Survey Finds Investor Headiness for Growth Persists with Expectations Intact for 2026 Expansion; Frothy Valuations, Policy Impact, Geopolitics, and AI Bubble Curb Enthusiasm Somewhat

Access Our Latest Research

Q3’25 Inside The Buy-Side® Industrial Sentiment Survey®

Amid “Mixed Bag”, Stable Q3’25 Industrial Performance Expected with Pockets of Strength; Cautious Optimism Continues to Build for a Stronger, More Broad-based Growth Setup in 2026

By providing The Big So What®, we inform, inspire, and influence positive change

This Week in Earnings

Materials in our Sector Beat

In last quarter’s Materials Sector beat, we reported that executive commentary reflected an industry still in flux, with varied outlooks across end markets but showing more signs of optimism for demand to normalize as the year progressed. In that regard, this quarter has “played out as expected” with destocking in the rearview and volumes getting a near-term boost from pockets of restocking. At the same time, some end markets remain challenged, and outlooks are tempered by a softening economic backdrop and persistent macro headwinds, including inflation, higher rates, election uncertainty, and ongoing geopolitical tensions.

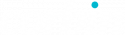

As with last quarter, demand trends are mixed and vary across end markets. Indeed, while areas of restocking have recently been supportive of volumes, overall commentary reflects a demand environment that continues to be characterized as bottoming/stabilizing rather than accelerating, with many expecting these conditions to persist through the rest of the year. As such, the proportion of Materials companies lowering top-line guides is more than double the all-company benchmark.

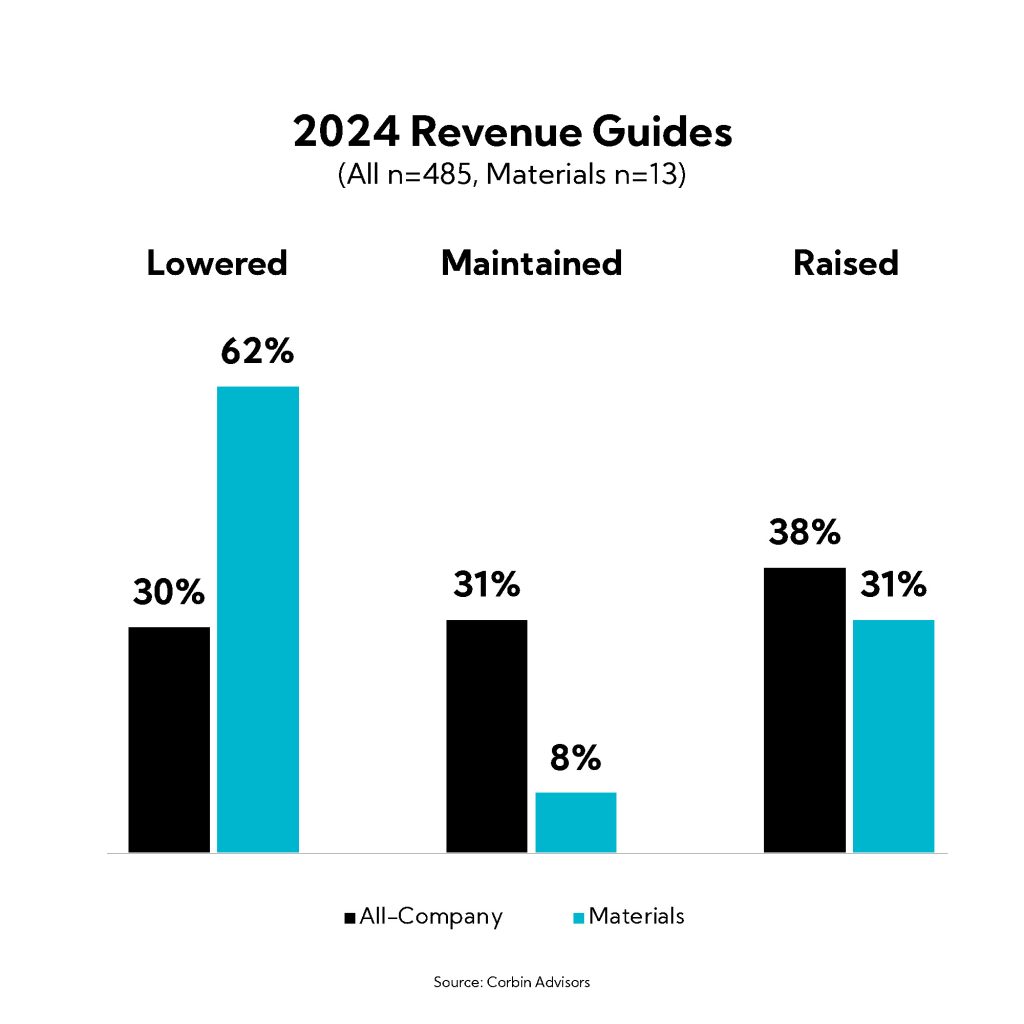

Rather than counting on resurgent volumes, executives are squarely focused on controlling what they can control, highlighting expense management and productivity initiatives — and, in some cases, headcount reduction — that are starting to bear fruit and drive margin expansion. Meanwhile, commentary is more mixed around pricing and input costs; while some point to moderating inflation and improving pricing, others highlight pricing pressures (particularly in China and in end markets impacted by an increasingly price-conscious consumer) as well as idiosyncratic raw material challenges.

Finally, with elevated U.S. election (and policy) uncertainty, trade tensions and the impact from tariffs and anti-dumping measures remained top of mind, garnering further attention during analyst Q&A. Executives note that whoever wins in November, the expectation is for a heightened tariff enforcement environment, and executives are refreshing their playbooks accordingly.

Key Themes

- Macro and Outlook: Sector Challenges Have “Played Out as Expected”, though Execs are “Keeping a Close Eye” on Persistent Macro Headwinds; While Demand is Seen as Having Bottomed/Stabilized, Lack of Acceleration Has Prompted Lowered Revenue Guides for Some, but Interest Rate Relief Expected to be a Tailwind into 2025

- Demand and Volume: Trends Through Q2 are Mixed and Vary by End Market, though Weakness is Noted for Many Across the Sector; Still, Most Assert Destocking has “Run Its Course”, With Chemicals and Packaging Companies Seeing Green Shoots for a Recovery

- Expense Management and Productivity: Amid Largely Sluggish Volume Environment, Executives Point to Expense Management and Productivity Initiatives Coming to Fruition, Including Headcount Reductions for Some

- Pricing and Inflation: Commentary is a Mixed Bag; While Some Highlight an Improving Pricing and Moderating Cost Environment, Others Face Competitive Pressures and Raw Material Challenges

- Trade Tensions: Chinese “Dumping” Low-Cost Imports are Under the Microscope as Executives and Analysts Anticipate a Heightened Tariff Enforcement Environment

Corbin Advisors is a strategic investor relations and investor communications advisory firm with a track record of supporting our publicly traded clients in creating sustained shareholder value. Our approach leverages decades of Voice of Investor® (VOI) research and data-driven insights; capital markets expertise and deep best practice knowledge; and a proven playbook and passion for client outperformance. We are a trusted advisor and partner to boards of directors, executive leaders, and investor relations professionals, serving a broad range of companies globally across sectors, sizes, and situations. Through defining the standard of excellence and challenging conventional thinking, we enable our clients to boldly differentiate their equity brand, maximize valuation, and build more durable franchises.

Corbin Advisors. Outperformance Built on Trust®.