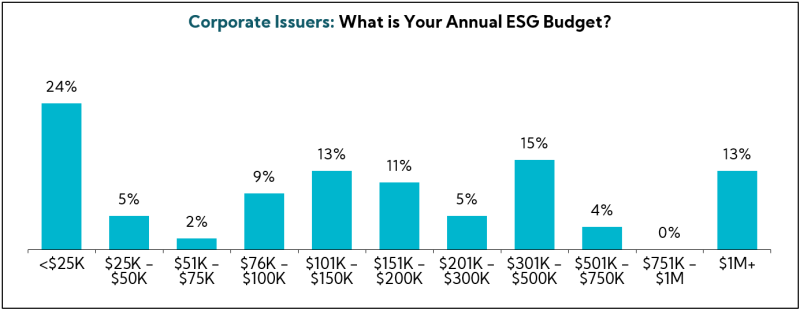

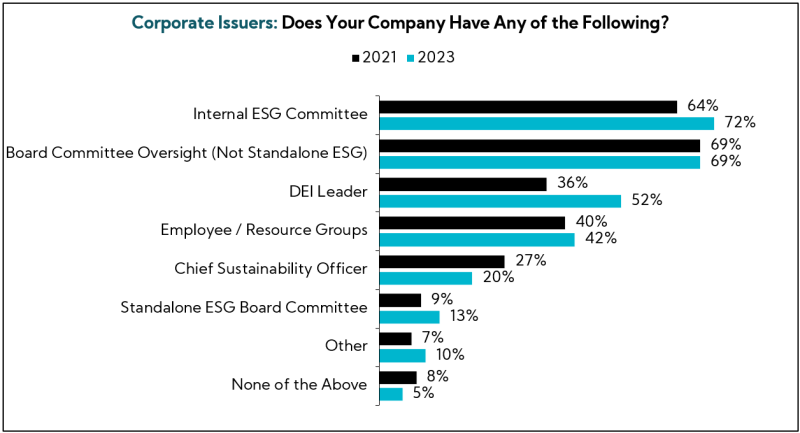

While most annual ESG budgets remain unspecified, three-quarters of corporate issuers expect ESG budgets to expand in the coming years, and none expect levels to decrease. Also, increases in internal ESG practices reflect growing investment and large buy-in at the executive and board levels, with issuers largely signaling an increase in the number of ESG groups and individuals at their companies versus the 2021 Study. Notably, issuers reporting to have an Internal ESG Committee rose from 64% in 2021 to 72%, and DEI Leaders grew an impressive 16 percentage points to reflect more than half of all surveyed issuers.

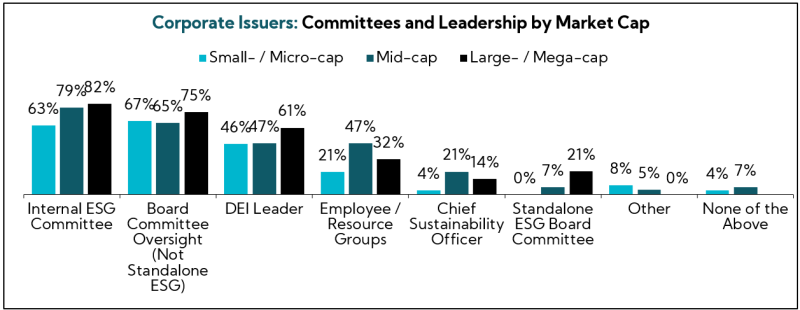

Not surprisingly, the largest companies have cultivated some level of representation across most ESG-related functions, but they share similar emphasis with smaller companies in the areas of establishing an Internal ESG Committee, ensuring there is appropriate Board Oversight within existing committee structures, and appointing a DEI Leader.

But who is overseeing ESG?

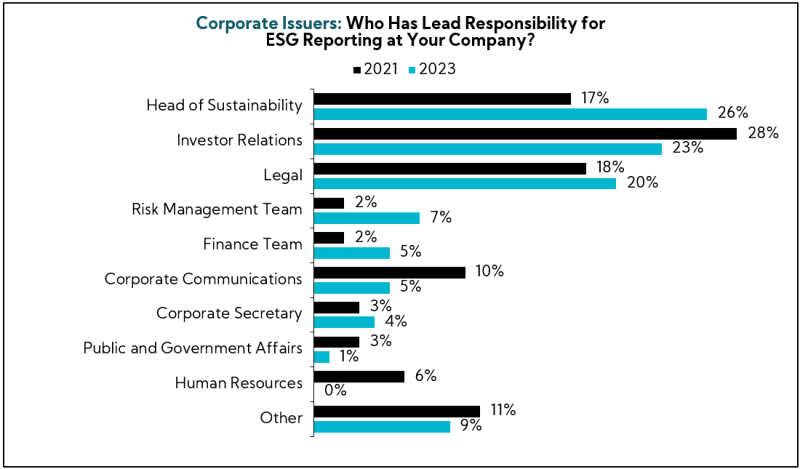

In our 2021 ESG Survey, issuers largely reported that the IR Leader maintained chief responsibility of ESG efforts. This makes sense from a historical perspective, as issuers have largely relied on IR to manage all matters stemming from the investor community, especially those that don’t clearly fit within current operations.

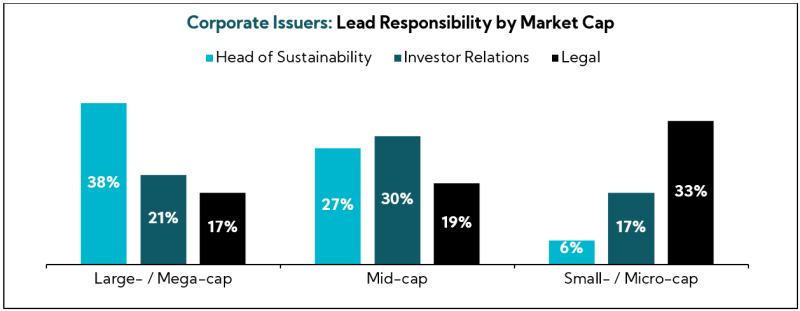

However, as the integration of ESG considerations has continued to materialize and formalize, introducing additional layers of complexity and dynamism at every turn, companies are more and treating ESG as its own focus, resulting in the proliferation of the Head of Sustainability role. Indeed, our research shows Sustainability leads have supplanted IR in overseeing ESG, while there has also been a notable decrease in Corporate Communication’s oversight.

When breaking respondents down by market cap, larger-cap companies with multifaceted, global ESG considerations tend to lean on a defined Head of Sustainability; small-caps typically resort to Legal; and mid-caps tend to straddle the use of both IR and Heads of Sustainability. However, in our experience, all three are usually involved in key decision-making, as ESG matters often require unique perspectives from each of these spheres of expertise.

In Focus: The Board of Directors

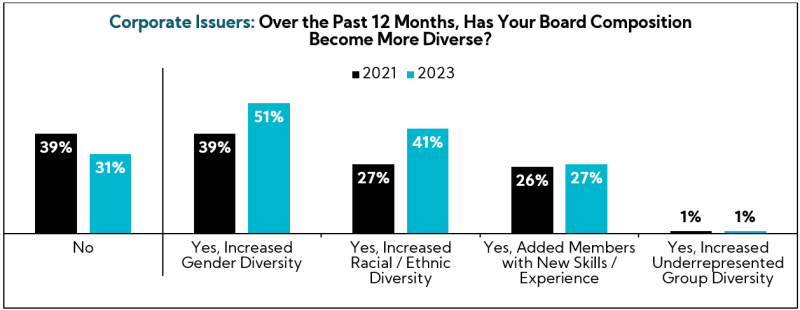

Oversight and responsibilities aren’t the only areas of change. The majority of corporate issuers indicate that Board composition is also shifting, with roughly 70% of participants asserting the director slate has become more diverse across gender, ethnic, racial, and/or skills-based dimensions over the past 12 months, demonstrating broad-based increases from our 2021 Survey.

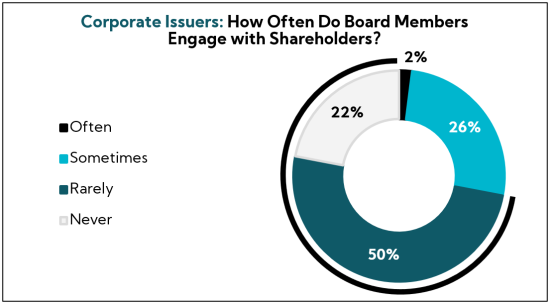

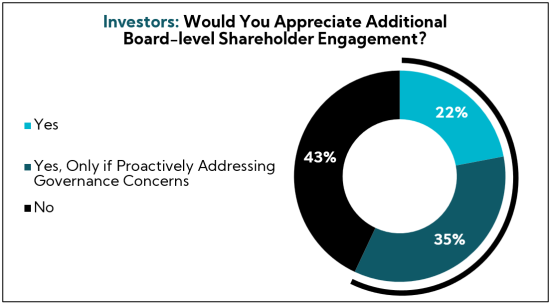

Meanwhile, investor expectations are changing, too. While a majority, 57%, would appreciate some level of engagement with the board, 72% of corporate issuers assert they rarely or never provide this. Those who do engage often interact during proxy season, in line with investor preferences for board members to be proactive when addressing governance concerns.

Stakeholders Converge on the Growing Human Capital Management (HCM) Imperative

Human Capital Management (HCM) has emerged as an influential component in the ESG landscape. As we have reported in our prior pieces, nearly half, 49%, of corporate issuers point to retaining talent as an explicit motivation to incorporate ESG into the company strategy.

The key areas of focus in HCM typically include:

- Workforce Planning and Strategy: Forward-looking planning to meet the talent needs of the business, including succession planning and skills development strategies.

- Talent Acquisition: Strategies for attracting and hiring the best talent, with a core focus on inclusive hiring practices.

- Talent Development: Ongoing training, upskilling, and career development opportunities for employees.

- Performance Management: Clear processes for setting expectations, providing feedback, and recognizing and rewarding performance.

- Employee Wellness: Programs to support the mental and physical well-being of employees, encompassing everything from healthcare benefits to flexible working arrangements.

- Diversity, Equity, and Inclusion: Efforts to ensure a diverse, equitable, and inclusive workplace that welcomes and supports all employees.

- Workplace Culture: Building an engaging, positive, and supportive workplace environment that encourages collaboration, innovation, and employee satisfaction.

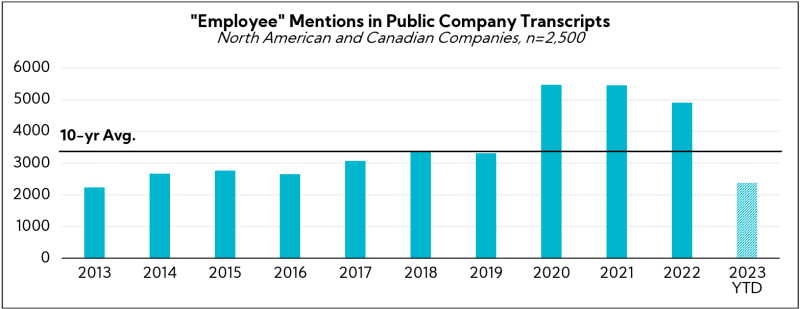

By way of simple illustration, the number of companies referencing “employees” in their public transcripts has skyrocketed coming out of the COVID-19 pandemic. Since 2020, mentions have hovered well above the 10-year average, with 2023 on track to clock in another year of roughly 5,000 mentions.

The surge in HCM focus comes amidst labor tightness, as well as clear preferences among Gen Z and Millennial workers (who constitute roughly half of the U.S. workforce according to Gallup) to work for ethical and diverse organizations that prioritize employee wellbeing.

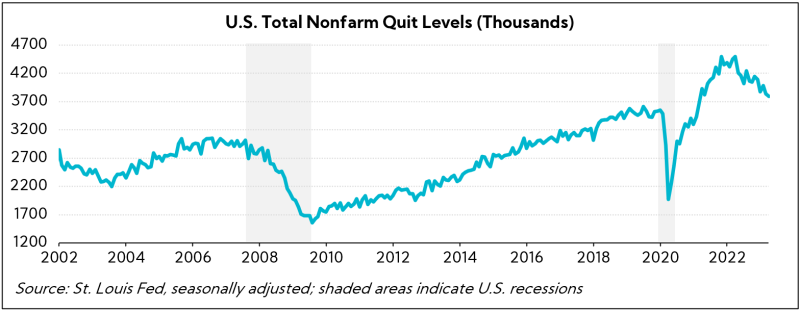

Echoing these dynamics, U.S. total non-farm quit levels shot to new highs in 2022 and remain elevated as a result of the well-publicized “Great Resignation”. This demonstrates the criticality of strong HCM practices in not only attracting but also retaining talent in today‘s competitive and dynamic labor market.

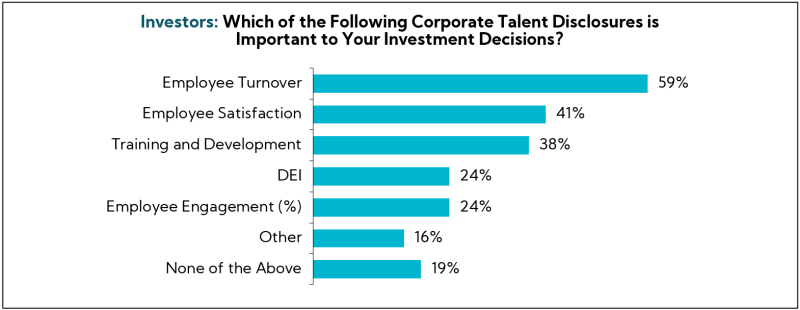

And it’s not just corporate issuers and employees. From an investor perspective, more than 80% assert talent disclosures are important to their investment decisions. Specifically, investors home in on Employee Turnover, Employee Satisfaction, and Training and Development as leading preferred issuer disclosures.

In sum, robust HCM practices are being increasingly considered as a critical component of corporate strategy. Moreover, the increased attention from investors toward talent disclosure underscores the growing recognition of the direct impact HCM has on long-term value creation.

Corporate Issuer ESG Acceleration Practices

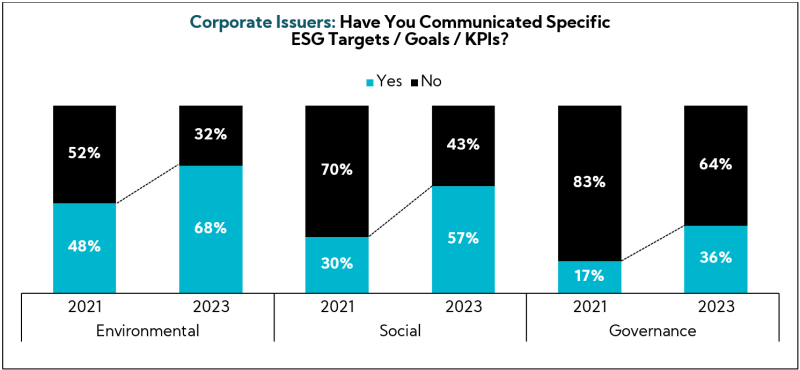

As issuers strive to meet the rising tide of stakeholder expectations and stay abreast of regulation, corporates are utilizing their evolving ESG functions to help define and accelerate the sustainability opportunity. Indeed, more are communicating specific targets and goals across each measure versus our 2021 Survey.

How ESG is operationalized within an organization can greatly influence its trajectory and success. Furthermore, communicating it effectively not only reflects the organization‘s commitment, but also instills trust in the accuracy of the disclosed information.

Broadly speaking, we see three levels of organizational structure:

- Oversight: Board of Directors or committee members responsible for ESG program oversight

- Management: Senior leaders under whom the risks and opportunities from the material topics roll into (e.g., Head of Sustainability)

- Working Groups: Subject matter experts (SMEs) for each material topic who work together to arrive at company-wide and unit-level strategies for each topic, determine KPIs, and manage information gathering

Whether it‘s achieving net zero carbon emissions, enhancing Board diversity, or improving worker safety, these structures and goals serve as clear markers of an organization‘s commitment to sustainable and responsible operation.

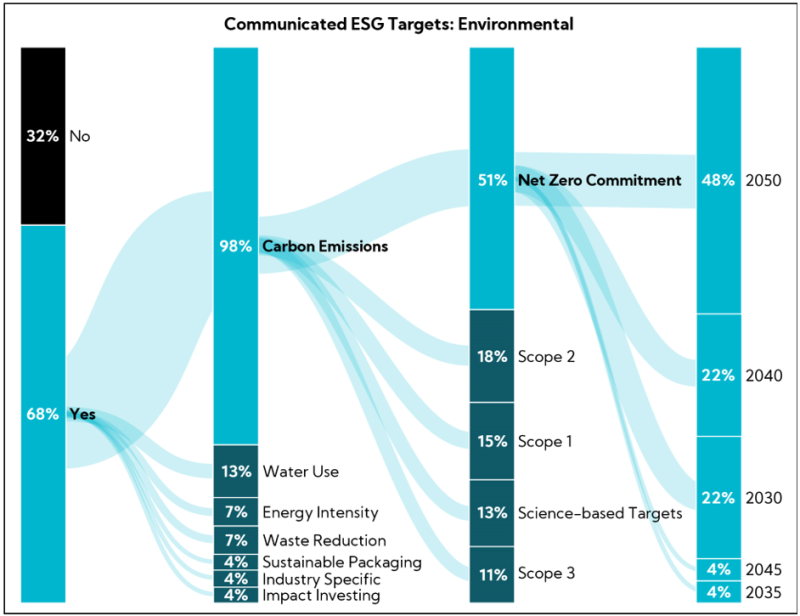

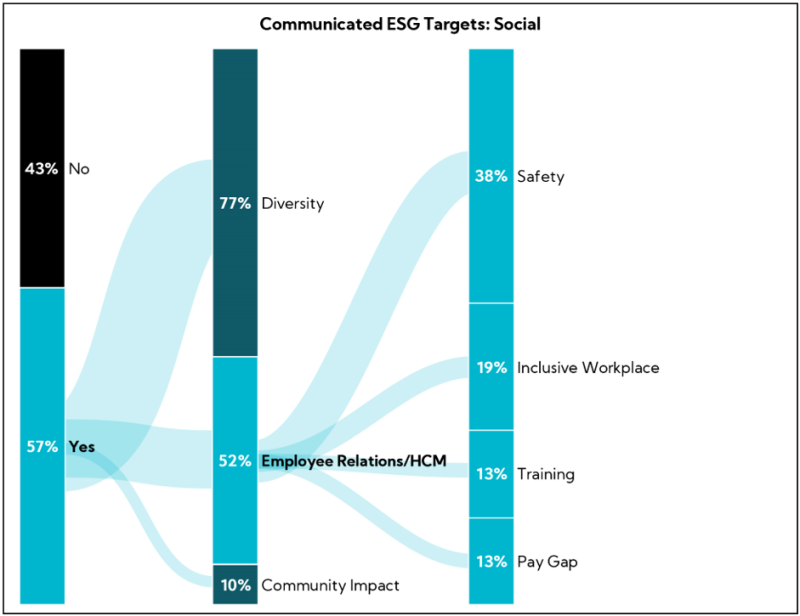

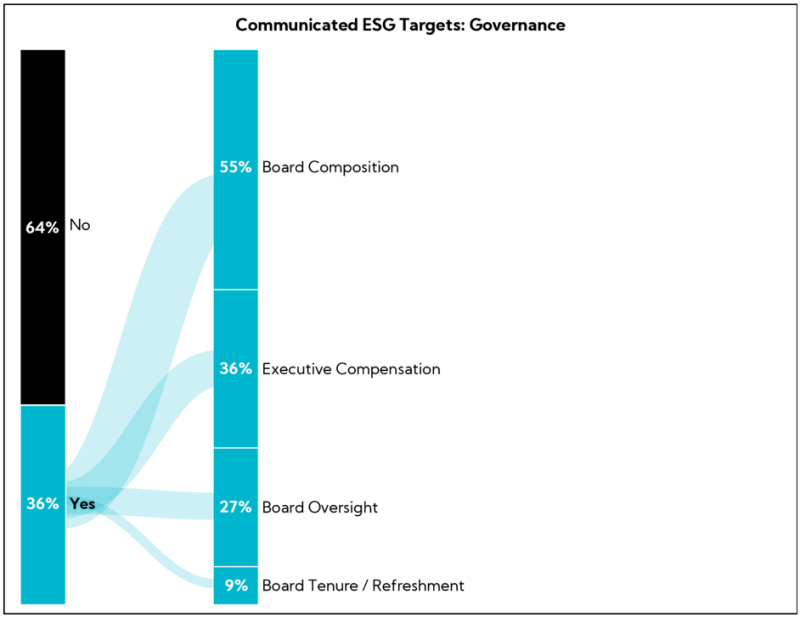

Below, we have consolidated the most commonly communicated corporate issuer targets throughout our 2023 Survey across environmental, social, and governance factors.

Environmental

More than two-thirds of issuers in our 2023 Survey reported they have communicated environmental targets, nearly all of which relating to carbon emissions disclosure and goals. Of those goals, just over half, 51%, have communicated a Net Zero commitment, with most aiming to accomplish by 2050.

Social

Nearly 60% have communicated public social targets, the majority of which relate to diversity. Continuing, more than half, 52%, have also committed to employee relations/HCM targets, most commonly including safety initiatives such as total recordable incident rate (TRIR) reductions.

Governance

Lastly, just over one-third of issuers have communicated governance targets, mostly surrounding Board composition and executive compensation. Regarding the latter, our Survey of investors identifies Total Shareholder Return (TSR) and Return on Invested Capital (ROIC) / Capital Employed (ROCE) as most aligned with shareholder interests.

In Closing

As stakeholder interests converge, more companies are turning to their established ESG programs to enhance their sustainability opportunity. Our Survey shows corporates have made great strides in responding to the ESG megatrend, and responses point to an overall increase in maturation as more companies implement internal structures and processes aimed at formalizing goal setting, tracking, measurement, and communication.

We hope you’ve found our four-part 2023 Global ESG Survey series insightful, thought-provoking, and actionable. As researchers with an insatiable curiosity, we learned a lot ourselves about the dynamic and maturing ESG landscape and will continue to monitor and cover trends to keep you, our clients, up to date and at the cutting edge.

- Morningstar Direct

Any unauthorized use, duplication, redistribution or disclosure of this proprietary research (the “Presentation”), including, but not limited to, redistribution of the Presentation by electronic mail, posting of the Presentation on a website or page, and/or providing to a third party a link to the Presentation, is strictly prohibited. The information contained in the Presentation is intended solely for the recipient and may not be further distributed by the recipient to any third party. Thank you for respecting our Intellectual Property and recognizing the challenges we face, including significant loss and brand erosion, when it is shared outside of designated recipients.

Corbin Advisors is a strategic consultancy accelerating value realization globally. We engage deeply with our clients to assess, architect, activate, and accelerate value realization, delivering research-based insights and execution excellence through a cultivated and caring team of experts with deep sector and situational experience, a best practice approach, and an outperformance mindset.

Our growing repository of proprietary, research-based insights on the rapidly developing ESG landscape has fueled our thought leadership on this important topic. We began building our ESG knowledge base in 2010, surveying institutional investors globally on the topic, so we can provide our clients with expert experience today.

Leverage the experience and expertise of our team

Access insights in our regularly published research, which captures trends in institutional investor sentiment globally