Cautiously Optimistic Investor Sentiment Prevails as Intact Secular Growth Trends and Constructive Views on Order Rates Support Firm Setup in 2026; Policy Impact Serves as a Governor

Access Our Latest Research

Q4’25 Inside The Buy-Side® Earnings Primer®

Survey Finds Investor Headiness for Growth Persists with Expectations Intact for 2026 Expansion; Frothy Valuations, Policy Impact, Geopolitics, and AI Bubble Curb Enthusiasm Somewhat

By providing The Big So What®, we inform, inspire, and influence positive change

This Week in Earnings

Industrials in our Sector Beat

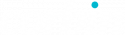

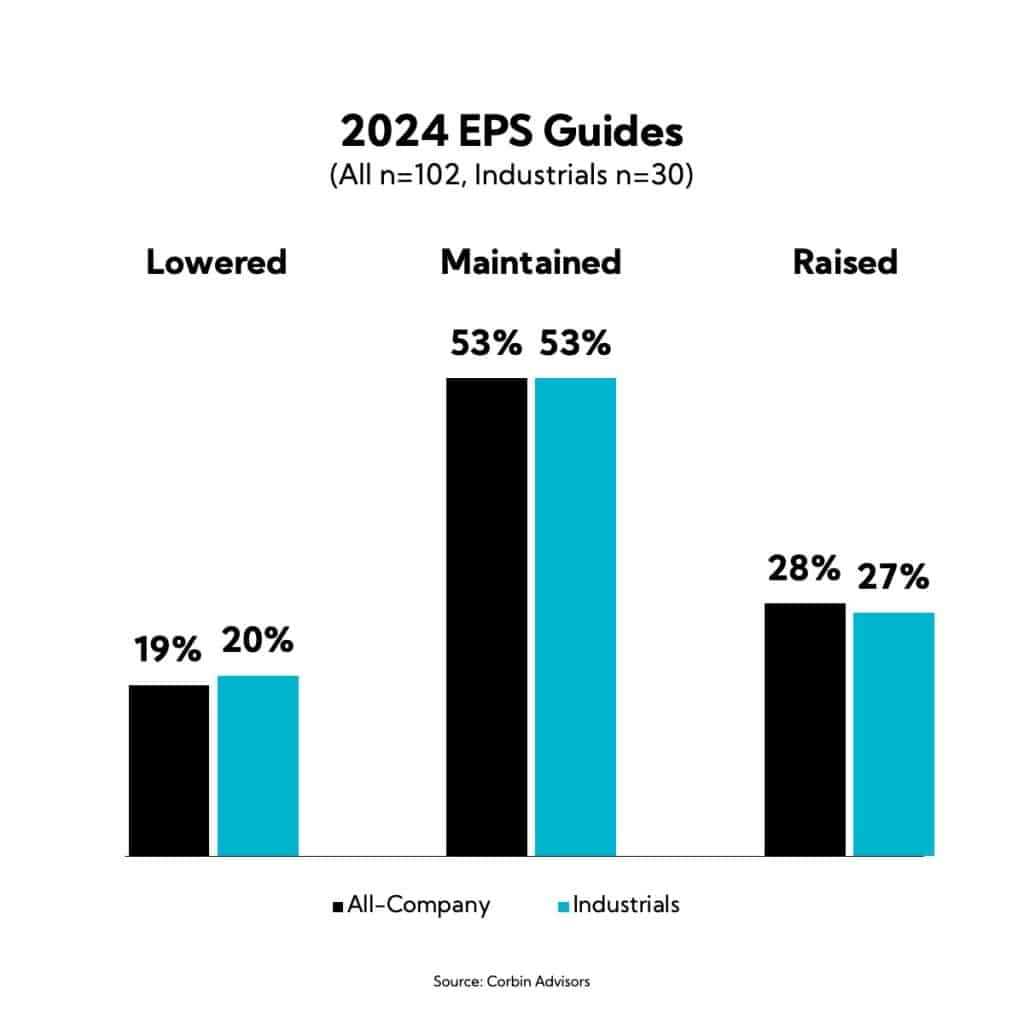

Earnings across the sector have been mixed, with commentary reflecting a cautious tone due to more pronounced macro uncertainty and various idiosyncratic challenges. While EPS beats for the roughly 50% of S&P 500 Industrials that have reported Q2 figures have so far come in at a healthy clip across the sector — 78% have topped consensus, only slightly below the 79% figure for the S&P 500, in aggregate — revenue has been more of a mixed bag. To that end, 50% have posted top-line figures below consensus versus the broader index average of 42%. This comes despite a significant moderation in expectations since the beginning of the year — from YoY growth expectations of 4.1% to actuals of -0.4% currently.

Specifically, Industrials are referencing a more price-sensitive consumer, evidenced by a shift toward lower value and more economical products. The transportation group remains in an unprecedented freight recession, with execs highlighting challenges such as overcapacity, a tough cost/pricing environment, labor action uncertainties, and Red Sea disruptions. On the positive side, West Coast ports continue to see a resurgence in container imports and cargo growth.

As for demand, commentary is mixed by end market, though a bright spot continues to be Aerospace and Defense, with companies reporting strength despite input supply constraints and sluggish deliveries. Continuing, destocking headwinds have also seemingly receded, in line with findings from our Q2’24 Industrial Sentiment Survey®. Further, election uncertainty is casting a pall on certain order timeframes, and many are reporting customers taking a “wait-and-see” approach until the election results come in. To that end, many are reporting increasing levels of promotional activity.

Globally, trends are mixed with India and Latin America among pockets of strength. Commentary around Europe notes continued softness, though some highlight early signs of recovery, while sentiment toward China remains downbeat with executives citing pricing pressures and a weak demand environment.

Key Themes

- Outlook and Macro: Increased Uncertainty and Tighter Spending Rains on the 2H Recovery Parade, but All is Not Gloom; Gov. Stimulus, Inventory Stabilization, and Signs of Improving Economic Measures Give Hope for Brighter Days Ahead

- Demand: “Tumultuous” U.S. Election Compounds Weakening Customer Demand, Anemic Domestic Freight, Increased Promotional Activity, and Supply Chain Issues; Aerospace & Defense Remains a Bright Spot

- Inflation and Pricing: Margins Pressured by Dwindling Pricing Power amid Persistent Inflation, Notably in Labor; Still, EPS Guides Remain Intact, and Executives Highlight Value Propositions and Flexible Cost Structures

- Inventory: As Noted in our Recent Industrial Sentiment Survey®, Destocking Reported to Be Largely in the Rearview; Commentary Suggests Low Inventory Levels and Balanced Sell-in/Sell-out Ratios

- Supply Chain: Reshoring Trends Driven by Infrastructure Spending Continue in the Americas, While the Red Sea Conflict, and Other Idiosyncratic Issues, Such as Potential Rail and Port Labor Issues, Continue to Stymie Normalization

- Global Trends: Europe Remains Soft though Signs of Recovery are Evident for Some, Softer-than-Expected Weakness Prevails in China, while India and LatAm are Relative Bright Spots

Corbin Advisors is a strategic investor relations and investor communications advisory firm with a track record of supporting our publicly traded clients in creating sustained shareholder value. Our approach leverages decades of Voice of Investor® (VOI) research and data-driven insights; capital markets expertise and deep best practice knowledge; and a proven playbook and passion for client outperformance. We are a trusted advisor and partner to boards of directors, executive leaders, and investor relations professionals, serving a broad range of companies globally across sectors, sizes, and situations. Through defining the standard of excellence and challenging conventional thinking, we enable our clients to boldly differentiate their equity brand, maximize valuation, and build more durable franchises.

Corbin Advisors. Outperformance Built on Trust®.