Part 1: Demystifying the Capital Markets’ Shifting ESG Priorities

Setting the Stage

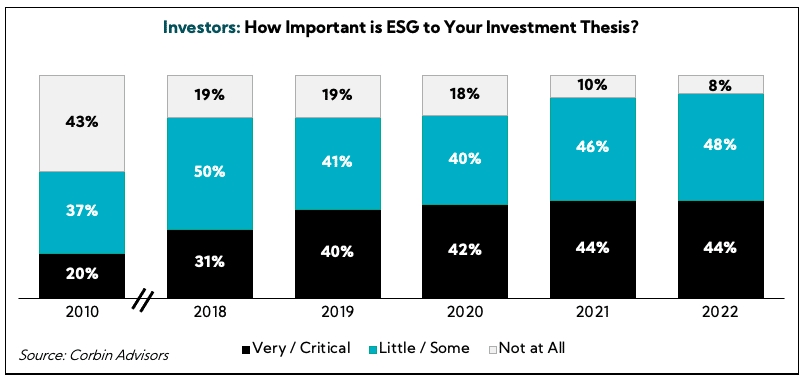

Based on tracking buy-side views for more than a decade, our research has identified investors increasingly incorporating ESG into their investment decisions. In fact, the decade from 2010 to 2020 saw a more than doubling of investors reporting ESG was “very important” or “critical” to their investment decisions.

After continuing that trend in 2021 and despite rampant market volatility and increasing signs of slowing growth in 2022, we continued to find that ESG remained an influential investment factor. Indeed, our proprietary research shows over 90% of investors continue to place at least some importance on ESG when making investment decisions, the highest level ever recorded. At the same time, companies broadly are finding it increasingly challenging to differentiate amid a push toward standardization and a “leveling of the playing field.” In other words, like in a product lifecycle, we have moved from “introduction” to somewhere between the “growth” and “mature” stages of ESG. And, like any widely adopted product, ESG will see many revolutions.

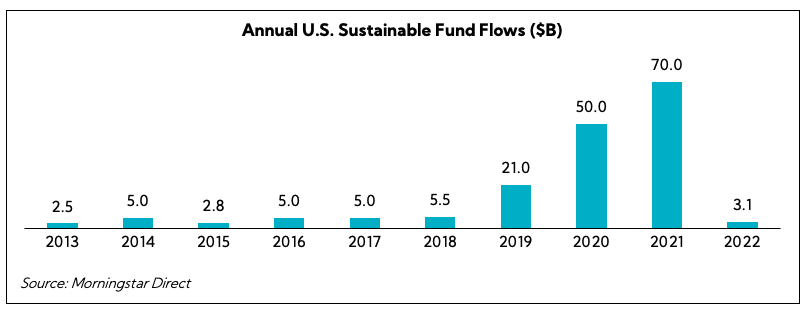

After a record-breaking run in 2021, what we have coined “the golden year” — when global sustainable funds saw net inflows of over $640B — 2022 and Q1 2023 have since experienced slowing growth. Global inflows fell from nearly $160B in Q4 2021 to just over $60B a quarter later, and quarterly inflows have since straddled the $25B – $45B range.

In the U.S. specifically, recent data indicates sustainable funds are under pressure. Despite still seeing positive net inflows of $3.1B in 2022 (buoyed by a $10.4B intake during Q1 2022), annual U.S. sustainable fund flows resulted in the lowest level since 2015.

Of course, a significant portion of this can be attributed to overall market conditions, with U.S. funds witnessing substantial outflows of over $370B in 2022. Three of the last four quarters have experienced modest net outflows, with the latest figures indicating investors pulled a net $5.2B from sustainable funds in Q1 2023.

That said, global sustainable fund assets stood at $2.7T across 7,030 funds in Q1 2023, and rising equity and bond valuations in the U.S. drove existing U.S. assets to $296B, their highest level since Q1 2022. In fact, despite shaky demand, 26 new sustainable funds were introduced to the market, the highest level since Q2 2022, including the likes of Calvert and Putnam. As the law of large numbers takes effect and we enter different economic times, the flattening of the ESG fund curve is stark but still remains substantial.

In Review — Distilling the ESG Landscape since 2021

To summarize key events that played a significant role in driving ESG fund flows, below is a timeline of the last two years:

2021

May 2

Engine No. 1 wins battle against ExxonMobil to install three new directors in what was earmarked as a watershed moment for environmental activism

July 8

The European Central Bank announces its intention to incorporate climate considerations into its monetary policy and operations, recognizing the importance of addressing climate-related risks

August 6

The SEC approves Nasdaq’s board diversity listing standards whereby companies listed on the exchange must publicly disclose board-level diversity statistics on an annual basis using a standardized matrix template

November 3

In a bulletin posted to their website, the SEC alters the way they enforce issuers’ ability to exclude certain shareholder proposals from the proxy, resulting in a higher volume of shareholder proposals and overall declining support, particularly on environmental and social (E&S) topics

2022

February 10

Morningstar drops “sustainable” tag from 1,200 global funds, representing more than $1T in assets, amidst concerns over greenwashing

March 21

The SEC proposes mandatory climate disclosure rules which, if implemented, would require comprehensive disclosure from publicly traded companies regarding their climate-related risks, strategies for achieving net-zero emissions, and GHG disclosure (including audited Scope 1 and 2 disclosure, as well as Scope 3 if material)

June 3

BlackRock gives clients ~$5T control over voting at Annual General Meetings in a commitment to “democratize participation in the financial markets by providing clients the industry’s broadest range of choice to help them meet their investment objectives”

November 10

The White House proposes GHG disclosure rules for Federal contractors, imposing emission disclosure requirements on contractors that received at least $7.5M in federal contract obligations

December 13

Through the course of 2021-2022, 18 states either propose or adopt “anti-ESG” legislation in an effort to curtail state-funded investment arms from participating in ESG investing activities or from adopting certain ESG policies

December 15

IFRS’ International Sustainability Standards Board (ISSB) issues guidance to support the inclusion of Scope 3 GHG emission disclosures as a part of new ESG standards being developed

2023 – as of May 31

February 3

Anonymous sources confer with Politico and The Wall Street Journal that SEC Chair Gary Gensler is considering softening some of the proposed climate disclosure rules proposed in March 2022, signaling concerns over a wave of anticipated lawsuits

May 11

The ISSB opens consultation to seek feedback on its proposed methodology for enhancing the international applicability of the Sustainability Accounting Standards Board (SASB) standards

May 11

35% of listed companies disclose at least some of their Scope 3 emissions as of March 31, 2023, increasing 4% over the past 7 months according to MSCI’s latest Net Zero Tracker

May 31

682 ESG-related shareholder proposals are filed in the first five months of 20232, surpassing 2022’s record 660 proposals; however, those filing “anti-ESG” proposals also peaked at 74, up 72% YoY

Corbin Advisors’ 2023 Global ESG Survey – Findings and Insights

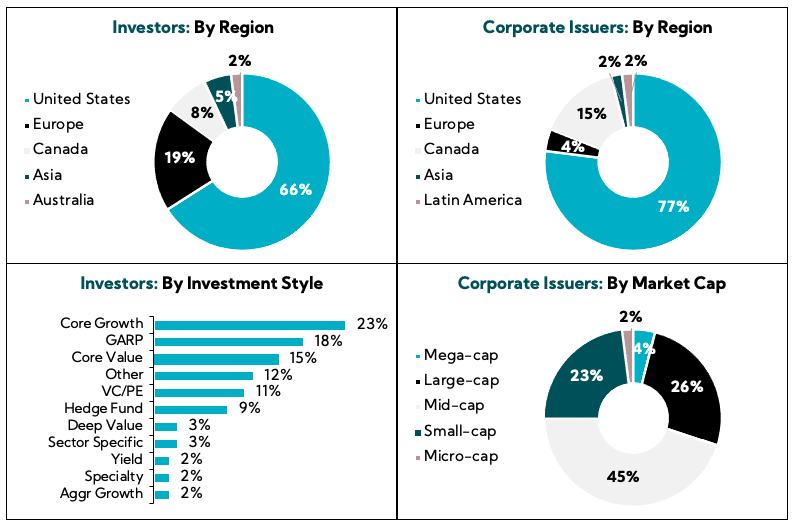

To evaluate the emerging perspectives from both institutional investors and corporate issuers, we surveyed 155 buy-side professionals and 103 IR and C-suite executives globally from March 14 – May 17, 2023, across more than 30 focus areas relating to ESG. In aggregate, buy-side participants represent equity assets under management of ~$10.3T.

Investor and Corporate Views

Investor Priorities Shift, though Signs Point to Industry Maturation as ESG Becomes More Ubiquitous

Throughout closed- and open-ended investor responses, our proprietary research shows an overall increase in the consideration of ESG in the investment approach but with a decrease in those viewing it as an “essential” factor study-over-study.

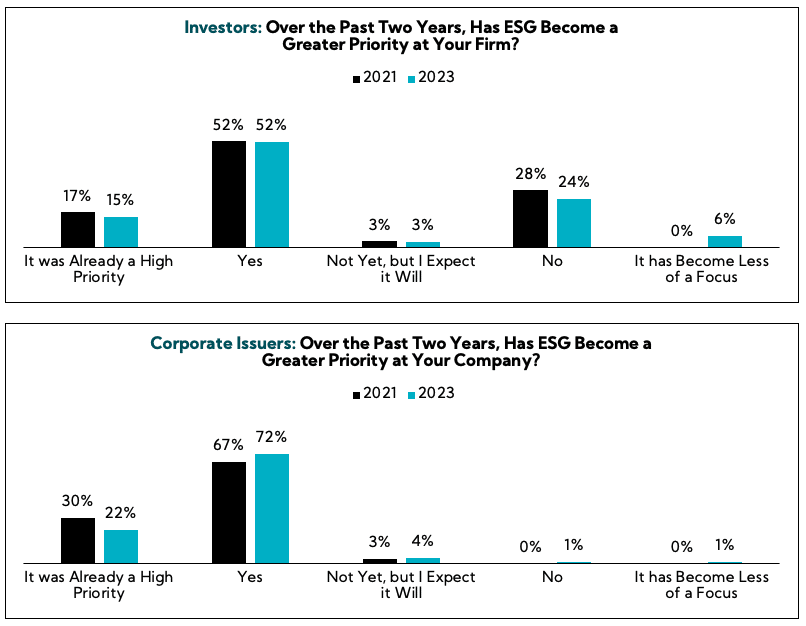

Nearly identical to results registered in our 2021 Global ESG Survey, two-thirds of investors note ESG has become a greater priority at their firm over the last two years or remained a high priority. This compares to approximately one-quarter who note it has not become a greater priority, and only 6% describing ESG as less of a focus.

For issuers, ESG continues to become a greater priority across boards of directors, c-suite executives, and IR leaders.

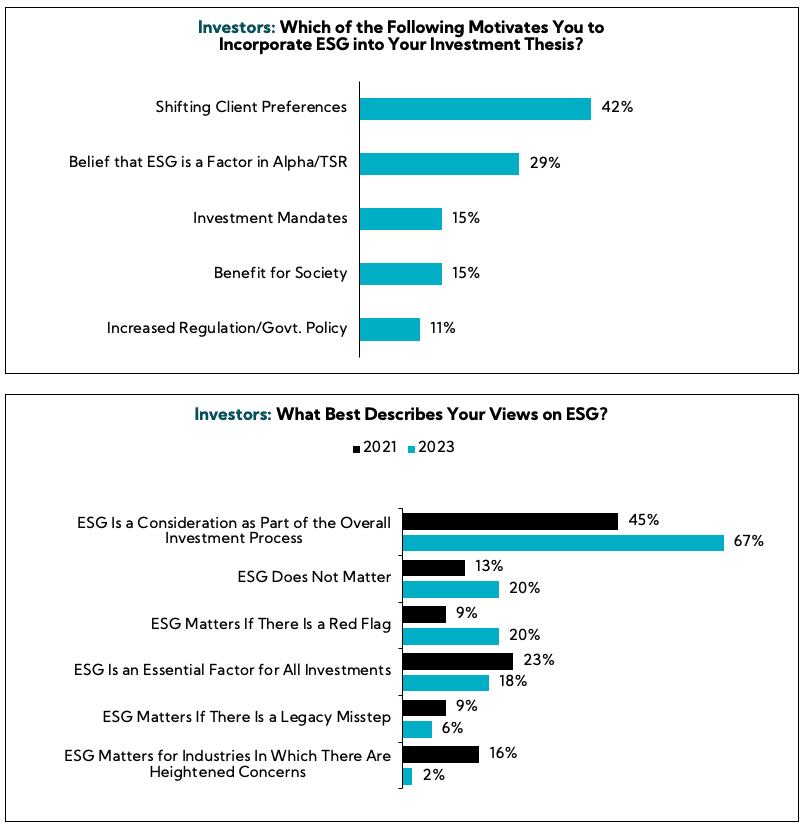

Similar to the 2021 Survey, participants continue to report shifting client preferences is the most significant driver of the inclusion of ESG in the investment process, followed by 29% believing that ESG is a factor in Alpha/TSR, more than tripling from 8% in 2021. And, the number of buy-side considering ESG as a consideration of the overall investment process increased to 67%, a more than 20 percentage point uptick study-over-study.

Executives Consider ESG an Important Factor for Their Company’s Long-term Success, Particularly as the Size of the Company Increases

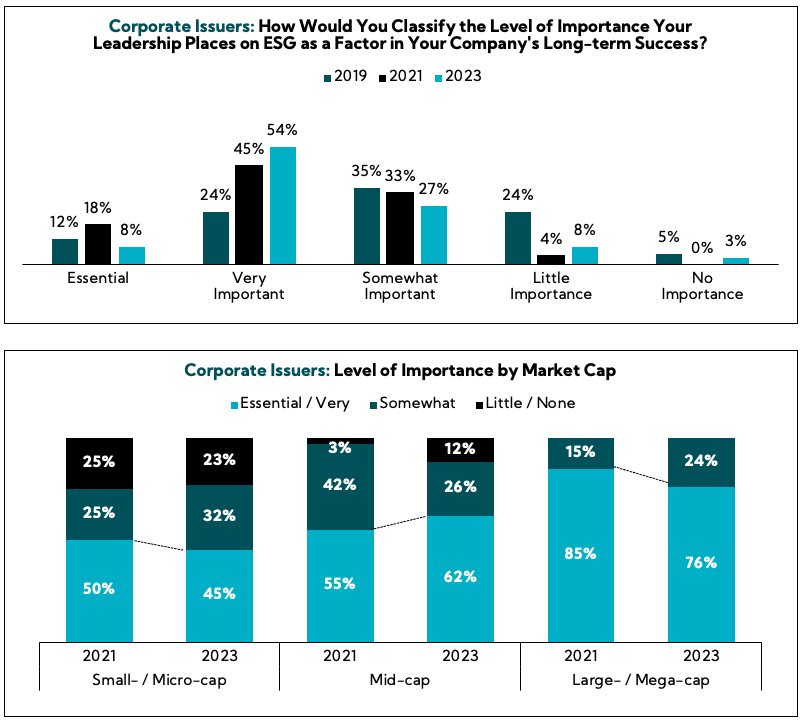

More than 50% of issuers note executives consider ESG very important to their company’s long-term success, up from 45% in 2021 and more than doubling since 2019. Still, similar to investor sentiment, those classifying ESG as essential decreased, registering a drop of 10 points from 2021, while those asserting the company ascribes little to no importance to ESG increased from 4% to 11% — albeit, still well below 29% in 2019.

When stratifying by market cap, not surprisingly, mega- and large-cap companies continue to place the highest levels of importance on ESG, in line with both the 2019 and 2021 Surveys, as more firms come under pressure from stakeholders to dedicate additional resources to reporting and initiatives. Mid-caps categorizing ESG as essential or very important increased to 62%, up from 55% in 2021 and 24% in 2019. While small- and micro-caps collectively reported a slight decline in these same categories since the 2021 Survey, ESG being viewed as essential or very important nearly doubled from 2019 levels.

Looking Ahead, Issuers Believe the Development and Implementation of ESG Will Accelerate but Investors Demonstrate More Mixed Views

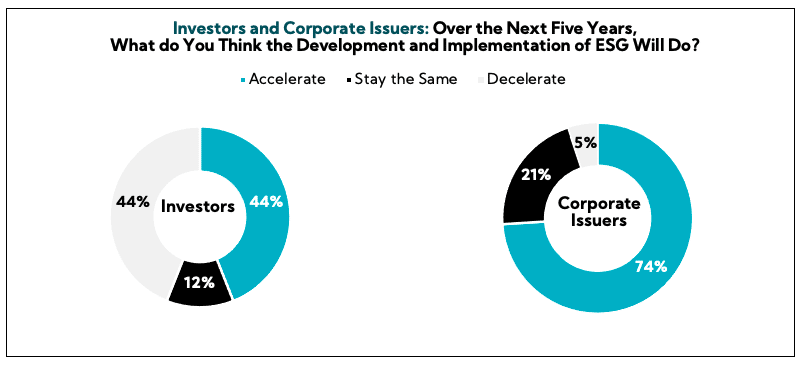

When asked about the next five years, nearly three-quarters of issuers anticipate the development and implementation of ESG will accelerate. However, investor views are evenly split between those expecting acceleration and deceleration.

Still, over half of investors, 54%, note their firm has experienced increases in managed assets mandated for ESG / Sustainability investment, and 65% of corporates report receiving more questions in the last 12 months about ESG from investors.

Below, we’ve included a selection of representative examples from both investors and corporate issuers illustrative of broad-based ESG adoption despite varying perspectives:

Investors

“It is becoming much more focused, much more embedded into our investment analysis and we are trying to understand how the companies’ rate and how they are improving and where their opportunities are for more improvement. It has become a bigger part.”

“We’ve always had as a criterion that companies need to be aware of their constituencies. We figure if the companies aren’t aware of how they impact all their different constituencies, then it’s not going to be a good business model. We don’t quantify that; it’s just part of a broad criteria that we have and something that we consider when we’re looking at companies.”

“ESG is complex, and beauty is in the eye of the beholder in some senses. Our clients all have different views of what is important in ESG. Our European clients have been focused on ESG for much longer and they put emphasis on the G as much as the E and the S whereas in the U.S., it is a much looser definition. For us, the more important angle has been how does it impact the fund flows around the stock?”

“Today, it is a lot more than maybe five years back, and five years hence it will be even more than what it is today. We are improving our capability to evaluate prospective investments and existing holdings on various E, S and G metrics.”

“It is one of the most important parts of our process. It has always been a part of our process, but we formalized it a little more in the last year or two at our firm.”

“ESG has become marginally more important because others are focused on it, but not from a specific investment process point of view. As long as others care, I need to care.”

Corporate Issuers

“Further integration into our strategic planning process is continuing to mature as stakeholder demand increases and regulations are required.”

“ESG has become of greater importance, but I still would not characterize as “highly important”; rather, it’s more along the lines of compliance type items (i.e., we need to do something to meet the minimum).”

“ESG has been a priority for several years, but the intensity of our efforts has increased substantially in the past year.”

“There has been a strong ramp up over past four years.”

“We are preparing for an IPO and ESG is a critical leg of our story.”

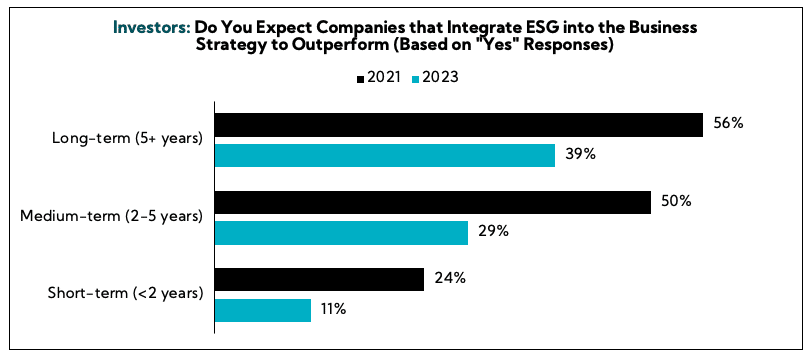

A notable shift in sentiment from 2021, only 39% of investors believe companies who integrate ESG into the business strategy will outperform over the long-term (5+ years), down from 56%, with similar trends identified over the medium- and short-term.

Qualitative investor feedback indicates this change comes as a result of the expected standardization of ESG reporting longer-term, a “leveling of the playing field”, as well as outsized negative views from ESG naysayers.

Investors

“From the E and S, those are things that factor into our thinking because over the long-term companies that do not focus on those areas can damage their business long-term. It is important in if they are building a sustainable company and culture and taking care to make good, long-term decisions.”

“This is contingent on how an investor defines outperform. In pure share price terms, no. However, if investors increasingly factor in a third dimension to returns targets, then pure financial return ceases to be the only pertinent metric.”

“With how heavy the focus is being given, over the near term we probably will see some outperformance from those that have better disclosures around ESG and make more of an effort to communicate how they incorporate it within their business. There will be a leveling of the playing field longer term and there will be some level of standardized disclosures from the SEC and other financial governing bodies. It will not be a race to try and figure out who is doing what. It will be disclosed the way we receive financial information in the 10Ks and other filings. It will be less a differentiator longer term.”

“When it comes to investments, it is dangerous to make any kind of statements around the short term. If they have opportunity over the medium to long term, absolutely. All these measures from an ESG perspective that can be implemented can reduce the overall risk profile of the business and reduces reputational issues so you can argue that it reduces the discount you would apply to that particular business and, hence, the return risk profile going forward is that much more attractive.”

“If a company has a decent strategy around ESG – and not just greenwashing what they are doing – that will result in a better rating. It is one of the elements but the capital allocation of management is more important than ESG.”

“We believe over time companies with good ESG ratings outperform those with base ESG ratings.”

“Every company I research now incorporates ESG so it’s not a differentiator at all.”

“The entire ESG topic is just one big fraud.”

“It’s a false paradigm.”

“The rhetoric around ESG outperformance is complete nonsense and not supported by any data.”

As ESG Sophistication Increases, Both Groups Are in Favor of Standardization

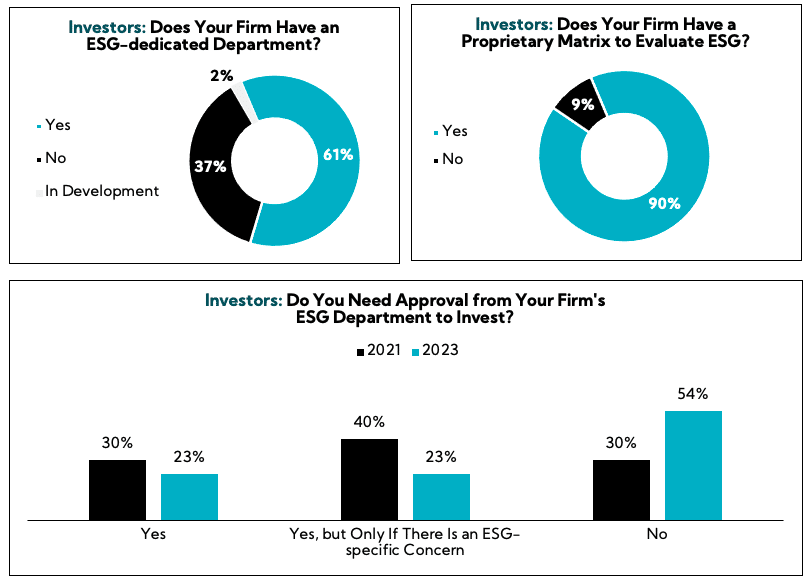

Representative of a growing level of sophistication among institutional investment firms worldwide in recent years, more than six in ten investors report having a dedicated ESG department / group, more than double the amount in 2019 and up slightly from 2021. Moreover, 90% report having an internal proprietary matrix, increasing an astonishing 67% from 2021. Most, 52%, report utilizing a hybrid matrix approach, incorporating quantitative and qualitative elements.

Despite the uptick in internal complexity, fewer investors report being tied to internal ratings. Only 46% require some level of approval before investing, down from 72% in 2021. Additionally, 68% assert they can invest in a company with poor ESG scores from third-party providers, up from 60%.

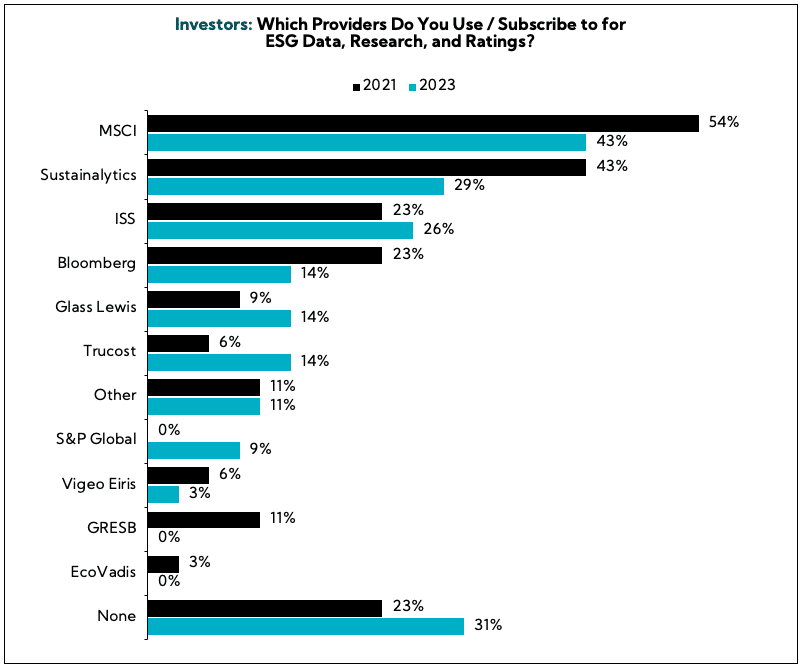

To that end, more investors, 53%, note they do not use 3rd party rankings / ratings in the research process, with open-ended commentary suggesting investors believe providers use imperfect methodologies and/or focus on the wrong factors.

Investors

“I do not look at any third-party ratings providers, mostly because they are incredibly flawed. One of the big ESG rating agencies turned out to be using a very perverse ranking system where it was not ranking companies on their standing and progress toward ESG goals; it was ranking an unlikely threat to their business model from ESG-related things, which is a completely different thing. The problem with ESG is it is very easy to game because there is no generally accepted set of definitions or standards and there are so many different metrics and nobody has been able to tell us what good looks like or even what we are trying to accomplish.”

“We look at 3rd party vendor data and rankings, but they are not the end all be all. In fact, some of those rankings are easy to challenge, so we keep that in mind.”

“The quality of the information is not yet reliable enough.”

“These 1) focus on the wrong factors and 2) are not independent.”

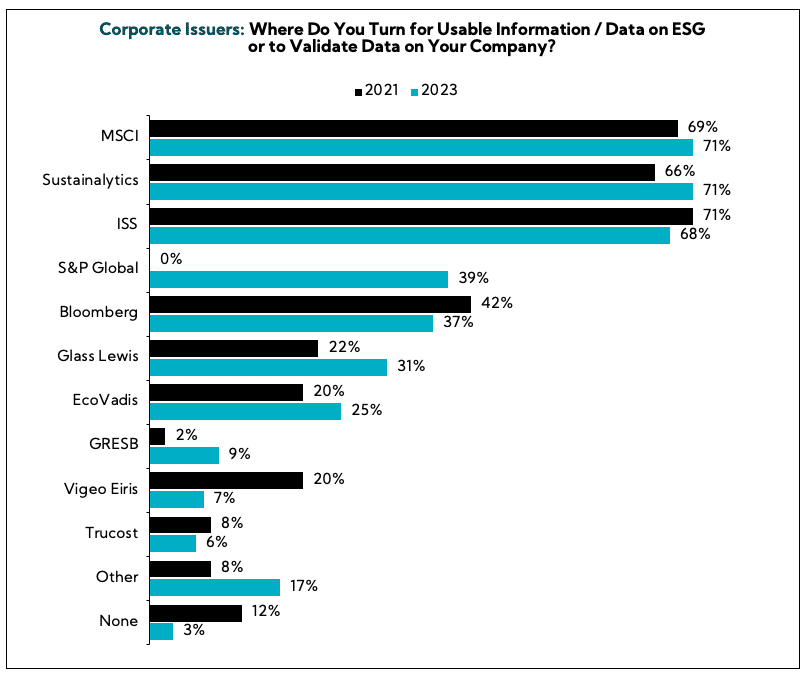

Still, ratings providers are an important part of the ESG ecosystem and, at this point in the ESG revolution, two clear leaders have emerged across corporate issuers and investors —MSCI and Sustainalytics, in line with the 2021 Survey. Notably, the top three sources are similar across investors and corporate issuers, while the latter places significantly greater emphasis on S&P Global.

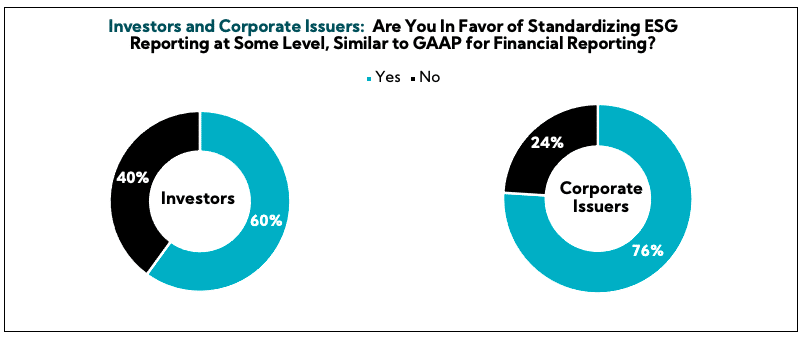

In that vein, there is a growing eagerness among investors and corporate issuers alike to establish consistent frameworks that facilitate meaningful ESG analysis and decision-making. Indeed, 76% of corporate issuers and 60% of investors are in favor of standardizing ESG reporting at some level; however, roughly 55% across both groups believe the SEC’s recent push on climate disclosure is not helpful to either the investment community or public companies.

In Closing

Our bird’s eye view of current capital market perspectives reveals that as the base-level adoption of ESG has increased, the investor has become increasingly in favor of standardization, echoing the sentiment coming out of the corporate community.

While sustainable fund flows may have ebbed over the past few quarters, this needn’t be an indictment on ESG as some may suggest. In fact, our research points to quite the opposite conclusion — ESG for investors and corporate issuers is not seen as a fad but rather a long-term trend that, more and more, is becoming embedded in the decision-making processes of both.

Our latest research indicates more investors consider ESG important to the investment process, the prioritization of ESG has increased over the last two years, and there is an increase in the use of ESG to deliver Alpha. And while fewer believe integrating ESG into the business strategy will lead to company outperformance, this is indicative of a more mature stage of ESG thinking. Rather than representing a standalone factor to long-term outperformance, ESG will be another sustainable competitive advantage that is part of a company’s broader investment story — similar to other recognized leading competitive advantages, like operational excellence.

- Source: Morningstar; Morningstar classifies funds as sustainable if “in the prospectus or other regulatory filings it is described as focusing on sustainability, impact investing, or environmental, social or governance (ESG) factors.”

- ISS Corporate Solutions

Any unauthorized use, duplication, redistribution or disclosure of this proprietary research (the “Presentation”), including, but not limited to, redistribution of the Presentation by electronic mail, posting of the Presentation on a website or page, and/or providing to a third party a link to the Presentation, is strictly prohibited. The information contained in the Presentation is intended solely for the recipient and may not be further distributed by the recipient to any third party. Thank you for respecting our Intellectual Property and recognizing the challenges we face, including significant loss and brand erosion, when it is shared outside of designated recipients.

Corbin Advisors is a strategic consultancy accelerating value realization globally. We engage deeply with our clients to assess, architect, activate, and accelerate value realization, delivering research-based insights and execution excellence through a cultivated and caring team of experts with deep sector and situational experience, a best practice approach, and an outperformance mindset.

Our growing repository of proprietary, research-based insights on the rapidly developing ESG landscape has fueled our thought leadership on this important topic. We began building our ESG knowledge base in 2010, surveying institutional investors globally on the topic, so we can provide our clients with expert experience today.