Part 2: Architecting an Impactful ESG Strategy that Prioritizes Leading Investor Focus Areas

Setting the Stage

Last week, we outlined our latest research which found over 90% of investors continue to place at least some importance on ESG when making investment decisions, the highest level ever recorded. At the same time, companies broadly are finding it increasingly challenging to differentiate amid a push toward standardization and a “leveling of the playing field,” as well as outsized negative views from ESG naysayers.

More than 50% of issuers note executives consider ESG very important to their company’s long-term success, up from 45% in 2021 and more than doubling since 2019. In particular, results indicate mega- and large-cap companies are among the issuers most likely to share this view, in line with both the 2019 and 2021 Surveys, as more companies come under pressure from stakeholders to dedicate additional resources to reporting and initiatives.

As the dust settles and ESG penetrates further into the investor and corporate lexicon, respondents demonstrate an appetite for clarification around how exactly ESG is adding value, with investors challenging companies to examine both their ESG approach and communications. Part and parcel to this shift is developing an impactful ESG strategy that incorporates leading investor focus areas.

Investor and Corporate Views

As a reminder, to evaluate the emerging perspectives from both institutional investors and corporate issuers, we surveyed 155 buy-side professionals and 103 IR and C-suite executives globally from March 14 – May 17, 2023, across more than 30 focus areas relating to ESG. In aggregate, buy-side participants represent equity assets under management of ~$10.3T.

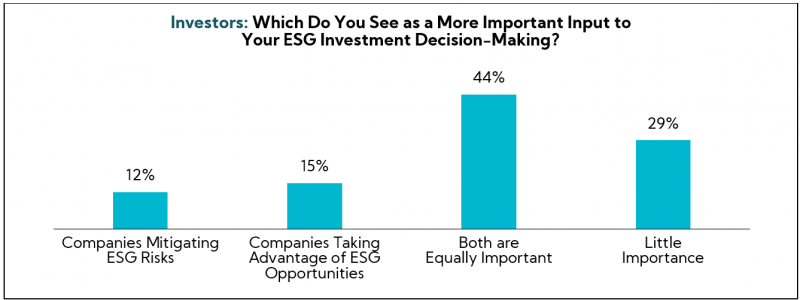

It's Not Just About Mitigating Risks or Taking Advantage of Opportunities — It’s Both

Much has been written about the pragmatic integration of ESG as it relates to the investment approach. In general, following the mainstream introduction of ESG, investors have been described as falling within two primary camps:

- Camp 1: Those who are loss-averse, prioritizing investments that have sufficiently mitigated legacy and / or “red flag” ESG risks (e.g., ensuring PFAS liabilities are properly insured / settled)

- Camp 2: Those who see ESG as an opportunity to enhance the business strategy and investment story (e.g., product innovation pipeline that responds to changing consumer preferences for less plastic and willingness to pay a premium for alternatives)

According to our proprietary research, investors report utilizing a blended approach, prioritizing both ESG risk mitigation and focusing on capturing burgeoning opportunities. While companies can avoid potential pitfalls, complex governance disputes, and reputational damage through comprehensive ESG risk mitigation, simultaneously, by identifying and leveraging opportunities, they can enhance their market positioning and drive innovation, as well as increased demand from ESG-linked investments, of which totaled $2.7 trillion globally through the end of Q1 20231.

Importantly, while fewer than one-third report little importance for either camp, open-ended commentary stresses the importance of issuers authentically articulating a balanced, long-term ESG approach, particularly among certain industries with enhanced risk or for issuers with seemingly overly promotional ESG ambitions:

“We fundamentally believe ESG is part of the risk/reward profile. These are sometimes underappreciated risks that need to be incorporated into the risk/reward profile. Sometimes they are longer term than what investors are looking at, but that does not mean it is not there.There are huge opportunities that are important to highlight for investors. If our clients ask for it, we are going to do it. A big part of that means increasing products that have certain ESG characteristics.”

“These are things that factor into our thinking because over the long term, companies that do not focus on those areas can damage their business. It is important in that they are building a sustainable company and culture and taking care to make good long-term decisions.”

“It depends on the strategy. For funds that have no ESG alignment or filter, it is more at the risk side. For funds that have some green or sustainable packaging associated with them, they are evenly weighted.”

“Company-executed materiality assessments are helpful to our ESG research in the sense that it is an indicator that the company is aware of ESG as a risk and an opportunity.”

“If a company has a decent strategy around ESG and is not just greenwashing what they are doing, that will result in a better rating.”

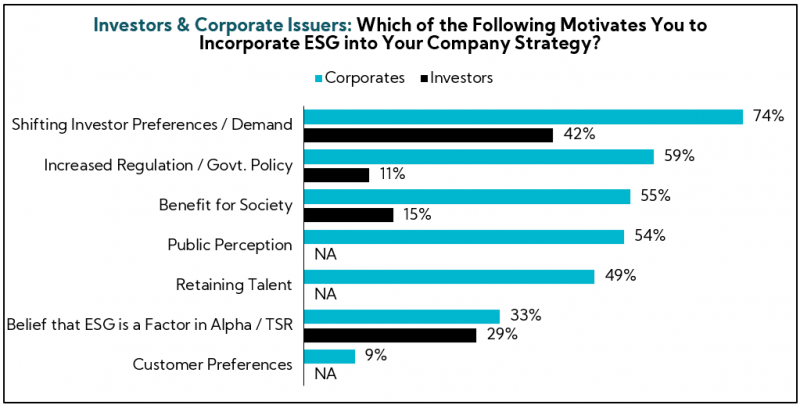

Indeed, in line with the investment community, more than 7 in 10 corporates cite shifting investor / client preferences as the most important driver of the inclusion of ESG into the company strategy, followed by roughly half pointing to increasing regulation, societal benefits, public perceptions, and retaining talent.

While ESG as a factor in Alpha / TSR is a lower corporate priority, weighing in at #6 versus #2 for investors whose sole business model revolves around returns, investors pointing to Alpha / TSR as an investment motivator rose to 29% from just 8% in 2021.

As such, a growing imperative for companies includes striking a proper balance between assuaging investor expectations for returns with explaining corporate priorities, including through helping investors quantify prevailing considerations (e.g., employee turnover rate improvement, notable customer acquisitions, marketing opportunities, regulatory incentives, etc.). In that vein, 16% of corporates report they have expressly quantified and / or linked a portion of company revenue to sustainability initiatives.

As ESG Matures, More Corporates Nail Down Materiality and Communicate Targets; Investors Hone Their Focus Areas

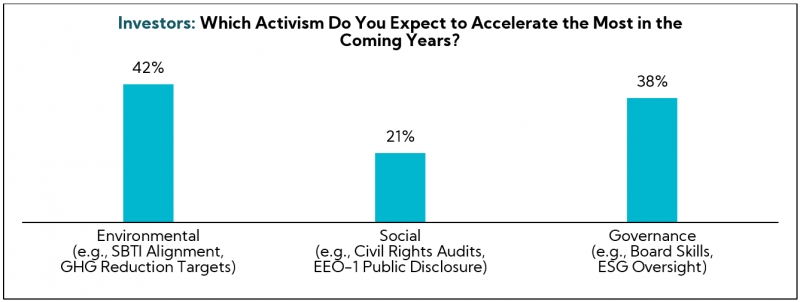

Since our 2021 Survey, the inclusion of ESG throughout the investment process has prompted the proliferation of communicated E, S, and G targets. Environmental and Governance targets increased 20 and 19 points vs. 2021, respectively, while Social goals registered an impressive 27% uptick. This comes amid roughly 40% of investors expecting Environmental and Governance activism to accelerate the most in the coming years.

Nearly all corporates, 97%, indicate they are being asked to discuss ESG topics in one-on-one meetings with more, 45%, characterizing the level of inquiries as sometimes (+4 points vs. 2021).

Continuing, 72% report having conducted a materiality assessment, with nearly one-third noting that they’re approach to refreshing these assessments is driven by material changes in the business and/or industry. This cadence coincides with investor preferences, and 54% of buy-side professionals indicate that company-executed materiality assessments are helpful to the ESG research and evaluation process.

Corporate issuer commentary is highly aligned with investor responses regarding their most important factors, representing another signal of the investment community’s commitment to integrating sustainability into their decision-making processes.

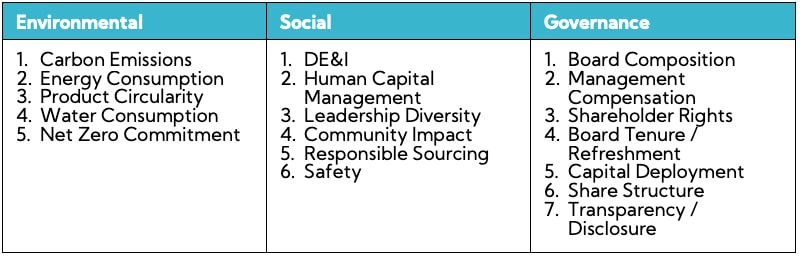

Corporates identify the following topics most frequently raised by investors in meetings:

Similarly but with some differences, investors highlight the following topics as priorities:

Dynamic Shifts Among ESG Standards and Framework Developers Leaves Investors Scratching their Heads; In Line with Our 2021 Survey, There is Still a Long Way to Go Before Standardized Reporting and Alignment

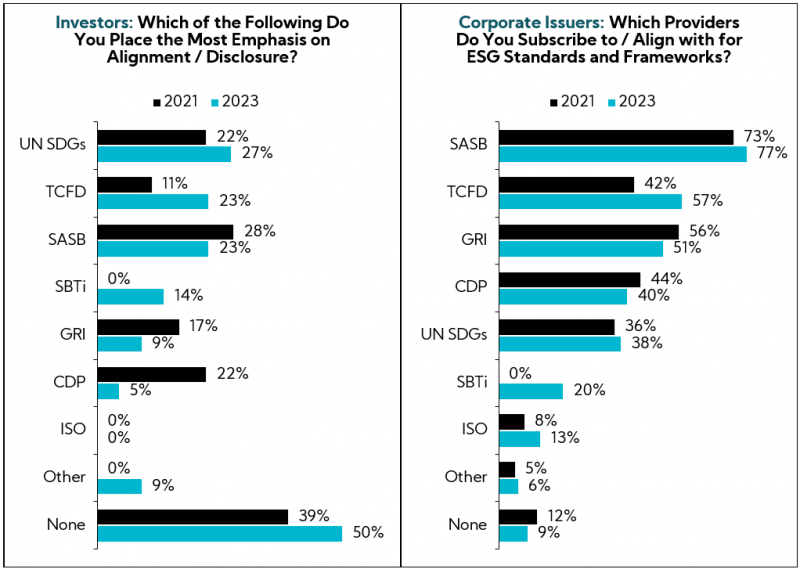

In last week’s Thought Leadership, we outlined that 76% of corporate issuers and 60% of investors are in favor of standardizing ESG reporting at some level. However, with ESG frameworks and regulations continuing to evolve and unfurl all over the world, our latest research finds 50% of investors do not place emphasis on any of the prominent standard setters or frameworks, up from 33% in 2021, noting a lack of reporting consensus and perceived politicization. In contrast, corporate issuers are much more focused on alignment, in general, with only 9% reporting placing no emphasis on the framework developers, down from 12% in 2021. This disconnect demonstrates the need for greater harmonization in ESG reporting standards and frameworks to bridge the gap between investors and corporate issuers.

Investors who do place a high emphasis on alignment point to United Nations’ Sustainable Development Goals (UN SDGs), Sustainability Accounting Standards Board (SASB), and the Task Force of Climate-related Financial Disclosures (TCFD), with CDP reporting falling from 3rd to 4th place. On the other hand, corporates point to SASB, TCFD, and the Global Reporting Initiative (GRI), the latter of which is a fifth investor priority.

Best Practices and Recommended Strategies

Our research shows a clear interest in boiling the ESG landscape down to material, decision-useful items with trackable qualities. As investors and issuers alike refine their strategies and approach, more are engaging in discussions and communicating ESG targets than ever before. However, as macro conditions continue to dominate mindshare and many report being wary of greenwashing, investors are finding it more difficult to translate how these initiatives will directly influence the bottom-line.

At Corbin, we firmly believe that realistic, authentic company communications serve to “cut through the noise” — not as a checking the box exercise, but as a means to deeply educate key stakeholders on the efforts being taken to improve a firm’s competitive positioning.

Below, we have outlined some best practices and recommended strategies to help architect an impactful ESG strategy that prioritizes leading investor focus areas:

1. Conduct a formal materiality assessment, and make sure it’s not a “one-and-done”

Investors want to hear a bespoke sustainability story that they can pinpoint, and one that will lead to tangible outcomes. The foundation of such a story is a materiality assessment where key stakeholders tell you what is most important in a codified manner. The result is a materiality map and / or matrix that prioritizes the initiatives most within a business’s control, serving as a benchmark for investors to assess the validity of your ESG investments.

For example, a tech company whose top customers are Meta and Google may need to measure their carbon footprint because Meta and Google are upping their requirements from partners to arrive at a Scope 3 assessment. Will investors find fault with the company for spending money on this project? We don’t think so, but they may if the reasoning and stakeholder demands are not clearly understood or articulated.

Materiality may differ from sector to sector and even industry to industry; engaging with a third-party materiality assessment provider enables:

- Expertise and Experience: Providers specialize in this area and possess deep knowledge in conducting assessments across various disciplines and business types.

- Objectivity and Unbiased Perspective: Third-party providers offer an independent evaluation of your organization’s materiality, helping to avoid any potential conflicts of interest.

- Credibility and Trust: This type of partnership enhances the credibility of your materiality assessment, with reputation adding weight to the results.

- Efficiency and Resource Optimization: Providers streamline the materiality assessment process, ensuring timely results and recommendation while saving your organization resources.

Importantly, our research demonstrates the expectation from investors that issuers update their materiality assessments as and when material changes occur. Please reach out if interested in learning more about conducting a materiality assessment.

2. When it comes to disclosures, think “decision-usefulness”, and prioritize consistency and transparency over quantity

Investor integration of E&S topics, in particular, within corporate judgement is a very recent phenomenon. Every year, the quantity of reported information grows. In our view, much of the information is not decision-useful due to the lack of quantification and standardization, poor articulation of key measures, and lack of progress updates. Forward-thinking companies understand this, and more are beginning to do the homework to help investors understand how both the risks and opportunities from identified material topics impact the financial condition and performance of their businesses. As mentioned, nearly one in five executives have already quantified and linked a portion of company revenue to enabling a more sustainable world — an impressive early start.

As frameworks mature, consistency of reporting will become a key to success. Using the framework providers as a benchmark — including global initiatives with the acknowledgement that ESG development is at various stages throughout the world — determine and segment what measures can be immediately gathered, those that require time and resources, and those that have already been published publicly. Build on these disclosures and develop a reporting cadence that works best for your stakeholders. Keep a pulse on emerging proposals bubbling within Washington and evolving customer requirements, and ensure your team is prepared to dynamically implement with proper oversight in place.

For example, since 2021, Nasdaq has required that listed companies annually disclose board-level diversity statistics using a standardized template. Building on this momentum, prominent proxy advisory firms ISS and Glass Lewis now both recommend Board gender diversity and disclosure, and investment firm State Street announced they are prepared to vote against Board leaders of companies that don’t disclose their EEO-1 Reports2. As a result of these trends, the number of Russell 1000 companies that publicly disclose intersectional data detailing gender, race, and ethnicity by job category from their EEO-1 reports or equivalent has grown substantially, from 3% in 2019 to 34% in 20223, the latest complete reporting period.

3. Connect the business strategy with the ESG strategy

After establishing the factors most material to your stakeholders and the reporting mechanisms, create a roadmap that links the overarching long- term strategy with your refined ESG priorities. This requires a wholistic approach, reiterating key messaging throughout investor channels and making a clear case for how “walking the walk” on chosen ESG initiatives supports the company’s vision and bolsters the strategy’s effectiveness.

This can materialize in number of ways, including:

- Innovation and Product Development: Companies may apply filters to their long-term strategy to develop new / sustainable products, such as leveraging renewable materials, reducing waste, addressing social needs through product design, capturing Federal stimulus, or simply as justification for entering a new product vertical.

- Risk Management: ESG considerations help identify and manage risks that may impact the company’s positioning, such as filtering a long-term geographic expansion strategy with climate change risks or resource scarcity, regulatory compliance related to environmental standards, fair labor practices, or national security considerations.

- Reputation and Brand Enhancement: As the “people” element of corporate strategy expands, human capital management has become increasingly important; initiatives include a focus on employee well-being, DE&I, and community engagement as a means to boost productivity and attract and retain talent.

- Supply Chain Management: Logistics strategy from an ESG lens ensures responsible sourcing, ethical supplier practices, and the reduction of environmental impacts throughout the supply chain; these can help mitigate risks, ensure resilience, and maintain stakeholder trust.

- M&A: Considering ESG factors in M&A decisions helps identify both potential vulnerabilities and strategic opportunities associated with the target company. By screening investments through ESG filters, a company can make more informed decisions and avoid investments that may pose significant risks to its reputation, operations, or compliance.

- Accountability: Ultimately, sound company governance encourages executives to prioritize strategic decisions and actions that support sustainable value creation over short-term gains.

In Closing

Architecting an ESG strategy that works for your company is no easy task. It requires resources, time, and creativity. Our research demonstrates a growing imperative for corporates to balance investor apprehension toward ESG with concrete results — measurable items that can be tracked over time and which demonstrate a deep integration with the broader strategy. This should be unequivocally relevant and authentic to your company.

- Morningstar Direct

- An EEO-1 Report is the Federally mandated annual report in which companies with at least 100 employees provide information on gender, race, and ethnicity by job categories.

- Source: Just Capital

Any unauthorized use, duplication, redistribution or disclosure of this proprietary research (the “Presentation”), including, but not limited to, redistribution of the Presentation by electronic mail, posting of the Presentation on a website or page, and/or providing to a third party a link to the Presentation, is strictly prohibited. The information contained in the Presentation is intended solely for the recipient and may not be further distributed by the recipient to any third party. Thank you for respecting our Intellectual Property and recognizing the challenges we face, including significant loss and brand erosion, when it is shared outside of designated recipients.

Corbin Advisors is a strategic consultancy accelerating value realization globally. We engage deeply with our clients to assess, architect, activate, and accelerate value realization, delivering research-based insights and execution excellence through a cultivated and caring team of experts with deep sector and situational experience, a best practice approach, and an outperformance mindset.

Our growing repository of proprietary, research-based insights on the rapidly developing ESG landscape has fueled our thought leadership on this important topic. We began building our ESG knowledge base in 2010, surveying institutional investors globally on the topic, so we can provide our clients with expert experience today.